Wake North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Locating authentic templates related to your local laws can be challenging unless you access the US Legal Forms library.

It’s an online collection of over 85,000 legal forms catering to both personal and professional requirements along with various real-life scenarios.

All documents are accurately categorized by usage area and jurisdictional regions, making it as simple as pie to find the Wake North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Maintaining documents tidy and compliant with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates accessible for any needs right at your fingertips!

- Familiarize yourself with the Preview mode and document description.

- Ensure that you've chosen the right one that fits your needs and fully aligns with the requirements of your local jurisdiction.

- Look for another template if necessary.

- If you notice any discrepancy, utilize the Search tab above to retrieve the accurate template.

- If it fits your requirements, proceed to the next step.

Form popularity

FAQ

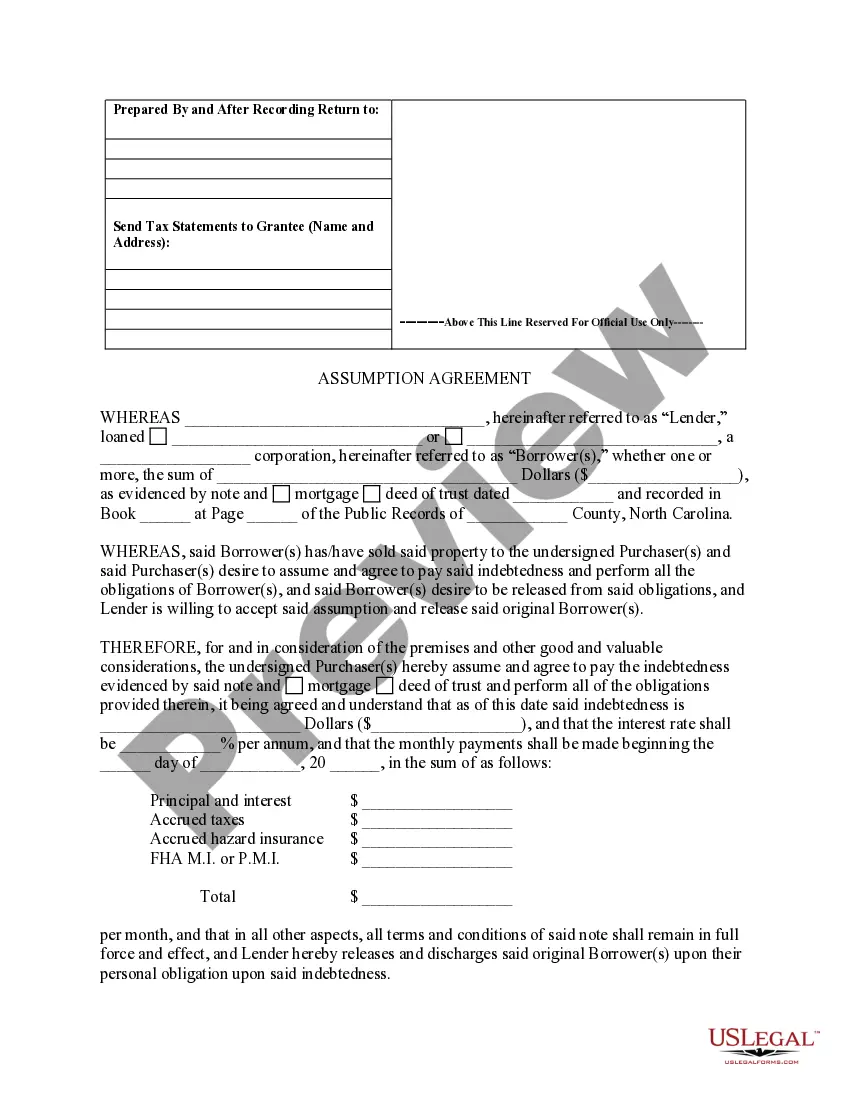

The assumption of the deed of trust allows a new borrower to take over the mortgage obligations from the original mortgagor. This is significant in the context of the Wake North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, as it facilitates the transfer of property and responsibility without immediate refinancing. It benefits both parties by providing clarity on financial obligations, ultimately fostering a smoother transition in ownership. You can find comprehensive resources and templates for this process on the US Legal Forms platform, ensuring that you have all necessary documents at your fingertips.

Various states across the U.S. utilize deeds of trust, including California, Texas, and of course, North Carolina. Each state may have different regulations governing their use. If you're in North Carolina, familiarizing yourself with the Wake North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors can provide clear guidance and peace of mind regarding your property agreements.

The choice between a mortgage and a deed of trust often hinges on the lender's preference and the state laws in place. In North Carolina, lenders typically favor deeds of trust for their efficiency in foreclosure processes. Additionally, borrowers may benefit from understanding the specific terms tied to the Wake North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, which can influence this choice.

North Carolina is predominantly a deed of trust state, which means most real estate transactions use deeds of trust rather than traditional mortgages. This system provides a more streamlined foreclosure process. Because of this approach, borrowers often find they have more options when entering into agreements, including the Wake North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

North Carolina primarily uses deeds of trust instead of traditional mortgages for property transactions. This method involves three parties: the borrower, the lender, and a trustee. Understanding this difference is essential when dealing with the Wake North Carolina Assumption Agreement of Deed of Trust, as it influences the overall transaction structure and legal obligations.

To release a deed of trust, you need to ensure that all financial obligations tied to it are met. After confirming this, you can file a release document with the appropriate county office. For a seamless experience, consider using US Legal Forms, which offers templates and instructions specifically related to the Wake North Carolina Assumption Agreement of Deed of Trust.

To obtain a deed of release in Wake, North Carolina, you can request it through your lender or mortgage servicer. Many online platforms, such as US Legal Forms, provide templates and guides to help you navigate this process. It's essential to ensure you have the correct documentation to facilitate the release of the original mortgagors under the Wake North Carolina Assumption Agreement of Deed of Trust.

In most instances, the original deed of trust is held by the lender until the mortgage debt is fully repaid. This ensures the lender maintains a secured interest in the property. When dealing with the Wake North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, it’s crucial to know who currently holds the deed of trust to understand any obligations or laws that may apply. Check with uslegalforms for guidance and forms that may help you navigate these situations.

To obtain a copy of your deed in North Carolina, you can request it from the county register of deeds where your property is located. You will need to provide specific details about your property, such as the address and tax parcel number. Familiarizing yourself with the Wake North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors can also guide you in this process. Our platform, uslegalforms, offers useful forms that simplify these tasks.

The process in a deed of trust usually involves the borrower, the lender, and a third-party trustee. This trustee, appointed by the lender, manages the property title and ensures all parties fulfill their obligations. If you are navigating the Wake North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, you may want to seek legal advice or use uslegalforms for assistance. This will help you understand all necessary steps clearly.