Charlotte North Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out North Carolina Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children?

Obtaining verified templates that comply with your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It is a virtual collection of over 85,000 legal documents catering to both personal and professional requirements across various real-life circumstances.

All documents are correctly grouped by usage category and jurisdiction, making it straightforward to find the Charlotte North Carolina Living Trust for Individuals Who Are Single, Divorced or Widowed with Children as easy as 1-2-3.

Maintain your paperwork organized and compliant with legal stipulations is crucial. Utilize the US Legal Forms repository to ensure you always have essential document templates available at your fingertips!

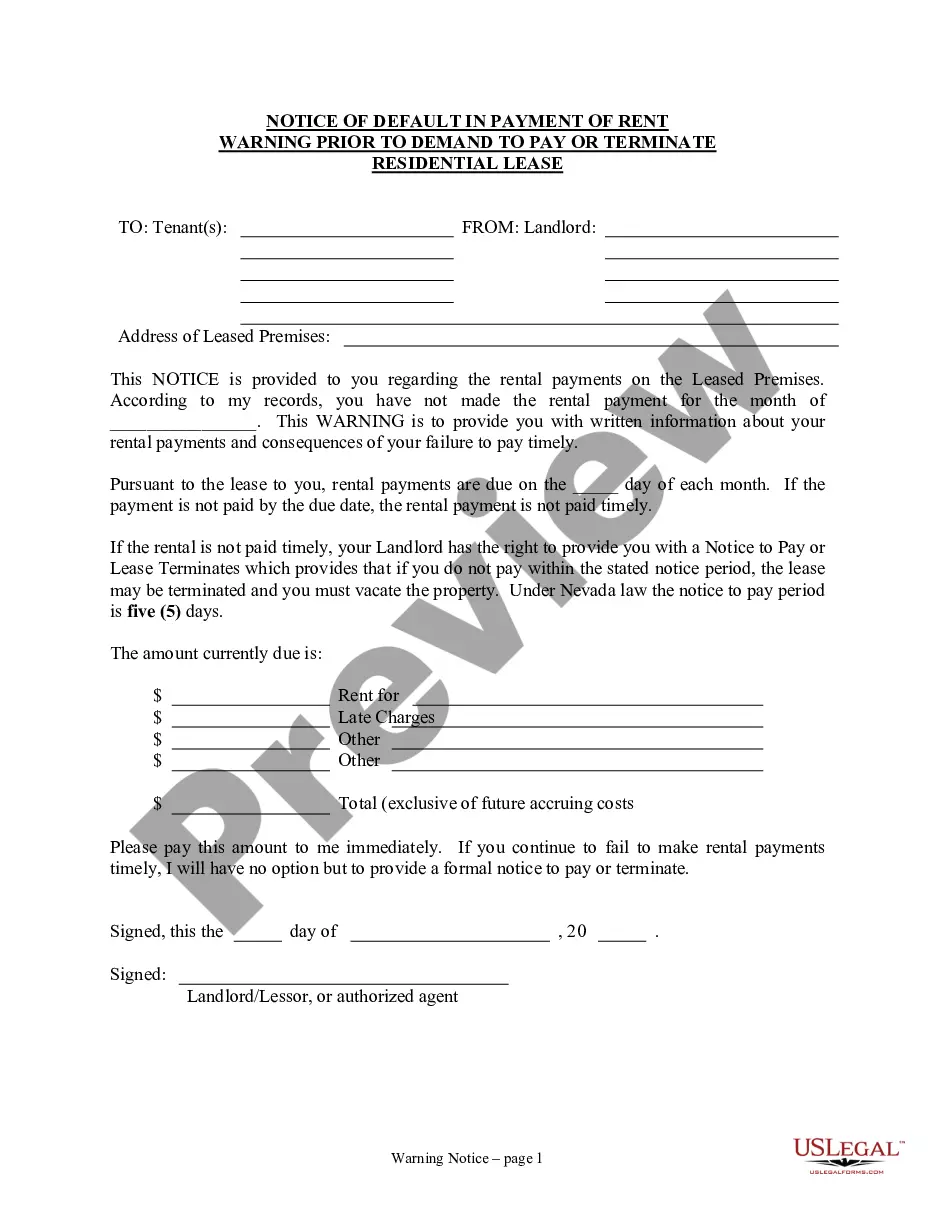

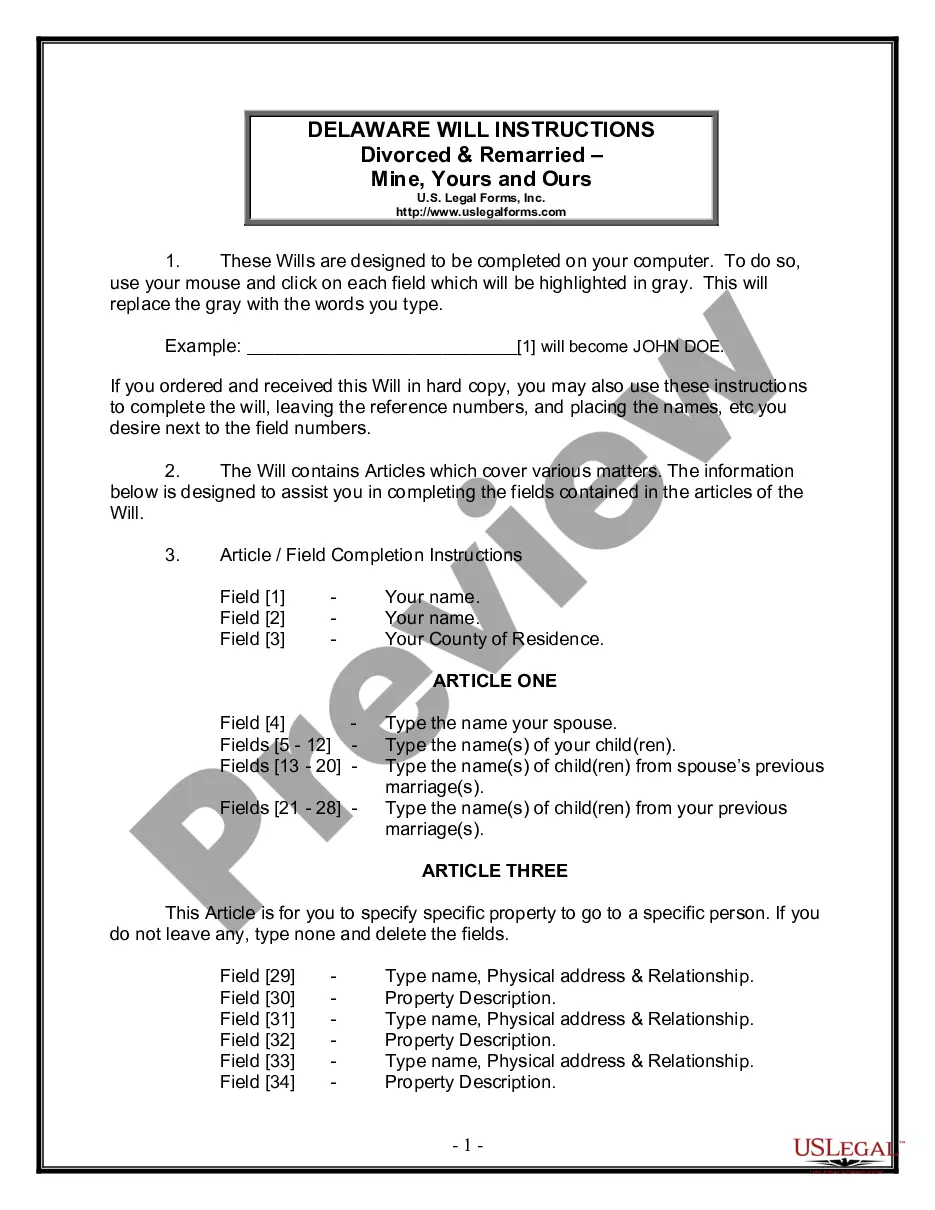

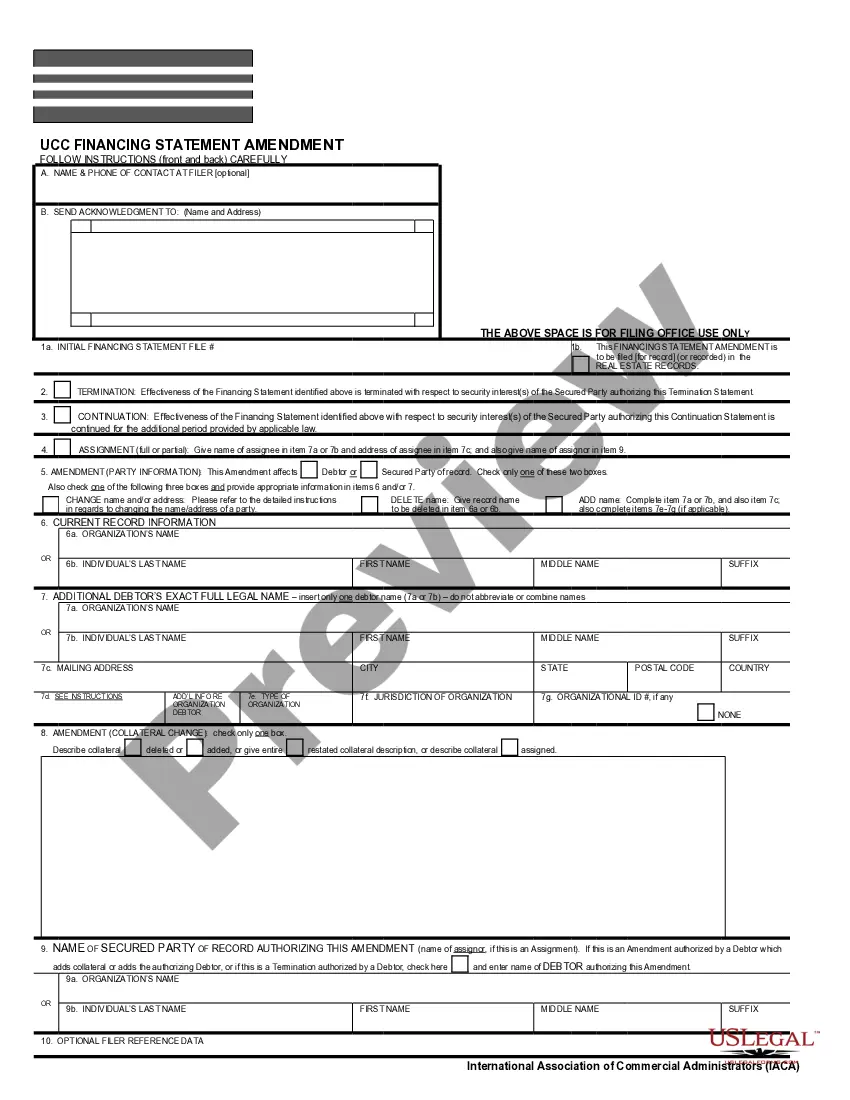

- Review the Preview mode and document description.

- Confirm that you have selected the correct option that fulfills your requirements and fully aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- Should you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

- Acquire the document. Click on the Buy Now button and select your preferred subscription plan.

Form popularity

FAQ

A Bypass Trust is a sub-Trust that becomes irrevocable after the first spouse dies. A Bypass Trust is sometimes called a Residual Trust, a Family Trust, or a Tax Avoidance Trust.

One advantage for using a trust is that trusts can be used to begin distributing property before death, at death or even sometime afterwards. That isn't helpful or important in all cases, but it provides a level of flexibility that a will simply can't.

Likewise, North Carolina law provides that all current trust beneficiaries have a right to receive a copy of the trust document, and a right to financial accountings and trust management records at ?reasonable intervals.? It is a good idea for a trustee to be proactive, and responsive, in providing these items to

A typical sub trust that would become effective as of the death of the first spouse is often called the ?Survivor's Trust.? The Survivor's Trust holds certain assets for the spouse that ?survives? the other. Typically the Survivor's Trust is revocable - in other words, it can be changed by the surviving spouse.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

A will distributes assets immediately after probate ends. A trust lets you keep assets in the trust if you wish and pass them on at later dates, such as beneficiaries' significant birthdays. Your revocable living trust protects you should you become mentally incapacitated.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

There are two main types of trusts: revocable and irrevocable.

F Trust means the trust which immediately after the Trust Reorganization owned, directly or indirectly, all of the outstanding equity interests in Tak Tent-F.

The Survivor's Trust is the surviving spouse's share of the estate. The survivor's portion of the Trust can typically be revoked or amended while the surviving spouse is still alive. A Survivor's Trust is different from a Bypass Trust because a Bypass Trust cannot be changed.