Winston-Salem North Carolina Legal Last Will and Testament Form with All Property to Trust, commonly referred to as a Pour Over Will, is a crucial legal document that ensures the proper distribution of assets after the testator's death. It allows individuals in Winston-Salem, North Carolina, to establish a trust, known as a Pour Over Trust, which collects any remaining assets not explicitly placed in the trust during the testator's lifetime. A Pour Over Will acts as a safety net to ensure that any significant assets or property overlooked during the creation or funding of the trust are transferred into the trust upon the testator's passing. This document helps to align the distribution of assets with the provisions outlined in the Pour Over Trust, which can be an essential part of estate planning and preserving the intended asset distribution. Various types of Winston-Salem North Carolina Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will, can be tailored to meet individual needs: 1. Simple Pour Over Will: This is a straightforward document that designates the Pour Over Trust as the primary beneficiary of all the testator's remaining property upon their death. It ensures a seamless transfer of assets into the trust while maintaining privacy and reducing potential probate complications. 2. Conditional Pour Over Will: This type of Will includes specific conditions that must be met for the Pour Over Trust to receive the assets. For example, it may stipulate that if a particular individual predeceases the testator or fails to meet certain criteria, their share of the estate goes directly to the trust. 3. Testamentary Pour Over Will: This Will allows the testator to designate specific assets, such as real estate, investments, or valuable possessions, to be poured over into the trust after their death. It offers flexibility in asset distribution and allows for efficient management by the trust's designated trustee. 4. Living Pour Over Will: Unlike a traditional Will, a Living Pour Over Will becomes effective during the testator's lifetime, allowing them to transfer certain assets into the trust before death. This enables the efficient administration of assets and minimizes the likelihood of disputes or confusion regarding asset distribution. Creating a Winston-Salem North Carolina Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will requires careful consideration of the testator's intentions and comprehensive legal knowledge. It is advisable to consult with an experienced attorney specializing in estate planning to ensure the document meets all legal requirements and addresses specific personal circumstances.

Winston–Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Winston–Salem North Carolina Last Will And Testament With All Property To Trust Called A Pour Over Will?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our advantageous website offers thousands of documents, making it easy to locate and obtain nearly any document sample you need.

You can export, complete, and sign the Winston–Salem North Carolina Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will within minutes, rather than spending hours online searching for a suitable template.

Utilizing our library is an excellent method to enhance the security of your record submissions. Our knowledgeable attorneys routinely examine all the documents to ensure that the templates are suitable for a specific state and adhere to new laws and regulations.

Access the page with the template you need. Ensure that it is the form you were seeking: verify its name and description, and utilize the Preview function when it is accessible. If not, make use of the Search field to identify the correct one.

Initiate the downloading process. Click Buy Now and select the pricing plan that fits you best. Then, create an account and complete your order using a credit card or PayPal.

- How can you acquire the Winston–Salem North Carolina Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will.

- If you possess a profile, simply Log In to your account. The Download button will be activated on all the documents you view. Furthermore, you can access all your previously saved documents in the My documents section.

- If you do not yet have an account, follow the instructions outlined below.

Form popularity

FAQ

To create a pour-over will, begin by drafting your will to state that your assets will transfer into your trust upon your passing. This type of will ensures that any property not designated in your trust is redirected there, acting as a safety net. The Winston–Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will is an ideal example of this process. For guidance and templates, consider using uslegalforms, which offers tailored solutions for estate planning.

Creating a last will and testament in North Carolina is straightforward. You must be at least 18 years old and of sound mind. Begin by stating your name and declaring this document as your will. Clearly indicate how you wish to distribute your assets, including any property and trusts, similar to the Winston–Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will. Utilize online platforms like uslegalforms to simplify the drafting process and ensure all legal requirements are met.

When someone dies without a will in North Carolina, their assets, including bank accounts, will be subject to state laws of intestacy. This means the court will decide how to distribute the assets among surviving relatives. The process can be lengthy and complicated, unlike having a clear plan in place with a last will and testament, such as the Winston–Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will, which helps ensure your wishes are met. Using uslegalforms can streamline your planning process and avoid complications.

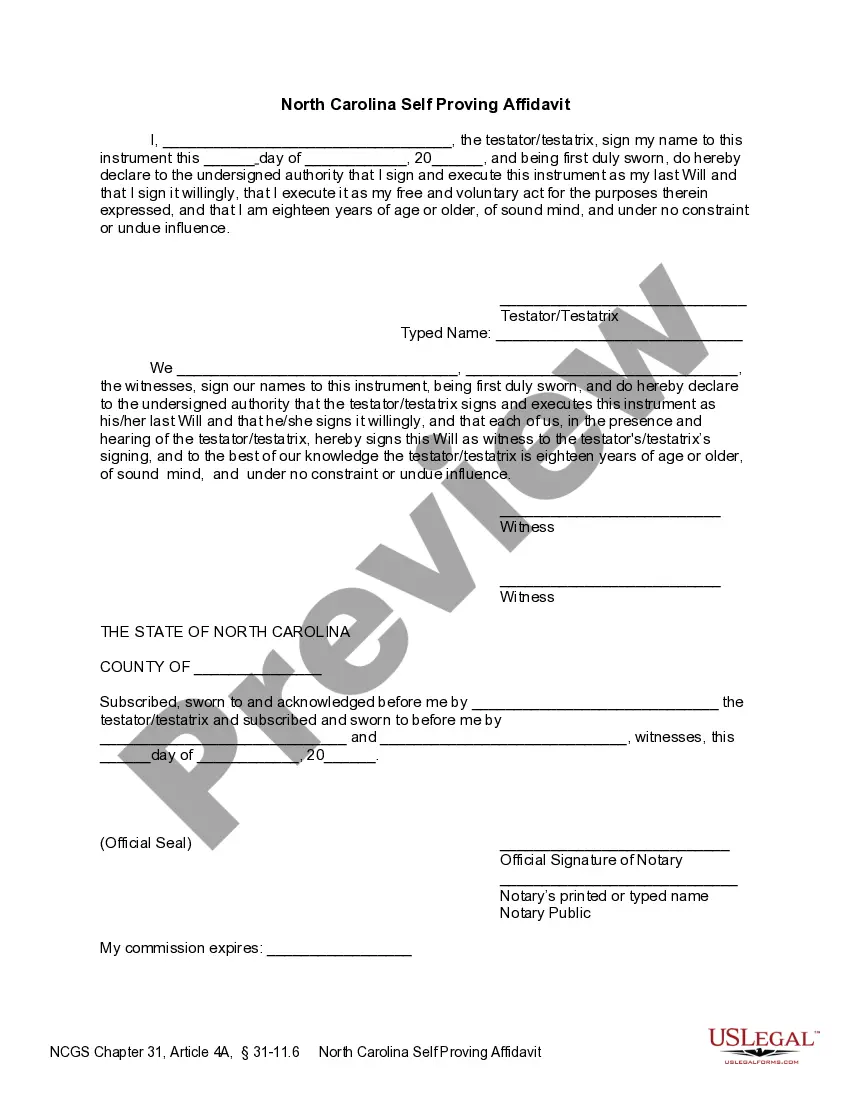

In North Carolina, a last will and testament, including the Winston–Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will, does not require notarization to be valid. However, having the will notarized can provide an extra layer of assurance. Additionally, proper execution according to North Carolina law is essential for your will to be honored. You may consider using services such as uslegalforms to ensure compliance.

over will is beneficial because it ensures that assets not yet transferred into your trust will still be incorporated upon your passing. This type of will simplifies the estate management process, ensuring that your wishes are honored without leaving assets unaccounted for. Many individuals prefer the security of a WinstonSalem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will for its practical approach to asset distribution and trust funding.

One primary drawback of a pour-over will is that it still requires probate, which can be time-consuming and incur additional costs. During the probate process, assets placed in the trust may not be immediately accessible, causing potential delays for beneficiaries. Nevertheless, a Winston–Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will remains a valuable tool for directing your estate efficiently after your death.

To transfer property to a trust in North Carolina, you must execute a deed that transfers ownership from you to the trust. This process includes drafting and signing the deed, which then needs to be recorded at the county registry of deeds. Utilizing a Winston–Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will can further ensure that any assets not transferred during your lifetime are covered by the trust when you pass.

A regular will specifies how to distribute your property directly at your death, while a pour-over will directs that your assets go into a trust upon your death. This means that a Winston–Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will serves as a bridge, ensuring that any property not in your trust at the time of your passing pours over into the trust for management and distribution as per your wishes. This setup simplifies the estate handling process.

In North Carolina, a will does not need to be filed with the court during your lifetime. However, once you pass away, the executor must file the will with the probate court to begin the estate settlement process. This step is crucial for the distribution of assets, especially if your will is a Winston–Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will, as it ensures your trust inherits all specified assets.

In North Carolina, a will does not generally override a deed since deeds transfer property ownership. If the property is transferred to a trust as per a Winston-Salem North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will, the trust becomes the legal owner upon death. Therefore, it's crucial to ensure that property titles are aligned with your estate plan. Consider using services like uslegalforms to clarify the relationship between deeds and wills during estate planning.