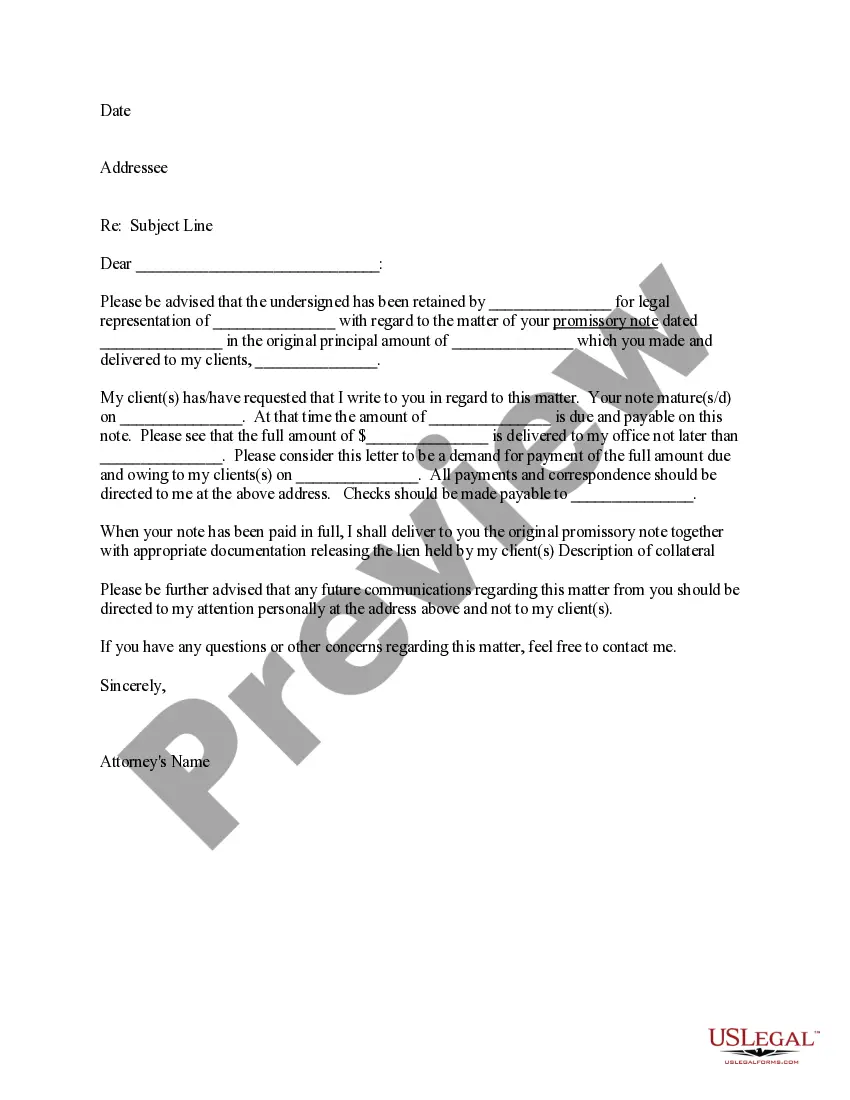

Minneapolis Minnesota Demand Letter - Repayment of Promissory Note

Description

How to fill out Minnesota Demand Letter - Repayment Of Promissory Note?

We consistently aim to minimize or avert legal complications when managing intricate law-related or financial issues.

To achieve this, we seek legal remedies that are generally very costly.

However, not every legal situation is of the same level of intricacy.

Many can be effectively handled by ourselves.

Utilize US Legal Forms whenever you need to obtain and download the Minneapolis Minnesota Demand Letter - Repayment of Promissory Note or any other form quickly and securely. Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it from within the My documents section. The procedure is just as straightforward if you are not familiar with the platform! You can create your account in just a few minutes. Ensure to verify if the Minneapolis Minnesota Demand Letter - Repayment of Promissory Note adheres to the laws and regulations of your state and area. Furthermore, it is crucial that you read the form’s description (if available), and should you find any differences from your initial expectations, look for an alternative template. Once you confirm that the Minneapolis Minnesota Demand Letter - Repayment of Promissory Note is suitable for you, you can select a subscription plan and proceed to payment. Then you can download the document in any preferred format. For over 24 years, we have assisted millions by offering ready to customize and up-to-date legal forms. Take full advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our library empowers you to take control of your matters independently without relying on legal advice.

- We provide access to legal form templates that are not always publicly accessible.

- Our templates are specific to states and areas, which greatly simplifies the search for appropriate forms.

Form popularity

FAQ

To enforce a promissory note, the holder must provide notice as is required per the note. If timely payment is not made by the borrower, the note holder can file an action to recover payment.

Dated Signature: In Minnesota, both unsecured and secured promissory notes should be signed and dated by the borrower, any co-signer, the lender, and a witness. There is no legal requirement for promissory notes to be notarized in Minnesota.

Circumstances for Release of a Promissory Note The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

A promissory note may include a default on secured debt as part of the agreement. This means that if the borrower fails to pay under the agreed-upon terms of the promissory note, then the lender can take the secured debt as a form of payment.

The original copy of a valid promissory note is usually held by the lender, but the borrower should also keep a copy of the signed document. If the borrower does not repay the loan, the lender can pursue appropriate legal action.

336.3-118 STATUTE OF LIMITATIONS. (b) Except as provided in subsection (d) or (e), if demand for payment is made to the maker of a note payable on demand, an action to enforce the obligation of a party to pay the note must be commenced within six years after the demand.

A promissory note payable on demand is a way to get repaid when you loan money to someone. It is a document that states the terms of the loan and includes the ?payable on demand? notation on it. This means that you can demand full payment of the loan at any time you deem necessary.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.