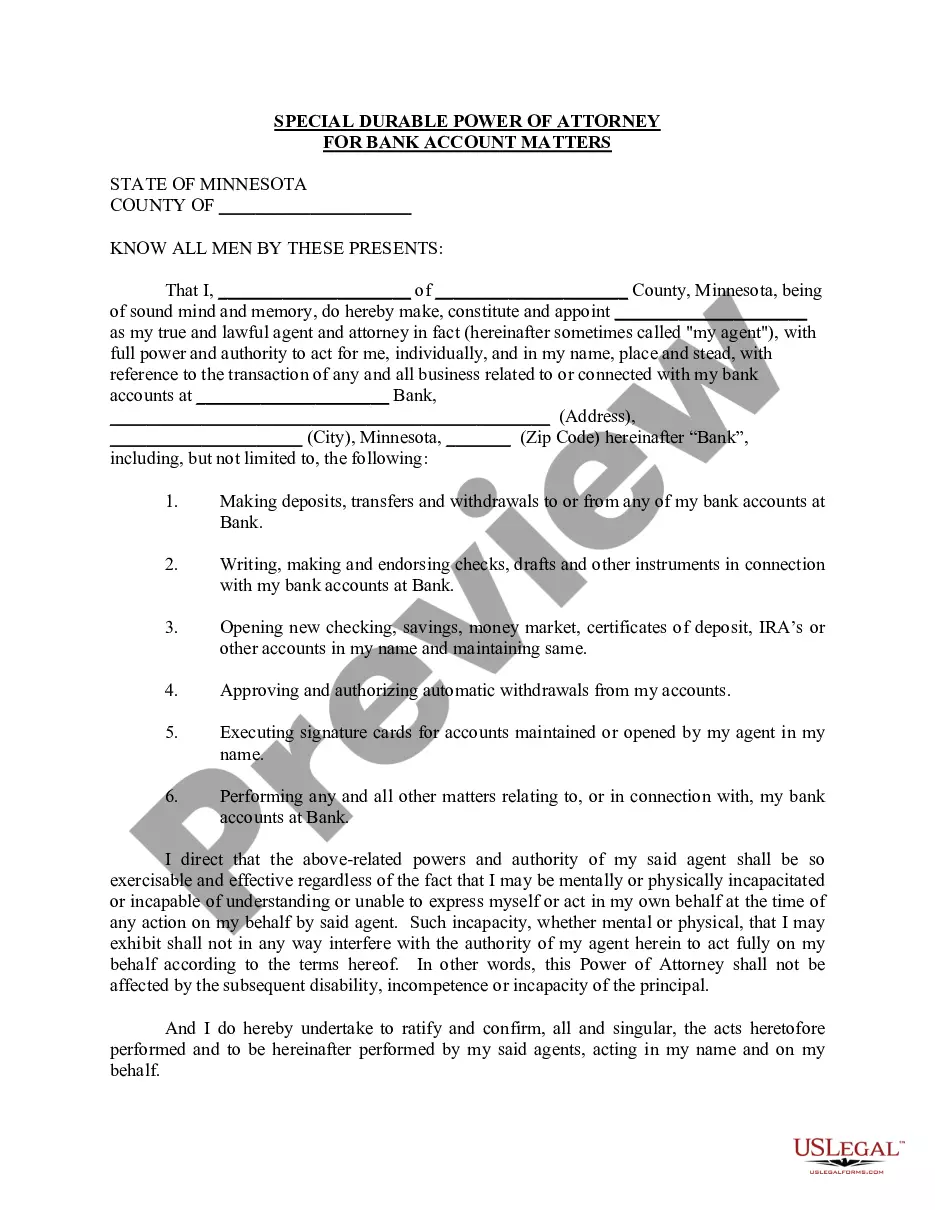

Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Minnesota Special Durable Power Of Attorney For Bank Account Matters?

If you are seeking a pertinent form template, it’s incredibly challenging to find a more suitable location than the US Legal Forms website – one of the most extensive collections on the web.

Here you can discover a wide array of templates for commercial and personal use categorized by types and states, or keywords.

With our advanced search feature, obtaining the latest Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters is as straightforward as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

Receive the template. Choose the format and save it to your device.

- Moreover, the pertinence of each document is validated by a team of knowledgeable attorneys who routinely review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and have a registered account, all you need to acquire the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have opened the sample you need. Review its description and utilize the Preview feature (if available) to examine its content. If it does not satisfy your requirements, employ the Search field at the top of the page to find the desired document.

- Confirm your choice. Click the Buy now button. After that, select your preferred subscription plan and enter information to create an account.

Form popularity

FAQ

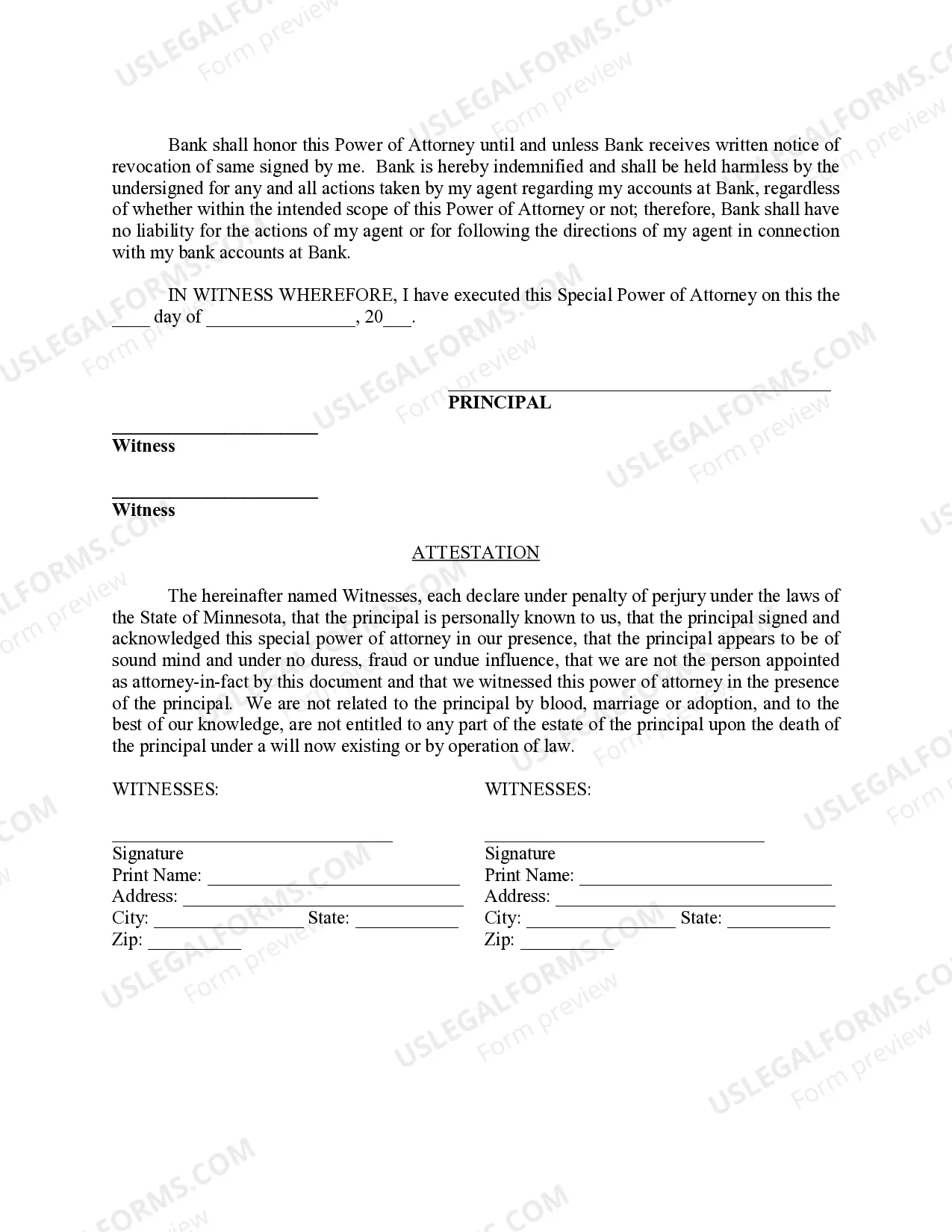

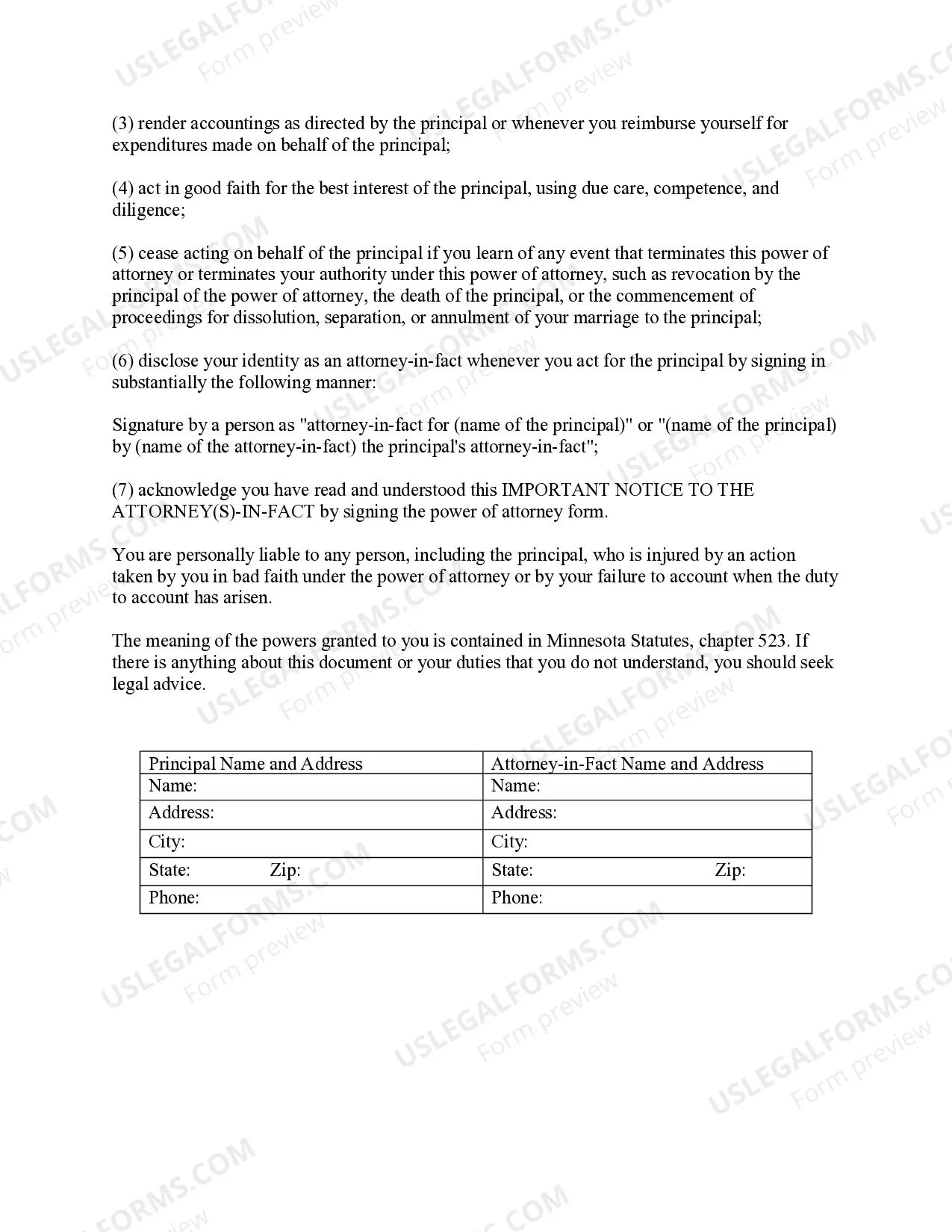

When you want to present your Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters to the bank, schedule an appointment with a bank representative. Bring the original document and any necessary identification, showing that you are authorized to act for your accounts. The bank may require additional documentation or forms, so be prepared to answer any questions. Providing clear communication can help ensure a smooth process.

To fill out the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters, start by carefully reading the provided instructions. You will need to enter your personal information and specify the bank accounts you want to include. Make sure to designate your agent clearly, as they will act on your behalf. After completing the paperwork, review it for accuracy before signing.

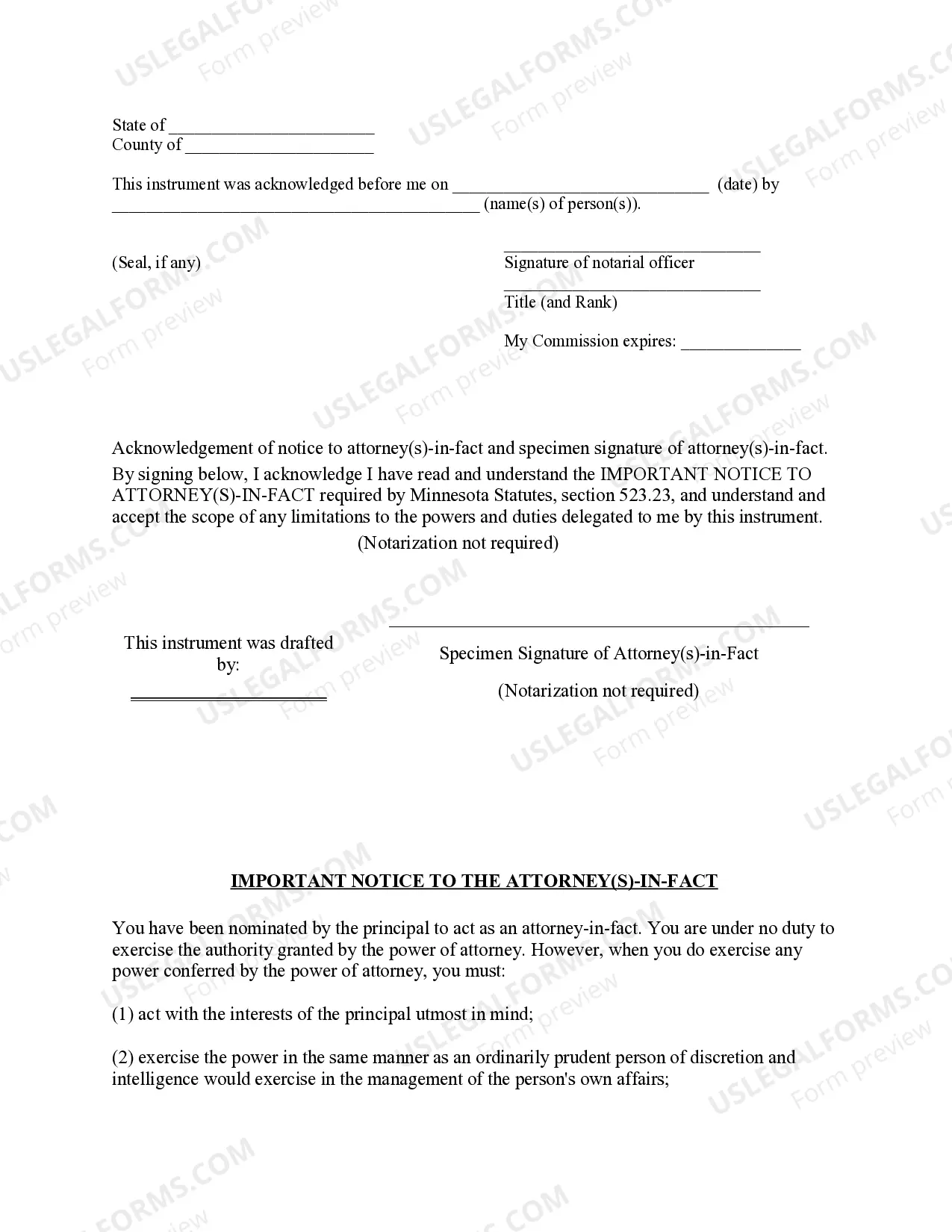

A Power of Attorney cannot make decisions regarding the principal's personal matters, such as marriage or adoption. Additionally, they cannot change a will or establish a trust on behalf of the principal. Understanding these limitations is crucial when executing the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters, as it ensures you act within the permissible boundaries.

Closing a bank account using a power of attorney involves presenting the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters to the bank. You will need to inform the bank representative that you wish to close the account and provide the necessary identification. Follow any specific procedures they outline, ensuring you complete all required steps to finalize the account closure.

Being a Power of Attorney comes with several responsibilities and potential disadvantages. You may face legal liability if decisions made are perceived as harmful or not in the best interest of the principal. Additionally, managing finances and affairs can lead to emotional stress, especially during challenging situations, making it important to understand the scope of the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters.

To submit a power of attorney to a bank, you need to provide the bank with the signed document, known as a Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters. First, visit your bank's local branch and ask to speak with a representative. They will guide you through their specific submission requirements, which may include notarization or additional forms.

Yes, a durable power of attorney in Minnesota, including the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters, must be notarized to be valid. Notarization helps to prevent misuse and verifies your identity, adding an extra level of security to your financial decisions.

While you can create a power of attorney without a lawyer in Minnesota, consulting with one can be beneficial. Using resources like USLegalForms can simplify the process of obtaining a Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters. This approach ensures that your document meets all legal requirements.

In Minnesota, a power of attorney does not need to be recorded; however, recording the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters can provide additional protection. Some financial institutions might require it to facilitate certain transactions. It's advisable to consult with your bank for their specific policies.

If the power of attorney is not notarized, it may still be valid but can lead to complications. Banks and other institutions may question its legitimacy, especially in cases involving the Saint Paul Minnesota Special Durable Power of Attorney for Bank Account Matters. Notarization serves as a safeguard, ensuring your intent is clear and recognized.