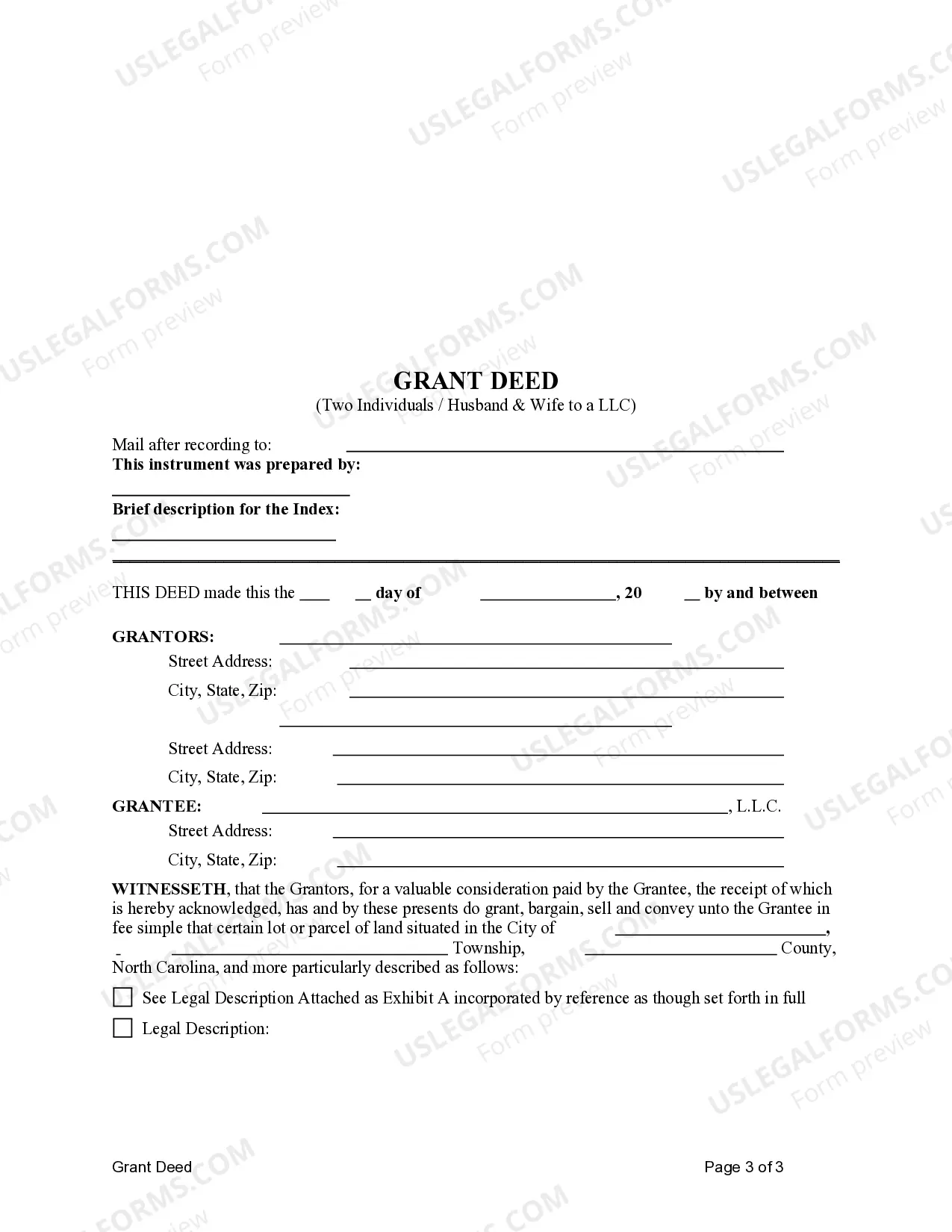

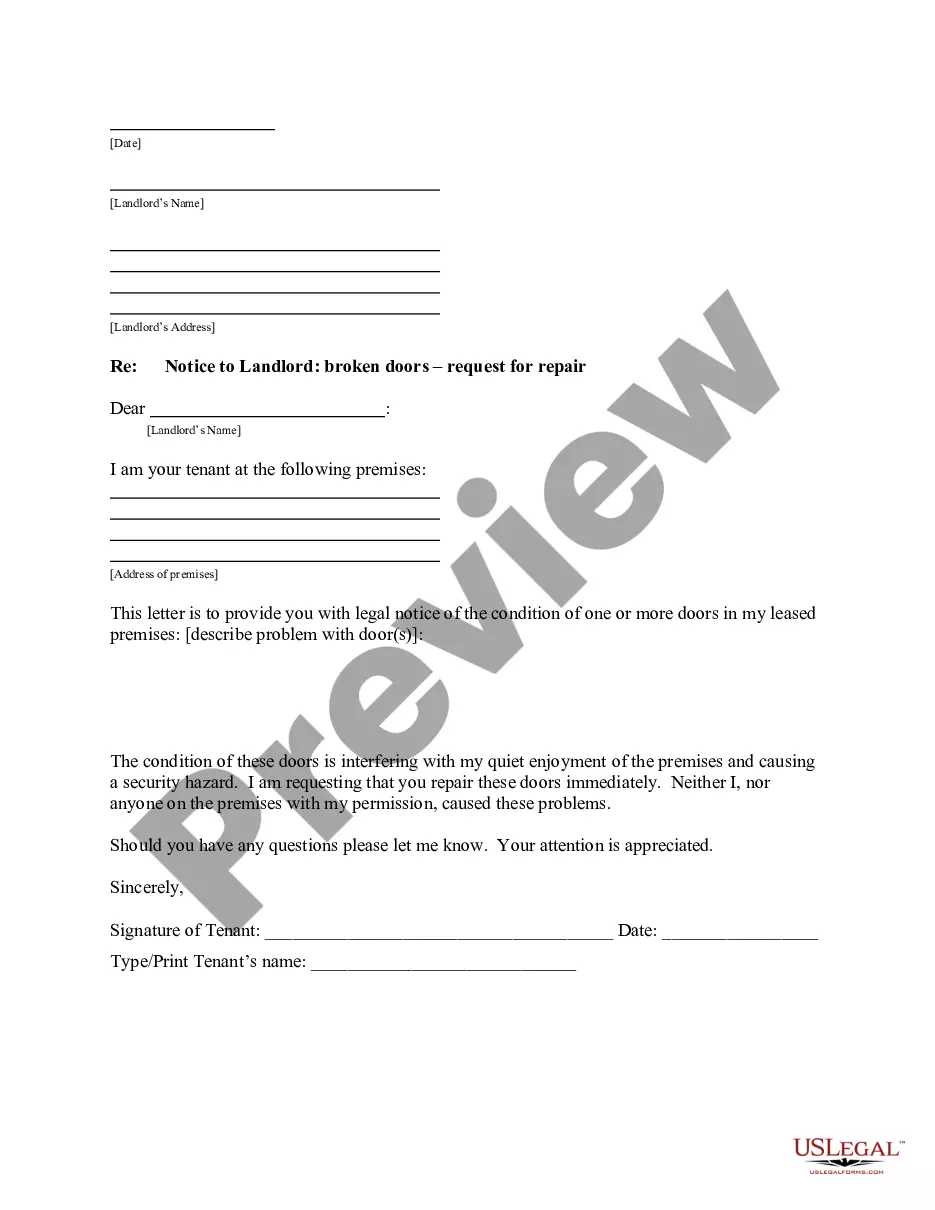

This form is a Grant Deed where the Grantors are husband and wife, or two individuals, and the Grantee is an LLC. Grantors convey the described property to the Grantee. This grant deed simply transfers the title of the property to the grantee. Included in the deed are statements verifying the property is not sold to other parties and all encumbrances on the property are known to the grantee. This deed complies with all state statutory laws.

Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company

Description

How to fill out North Carolina Grant Deed From Husband And Wife, Or Two Individuals, To A Limited Liability Company?

Irrespective of societal or occupational position, finalizing legal-related paperwork is a regrettable requirement in the contemporary professional landscape.

Frequently, it’s nearly impossible for an individual without legal expertise to construct this type of documentation from scratch, primarily due to the intricate language and legal subtleties they encompass.

This is where US Legal Forms proves beneficial.

Ensure that the template you’ve selected is applicable for your region, as the regulations of one state or county may not be valid in another.

Review the document and quickly read a brief description (if available) of situations for which the document may be used.

- Our platform provides a vast catalog with over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms also serves as an excellent resource for associates or legal advisors aiming to save time utilizing our DIY papers.

- Whether you require the Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company, or any other document valid in your state or county, with US Legal Forms, all your needs are met.

- Here’s how to quickly acquire the Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company using our dependable platform.

- If you are currently a subscriber, you may proceed to Log In to your account to access the necessary form.

- However, if you are not acquainted with our library, make sure to follow these steps before downloading the Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company.

Form popularity

FAQ

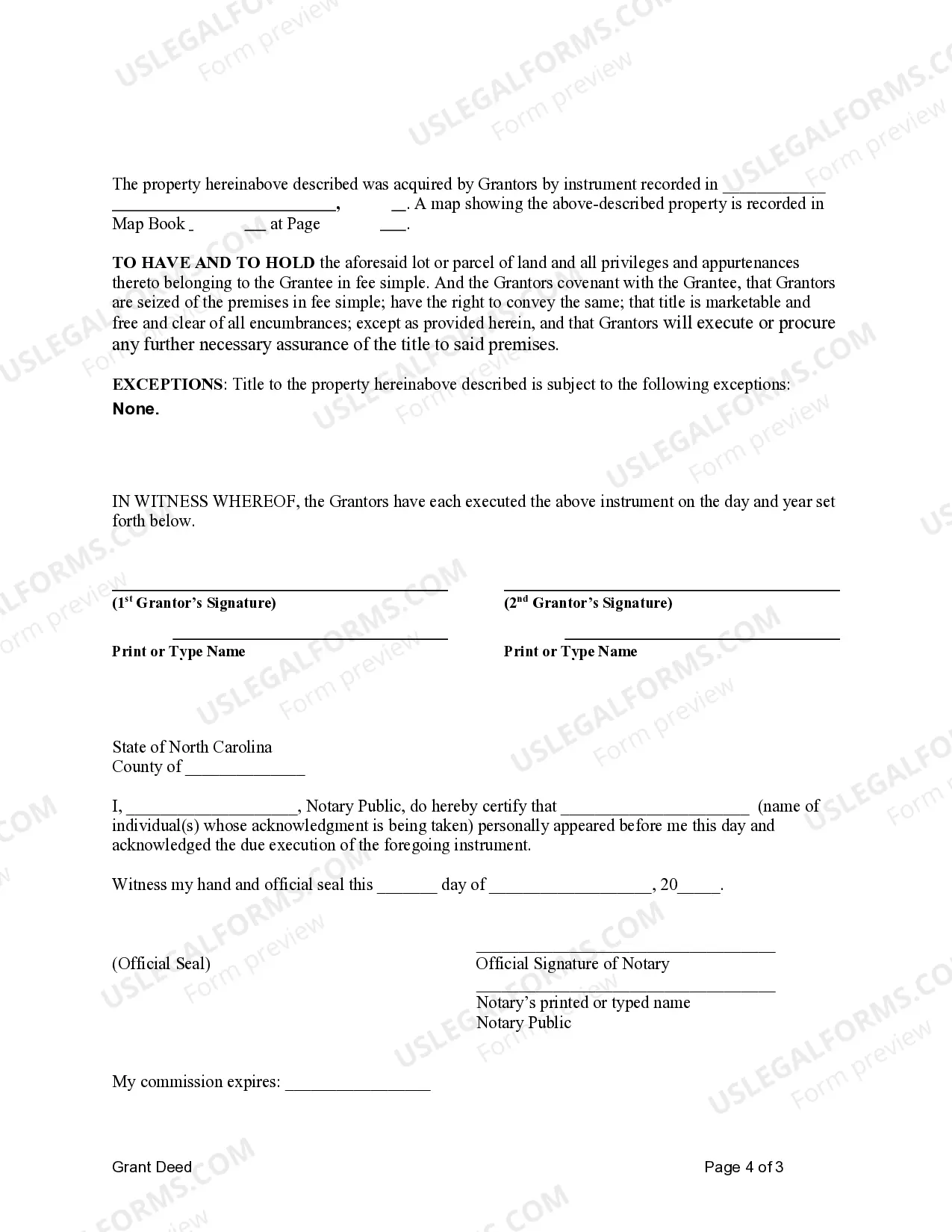

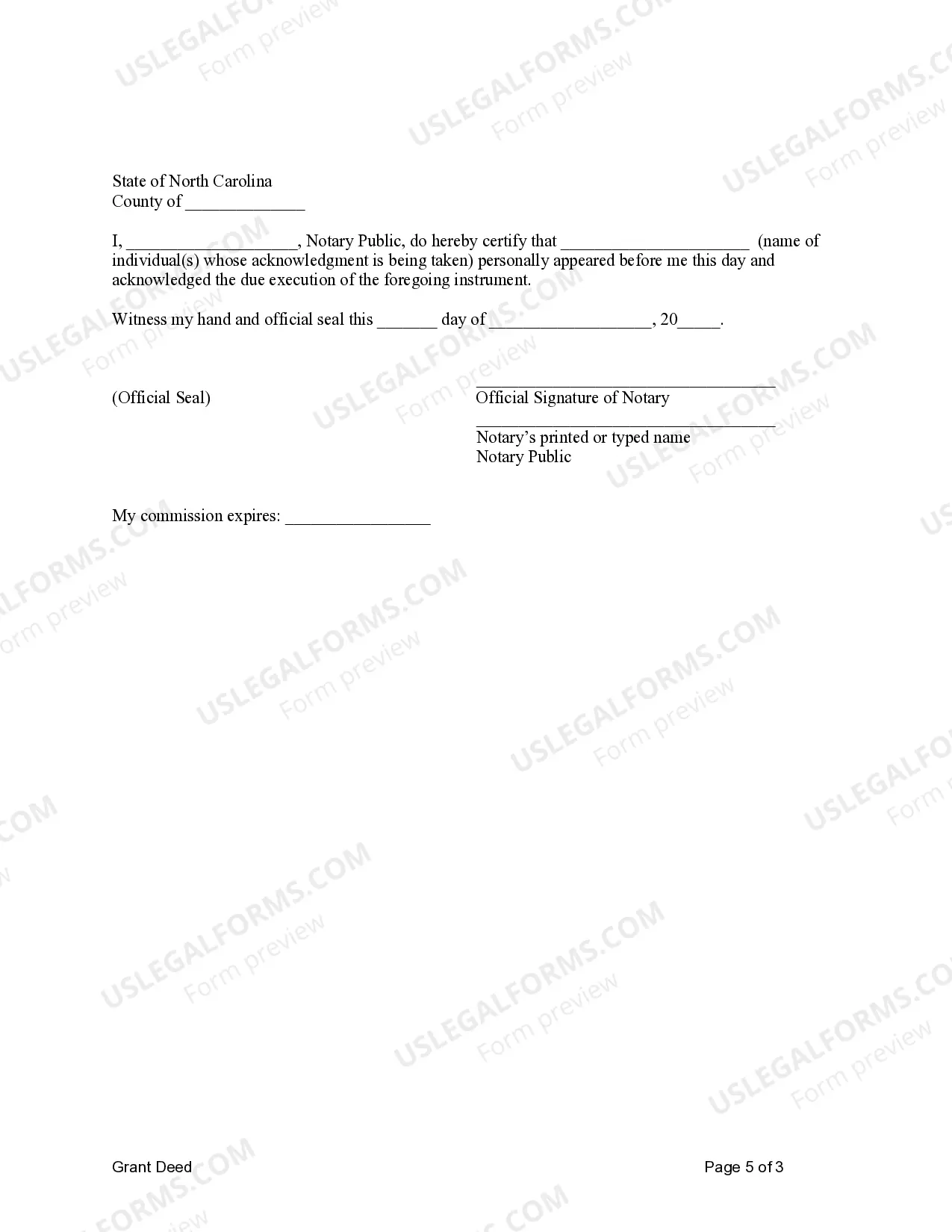

A Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company is valid when it includes necessary elements, such as the grantor's and grantee's names, a clear property description, and proper signatures. Additionally, it must be notarized and recorded with local authorities. Following these steps ensures your deed complies with state laws, granting it legal standing.

The best way to add your wife to your deed is to execute a new Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company that includes both your names. You can complete this process using a deed template available on online platforms like uslegalforms. Once created, sign the deed and record it with your local county office to ensure that both of you are recognized as co-owners of the property.

Yes, a Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company is considered a public record once it is filed with the county. This means anyone can access it through the appropriate county office. Public records often serve as an important source of information for property history and ownership, which benefits future buyers and sellers.

Writing a Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company involves including essential details such as the names of the parties, a legal description of the property, and the intended grantee. You can use a deed template to structure your document correctly. Make sure to sign and date the deed, and keep in mind that the deed must be recorded with your local county office to make it official.

While hiring a lawyer can provide guidance, you can prepare a Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company without legal representation. Many individuals successfully create deeds using online resources or templates. However, if you have specific concerns about your property or legal situation, consulting with a professional can ensure your deed is compliant with regulations.

As mentioned earlier, it is not mandatory for your spouse to be on the deed in North Carolina. While you can legally title property in your name alone, it is wise to think about including your spouse to prevent potential issues later. Employing a Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company can be beneficial in ensuring that both parties are represented in the ownership of the property.

If your husband passes away and your name is not on the deed, the property's ownership will depend on several factors, including whether there is a will. In North Carolina, intestate succession laws will determine your rights to the property. To avoid complications, it is advisable to consult legal professionals or use resources like the Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company to ensure proper documentation.

In North Carolina, it is not legally required for your spouse to be on the deed. However, if you are married and own property, including your spouse on the deed may protect their interests. This is especially important if you plan to transfer the property using a Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company. Including a spouse in the deed often ensures clarity and mutual consent in property matters.

Yes, a grant deed serves as a legal document that transfers property ownership. It contains essential information, such as the names of the grantors and grantees, and a description of the property. When executed correctly, it provides clear evidence of ownership. In the context of a Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company, this document is crucial for establishing vested rights.

In North Carolina, a spouse does not automatically inherit everything. Instead, the state's intestate succession laws come into play if a person dies without a will. These laws provide that a surviving spouse shares the estate with the deceased's children. To ensure a specific inheritance plan, consider creating a will or using a Greensboro North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company.