Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Obtaining verified templates applicable to your local laws can be challenging unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both personal and professional requirements and various real-life situations.

All the files are accurately organized by category of use and jurisdictional areas, making it simple and swift to locate the Wilmington North Carolina Dissolution Package for Dissolving a Limited Liability Company LLC.

Maintain your documentation organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have indispensable document templates for any requirements right at your fingertips!

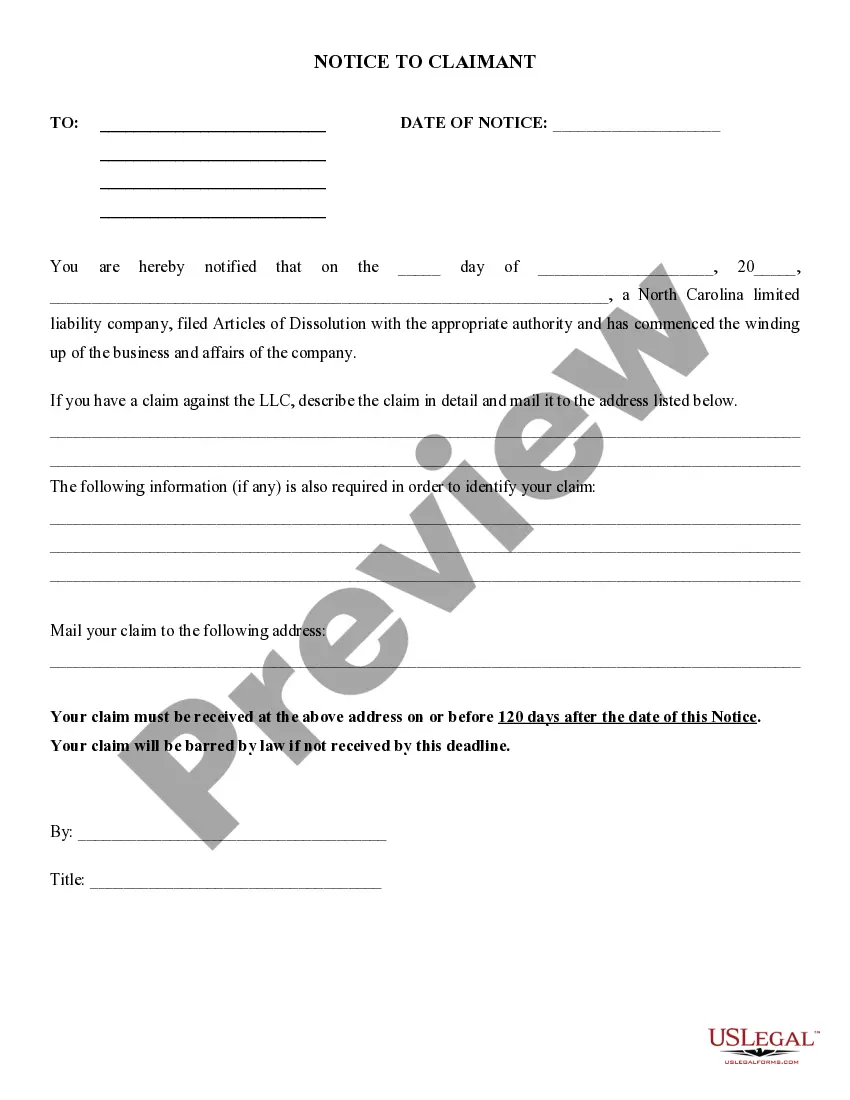

- Ensure to Review the Preview mode and form description.

- Confirm you've selected the appropriate one that satisfies your needs and fully complies with your local jurisdiction requirements.

- Look for an alternative template, if required.

- If you notice any discrepancies, utilize the Search tab above to find the correct one. If it fits your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

No, a business cannot legally operate if it has been dissolved, whether voluntarily or administratively. This includes conducting transactions or entering contracts, as the entity loses its legal protections. To avoid this issue, consider the Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC, ensuring a smooth transition into dissolution or reinstatement.

Yes, you can sue an administratively dissolved LLC, but collecting judgment might be difficult. The entity cannot conduct business or manage assets after dissolution, which may complicate any legal actions. Using the Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC can help you navigate such scenarios and understand your rights.

The time it takes to dissolve a business in North Carolina can vary, but typically, once you submit the necessary forms, it can take a few weeks for the state to process your request. If you use the Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC, you can streamline this process and ensure you meet all requirements promptly.

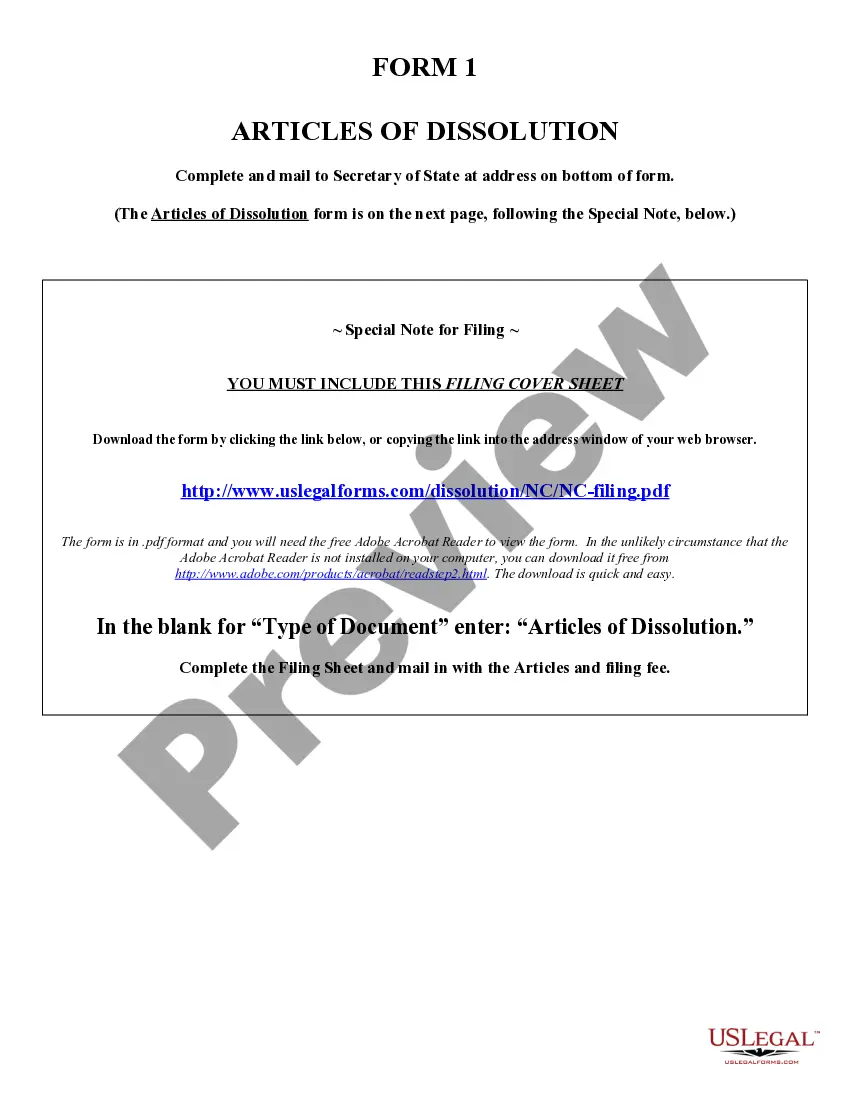

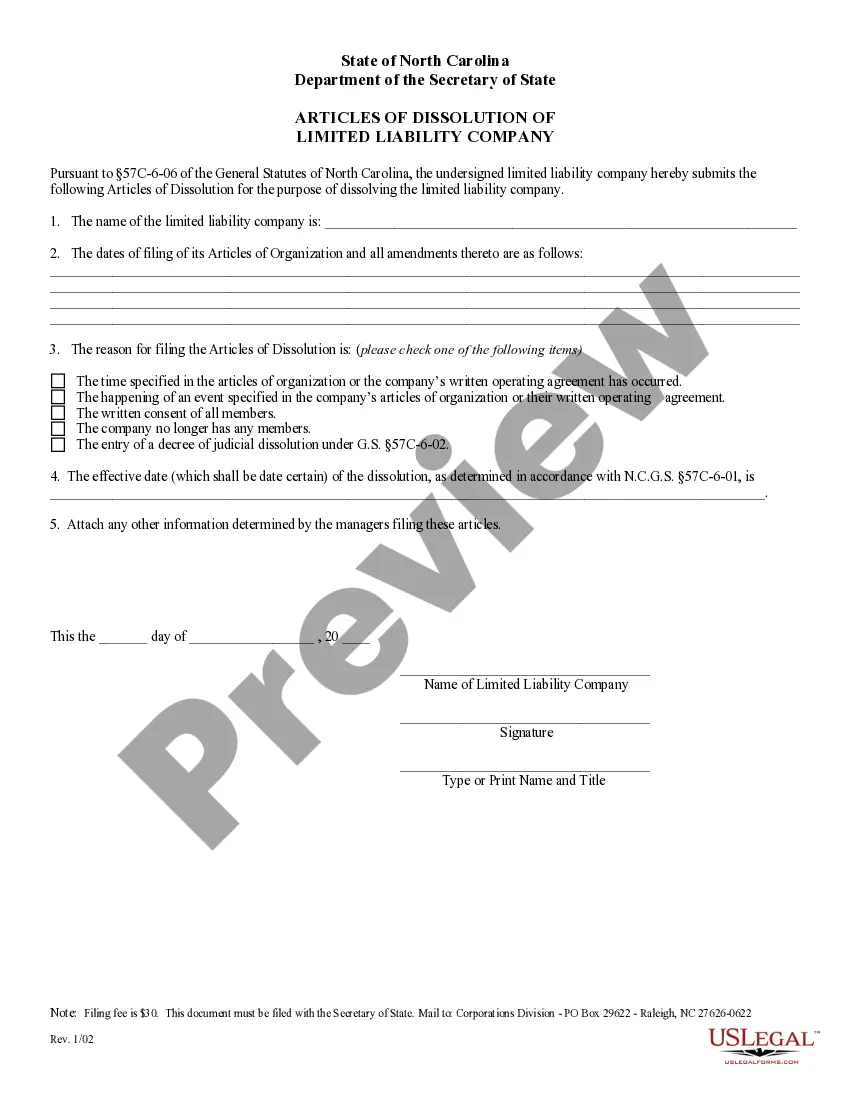

To officially close an LLC, you need to file the necessary paperwork with the North Carolina Secretary of State. This process includes submitting a Statement of Cancellation along with your Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC. Ensure all financial obligations are settled and notify any stakeholders before completing the close.

When an LLC is administratively dissolved in North Carolina, it loses its legal status and cannot conduct business. This dissolution occurs when the LLC fails to comply with state requirements, like filing annual reports. To remedy this, the Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC can help guide you through reinstatement or proper dissolution procedures.

When you dissolve your LLC, you may face certain tax consequences that you need to be aware of. Typically, the IRS requires you to report any gains or losses from the sale of assets before you fully dissolve. Using the Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC helps simplify this process, as it guides you through necessary filings. Always consult a tax professional to understand your specific obligations and avoid any unexpected liabilities.

Once your LLC is dissolved using the Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC, it is crucial to handle several steps. First, officially notify state agencies to finalize your LLC's dissolution status. Next, distribute any remaining assets to members according to your operating agreement. Also, keep accurate records of the dissolution process to prevent any future legal complications.

Before you proceed with the Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC, ensure you have a clear understanding of your LLC's financial standing. First, settle any outstanding debts or obligations to avoid potential claims. Next, notify all members of the LLC as well as any involved parties. Finally, gather essential documents such as your operating agreement and financial records to streamline the dissolution process.

Removing yourself from an LLC in North Carolina involves specific steps. You will typically need to file an amendment to the Articles of Organization and follow the protocol outlined in your LLC's operating agreement. The Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC provides detailed instructions and forms to guide you through this process effectively.

Yes, you must notify the IRS if you close your LLC. This step is crucial to ensure that you properly report the business's final income and expenses. Additionally, using the Wilmington North Carolina Dissolution Package to Dissolve Limited Liability Company LLC can help streamline the process, making it easier to understand your tax obligations. This package provides the necessary forms and guidance for a smooth transition.