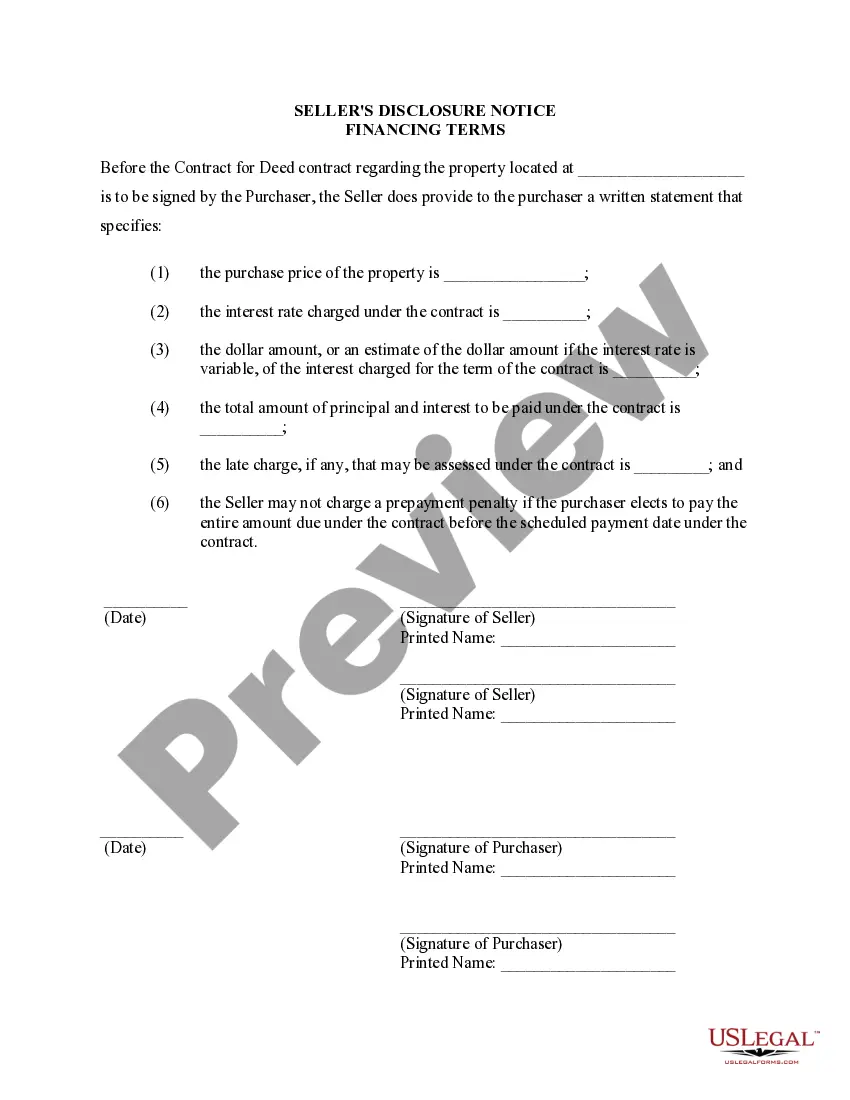

High Point North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out North Carolina Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Are you in search of a reliable and affordable legal document provider to obtain the High Point North Carolina Seller's Disclosure of Financing Terms for Residential Real Estate in relation to a Contract or Agreement for Deed also known as a Land Contract? US Legal Forms is your ideal choice.

Whether you need a basic agreement to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce in court, we have what you need. Our platform features more than 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic and are tailored according to the requirements of specific states and regions.

To acquire the document, you must Log In to your account, find the necessary form, and click the Download button adjacent to it. Please be aware that you can retrieve your previously downloaded document templates at any time from the My documents section.

Are you visiting our site for the first time? No need to worry. You can create an account in mere minutes, but prior to that, be sure to do the following: Check if the High Point North Carolina Seller's Disclosure of Financing Terms for Residential Real Estate in relation to a Contract or Agreement for Deed also known as a Land Contract aligns with your state's and local regulations. Review the form’s description (if available) to understand who and what the document serves. Restart your search if the form is unsuitable for your legal situation.

Try US Legal Forms today, and put an end to spending countless hours searching for legal documents online.

- Now you can proceed to register your account.

- Select a subscription plan and move forward to payment.

- Once payment is completed, download the High Point North Carolina Seller's Disclosure of Financing Terms for Residential Real Estate in relation to a Contract or Agreement for Deed also known as a Land Contract in any available format.

- You can return to the website any time to redownload the document at no extra cost.

- Acquiring current legal forms has never been simpler.

Form popularity

FAQ

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

Property sellers are usually required to disclose negative information about a property. It is usually wise to always disclose issues with your home, whether you are legally bound to or not. The seller must follow local, state, and federal laws regarding disclosures when selling their home.

Most Common Disclosures in Real Estate Natural Hazards Disclosure. First on the list is the natural hazards disclosure.Market Conditions Advisory (MCA) Market Conditions Advisory, also known as MCA, covers items more financial in nature.State Transfer Disclosure.Local Transfer Disclosure.Megan's Law Disclosures.

North Carolina law mandates that sellers identify any known defects in their property before a purchase contract is signed. The purpose of this is to make sure that buyers are not surprised with a problem when they move into the home: a busted air-conditioner, a termite infestation, a flooded basement, and so forth.

Material Fact: Any fact that could affect a reasonable person's decision to buy, sell, or lease is considered a material fact and must be disclosed by a broker to the parties in the transaction and any interested third parties regardless of the broker's agency role within the transaction.

North Carolina law mandates that sellers identify any known defects in their property before a purchase contract is signed. The purpose of this is to make sure that buyers are not surprised with a problem when they move into the home: a busted air-conditioner, a termite infestation, a flooded basement, and so forth.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

When they lie, you have grounds for a lawsuit against the seller. Any kind of misrepresentation or even failure to disclose defects in the home can lead to financial compensation. Had the seller disclosed some defects, you might not have bought the home.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.