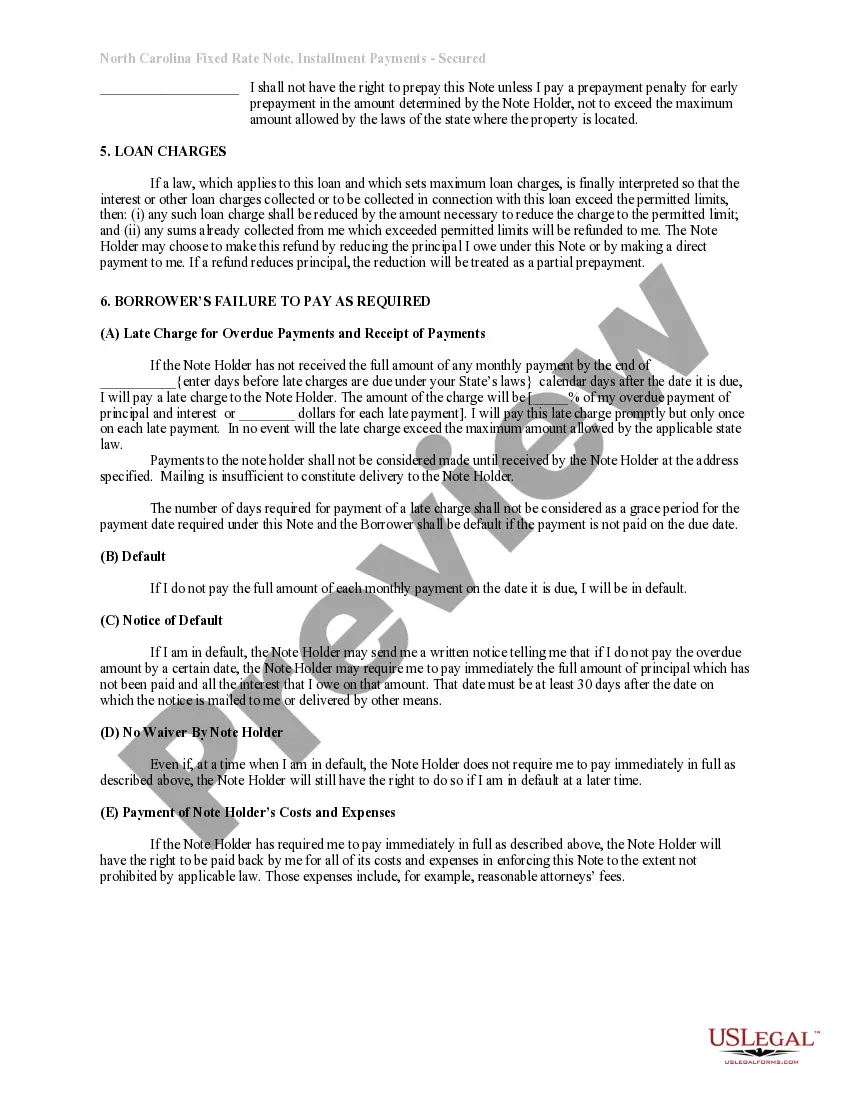

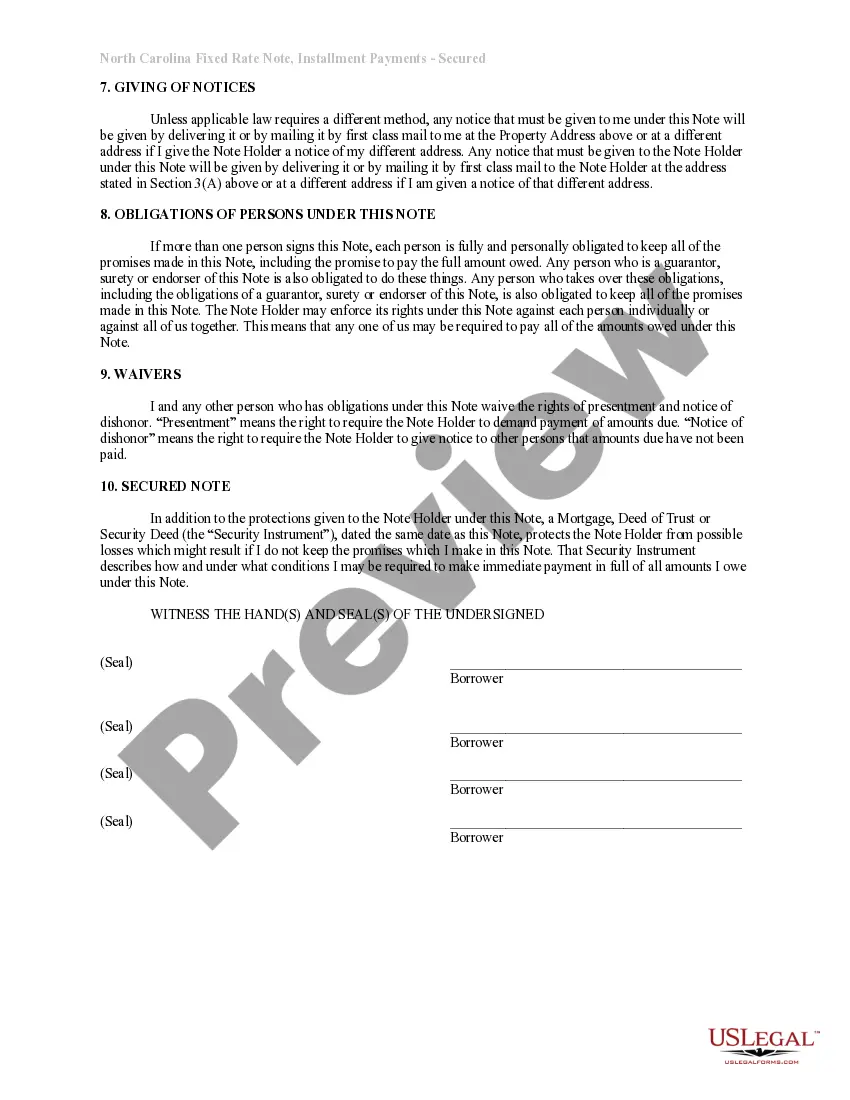

Cary North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out North Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Finding validated templates tailored to your regional regulations can be challenging unless you access the US Legal Forms library.

It’s an online collection of over 85,000 legal documents for both personal and business purposes, as well as various real-world scenarios.

All the files are appropriately classified by usage area and jurisdictional domains, making it quick and straightforward to locate the Cary North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Complete your payment by providing your credit card information or utilizing your PayPal account to finalize the subscription. Download the Cary North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate and save it on your device, allowing you to fill it out and access it within the My documents menu of your profile whenever you need it again. Keeping documents organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have essential document templates readily available for any requirements!

- Familiarize yourself with the Preview mode and document description.

- Verify that you have selected the correct one that aligns with your needs and fully complies with your local jurisdiction.

- Search for an alternative template, if necessary.

- Should you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it matches your criteria, proceed to the next stage.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan.

Form popularity

FAQ

To fill out a promissory demand note, clearly indicate the lender's name and the borrower's name, along with the amount borrowed. Define that it is a demand note to clarify that the repayment must occur upon the lender's request. Include interest rates and any special terms that may apply. For added clarity and a structured approach, consider templates from US Legal focused on notes secured by property in Cary, North Carolina.

You can obtain a Cary North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate through various resources. Local banks and credit unions often provide templates and legal advice for mortgage documentation. Additionally, for a more streamlined process, consider using platforms like US Legal Forms, which offers user-friendly access to a variety of legal documents. You can confidently create an installment promissory note that meets your needs and complies with North Carolina law.

In North Carolina, a promissory note does not necessarily need notarization to be valid, but it is highly recommended. Having a notary public witness your signature can provide additional legal protection if disputes arise in the future. For peace of mind, consider using uslegalforms to ensure your notes meet all legal requirements.

Yes, promissory notes are legally binding and can hold up in court if drafted correctly. In Cary, North Carolina, the strength of your note largely depends on its adherence to state laws. A properly executed promissory note secured by residential real estate can serve as strong evidence in case of disputes.

You record a promissory note at the county recording office where the property is located. In Cary, North Carolina, this office is typically part of the courthouse. Recording the note helps establish your rights to the secured property, making it easier to enforce the agreement.

In Cary, North Carolina, you file a promissory note with your local county register of deeds. This filing is necessary to ensure the note is officially recognized within the legal system. By taking this step, you create a public record of your financial agreement.

A promissory note must include essential elements such as the amount owed, interest rate, repayment terms, and signatures of the parties involved. It also needs to be clear and unambiguous. When drafting a Cary North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensuring these requirements are met will help protect your interests.

An assignment of promissory notes does not typically need to be notarized, but doing so can add legal strength to the transaction. If you choose to handle a Cary North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate, notarizing the assignment may help prevent disputes and clarify the transfer of obligations.

The validity of a promissory note in North Carolina is generally subject to the terms agreed upon by the parties. Typically, this could range from a few months to several years. When utilizing a Cary North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate, be sure to clearly specify the duration to avoid confusion later on.

In North Carolina, most contracts do not require notarization to be valid. However, certain documents, particularly those involving real estate, benefit from notarization. If you are using a Cary North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate, notarization can provide additional protection and credibility, making it advisable.