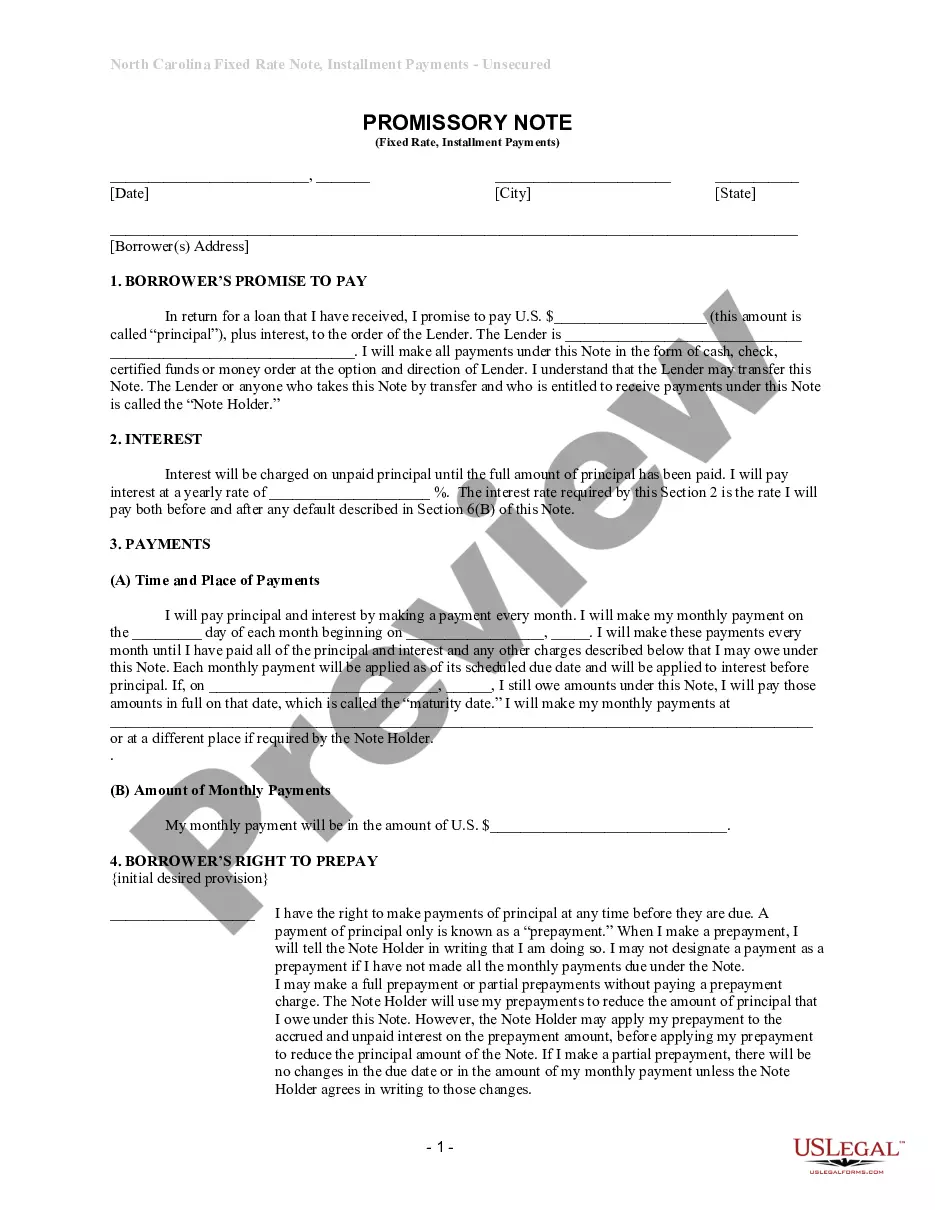

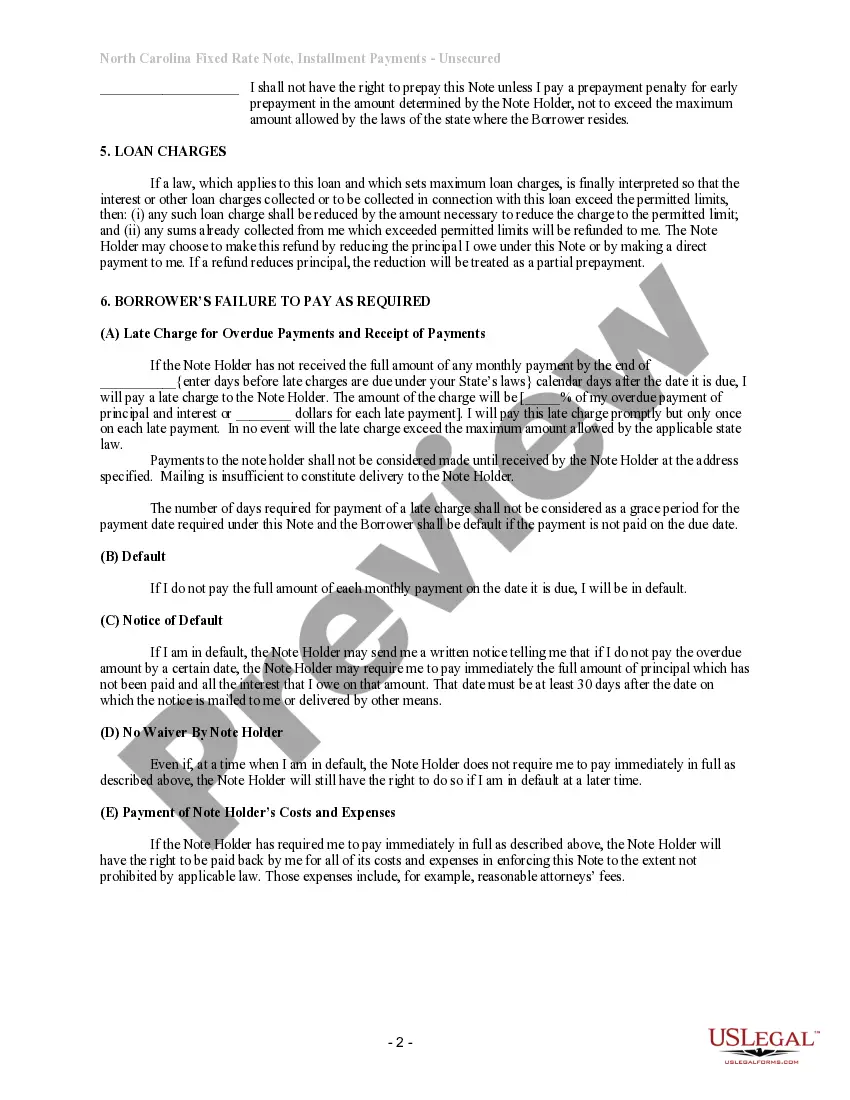

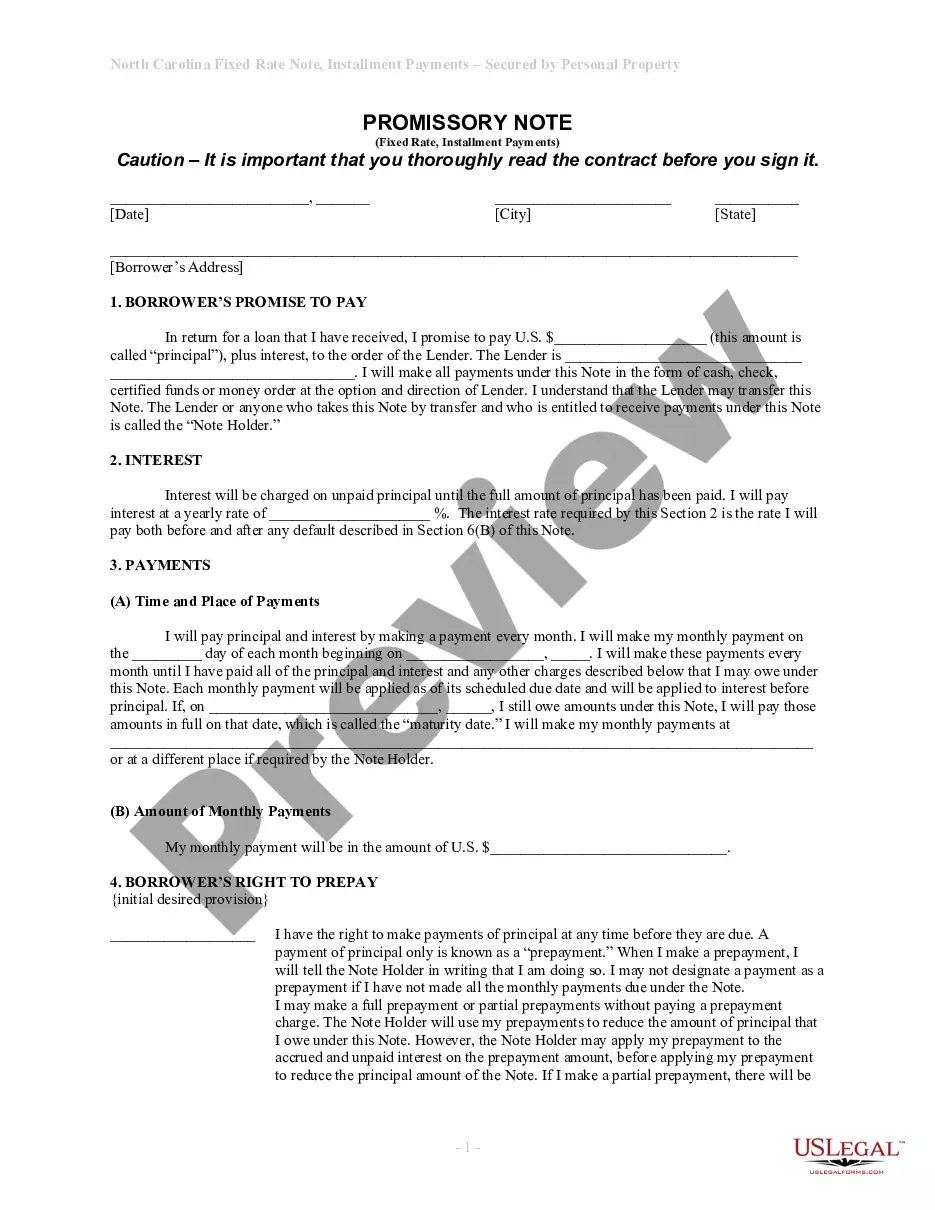

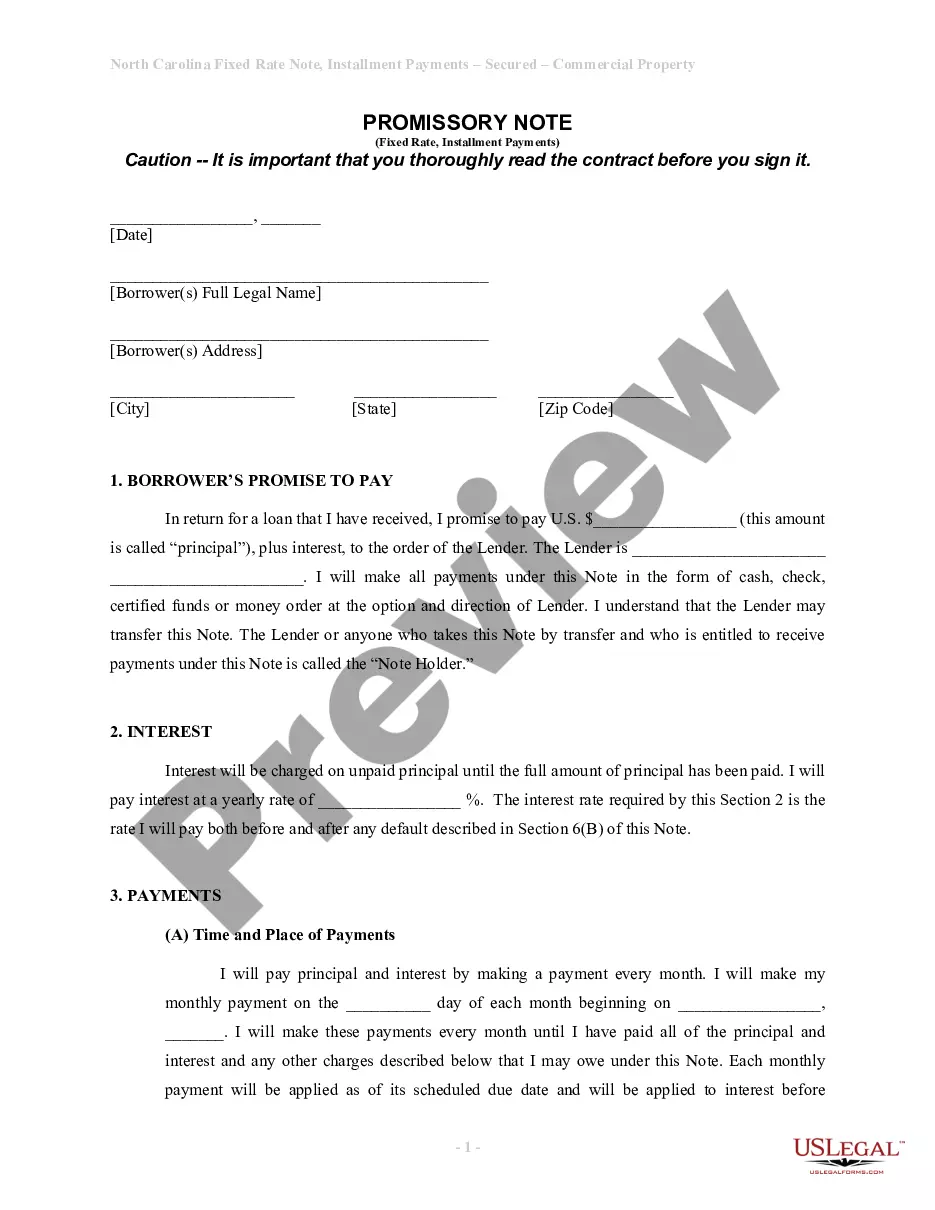

Cary North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate

Description

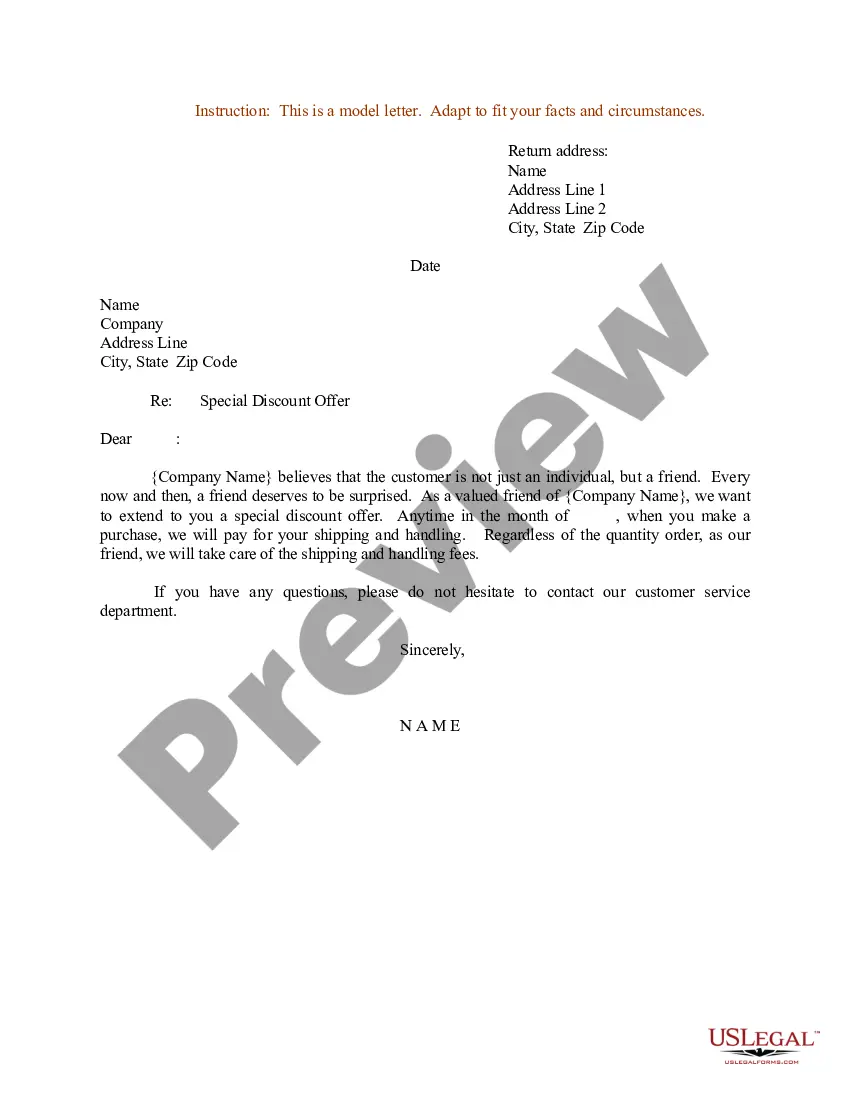

How to fill out North Carolina Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are looking for an authentic form, it’s exceptionally challenging to select a superior service than the US Legal Forms site – one of the largest collections on the web.

Here you can discover a vast number of form samples for business and personal uses categorized by types and states, or keywords.

With our sophisticated search feature, locating the latest Cary North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and save it to your device.

- Moreover, the validity of each document is verified by a team of qualified attorneys who routinely assess the templates on our platform and refresh them in line with the most recent state and county laws.

- If you are already familiar with our system and have an account, all you need to do to obtain the Cary North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the sample you need. Review its description and utilize the Preview feature to assess its content. If it doesn’t satisfy your requirements, use the Search option at the top of the page to find the correct document.

- Confirm your choice. Select the Buy now option. Then, pick the preferred subscription plan and provide the necessary information to register for an account.

Form popularity

FAQ

You can obtain a Cary North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate through various channels. Online platforms, such as US Legal Forms, offer a reliable solution by providing customizable templates that you can fill out according to your specific needs. This ensures that you comply with local laws while creating a legally binding document. Additionally, consulting with a local attorney can help you ensure that your promissory note meets all necessary legal requirements.

In North Carolina, most contracts do not need to be notarized to be effective, including unsecured installment payment promissory notes for fixed rate. However, certain contracts may benefit from notarization, as it provides an extra layer of authenticity. It is always a good practice to consult a legal expert if you have specific concerns about validating your documents. You can also find helpful guidance on platforms like US Legal Forms.

Generally, an assignment of promissory notes does not require notarization in Cary North Carolina, but it may be beneficial. If notarized, the assignment can provide additional proof and security should any disagreements arise later. Ultimately, the goal is to ensure a clear transfer of rights in the unsecured installment payment promissory note for fixed rate. Consulting resources like US Legal Forms can give you the necessary templates to simplify the process.

To be valid, a promissory note must contain specific elements, including the amount borrowed, repayment terms, and signatures from both the borrower and lender. In Cary North Carolina, the language should be clear and unambiguous to avoid future disputes. A well-structured unsecured installment payment promissory note for fixed rate can help clarify the expectations and obligations of the parties involved. Using platforms like US Legal Forms can ensure that your note meets all legal standards.

In Cary North Carolina, an unsecured installment payment promissory note for fixed rate can still be valid without notarization. However, notarization can strengthen enforcement if disputes arise. It's wise to consider getting it notarized to prevent future complications. A properly drafted note is essential for clarity and legal protection.

In North Carolina, a promissory note does not require notarization to be valid. However, having the note notarized can help establish its legitimacy and may aid in enforcement if disputes arise. If you are preparing a Cary North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate, consider notarization as an extra layer of security during the transaction process.

A promissory note can indeed be unsecured if it does not involve any guaranteed collateral. Unsecured notes usually present higher risk for lenders, which may be reflected in the terms. If you are looking to create a Cary North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate, it helps to clearly express the repayment terms to protect all parties.

Several factors can render a promissory note invalid, including lack of essential terms, unclear language, or if it was signed under duress. Additionally, if the document is not properly executed, it may lead to questions about its enforceability. It is essential to ensure your Cary North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate is drafted correctly to avoid these issues.

A promissory note does not necessarily need to be secured. The decision depends on the agreement between the parties involved and the level of risk they are willing to take. If you are considering a Cary North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate, ensure you understand the implications of not having collateral backing the debt.

Yes, a promissory note can be unsecured, which means it is not backed by collateral. This option is typically more accessible for borrowers, yet it may come with higher interest rates. For those interested in a Cary North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate, it is critical to clearly define the terms to avoid potential disputes.