Charlotte North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out North Carolina Installments Fixed Rate Promissory Note Secured By Personal Property?

Regardless of one's social or professional position, completing legal documents is a regrettable obligation in the contemporary professional landscape.

Frequently, it's nearly impossible for individuals lacking a legal background to generate such documents from the ground up, primarily due to the complex terminology and legal subtleties they involve.

This is where US Legal Forms becomes beneficial.

However, if you are new to our platform, be sure to follow these steps before downloading the Charlotte North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property.

Ensure that the form you have selected is tailored to your location since the regulations of one state or region do not apply to another.

- Our service offers an extensive repository with over 85,000 state-specific forms that are suitable for nearly any legal circumstance.

- US Legal Forms also functions as a valuable tool for associates or legal advisors looking to save time by using our DYI forms.

- Whether you need the Charlotte North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property or any other valid document for your region, with US Legal Forms, everything is just a click away.

- Here’s how to obtain the Charlotte North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property in just minutes using our reliable service.

- If you are an existing user, you can proceed and Log In to your account to retrieve the desired form.

Form popularity

FAQ

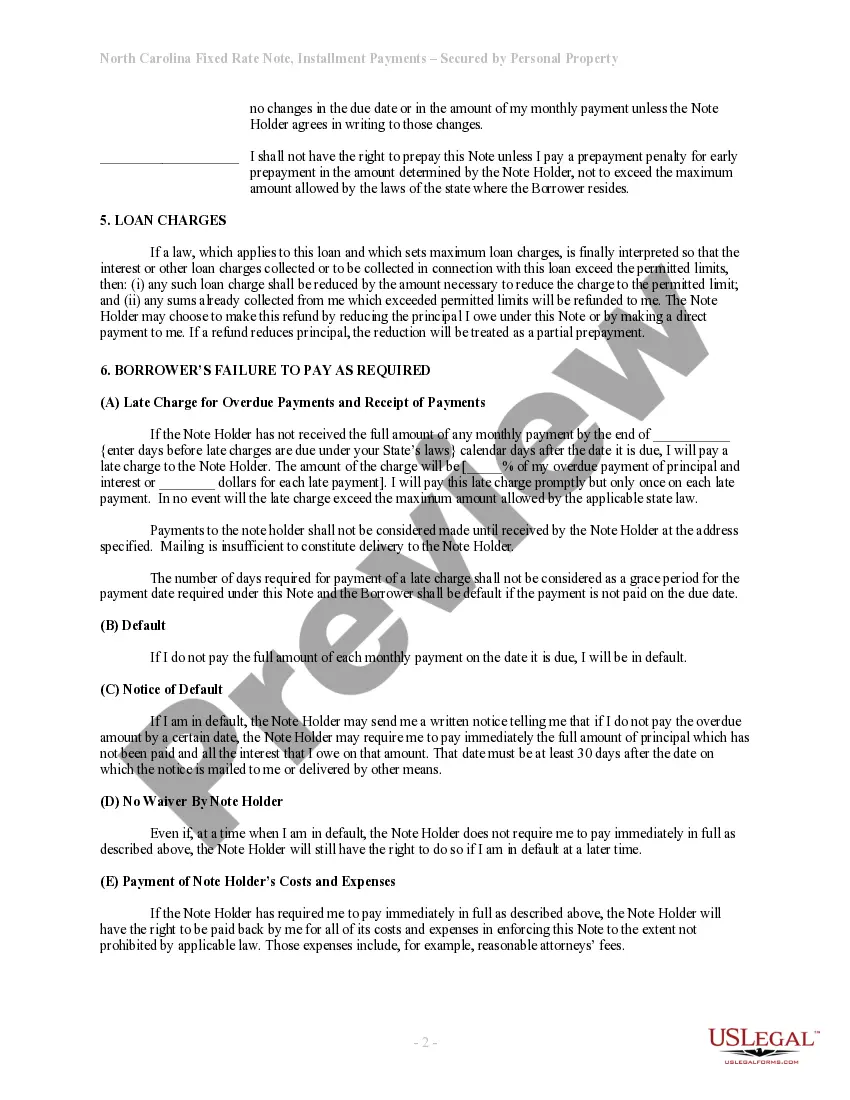

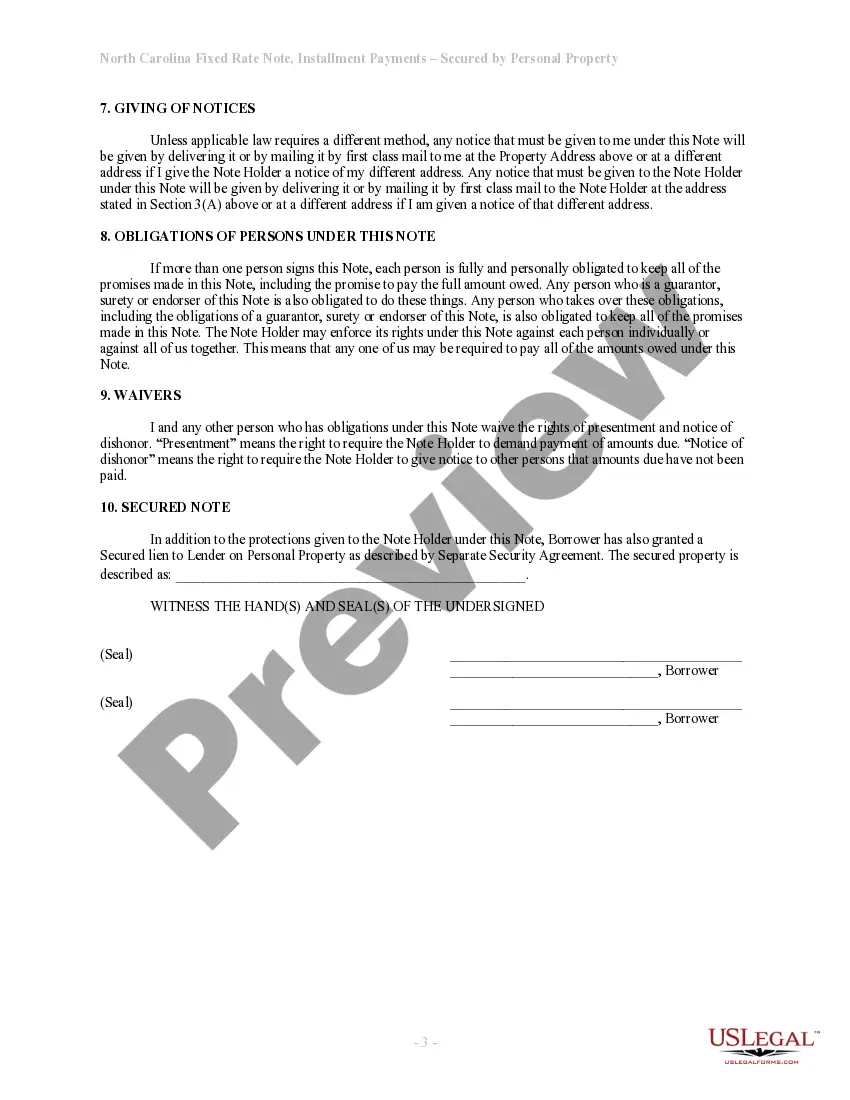

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

An unsecured promissory note does not come with these upfront requirements, though you are still obligated to repay the loan. Most commonly, a promissory note will be secured by the home you are purchasing, which also serves as collateral for the mortgage itself.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

There is no legal requirement for most promissory notes to be witnessed or notarized in North Carolina.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

In North Carolina, the statute of limitations for automobile loans, installment loans, credit cards and promissory notes is three years from the date of the last payment or charge. What this means is that every payment made on a delinquent account resets the clock and restarts the statute of limitations.

Most commonly, a promissory note will be secured by the home you are purchasing, which also serves as collateral for the mortgage itself.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.