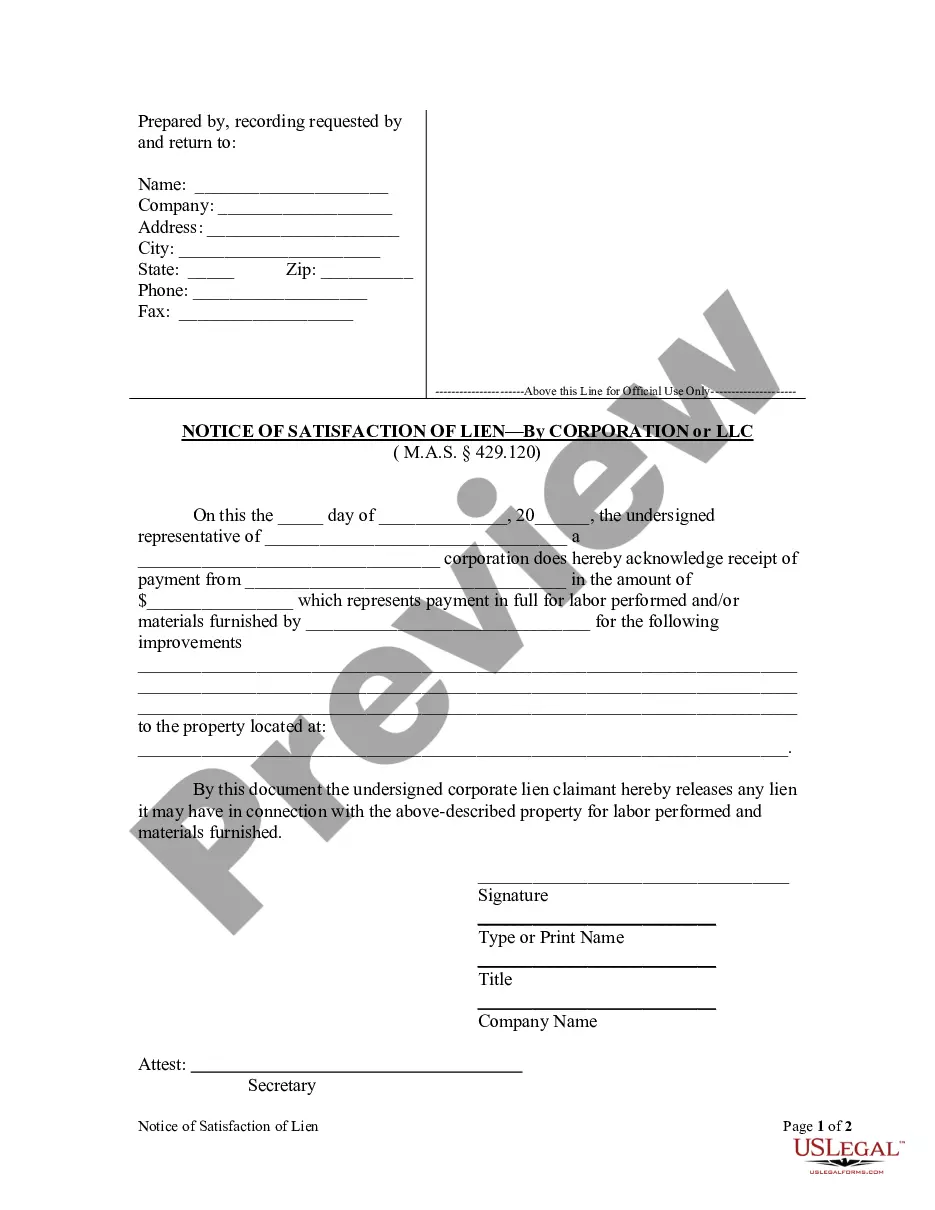

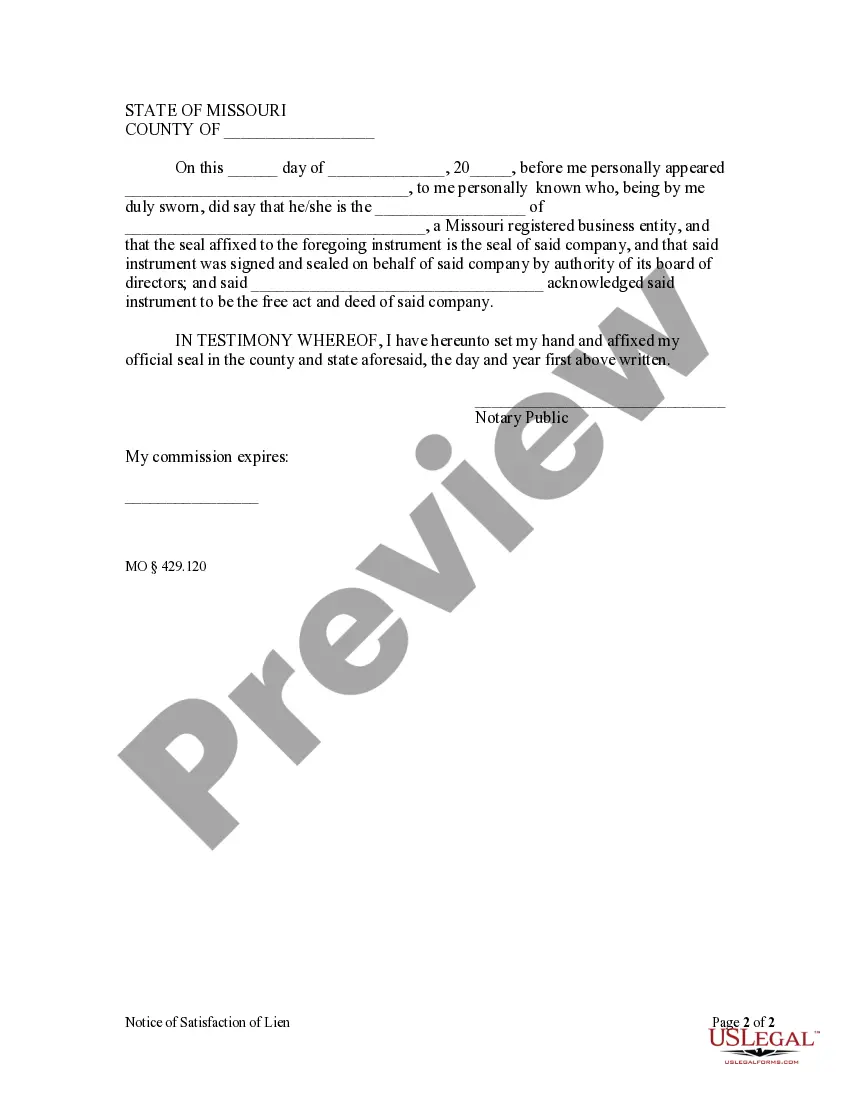

In the event that a lien has been satisfied by payment in full, this form allows a lien claimant to certify that the lien has been satisfied.

Lee's Summit Missouri Notice of Satisfaction - Corporation

Description

How to fill out Missouri Notice Of Satisfaction - Corporation?

Utilize the US Legal Forms and gain prompt access to any document you need.

Our user-friendly platform with thousands of templates streamlines the process of locating and acquiring nearly any document sample you need.

You can save, fill out, and sign the Lee's Summit Missouri Notice of Satisfaction - Corporation or LLC in just a few minutes rather than spending hours online searching for a suitable template.

Using our collection is a fantastic method to enhance the security of your document submissions.

If you haven’t created a profile yet, follow these instructions.

Feel free to take advantage of our form library and enhance your document experience to be as seamless as possible!

- Our knowledgeable legal experts regularly examine all documents to ensure that the templates are suitable for a specific state and in compliance with updated laws and regulations.

- How can you acquire the Lee's Summit Missouri Notice of Satisfaction - Corporation or LLC? If you holds a subscription, simply Log In to your account.

- The Download feature will be available on all templates you view. Additionally, you can access all previously saved documents from the My documents section.

Form popularity

FAQ

Unlike most other states, Missouri does not require LLCs to file an annual report.

To dissolve your LLC in Missouri, you must first complete (and provide by mail, fax or in person) either a Notice of Abandonment of Merger or Consolidation of Limited Liability Company (Form LLC-2) or a Notice of Winding Up (LLC-13) form, disclosing that a dissolution is in process.

Registration as a limited liability partnership or an LLLP is only valid for one year, but such registration may be renewed on a yearly basis by filing a renewal form with the Secretary of State.

Registration as a limited liability partnership or an LLLP is only valid for one year, but such registration may be renewed on a yearly basis by filing a renewal form with the Secretary of State.

You can also switch to a new Registered Agent later ? for a fee of $37 ? by filing a Statement of Change form with the Missouri SOS. It's free for the first year if you form your LLC with us and $119 a year after.

Fictitious name registration is completed through a filing with the Secretary of State. The filing may be completed online at the Secretary of State's Web site, or by mail. The fee for this filing is seven dollars, and the registration must be renewed every five years.

What typically has to be done. Notifying creditors that the LLC is dissolved. Closing out bank accounts. Canceling business licenses, permits, and assumed names. Paying creditors or establishing reserves to pay them. Paying taxes. Filing final tax returns and reports.

Once the pre-dissolution actions are completed, the Missouri Secretary of State will process the Articles of Termination. Depending on how busy the Missouri Secretary of State office is at the time of filing, the process usually takes around five to eight business days.

Unlike most states, where LLCs have to file an ?Annual Report? (and pay a fee), Missouri LLCs don't have to file an Annual Report and they don't have to pay an annual fee to the Secretary of State. Missouri is one of the few states that doesn't have Annual Report requirements for LLCs.

Do You Need a Business License in Missouri? Most local governments in Missouri require business licenses on a city or county level. As with many other states in the U.S., the only business license regulated at the state level in Missouri is the sales tax license, sometimes commonly called a seller's permit.