Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out North Carolina Promissory Note In Connection With Sale Of Vehicle Or Automobile?

We consistently aim to reduce or evade legal repercussions when navigating intricate legal or financial situations.

To achieve this, we opt for legal services that are typically quite costly.

Nevertheless, not all legal issues are equally intricate; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to the desired document. If you happen to misplace the document, it can always be re-downloaded from the My documents section. The process remains just as simple if you’re a newcomer to the platform! You can set up your account within just a few minutes. Ensure the Wake North Carolina Promissory Note in Connection with the Sale of Vehicle or Automobile adheres to the laws and regulations applicable to your state and locality. Furthermore, it is crucial to review the document’s outline (if available), and if you discover any inconsistencies with what you initially sought, look for an alternative template. After confirming that the Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile fits your needs, you can select a subscription option and proceed with the payment. You’ll then be able to download the document in any appropriate file format. With over 24 years of operation, we have assisted millions by providing ready-to-customize and up-to-date legal documents. Maximize your use of US Legal Forms now to conserve time and resources!

- Our collection empowers you to handle your issues autonomously, without needing legal representation.

- We provide access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Wake North Carolina Promissory Note related to the Sale of Vehicle or Automobile, or any other form conveniently and securely.

Form popularity

FAQ

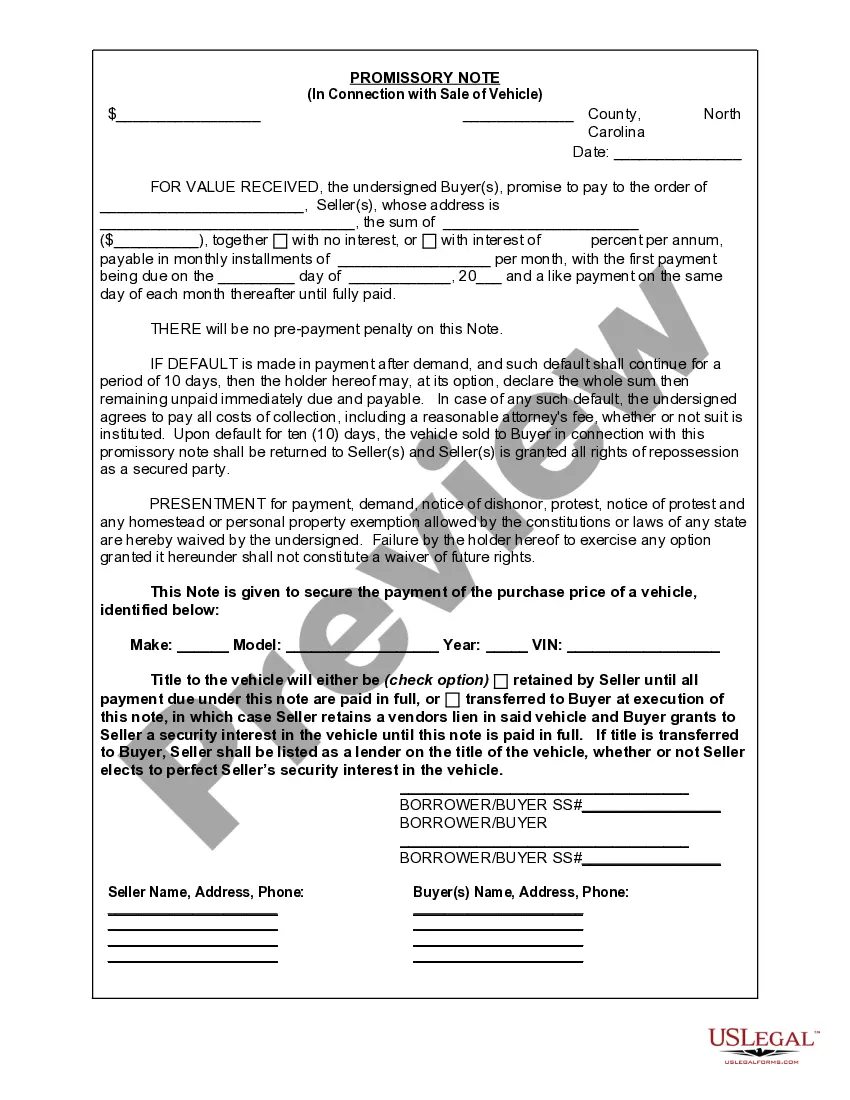

A bill of sale for an automobile with a promissory note is a document that finalizes the sale and outlines the terms of payment between the buyer and seller. It provides essential details about the vehicle and indicates that the buyer will use a promissory note to fulfill payment obligations. This combination protects both parties and clarifies the terms of the sale in Wake, North Carolina.

To fill out a promissory note, start by entering basic information like the date and parties involved. Include the vehicle's details, such as make, model, and VIN. Finally, outline the payment schedule and interest terms in a Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile. Remember to have both parties review and sign the note.

A promissory note for the sale of a vehicle is a formal agreement where the buyer commits to paying the seller a certain sum for the vehicle. This document includes essential details such as the vehicle description, payment method, and any agreed-upon fees. It is particularly important in Wake, North Carolina, as it provides legal protection for both the buyer and seller.

To fill out a promissory note sample effectively, start by including the names and addresses of both the buyer and the seller. Next, specify the sale amount, payment terms, and any interest rates for a Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile. Lastly, ensure both parties sign and date the document to make it legally binding.

Typically, a Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile does not need to be filed with any government office. Instead, the parties involved should keep their copies safe for record-keeping. If you desire legal protection, consider documenting the transaction through a service like USLegalForms, which offers templates and resources for properly managing and storing these documents.

In North Carolina, most contracts, including a Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, do not require notarization to be valid. The essence of a contract is mutual consent between the parties, which can be established through signatures. However, certain specific agreements, such as real estate transactions, may require notarization. Always review the specific requirements relevant to your situation.

In North Carolina, a Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile remains valid even if it is not notarized. While notarization can provide an extra layer of proof, it is not a legal requirement for the enforceability of the note. As long as the parties involved have signed the document, it is typically considered binding. However, notarization may still help in future legal proceedings.

You can obtain a promissory note through various means, including online legal form providers or by drafting one yourself. For the most reliable option, consider using a platform like uslegalforms, which offers templates specifically designed for a Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile. This ensures that your document meets state-specific requirements and accurately reflects your agreement.

You can write your own promissory note, and it can be a straightforward process. However, to ensure that it meets all legal requirements, it is best to include specific details, such as the amount owed, repayment schedule, and any interest rates. Using a template for a Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile can greatly simplify this process and ensure compliance with state laws.

Yes, anyone can issue a promissory note as long as they are of legal age and have the capacity to enter into a contract. This includes individuals and organizations. When creating a Wake North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, ensure that all parties understand the terms and obligations outlined in the document. Clarity in the note can prevent misunderstandings and conflicts.