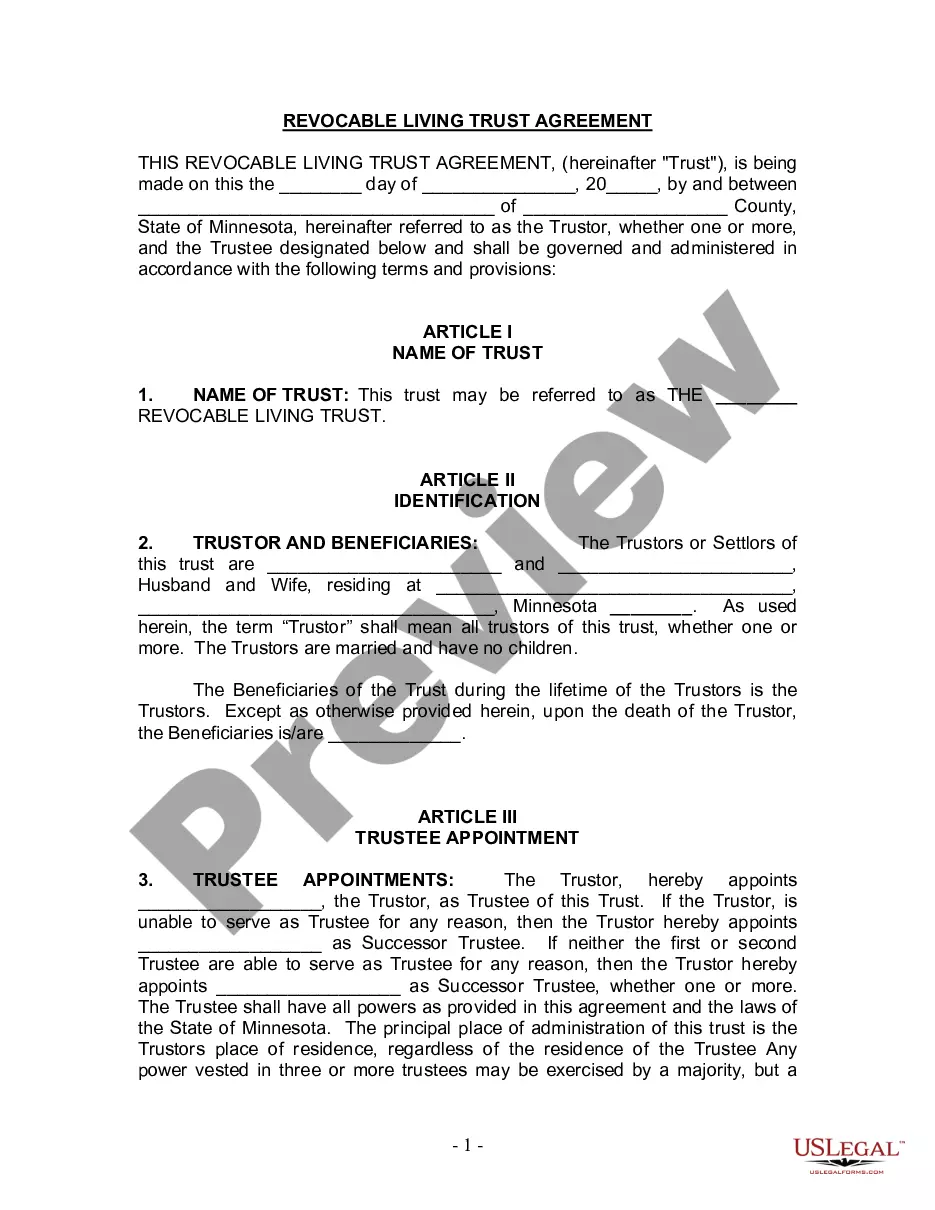

Minneapolis Minnesota Living Trust for Husband and Wife with No Children

Description

How to fill out Minnesota Living Trust For Husband And Wife With No Children?

In case you have utilized our service previously, Log In to your account and download the Minneapolis Minnesota Living Trust for Husband and Wife with No Children onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment agreement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continual access to all the documents you have acquired: you can find them in your profile within the My documents menu whenever you wish to use them again. Take advantage of the US Legal Forms service to swiftly locate and save any template for your personal or professional requirements!

- Ensure you’ve located the correct document. Review the details and utilize the Preview feature, if available, to confirm it suits your requirements. If it’s not suitable, employ the Search tab above to find the right one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete the payment. Use your credit card information or the PayPal option to finalize the transaction.

- Access your Minneapolis Minnesota Living Trust for Husband and Wife with No Children. Choose the file format for your document and save it to your device.

- Fill out your document. Print it or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

Joint trusts are easier to manage during a couple's lifetime. Since all assets are held in one trust, ownership mimics how many couples hold their assets - jointly. Both spouses having equal control of the management of joint assets held by the trust.

A married couple has many reasons to establish a living trust. A living trust can help their estate survive onerous estate taxes, avoid probate if they both die, and side step the need for a conservatorship if either one (or both) become incapacitated.

Common Types of Trusts Inter vivos trusts or living trusts: created and active during the lifetime of the grantor. Testamentary trusts: trusts formed after the death of the grantor. Revocable trusts: can be changed or revoked entirely by the grantor.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

A joint revocable trust is probably the easiest form of living revocable trusts for a married couple to use. A joint revocable trust merges the estate planning of a couple using a single trust document. Joint trusts and individual trusts each have advantages and disadvantages.

How Much Does It Cost to Create a Living Trust in Minnesota? The cost of creating a living trust depends on whether you do it yourself or hire an attorney to help you. You can use software to put together one yourself for usually less than a couple hundred dollars, and an attorney often costs more than $1,000.

To create a living trust in Minnesota, the grantor creates the trust and places assets in the control of the trust. You must name a trustee who is in charge of managing the assets during your lifetime. One of the benefits of a living trust is that you can name yourself trustee, and most people take advantage of this.

To make a living trust in Minnesota, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.