Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out North Carolina Last Will And Testament With All Property To Trust Called A Pour Over Will?

If you have previously utilized our service, sign in to your account and store the Wake North Carolina Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will on your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have consistent access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to access it again. Leverage the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

- Ensure you’ve located a suitable document. Review the description and utilize the Preview feature, if available, to verify if it aligns with your requirements. If it does not meet your expectations, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Wake North Carolina Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will. Choose the file format for your document and save it on your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

In North Carolina, a will does not override a deed; property ownership is defined by the deed itself. However, if the owner intends to transfer property posthumously, clear instructions in the will should be aligned with the deed. The Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will can help clarify your intent regarding property when dealing with trusts and estate planning.

over will can simplify the transition of assets into your trust after death, providing clarity for your beneficiaries. It also helps organize your estate, ensuring all assets are directed according to your wishes. By utilizing the Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will, you can ensure your assets are managed efficiently, reducing potential confusion for your loved ones.

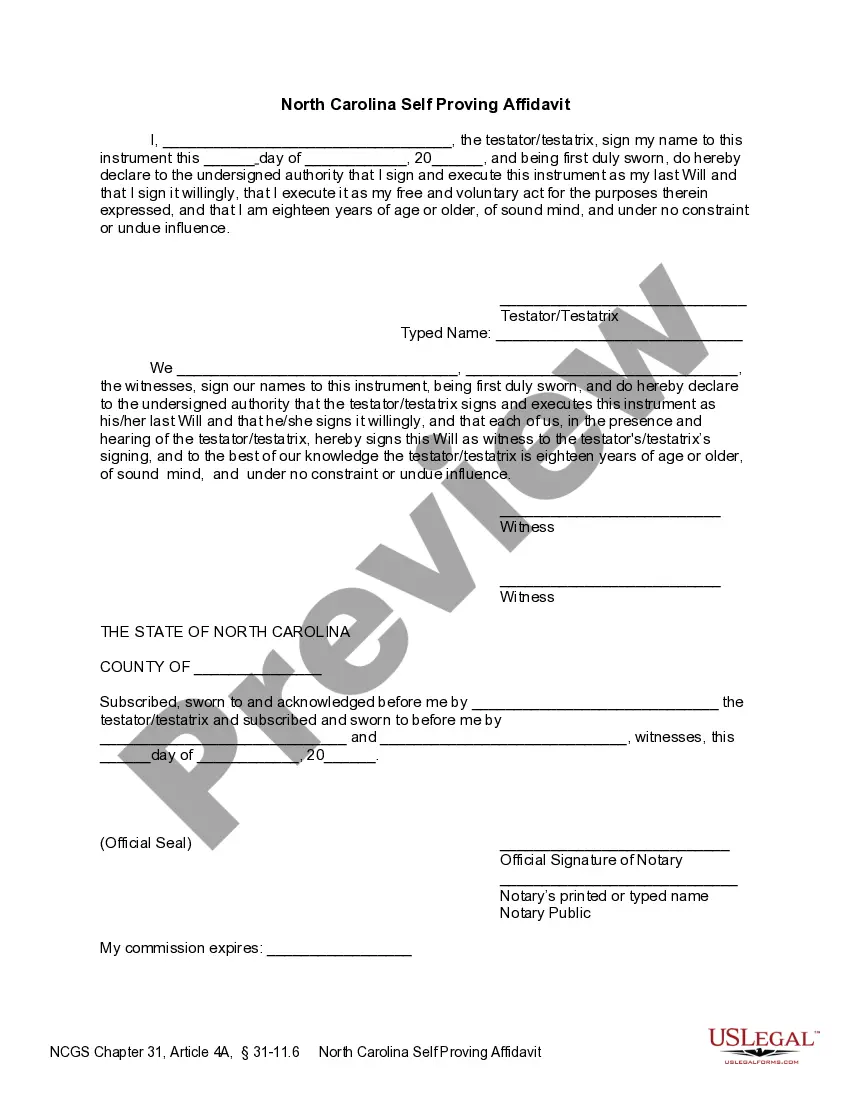

over will in North Carolina must meet specific legal requirements, including being written, signed, and witnessed to be valid. It's vital to ensure the will clearly directs assets to the designated trust. For those considering the Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will, consulting legal resources, such as US Legal Forms, can guide you through the document preparation.

Generally, the last will and testament does not override a trust; instead, it complements it. The terms established in the trust often dictate how assets are handled, even when a will exists. Therefore, when managing estate planning, using a Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will ensures that your desires align effectively with trust provisions.

In North Carolina, a pour-over will serves as a legal document that directs your assets into a previously established trust. This approach ensures that any assets not included in the trust during your lifetime can still be controlled and distributed according to your wishes. The Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will is crucial for maintaining alignment between your assets and trust intentions.

While a pour-over will can streamline asset management, it may lead to a lengthier probate process, as assets need to be transferred into the trust. Additionally, unless managed properly, it might not keep your estate out of probate altogether. Thus, it’s essential to consider your entire estate planning strategy when using the Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will.

over will is designed to transfer any remaining assets into a trust upon your death, making it a convenient option for those with a trust. In contrast, a regular will distributes assets directly to beneficiaries. The Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will simplifies estate management, aligning your assets within the trust parameters.

Typically, a trust takes precedence over a will when it comes to distributing assets. When you establish a Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will, any assets in the trust will be managed according to its terms, even if the will states otherwise. Understanding this relationship can help you effectively plan your estate, ensuring your wishes are honored. Engaging with a platform like uslegalforms can provide further clarity in navigating these important documents.

In general, a trust does not inherently override a last will and testament. Instead, both are vital components of a comprehensive estate plan, working in tandem. When you create a Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will, it ensures that any assets not included in your trust are properly directed to it. This process reinforces your intentions and minimizes potential disputes.

A will does not have authority over a trust, as they serve different functions in estate planning. A Wake North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will activates after you pass away, guiding distributions to your trust. However, a trust operates independently and can manage your assets while you are still alive. In essence, both documents function together to fulfill your wishes.