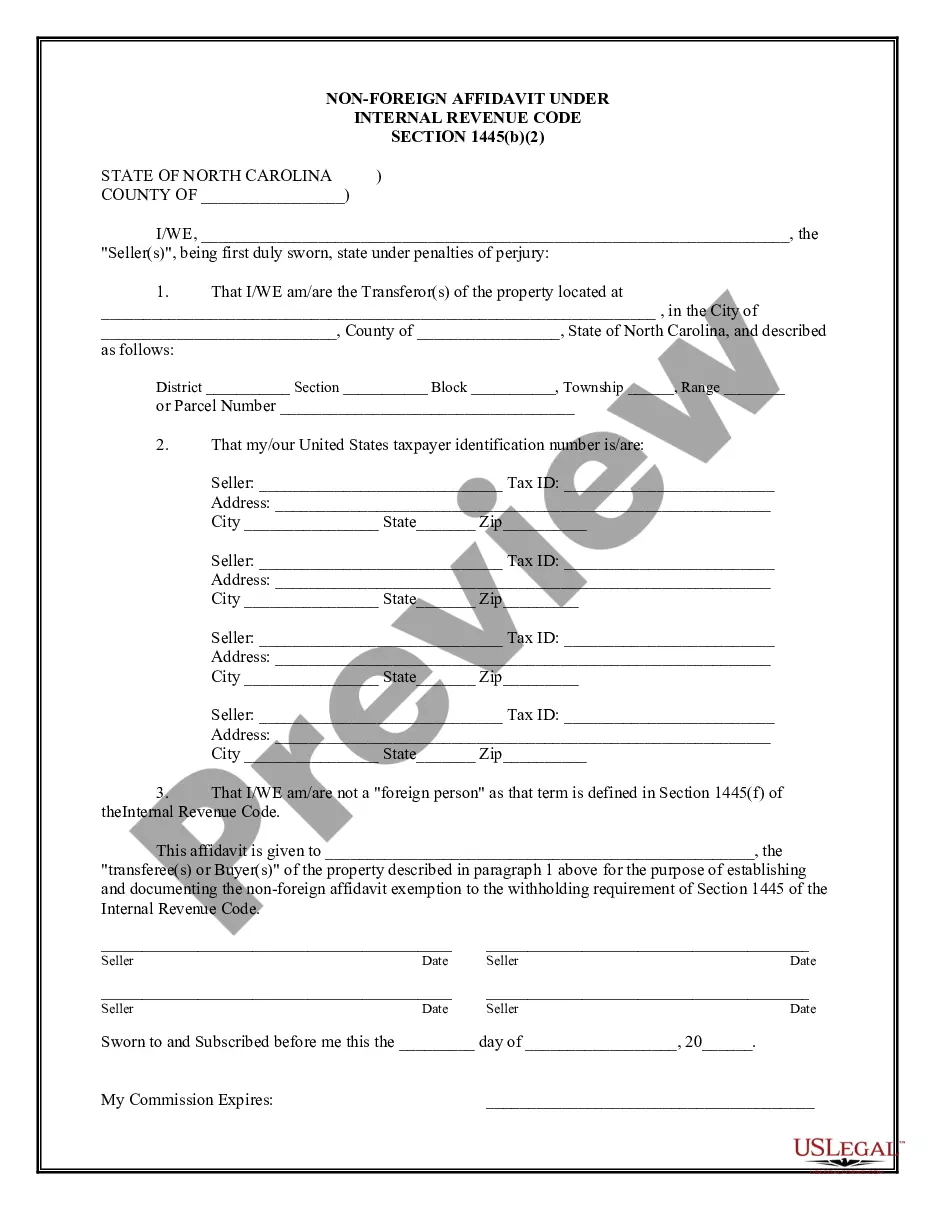

Charlotte North Carolina Non-Foreign Affidavit Under IRC 1445

Description

How to fill out North Carolina Non-Foreign Affidavit Under IRC 1445?

If you are in search of a legitimate document template, it’s hard to find a superior source than the US Legal Forms site – likely the largest online collections.

Here you can acquire a vast array of form examples for business and personal uses organized by categories and areas, or keywords.

With our premium search capability, obtaining the most recent Charlotte North Carolina Non-Foreign Affidavit Under IRC 1445 is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Choose the format and download it to your device.

- Furthermore, the accuracy of each document is validated by a team of expert attorneys who consistently examine the templates on our site and revise them in line with the most current state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Charlotte North Carolina Non-Foreign Affidavit Under IRC 1445 is to Log In to your account and click the Download button.

- If you're using US Legal Forms for the first time, simply follow the steps below.

- Ensure you have identified the form you need. Review its details and utilize the Preview option to view its contents. If it doesn’t satisfy your needs, use the Search field at the top of the page to find the right document.

- Verify your choice. Click the Buy now button. Then, select the desired pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

The Foreign Investment in Real Property Tax Act (FIRPTA) is a tax imposed on the amount realized from the sale of real property owned by a foreign seller. There are exceptions to this tax-withholding requirement.

U.S. Tax Person A citizen or resident of the United States, a corporation or partnership (except to the extent provided in applicable Treasury Regulations) or other entity created or organized in, or under the laws of, the United States, any State thereof or the District of Columbia, including any entity treated as a

There are two different types of FIRPTA Certifications: one for individuals (natural persons) and another for entities (e.g., corporation, partnership, limited liability company, etc.). The FIRPTA Certification must be signed by all transferors (sellers).

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

CERTIFICATION OF FOREIGN STATUS UNDER FIRPTA The purpose of this Certification is to notify Buyer of Seller's/Sellers' status under FIRPTA (Section 1445 of the Internal Revenue Code) with regard to a prospective real estate transaction involving the Property identified below.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

A foreign corporation that distributes a U.S. real property interest must withhold a tax equal to 21% of the gain it recognizes on the distribution to its shareholders.

The transferor gives the transferee a certification stating, under penalties of perjury, that the transferor is not a foreign person. The certification should contain the transferor's name, U.S. taxpayer identification number, and home address (or office address, in the case of an entity).

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.