With this Amendment to Lease Package, you will find the forms that are necessary to modify the terms of a lease. The forms in this package are designed to avoid disagreements over changes to leases and stay in compliance with state law.

Included in your package are the following forms:

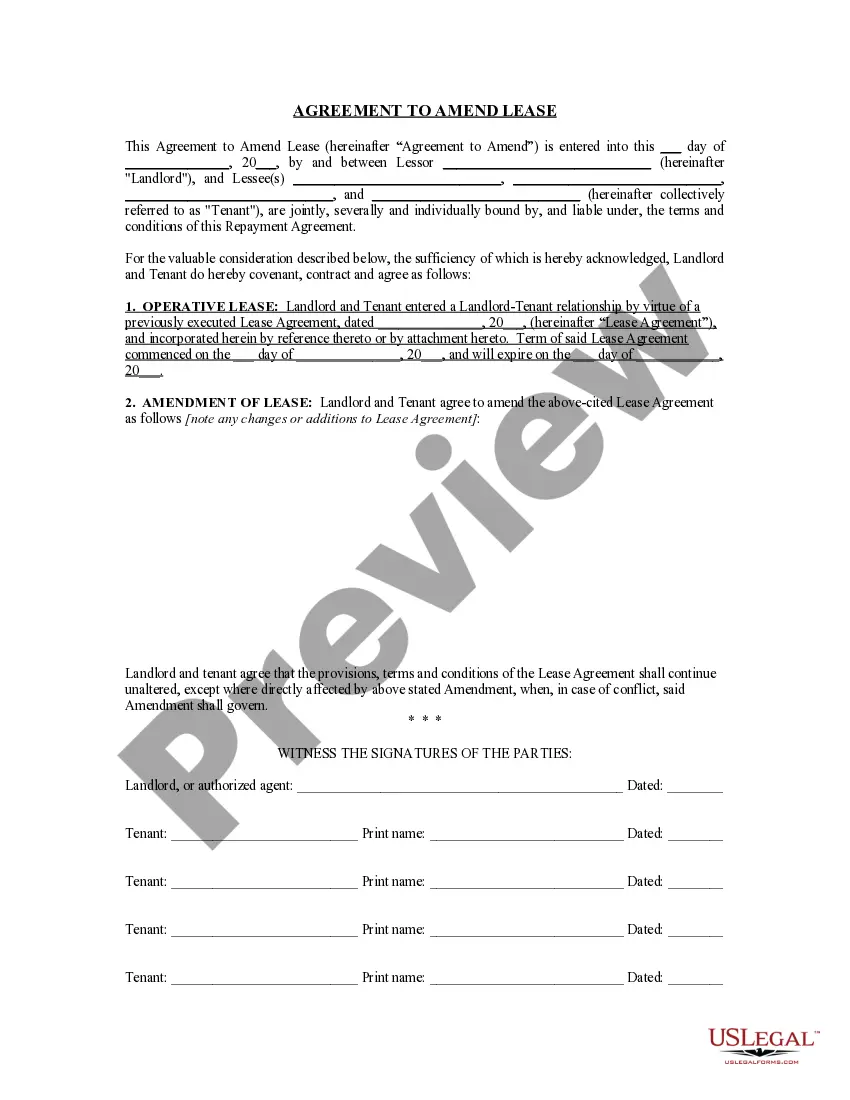

Amendment of Residential Lease

This Amendment of Residential Lease provides for adding agreed amendments to a lease agreement. This form permits changes to a lease agreement that will be incorporated as part of the overall lease contract. The structure of this form complies with applicable state statutes.

Amended Lease - Amendment for Office Building

This is an amended lease for an office building. Terms for modified rent and repairs to be made are included.

Modification of a Lease to Extend the Term and Increase the Base Rent

This agreement allows the landlord and tenant to agree to a new lease term and make adjustments to the rent payments. Other terms may be added as needed.

Modification of Lease Agreement

This forms allows the landlord and tenant to make any desired changes to the lease agreement. It may be customized to include any terms agreed upon.

Lease Modification Adding One or More Entities as Tenant Parties

This lease clause states that the landlord and the tenant agree that the lease (sublease) is modified, and illustrates the terms and conditions of the modifications of the lease.

Commercial Lease Modification Agreement

This office lease agreement contains detailed terms and conditions for the modification (and extension) of the lease. Terms for the tenant's option to a further lease extension in the future are included.