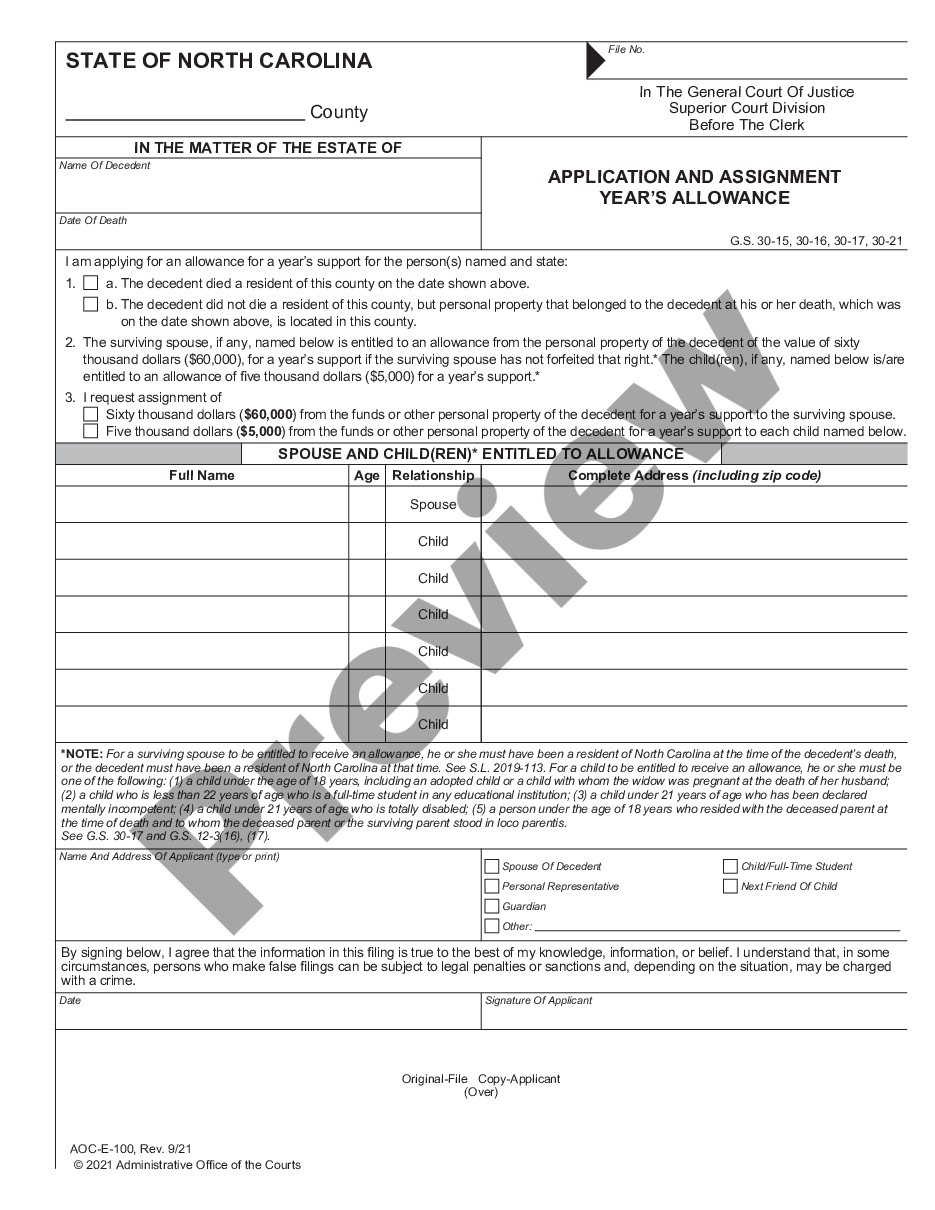

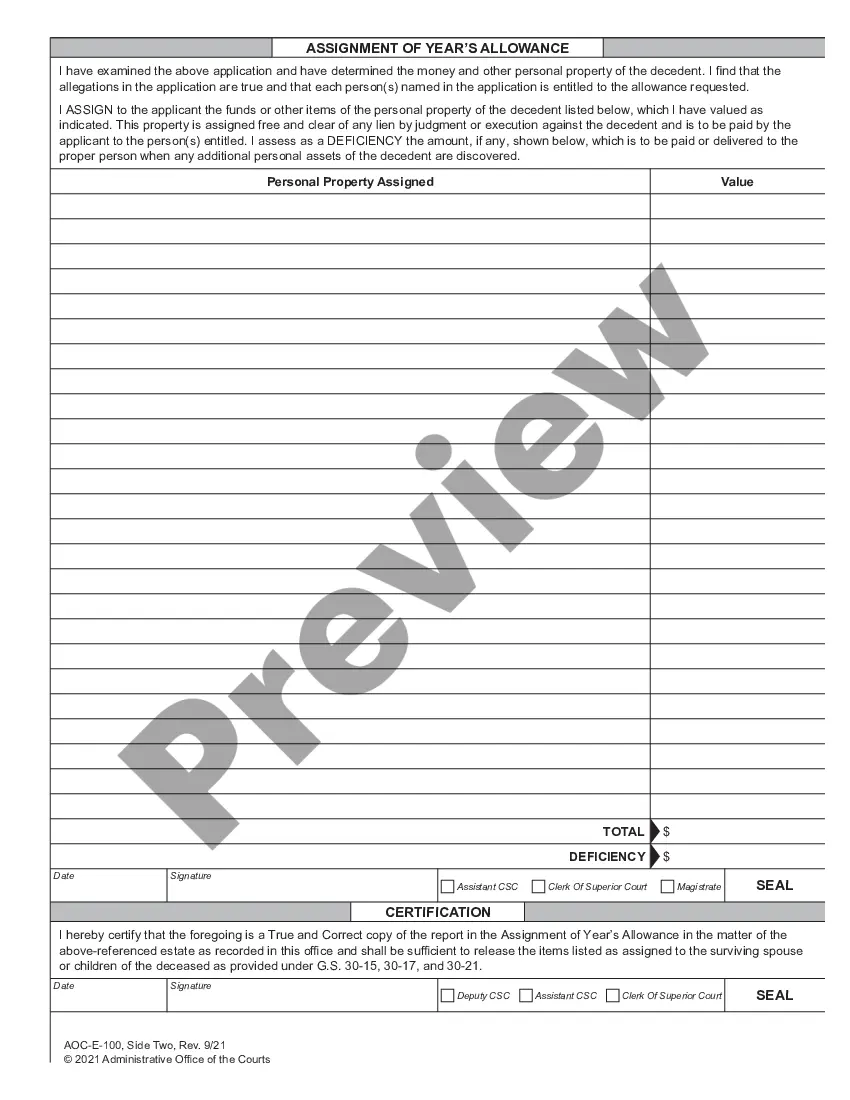

Application And Assignment Year's Allowance: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Wake North Carolina Application And Assignment Year's Allowance

Description

How to fill out North Carolina Application And Assignment Year's Allowance?

Utilize the US Legal Forms and gain immediate access to any document sample you desire.

Our helpful platform featuring numerous documents streamlines the process of locating and obtaining nearly any document sample you may require.

You can download, complete, and validate the Wake North Carolina Application And Assignment Year's Allowance in mere minutes instead of spending hours online searching for an appropriate template.

Employing our library is a fantastic tactic to enhance the security of your document filing.

If you do not yet possess an account, follow the instructions provided below.

Locate the form you need. Ensure that it is the document you are looking for: review its title and description, and utilize the Preview feature if it is available. If not, use the Search box to find the required document.

- Our experienced attorneys routinely review all documents to ensure that the forms are suitable for a specific state and adhere to the latest laws and regulations.

- How can you obtain the Wake North Carolina Application And Assignment Year's Allowance? If you have an account, simply Log In to your account.

- The Download button will be activated on all the samples you examine.

- Moreover, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

NCGS 30-15 provides that a surviving spouse shall be entitled to an allowance of the value of $60,000 from the personal property of the deceased spouse to support the surviving spouse. The surviving spouse must apply for this allowance through the Clerk of Court within one year of the deceased spouse's death.

Elective Share Based on Length of Marriage 25% if the couple was married for more than 5 years, but less than 10 years. 33% if the couple was married for more than 10 years, but less than 15 years. 50% if the couple was married for 15 years or longer.

The Spousal Allowance is considered countable income for the Community Spouse for Medicaid purposes and may also be considered income for SNAP and TANF.

Below is an example of a state elective share statute: The state law defines elective share as following; a) Elective share is the value of estate of deceased subtracts the value of estate owned separately by the surviving spouse. b) It is fixed one-third portion of the estate.

Spouses in North Carolina Inheritance Law If you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

NC Elective Share Spousal Elective Share The ?Elective Share? is the statutory amount that a surviving spouse may choose to take of their deceased spouse's estate as an alternative to what was provided for him or her in the deceased spouse's Last Will and Testament.

The spousal allowance (or ?year's allowance?) is an allowance that one receives from the deceased spouse's estate after the death of the spouse. It is typically given in the form of a lump sum or the assignment of certain assets, such as vehicles titled in the name of the deceased spouse.

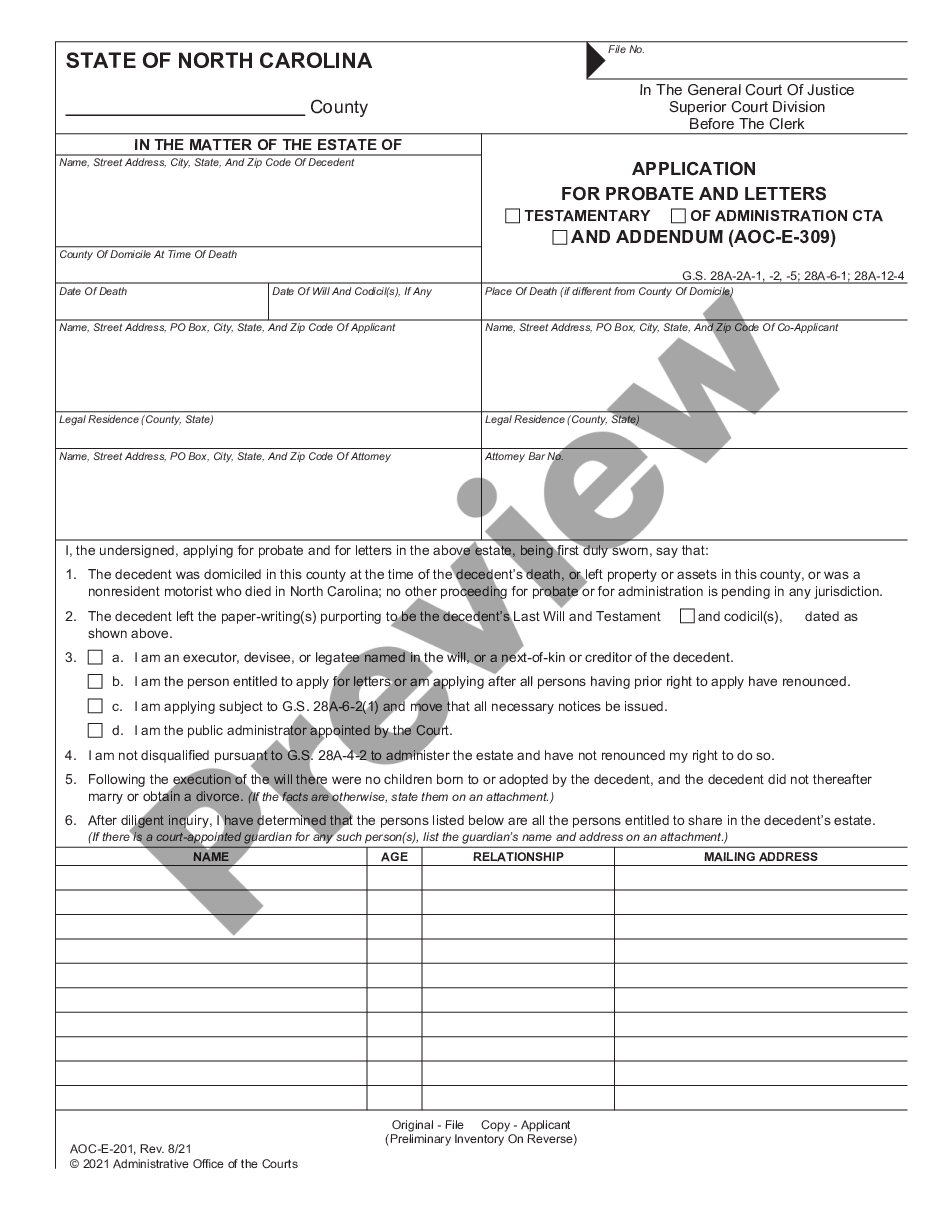

A North Carolina small estate affidavit is a document that allows an individual to petition for all or a portion of a deceased person's estate.... Step 1 ? Wait Thirty (30) Days.Step 2 ? No Personal Representative.Step 3 ? Complete Documentation.Step 4 ? File with the Superior Court.

A person's primary insurance amount is the amount of their monthly retirement benefit, if they file for that benefit exactly at their full retirement age. A Social Security spousal benefit is calculated as 50% of the other spouse's PIA.

Single. $13,267. Married Claiming zero (0) or one (1) exemption 1. $13,267. Married Claiming two (2) or more exemptions 1.