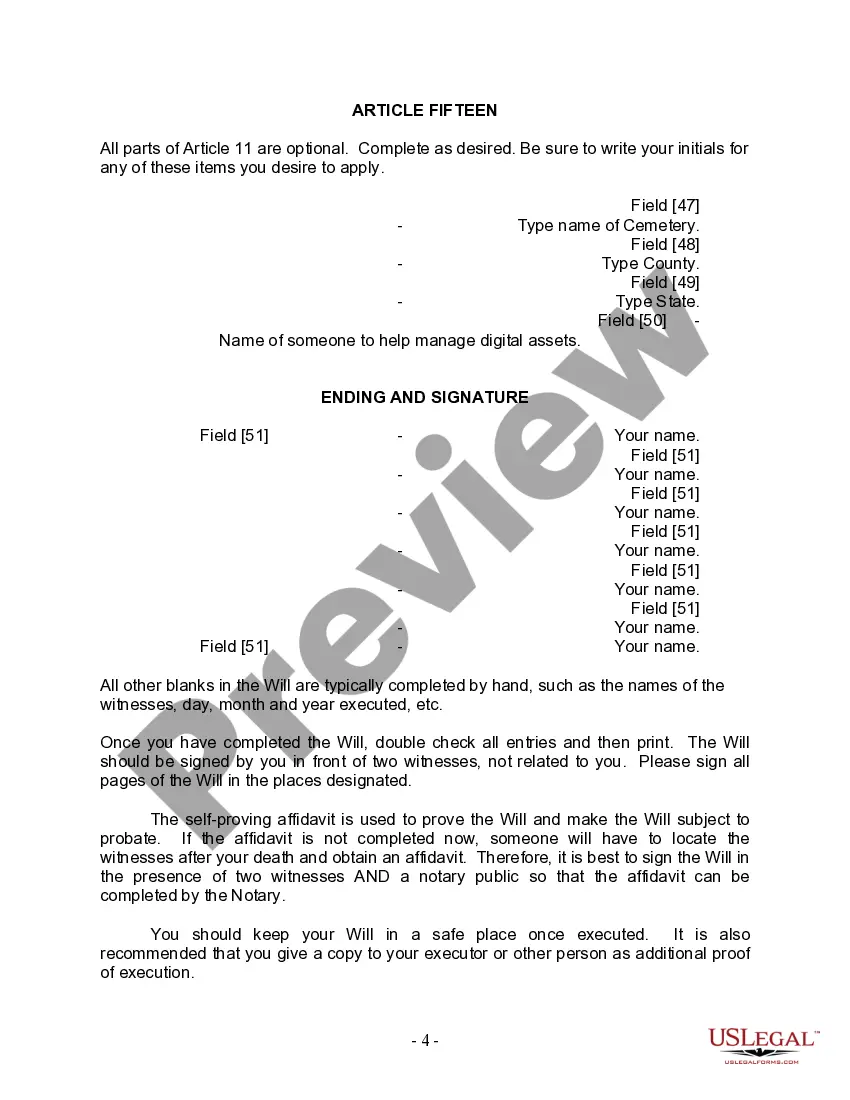

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Charlotte North Carolina Last Will and Testament for Married person with Minor Children

Description

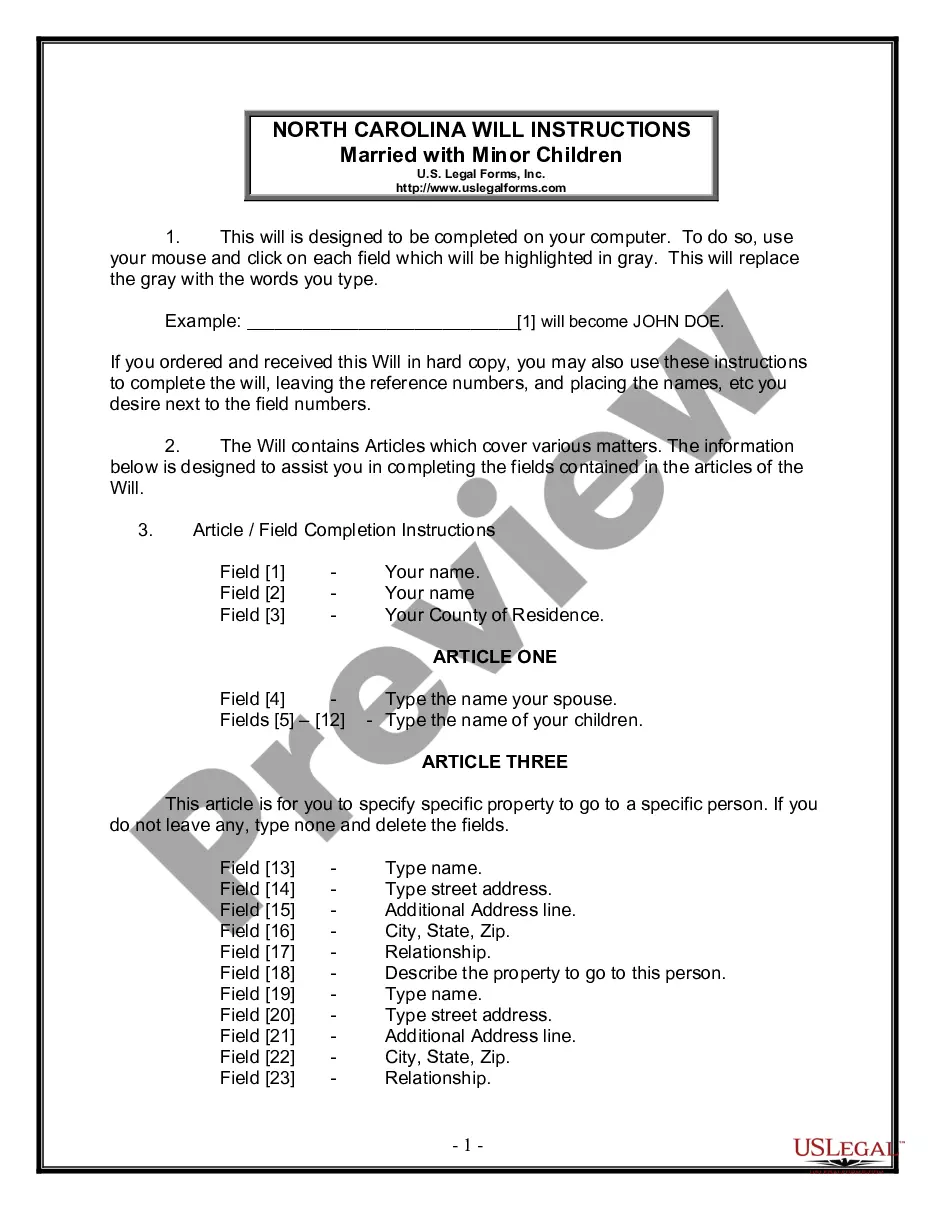

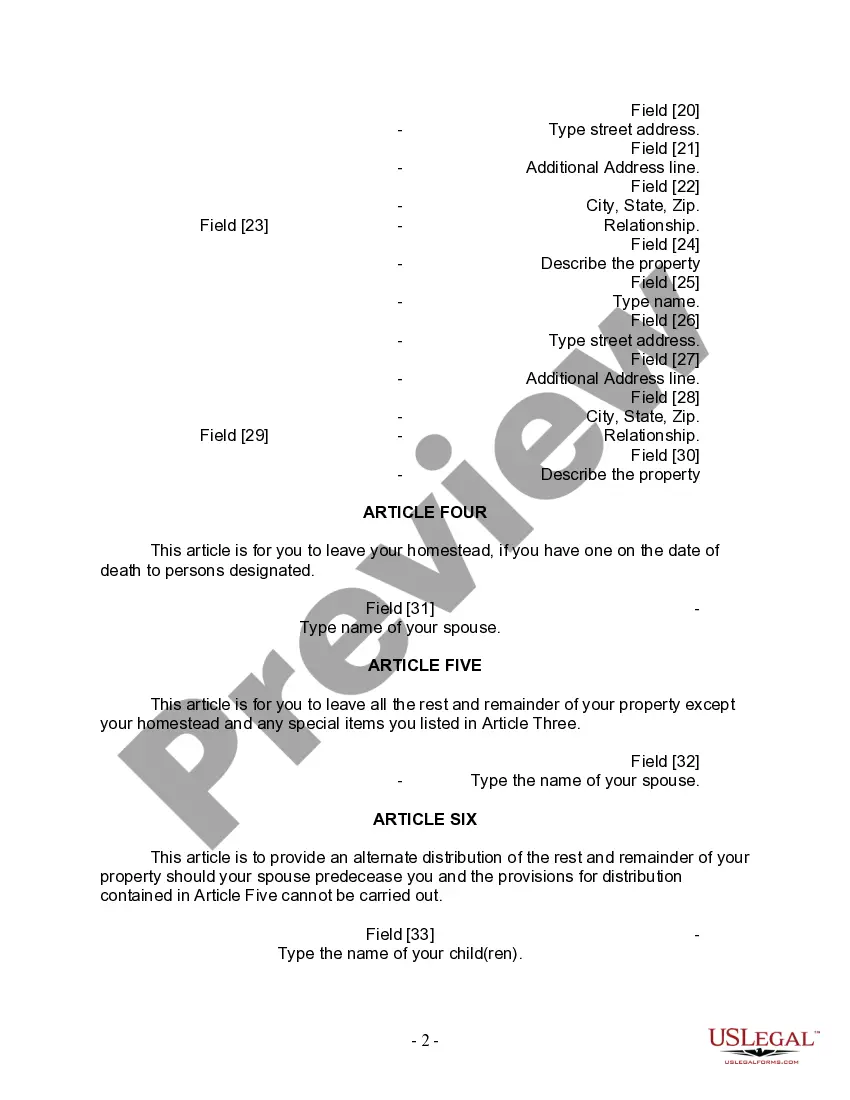

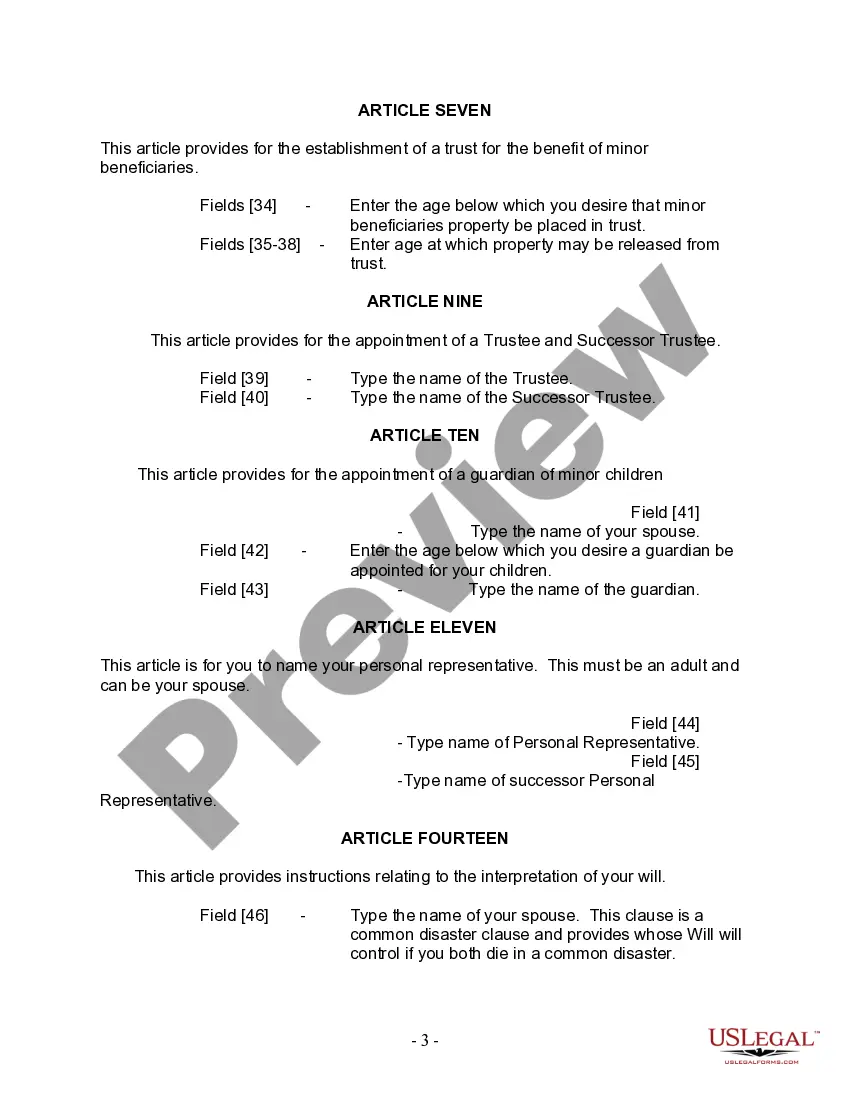

How to fill out North Carolina Last Will And Testament For Married Person With Minor Children?

Are you searching for a reliable and economical supplier of legal forms to acquire the Charlotte North Carolina Legal Last Will and Testament Document for Married individuals with Minor Children? US Legal Forms is your optimal option.

Whether you require a straightforward arrangement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce through the court system, we have you supported. Our platform offers over 85,000 current legal document templates for individual and business use. All templates we provide are not generic and are structured based on the regulations of specific states and regions.

To obtain the form, you must sign in to your account, locate the necessary form, and click the Download button adjacent to it. Please keep in mind that you can download your previously bought form templates at any time in the My documents section.

Is this your first time visiting our site? No need to worry. You can establish an account with ease, but prior to that, ensure to do the following.

Now you can register your account. Then select the subscription option and proceed with the payment. After the payment has been completed, download the Charlotte North Carolina Legal Last Will and Testament Document for Married individuals with Minor Children in any available format. You can revisit the website at any point and redownload the form at no cost.

Accessing updated legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal paperwork online.

- Check if the Charlotte North Carolina Legal Last Will and Testament Document for Married individuals with Minor Children complies with your state and local laws.

- Review the form’s specifics (if available) to determine for whom and what the form is designed.

- Reinitiate the search if the form does not fit your particular circumstances.

Form popularity

FAQ

The surviving children will split 2/3 of the real estate and the remaining personal property assets in equal shares under the rules of intestacy in North Carolina. Again, surviving or predeceased parents do not matter to the equation if there is a surviving spouse and at least one surviving child.

Q.Is Inheritance Considered Marital Property in a North Carolina Divorce? No. Unless the inheritance was giving as a marital gift or the spouse receiving the inheritance contributes the funds into a shared bank account or provides the additional spouse reasonable access to the inherited assets.

Your spouse only, no children or parents living: Your spouse will receive all property that could pass under a will. 4. Your spouse and one child: Your spouse will receive the first $60,000.00 of personal property, one-half (1/2) of the remaining personal property, and one-half (1/2) all real estate.

Technically, you do not need to file your will with the court while you are still living. But, it could be beneficial to your family or your executor to have the will entrusted to a third party where it can easily be produced.

Lack of a Signature and/or Witnesses A will that is unsigned or fails to meet the witness requirements may not be legally enforceable under North Carolina state law. You can contest a will on these grounds.

To be valid, the person making the Will (the testator) must, with the intent to sign the Will, sign it personally or direct another person to sign it in the testator's presence.

Spouses in North Carolina Inheritance Law If you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

Under North Carolina law, a will is filed with the court after the death of the testator. N.C.G.S. § 28A-2A-1. So, after you pass away, your will should be filed in your local probate court by the person named to be your personal representative (also called an ?executor? or ?administrator?).

29-14. As detailed in this statute, if the person who dies is survived by a spouse, the spouse will take in one of the following manners: If the person who dies is not survived by a child, a grandchild, or a parent, the spouse takes the entire estate, both real and personal property.

A will must be filed with the court in North Carolina. State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.