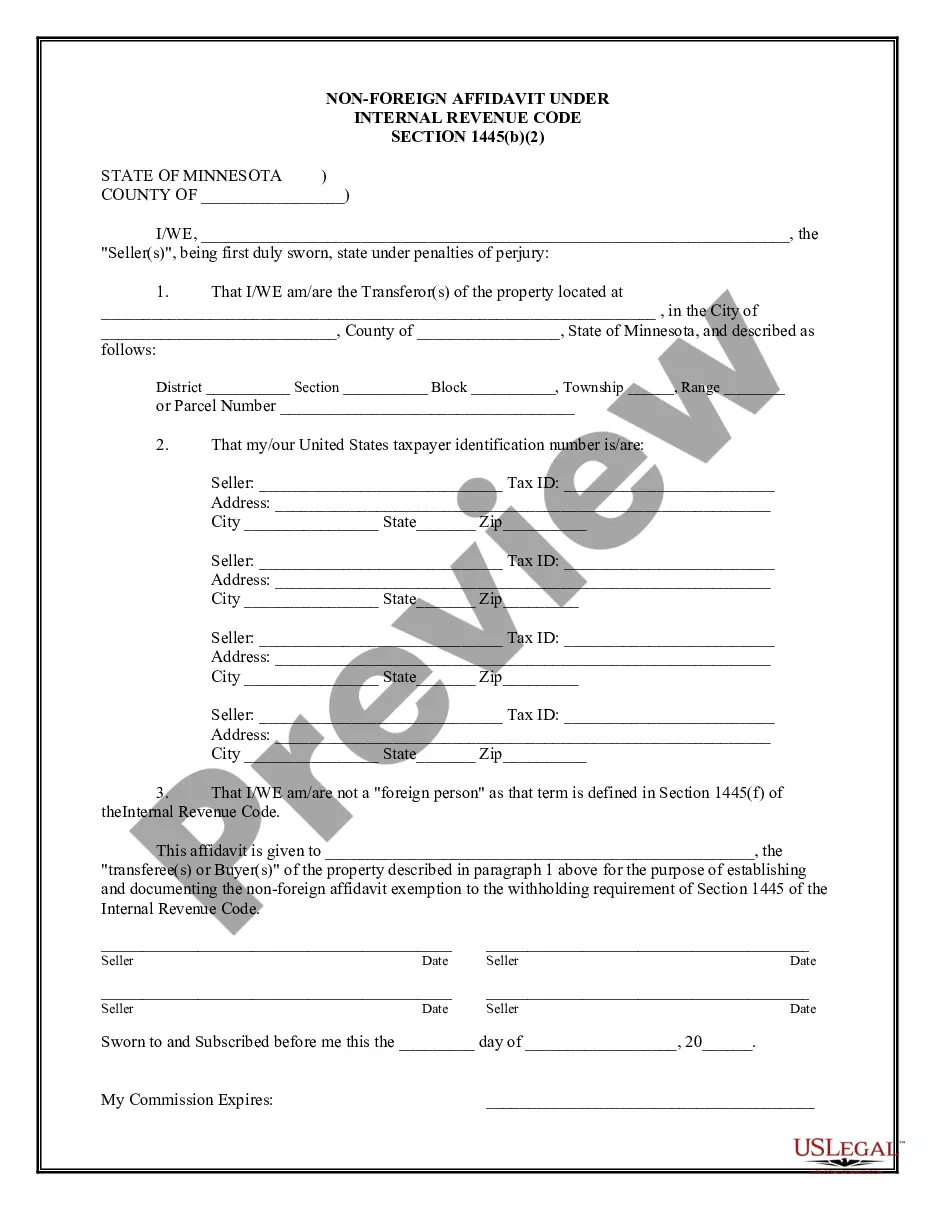

Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445

Description

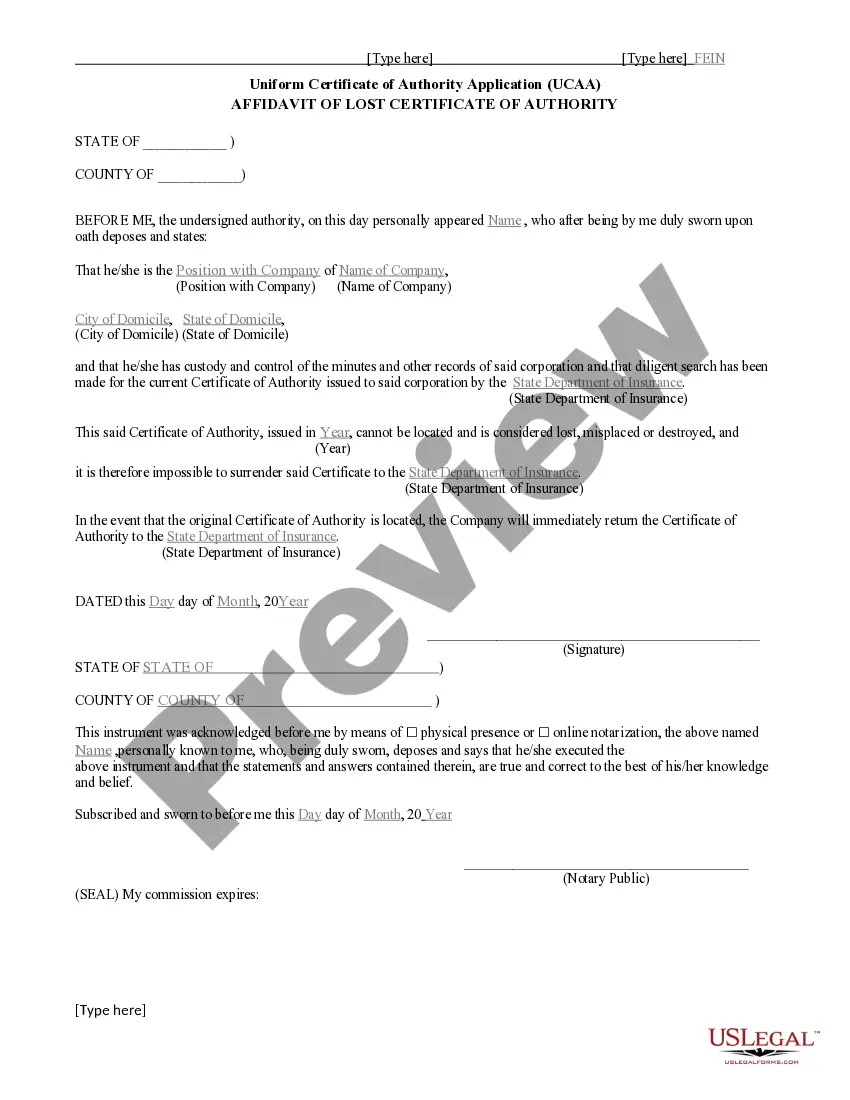

How to fill out Minnesota Non-Foreign Affidavit Under IRC 1445?

If you have previously used our service, Log In to your account and download the Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445 to your device by clicking the Download button. Ensure your subscription is active. If it's not, renew it per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section anytime you need to access it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

- Ensure you have identified the correct document. Review the description and utilize the Preview option, if available, to confirm it suits your requirements. If it does not match your needs, use the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and select a monthly or annual subscription option.

- Create an account and process your payment. Use your credit card information or the PayPal method to finalize the purchase.

- Obtain your Minneapolis Minnesota Non-Foreign Affidavit Under IRC 1445. Choose the file format for your document and save it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests. A disposition means ?disposition? for any purpose of the Internal Revenue Code. This includes but is not limited to a sale or exchange, liquidation, redemption, gift, transfers, etc.

If you're buying property, you should make sure the seller signs a FIRPTA Affidavit to protect yourself. You shouldn't take the seller's word for it ? or you could face serious penalties for not abiding by FIRPTA rules if they apply. A buyer can be penalized for not determining or disclosing a foreign seller.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an authorized officer of Borrower, stating (a) that Borrower is not a ?foreign corporation,? ?foreign partnership,? ?foreign trust,? or ?foreign estate,? as those terms are defined in the Code and the regulations promulgated

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

A citizen or resident of the United States, ? A domestic partnership, or ? A domestic corporation, or ? An estate or trust (other than a foreign estate of foreign trust as those terms are defined in Section 7701 (a) (31) of the Code.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

In order to potentially avoid FIRPTA withholding, the foreign seller, the Form 8288-B and a contract for the purchase of the replacement property, must be submitted to the IRS on or before the replacement property's closing following the procedures discussed in Rev. Rroc.