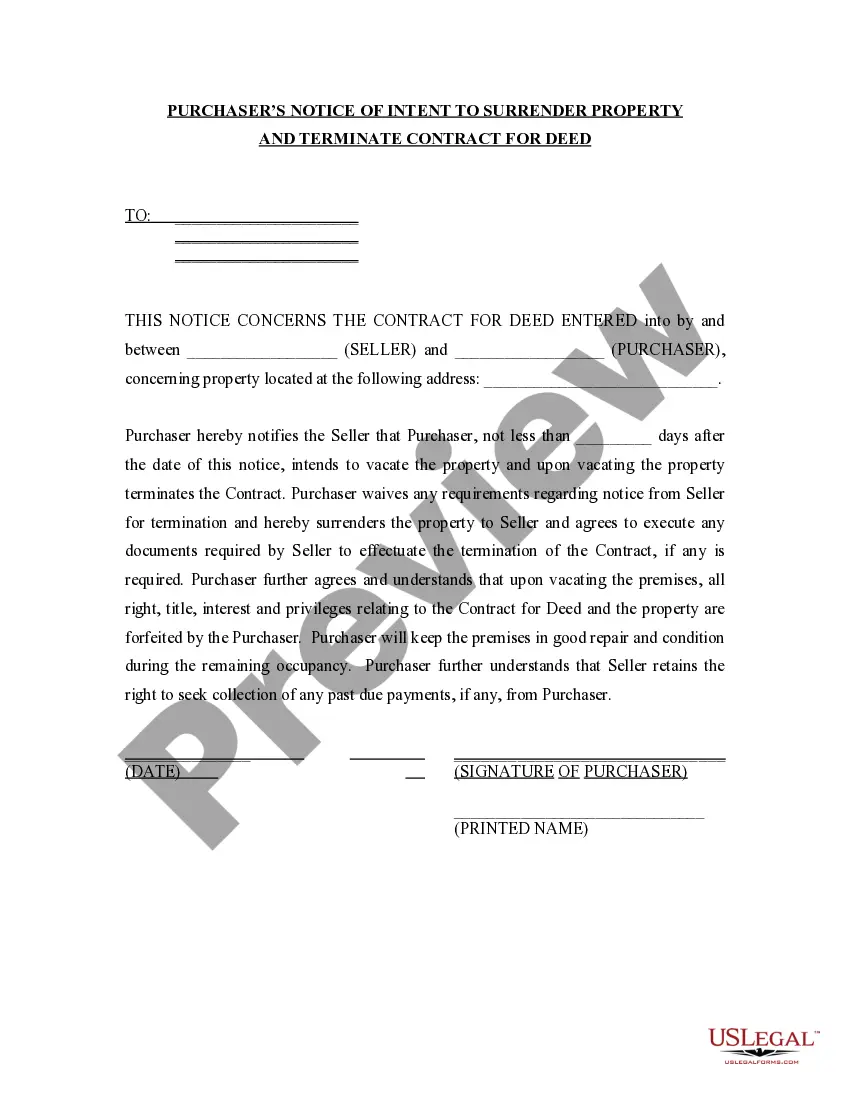

Cary North Carolina Buyer's Notice of Intent to Vacate and Surrender Property to Seller under Contract for Deed

Description

How to fill out North Carolina Buyer's Notice Of Intent To Vacate And Surrender Property To Seller Under Contract For Deed?

We consistently aim to minimize or avert legal harm when addressing complex legal or financial issues.

To achieve this, we enlist legal assistance, which is often quite expensive.

However, not every legal matter is of equal intricacy.

Many can be addressed independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Cary North Carolina Buyer's Notice of Intent to Vacate and Surrender Property to Seller under Contract for Deed or any other document swiftly and securely.

- US Legal Forms is a digital directory of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to manage your affairs independently without relying on an attorney.

- We provide access to legal document templates that may not always be publicly available.

- Our templates are specific to states and regions, greatly simplifying the search process.

Form popularity

FAQ

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

The land contract purchaser takes possession of the real estate and agrees to make installment payments of principal and interest, typically on a monthly basis, until the contract is paid in full or balloons. During the term of the contract, the purchaser has ?equitable title? to the property.

An agreement for deed is often referred to as ?land contract.? This arrangement is where a seller provides owner financing to a buyer. In turn, this allows a buyer to make monthly payments to the seller (instead of a bank). The seller will transfer the property title once receiving a certain amount of money.

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.

Preparing the Deed If your county government does not provide a deed, you may purchase one from a local stationery store or download one from the Internet. You could even prepare your own, although you'll need to make sure the language is correct. You can also pay an attorney to prepare one for you.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.