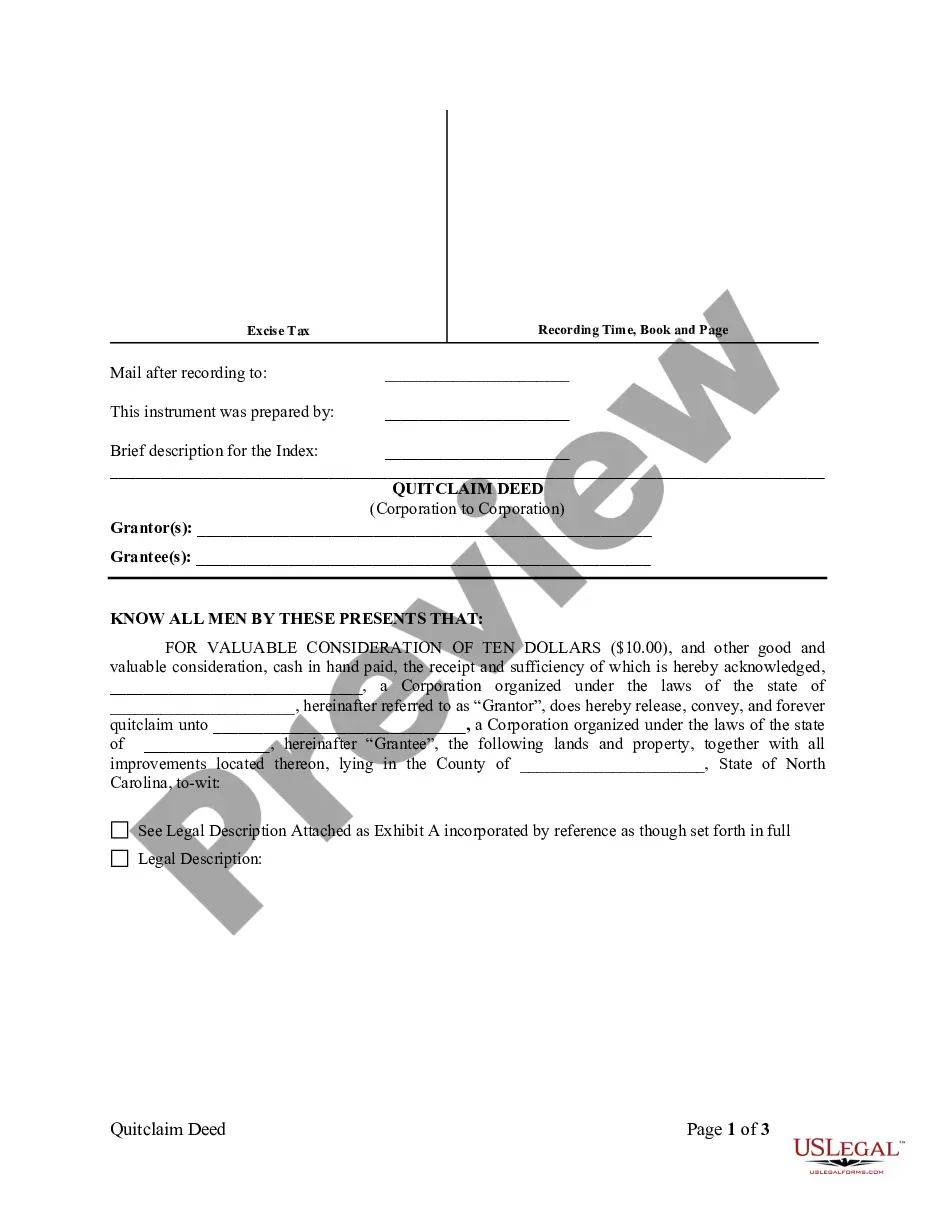

Charlotte North Carolina Quitclaim Deed from Corporation to Corporation

Description

How to fill out North Carolina Quitclaim Deed From Corporation To Corporation?

Acquiring validated templates pertinent to your local regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents catering to both personal and professional requirements and various real-life situations.

All the records are appropriately arranged by usage area and jurisdiction, making the search for the Charlotte North Carolina Quitclaim Deed from Corporation to Corporation as fast and straightforward as ABC.

Submit your credit card information or utilize your PayPal account to pay for the service.

- Review the Preview mode and document description.

- Ensure you’ve selected the appropriate one that satisfies your needs and fully aligns with your local jurisdiction standards.

- Search for an alternative template if required.

- Once you notice any discrepancies, use the Search tab above to find the right one. If it matches your criteria, proceed to the next step.

- Complete your purchase.

Form popularity

FAQ

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

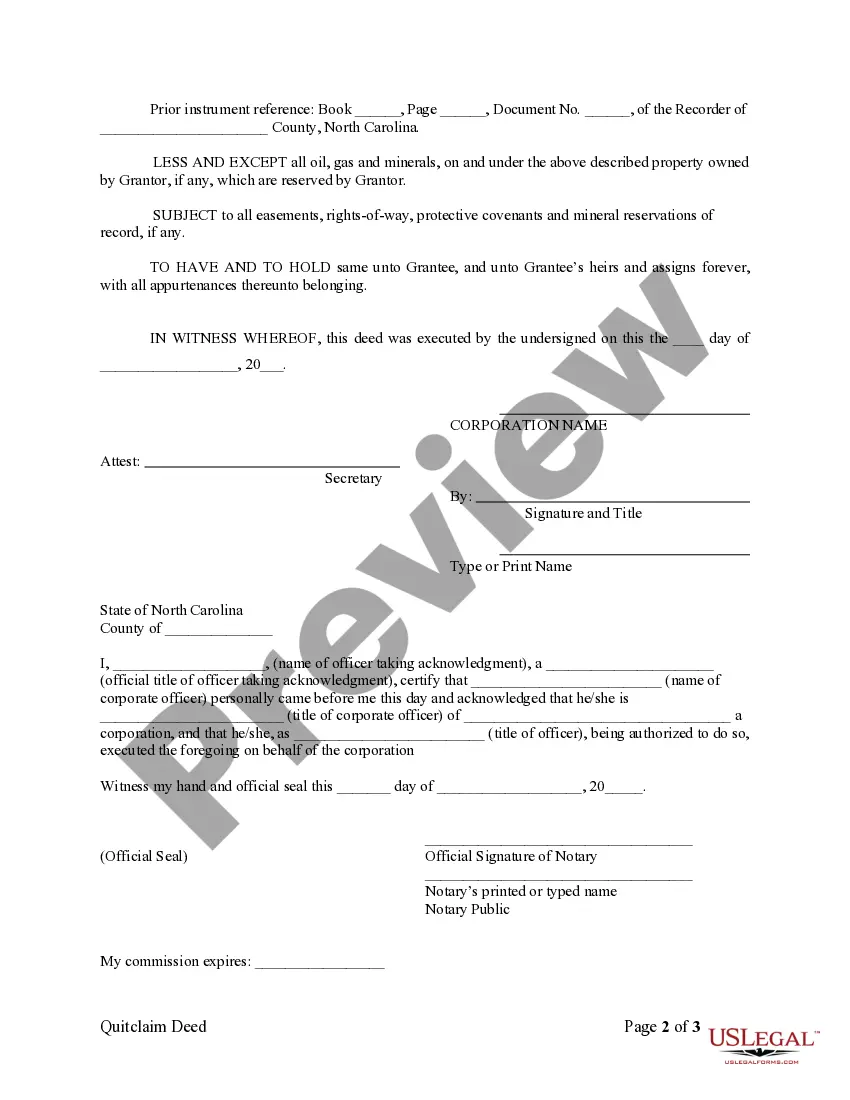

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

A North Carolina quit claim deed is a legal form used to convey real estate in North Carolina from one person to another. A quitclaim, unlike a warranty deed, does not come with a guarantee from the seller, or grantor, as to whether the grantor has clear title to the property or has the authority to sell the property.

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.

To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

Before you can transfer property ownership to someone else, you'll need to complete the following. Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

A deed is a legal instrument that evidences legal ownership of a parcel of real property, which includes land and any buildings on the land. To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.