Raleigh North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Regardless of social or occupational standing, completing legal documentation is an unfortunate requirement in the current professional landscape.

Frequently, it is nearly impossible for an individual lacking legal expertise to generate this type of paperwork from the ground up, primarily due to the intricate language and legal nuances they encompass.

This is where US Legal Forms can come to the rescue.

Verify that the template you have located is appropriate for your area, as the regulations for one state or county may not apply to another.

Go through the form and review a brief overview (if available) of the scenarios the document is applicable for.

- Our service offers an extensive collection of over 85,000 ready-made state-specific forms that cater to nearly any legal issue.

- US Legal Forms also serves as a valuable tool for paralegals or legal advisors aiming to enhance their efficiency with our DIY forms.

- Whether you need the Raleigh North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors or any other document that is recognized in your state or county, US Legal Forms makes everything readily accessible.

- Here’s how you can quickly acquire the Raleigh North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors using our reliable platform.

- If you are already a member, feel free to Log In to your account to obtain the relevant form.

- However, if you are new to our library, be sure to follow these instructions before acquiring the Raleigh North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Form popularity

FAQ

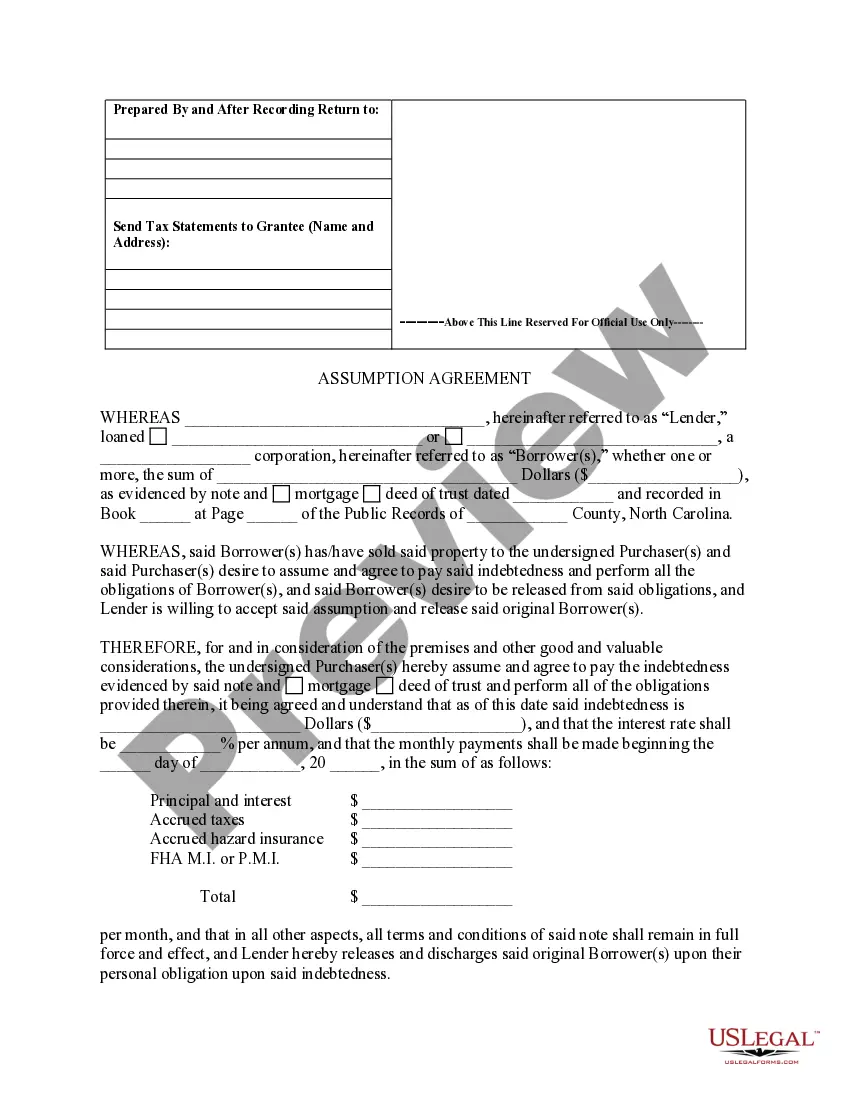

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

Deeds of trust and mortgages are a means of securing the payment of a debt or performance of an obligation. The debt may be established by promissory note, bond or other instrument. In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate.

Focusing on this geographical region, the Deed of Trust is the preferred or required security instrument for real property in the following states: Maryland, North Carolina, Tennessee, Virginia and West Virginia. Mortgages are used in Kentucky, Ohio and Pennsylvania.

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

A deed of trust is a legal document that secures a real estate transaction. It works similarly to a mortgage, though it's not quite the same thing. Essentially, it states that a designated third party holds legal title to your property until you've paid it off according to the terms of your loan.

A letter of assumption is a written agreement between a current homeowner and a prospective buyer. The letter states that the buyer agrees to take over the homeowner's debt in the home in exchange for ownership.

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate. Upon repayment of the debt or performance of the obligation, the conveyance becomes void.