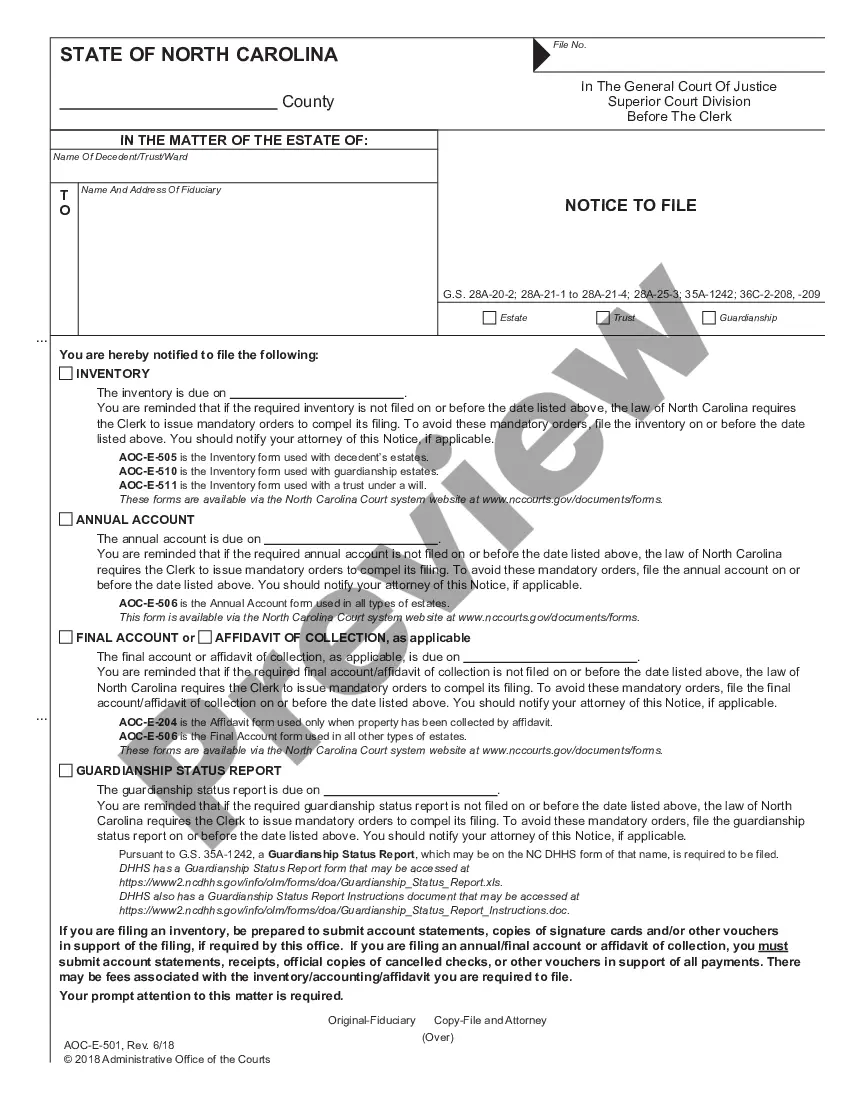

Account, Annual or Final: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Wake North Carolina Account Annual Final

Description

How to fill out North Carolina Account Annual Final?

Regardless of one’s social or professional position, completing legal documents is a regrettable requirement in modern society.

Frequently, it becomes nearly unfeasible for individuals lacking legal expertise to draft this kind of documentation from scratch, primarily due to the intricate terminology and legal subtleties they contain.

This is where US Legal Forms steps in to assist.

Verify that the form you selected is tailored for your region, as the rules of one state or area do not apply to another.

Review the document and check a brief overview (if available) of scenarios for which the form can be utilized.

- Our platform offers an extensive library with over 85,000 ready-to-use, state-specific templates applicable to almost any legal matter.

- US Legal Forms is also a valuable tool for aides or legal advisors who wish to conserve time using our DIY forms.

- Whether you seek the Wake North Carolina Account Annual Final or any other document that will be acknowledged in your state or region, with US Legal Forms, everything is available.

- Here’s how you can obtain the Wake North Carolina Account Annual Final quickly using our dependable service.

- If you are currently a member, feel free to Log In to your account to download the necessary form.

- However, if you are new to our library, ensure to follow these instructions before acquiring the Wake North Carolina Account Annual Final.

Form popularity

FAQ

To become an executor of an estate in North Carolina, you must be appointed by the court. Generally, you would need to file a petition and submit to a background check. Understanding these steps helps you approach the Wake North Carolina Account Annual Final with confidence and efficiency. Platforms like US Legal Forms can provide you with the necessary legal documents and guidance to navigate this process seamlessly.

In North Carolina, an estate can technically stay open for several years, depending on various factors such as asset liquidation and tax matters. However, it's generally advisable to complete the process within one to three years. This timeline can affect the Wake North Carolina Account Annual Final and your overall management of the estate. Consider using US Legal Forms to streamline the process and ensure adherence to legal timelines.

The process of being appointed an executor without a will can take several weeks to a few months in North Carolina. The timeline depends on the complexity of the case and the court's schedule. Patience and thorough preparation are essential during this time, especially when managing aspects like the Wake North Carolina Account Annual Final. Using resources like US Legal Forms can expedite your preparation and enhance your chances of a smooth appointment.

Proving an executor of an estate without a will in North Carolina often involves demonstrating familial relationships or close affiliations to the deceased. You may need to collect evidence, such as birth certificates or affidavits from witnesses. It’s important to understand that this proof is vital when dealing with Wake North Carolina Account Annual Final matters. US Legal Forms can assist you with templates and resources for presenting your case adequately.

To settle an estate without a will in North Carolina, you typically start by filing an application with the clerk of court. The court will then appoint an administrator to oversee the estate. This process is crucial because it allows you to address the Wake North Carolina Account Annual Final effectively. Utilizing platforms like US Legal Forms can guide you through the forms and legal steps necessary for this process.

While there is no strict minimum estate value for probate in North Carolina, the aforementioned $20,000 guideline generally applies to personal property. However, even smaller estates might require probate depending on the specific assets involved and the presence of any disputes. It's wise to assess your situation, using tools from Wake North Carolina Account Annual Final, to determine the best course of action.

In North Carolina, if an estate exceeds the value of $20,000 for personal property, it generally must go through probate. This threshold protects smaller estates from the complexities of the probate process, allowing for smoother transitions for families. It is important to stay informed about this figure as it can impact your planning efforts. Resources like Wake North Carolina Account Annual Final can provide essential insights.

In North Carolina, several assets are exempt from probate. These include bank accounts with designated beneficiaries, life insurance policies, and retirement accounts that name specific beneficiaries. Additionally, goods valued below a certain threshold can also avoid probate. Understanding Wake North Carolina Account Annual Final can help clarify which assets you may include.

Not all estates in North Carolina must go through probate. Certain assets, such as those held in joint tenancy or designated beneficiaries on accounts, can bypass the process. However, if the estate includes real property or other significant assets, probate may be required. To navigate these requirements, it's beneficial to explore Wake North Carolina Account Annual Final options.

In North Carolina, the form typically used for final accounting is the 'Inventory and Account of Estates'. This form requires detailed information about the estate’s assets and any transactions that occurred during administration. Executors must complete this to provide a clear overview to beneficiaries and the court. The Wake North Carolina Account Annual Final framework offers tools to assist with proper filings.