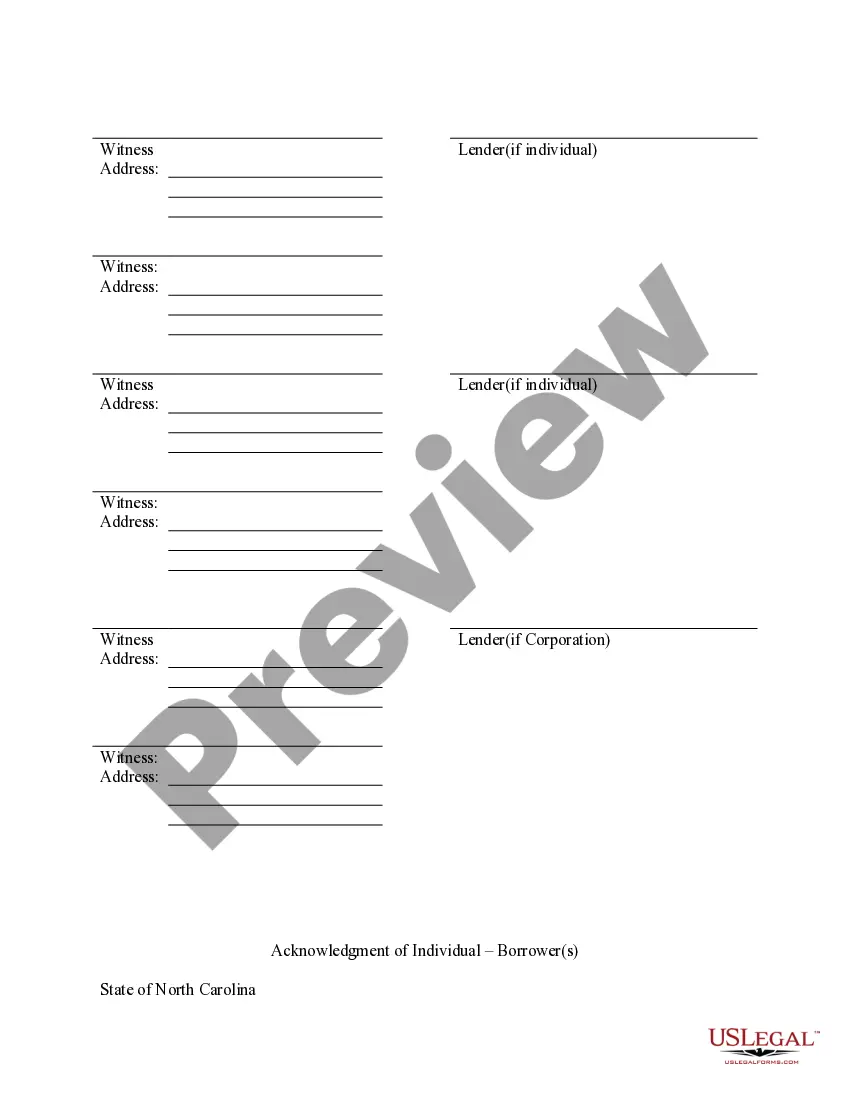

High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Utilize the US Legal Forms and gain instant access to any document you need.

Our efficient platform, featuring numerous document templates, enables you to search for and acquire virtually any sample document necessary.

You can export, complete, and validate the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors in just a few minutes instead of spending hours online searching for a suitable template.

Using our collection is an excellent approach to enhance the security of your document submissions. Our skilled attorneys routinely examine all documents to ensure that the templates are suitable for specific states and conform to current laws and regulations.

US Legal Forms is among the largest and most trustworthy document databases available online.

Our team is always eager to assist you in any legal matter, even if it’s just obtaining the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

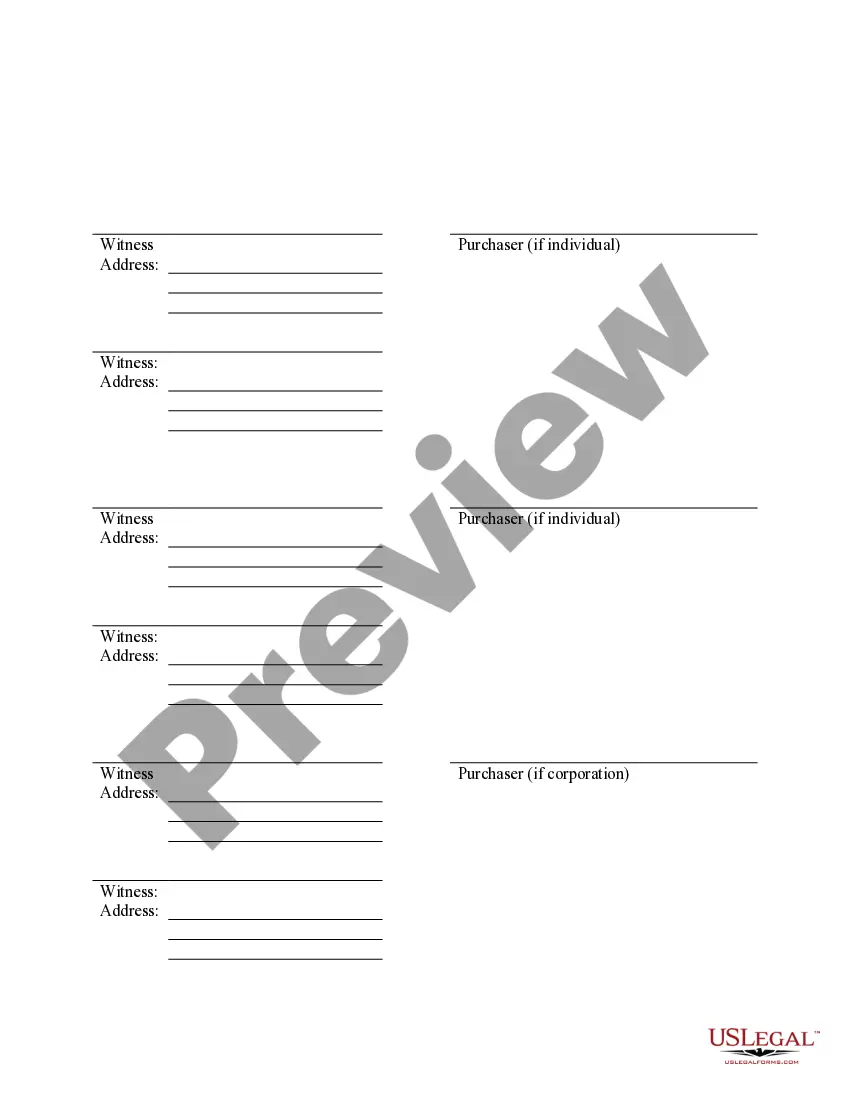

- How can you acquire the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

- If you possess an account, simply sign in to your profile. The Download button will be activated on all the samples you review. Additionally, you can access all the previously saved documents in the My documents section.

- If you have not yet created an account, follow the instructions below.

- Navigate to the page with the required form. Ensure it is the document you were looking for: verify its title and description, and use the Preview option when it’s available. Otherwise, use the Search bar to locate the desired document.

- Initiate the download process. Click Buy Now and select your preferred pricing plan. Next, create an account and complete your order using a credit card or PayPal.

- Download the document. Select the format to obtain the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors and modify, complete, or sign it as per your specifications.

Form popularity

FAQ

To obtain a copy of the deed to your house in North Carolina, you can visit the Register of Deeds office in your county. High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors records are often available through this office. Additionally, many counties provide online access to property records, allowing you to search for your deed from home. If you prefer a streamlined process, consider using platforms like US Legal Forms, which can guide you in obtaining the necessary documents more efficiently.

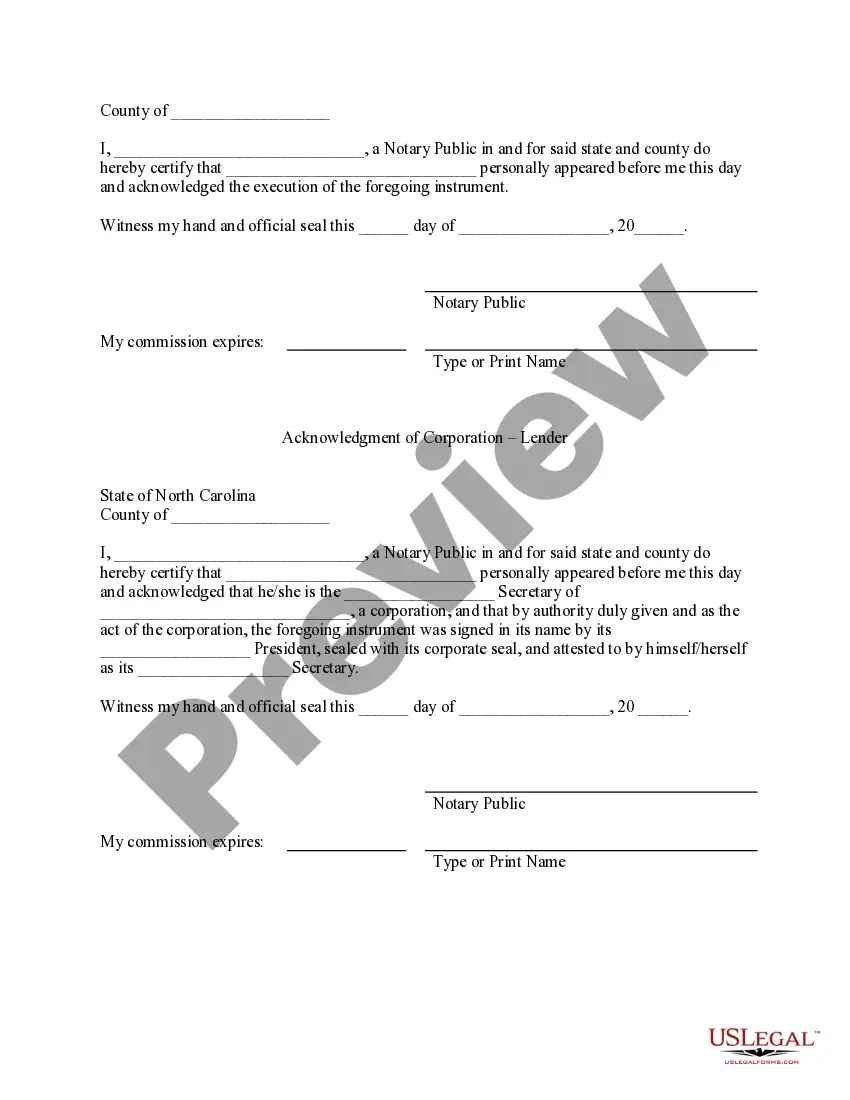

Lenders generally prefer deeds of trust because they allow for a quicker foreclosure process if a borrower defaults. This efficiency helps lenders protect their investment and reduce financial losses. In High Point North Carolina, the Assumption Agreement of Deed of Trust and Release of Original Mortgagors further clarifies lender rights and borrower responsibilities.

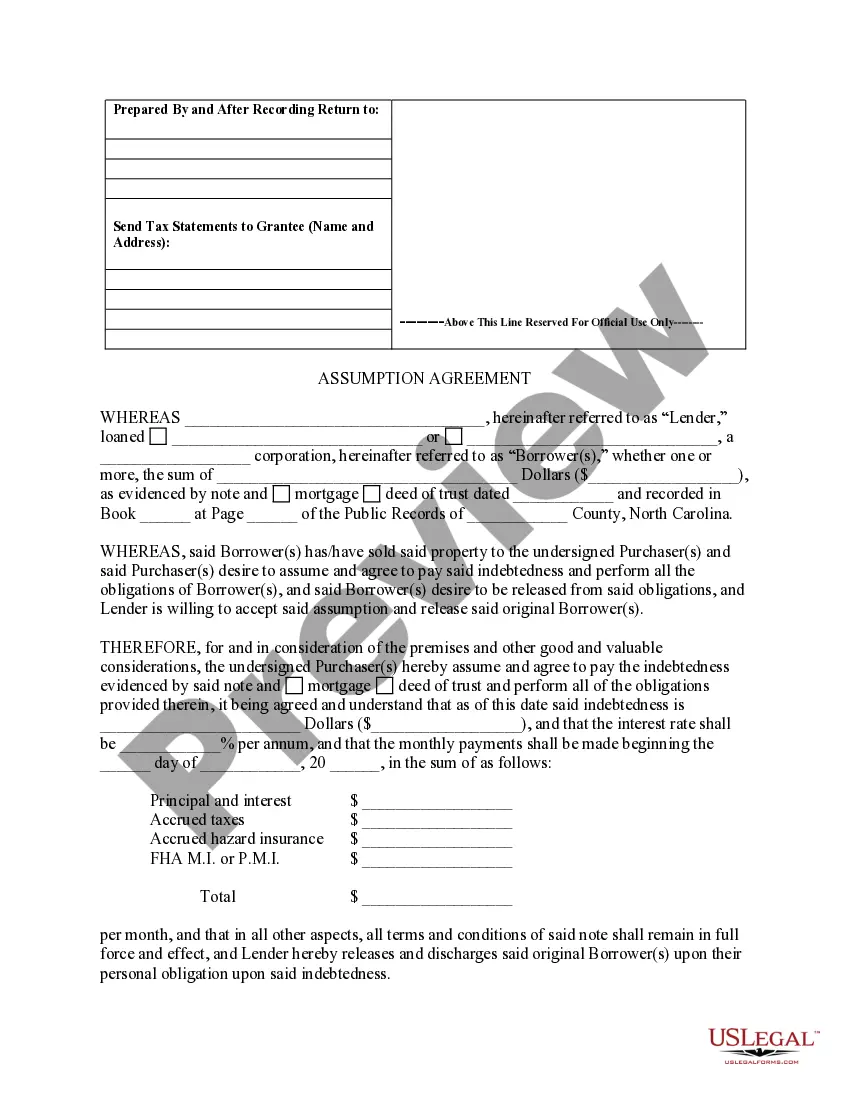

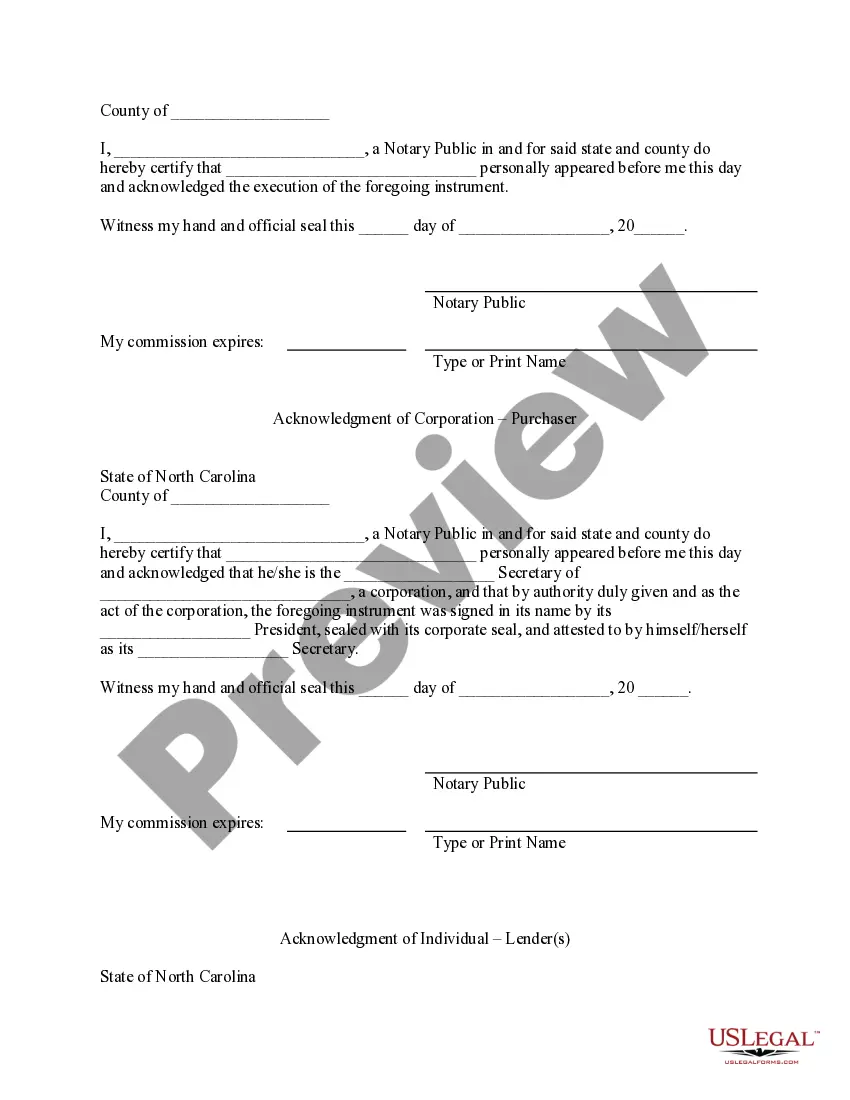

A deed of trust to secure assumption is a legal document that allows a buyer to assume the existing mortgage on a property. This document protects the lender's rights while making the property transfer easier. In High Point North Carolina, this method can provide peace of mind and clarity for all parties involved.

A deed assumption occurs when a buyer takes over a seller's existing mortgage obligations. This arrangement can be beneficial if the current mortgage terms are favorable. In High Point North Carolina, an Assumption Agreement of Deed of Trust and Release of Original Mortgagors can facilitate this process, ensuring that all parties are legally recognized.

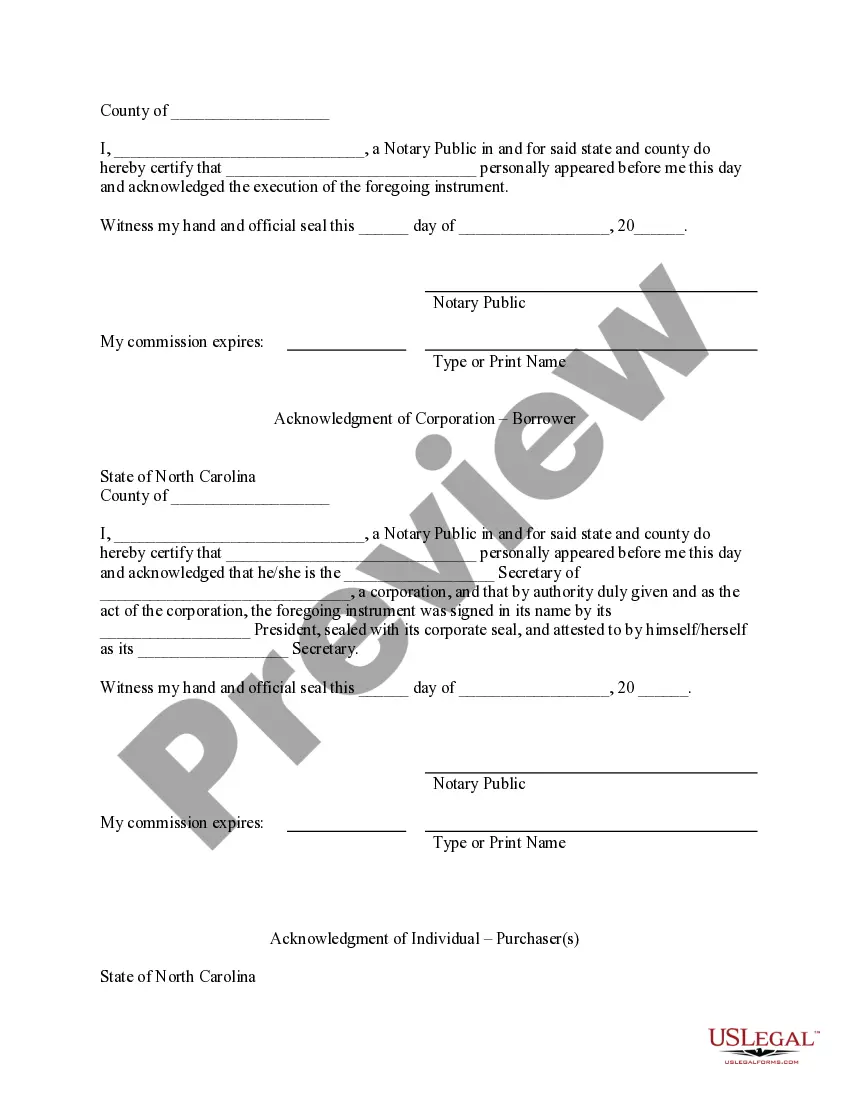

North Carolina primarily uses deeds of trust instead of traditional mortgages for securing loans. A deed of trust involves three parties: the borrower, the lender, and a third-party trustee. This setup is common in High Point North Carolina and tends to streamline the foreclosure process, affecting both the lender and borrower.

One disadvantage of a deed of trust is that the borrower may lose the property more quickly in case of default. In High Point North Carolina, the lender can initiate a non-judicial foreclosure, leading to a faster process compared to a traditional mortgage. Additionally, borrowers may feel they have less control over their property, which can lead to anxiety.

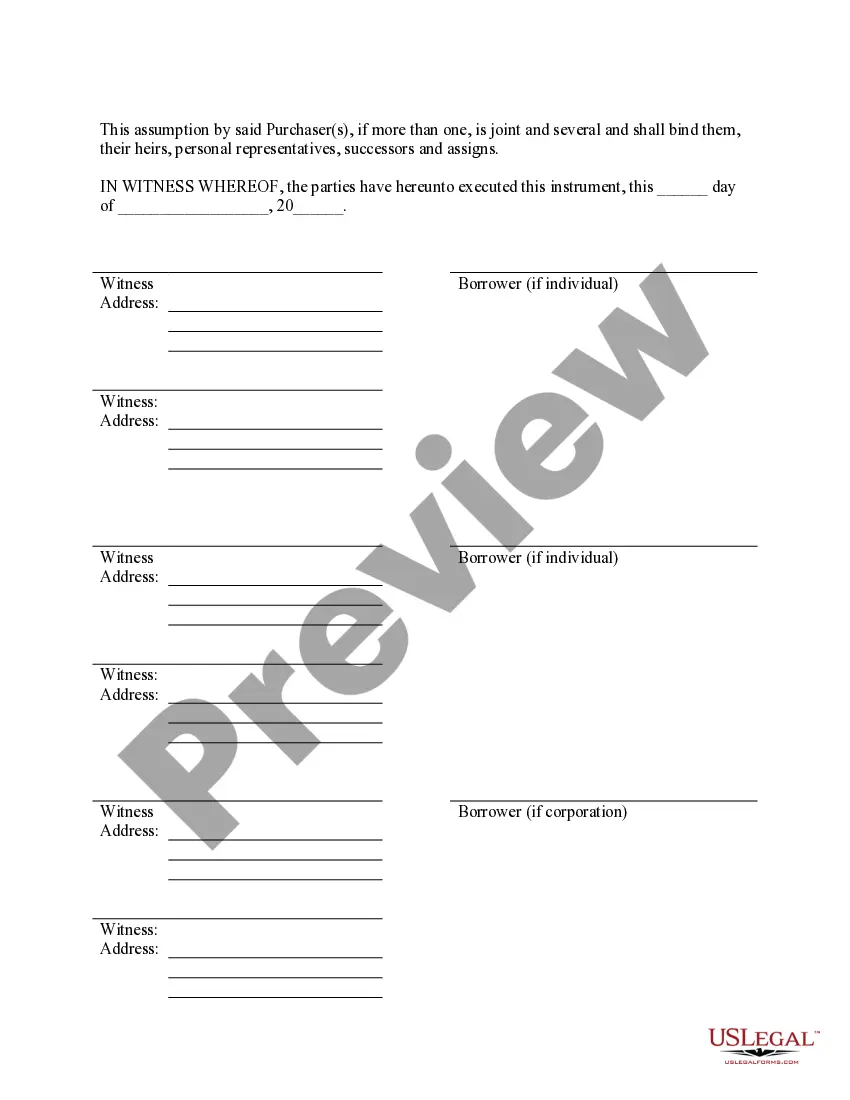

In most cases, a deed of trust appoints a neutral third party such as a bank, title company, or attorney as the trustee. This arrangement helps to establish trust between the lender and borrower by ensuring impartiality in fulfilling the agreement's terms. For those navigating the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, recognizing the trustee's position can streamline the process and help clarify expectations.

The trustee is neither the buyer nor the seller, but rather a neutral entity who oversees the transaction process. The trustee ensures that the deed of trust is respected and executed properly, acting in a manner that benefits both parties. For individuals engaging in a High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, understanding the trustee's role can provide clarity and confidence during real estate transactions.

Typically, the trustee in a deed of trust is a neutral third party, often a title company or an attorney, who holds the legal title to the property until the debt is satisfied. This trustee acts on behalf of the lender and the borrower, ensuring that all parties comply with the agreement. In the context of the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, the trustee safeguards the interests of all parties involved during the transaction.

In a trust, the trustee is usually a responsible individual or a financial institution assigned the duty of managing the trust's assets. The trustee must act in the best interest of the beneficiaries, ensuring that the terms of the trust are followed. With regard to the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, the trustee may also play a crucial role in facilitating the transfer of property rights.