High Point North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

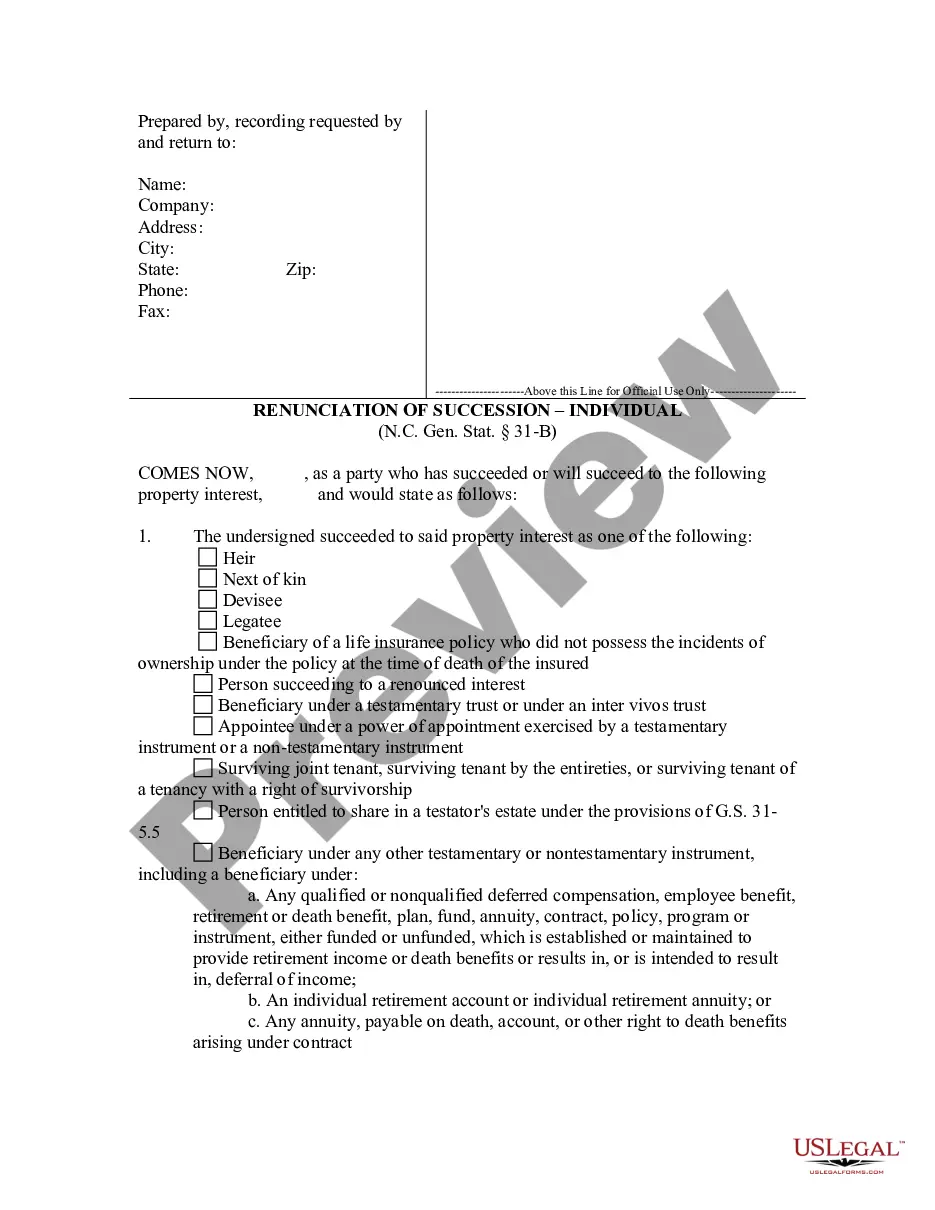

How to fill out North Carolina Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

We consistently aim to diminish or avert legal consequences when addressing intricate legal or financial matters. To achieve this, we seek attorney services that are typically quite costly.

However, not every legal matter is that complicated. A majority of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to manage your own affairs without the need for legal representation.

We provide access to legal form templates that are not always available to the public. Our templates are tailored to specific states and regions, greatly enhancing the search process.

You can create your account in just a few minutes. Ensure that the High Point North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract aligns with the laws and regulations of your specific state and region.

- Utilize US Legal Forms whenever you need to locate and download the High Point North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, or any other form swiftly and securely.

- Simply Log In to your account and click the Get button adjacent to it.

- If you misplace the form, you can always re-download it from the My documents section.

- The procedure is just as straightforward for newcomers to the platform!

Form popularity

FAQ

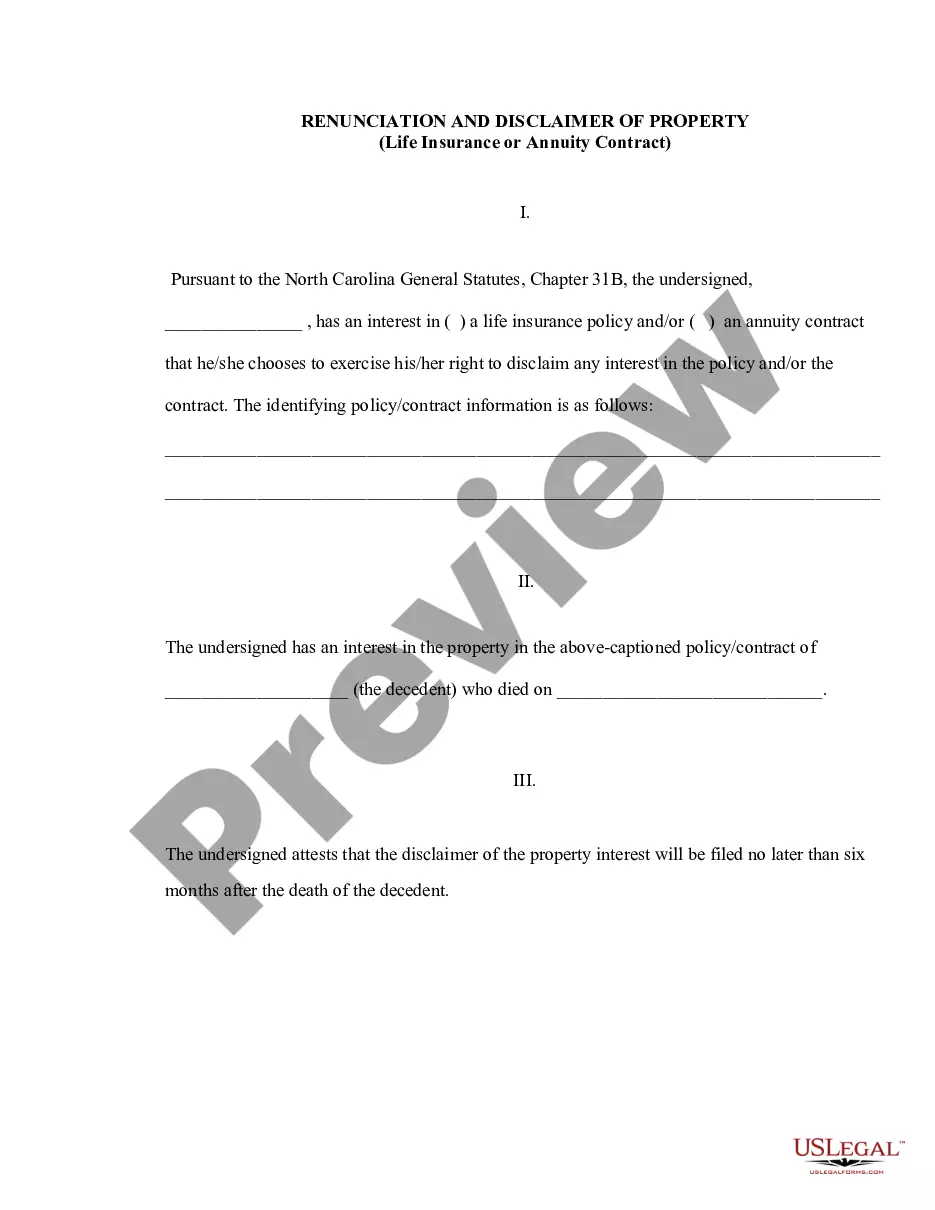

To write a disclaimer of inheritance, start with a clear declaration stating your intention not to accept the inheritance. Include your name, the description of the property, and a statement that you have not accepted any benefits associated with it. Utilizing templates from UsLegalForms can assist you in crafting a legally sound disclaimer tailored to the Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract in High Point North Carolina.

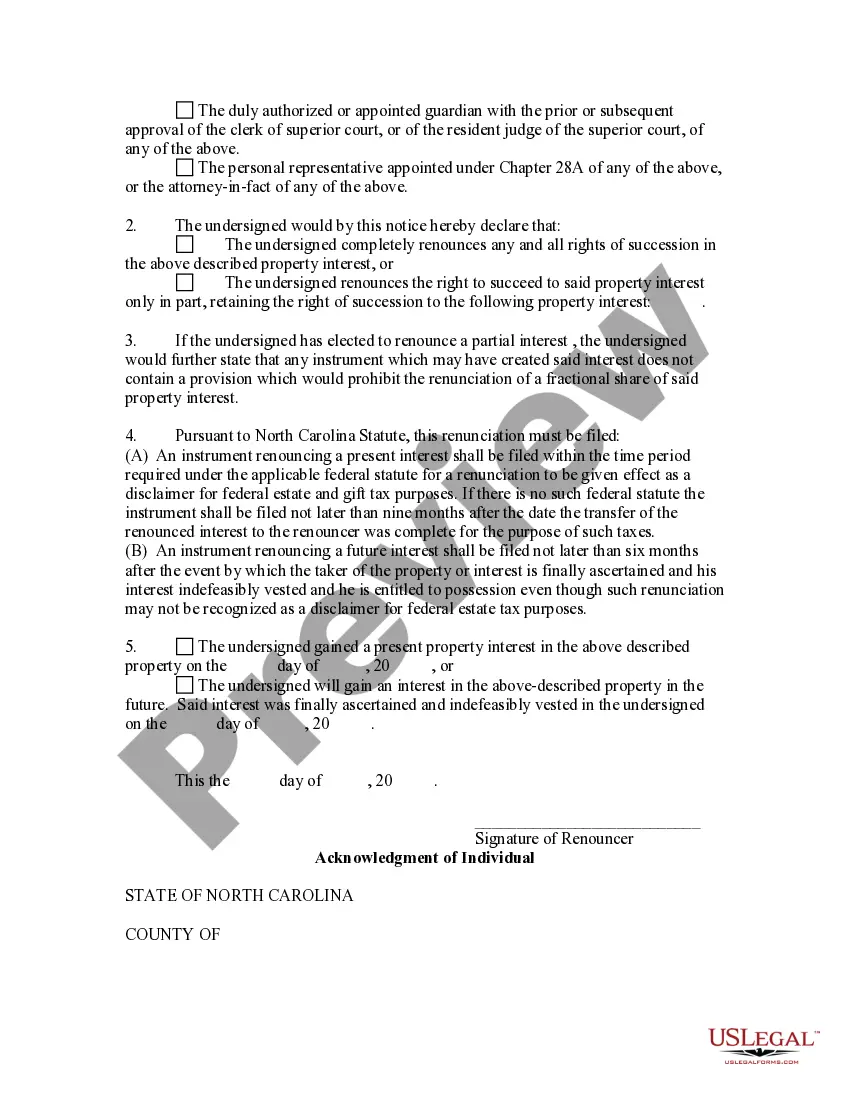

The renunciation of inheritance is a formal decision where you choose to refuse an inheritance that you are entitled to receive. In High Point North Carolina, this can be done through the Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. This legal step helps ensure that the property passes to the next eligible heir without affecting your estate.

To disclaim an inheritance in North Carolina, you must prepare a written disclaimer that meets specific legal requirements. It is important to include details about the property being disclaimed, and submit it to the appropriate parties. Using the Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can make this process clearer and more straightforward.

Yes, you can give away some of your inheritance through a disclaimer. In High Point North Carolina, the Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract allows you to reject certain assets while retaining others. This can provide flexibility in managing your estate and planning for taxes.

Disclaiming property means that you choose not to accept an inheritance or a gift, effectively declining any rights to it. For reasons like tax implications or personal choice, individuals in High Point North Carolina often utilize the Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract to formally express this decision. By doing so, you clarify that the asset will not be part of your estate.

Renunciation of inheritance means that an individual chooses to refuse or decline assets that they could receive from an estate. This decision may arise from personal, financial, or legal reasons and can apply to life insurance policies or annuity contracts. By understanding your options, you can ensure that your decision aligns with your overall estate planning strategies. For detailed guidance on the High Point North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, reach out to uslegalforms for reliable resources.

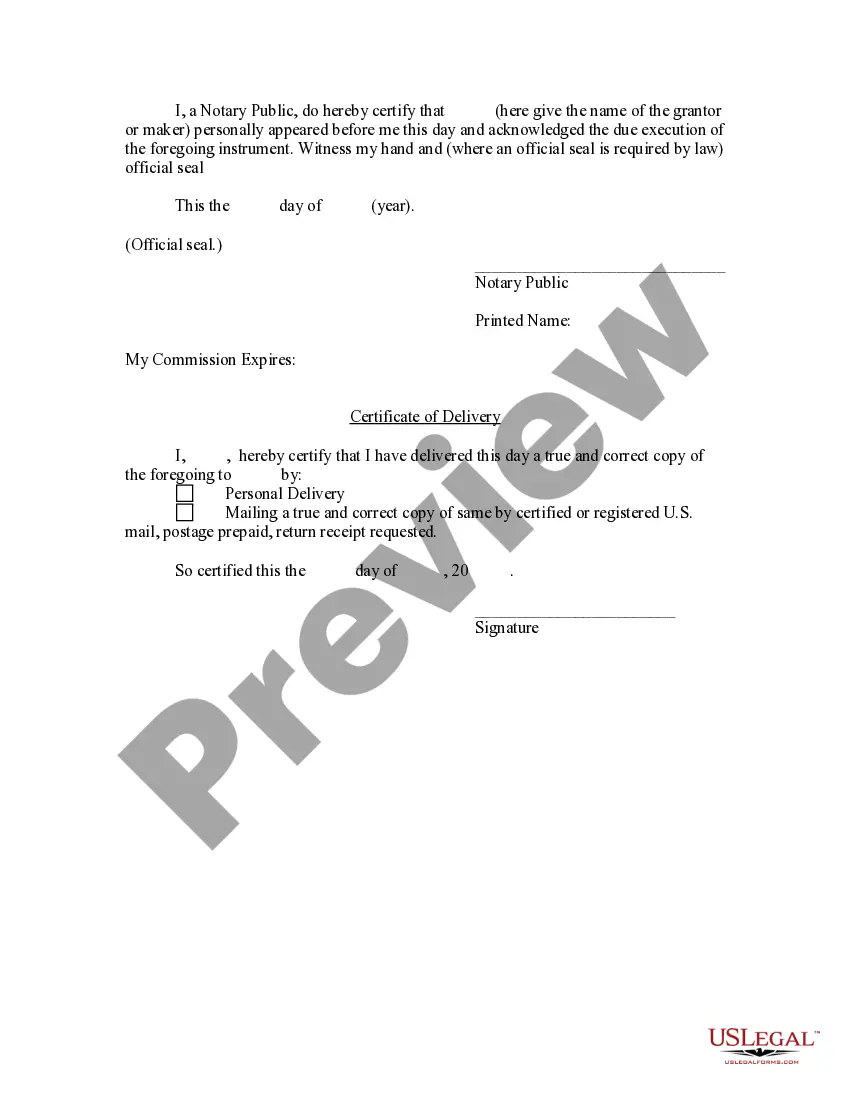

Disclaiming an inheritance in North Carolina involves submitting a written disclaimer to the appropriate parties, such as the executor of the estate or the life insurance provider. This document must clearly state your intention to renounce the inheritance and should be signed by you. After filing your disclaimer, it's crucial to notify all relevant parties. For assistance with the High Point North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, consider using a trusted platform like uslegalforms.

Yes, you can disclaim an inheritance in North Carolina. This process allows you to refuse assets that you would otherwise inherit, including property from a life insurance policy or annuity contract. It’s essential to understand the implications of renouncing your inheritance, especially in regard to taxes and liabilities. Consulting with a legal professional can guide you through the High Point North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

To renounce a property means to formally reject any rights or interests you may have in that property. In the context of High Point North Carolina, this often applies to situations involving inheritance or benefits from life insurance policies or annuity contracts. By choosing to renounce, you forfeit any entitlement to the property, allowing it to pass to other beneficiaries without encumbrances. For assistance in navigating this process, consider using resources like uslegalforms, which can provide the necessary templates and information.

Renunciation in real estate refers to the voluntary act of relinquishing one's rights or claims to a property. In High Point North Carolina, this can occur in various contexts, often involving properties that come from life insurance or annuity contracts. This legal action allows individuals to avoid potential tax responsibilities or liabilities associated with the property. Understanding the implications of renunciation can help you make informed decisions about your real estate interests.