The dissolution package contains all forms to dissolve a LLC or PLLC in Missouri, step by step instructions, addresses, transmittal letters, and other information.

Lee's Summit Missouri Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Missouri Dissolution Package To Dissolve Limited Liability Company LLC?

Leverage the US Legal Forms and gain instant access to any template you require.

Our user-friendly website with a vast collection of documents streamlines the process of locating and obtaining virtually any document sample you need.

You can download, fill out, and sign the Lee's Summit Missouri Dissolution Package to terminate Limited Liability Company LLC within minutes rather than spending hours online searching for a suitable template.

Using our catalog is an excellent method to enhance the security of your document submission.

If you have not yet created a profile, follow the instructions below.

Locate the template you require. Confirm that it is the correct template by checking its title and description, and utilize the Preview feature if it is available. If not, use the Search field to locate the appropriate one.

- Our knowledgeable attorneys frequently examine all documents to ensure that the forms are suitable for a specific state and adhere to the latest laws and regulations.

- How can you acquire the Lee's Summit Missouri Dissolution Package to terminate Limited Liability Company LLC.

- If you possess a subscription, simply Log In to your account.

- The Download option will be visible on every document you review.

- Additionally, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC.

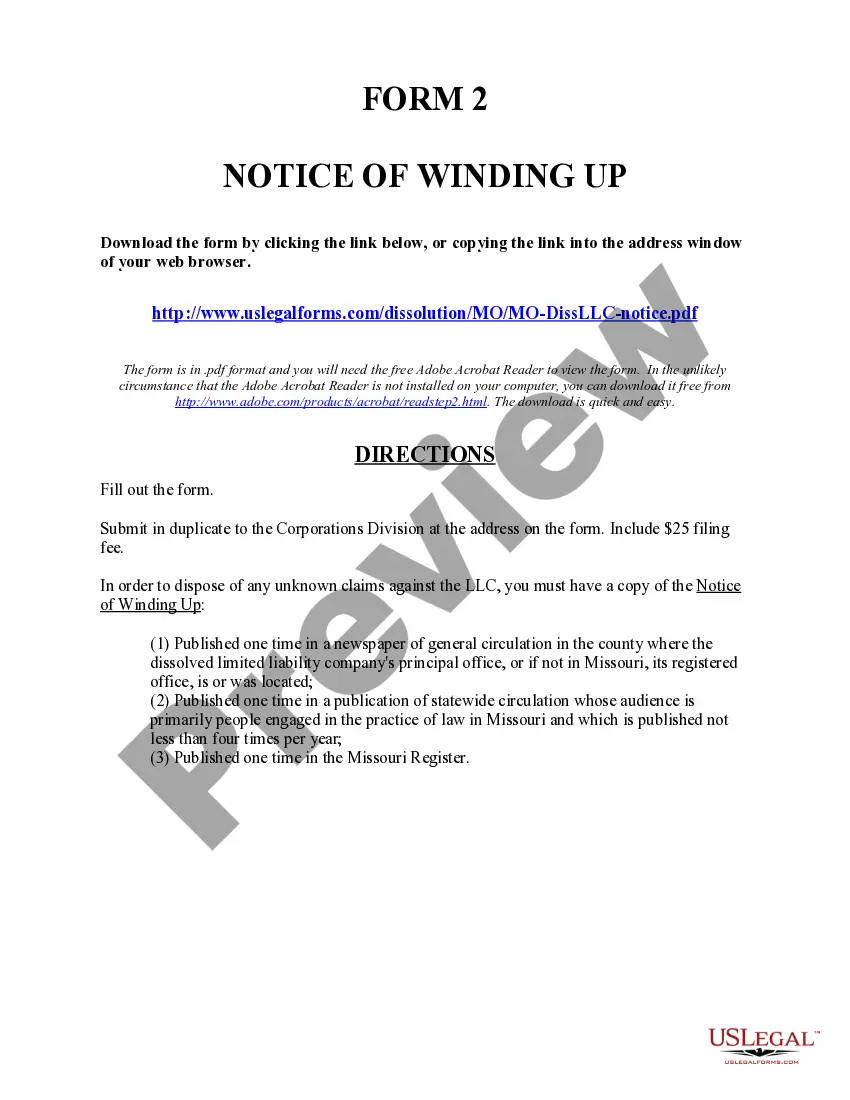

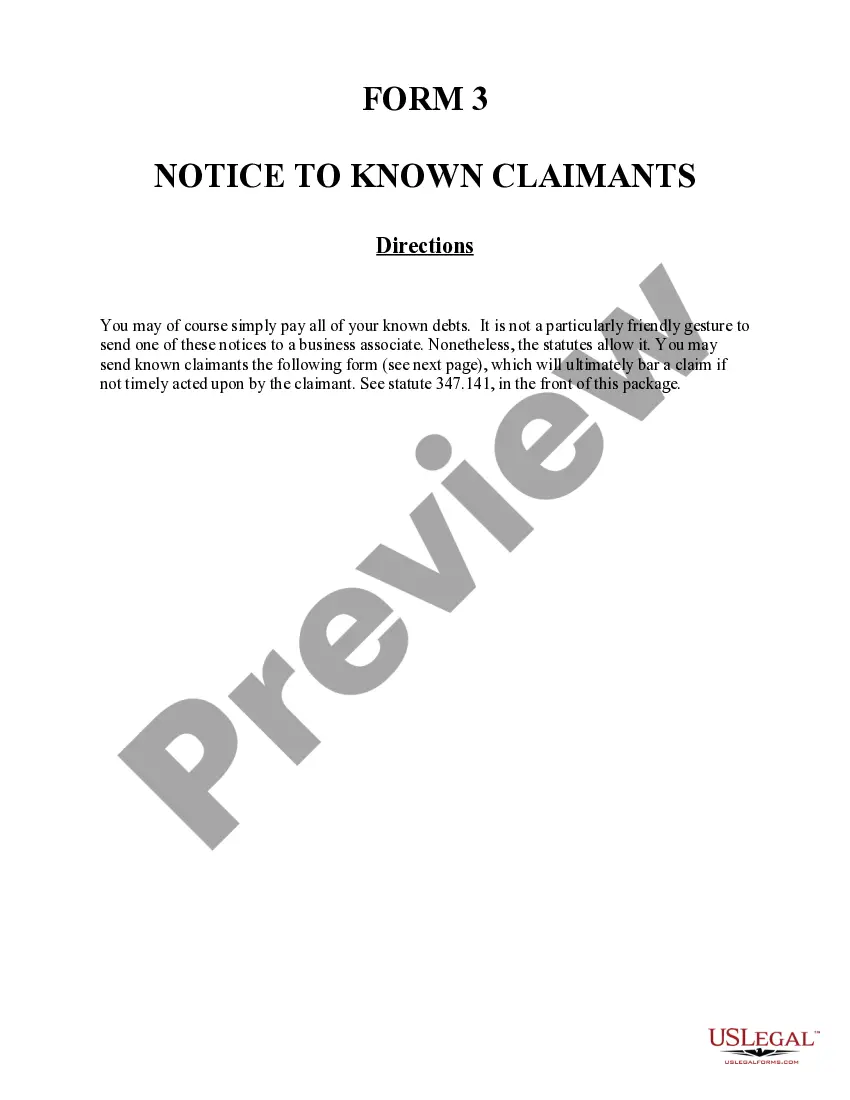

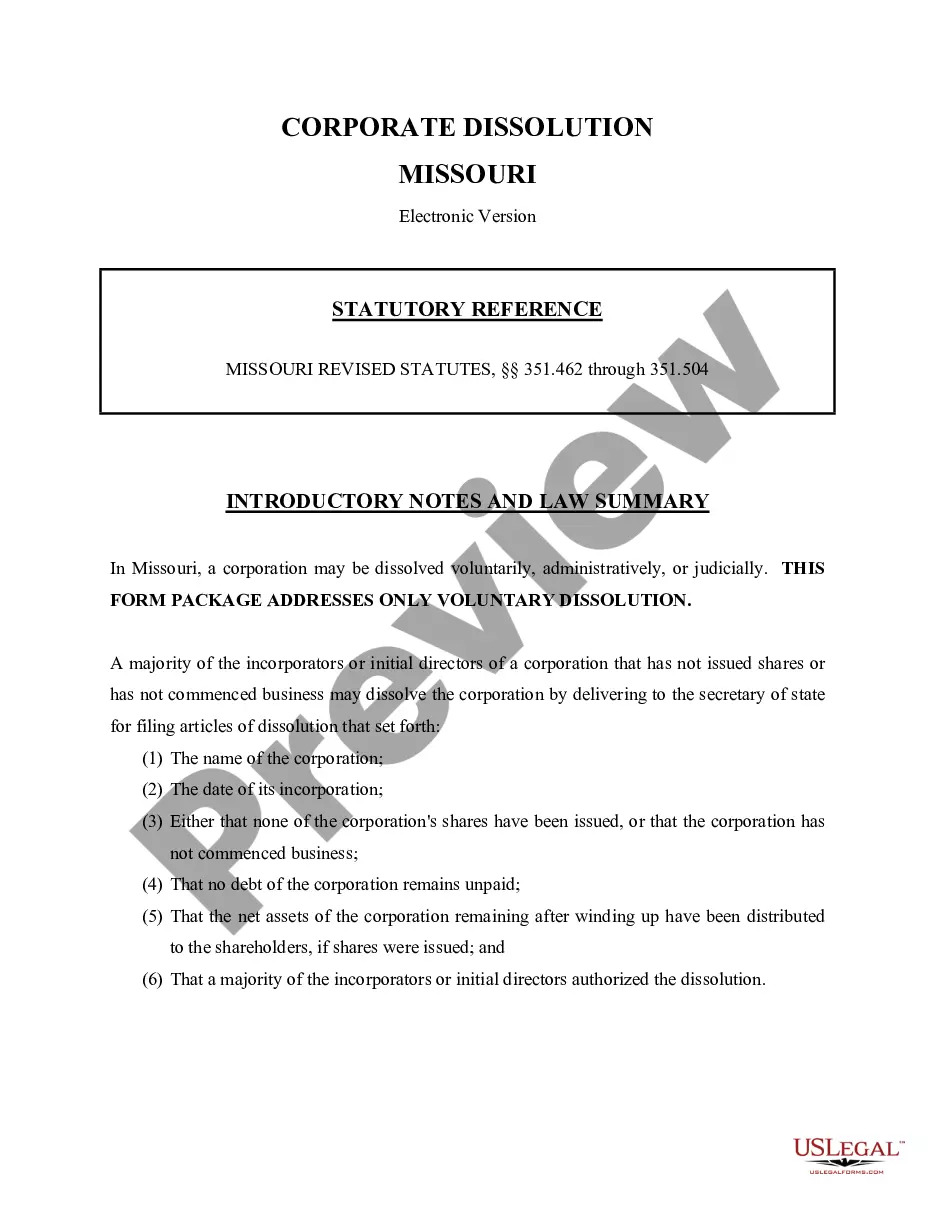

To dissolve your LLC in Missouri, you must first complete (and provide by mail, fax or in person) either a Notice of Abandonment of Merger or Consolidation of Limited Liability Company (Form LLC-2) or a Notice of Winding Up (LLC-13) form, disclosing that a dissolution is in process.

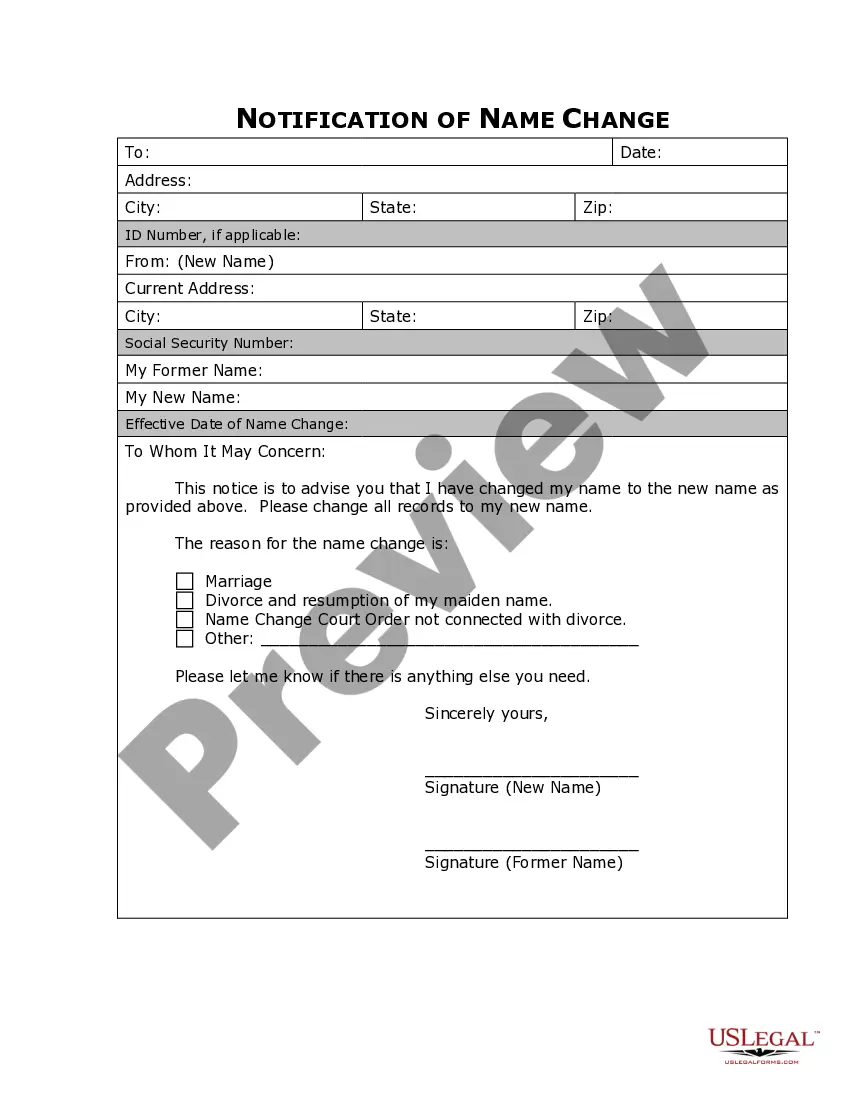

To dissolve a company, you must submit a DS01 form to strike off your company, which needs to be signed by all directors and will be sent to Companies House. You must also send copies to shareholders, creditors, and employees within a week of submitting this form.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

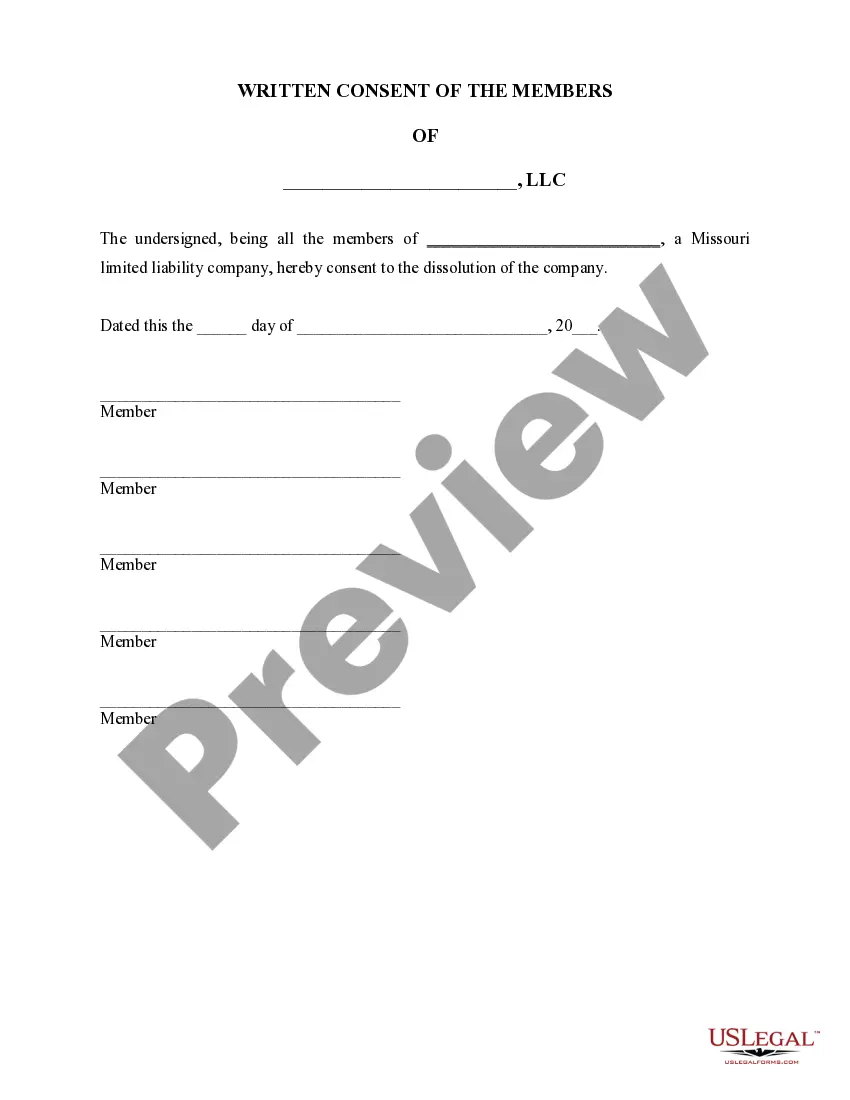

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

There is a $25 fee to file the articles of termination. Unlike some other states, Missouri does not require you to get tax clearance from the Department of Revenue before you can dissolve your LLC.

Generally called articles of dissolution, it usually states the LLC's name, the date it was formed, the fact the LLC is dissolving, and the event triggering the dissolution. Upon the effective date of this document, the LLC is considered dissolved and must stop doing its regular business and start winding up.

Once the pre-dissolution actions are completed, the Missouri Secretary of State will process the Articles of Termination. Depending on how busy the Missouri Secretary of State office is at the time of filing, the process usually takes around five to eight business days.

To close your account, you can email us at businesstaxregister@dor.mo.gov or call 573-751-5860. Please be sure to verify your correct mailing address.