Saint Paul Minnesota Instructions for Cost of Living Adjustment Worksheet

Description

How to fill out Minnesota Instructions For Cost Of Living Adjustment Worksheet?

If you have previously utilized our service, Log In to your account and download the Saint Paul Minnesota Guidelines for Cost of Living Adjustment Worksheet to your device by clicking the Download button. Ensure your subscription is current. If it isn’t, renew it per your payment plan.

If this is your initial experience with our service, adhere to these straightforward steps to obtain your document.

You have continual access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or professional requirements!

- Confirm you’ve located an appropriate document. Browse through the description and utilize the Preview option, if accessible, to verify if it aligns with your needs. If it’s unsuitable, utilize the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and complete a payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Obtain your Saint Paul Minnesota Guidelines for Cost of Living Adjustment Worksheet. Choose the file format for your document and save it to your device.

- Complete your sample. Print it or take advantage of professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Social Security is designed to keep pace with inflation through its cost-of-living adjustment, or COLA, which is calculated annually. Starting in January, the increase will lift the typical monthly retiree benefit by $140 to $1,827. That follows a 5.9 percent increase for 2022, a four-decade high at the time.

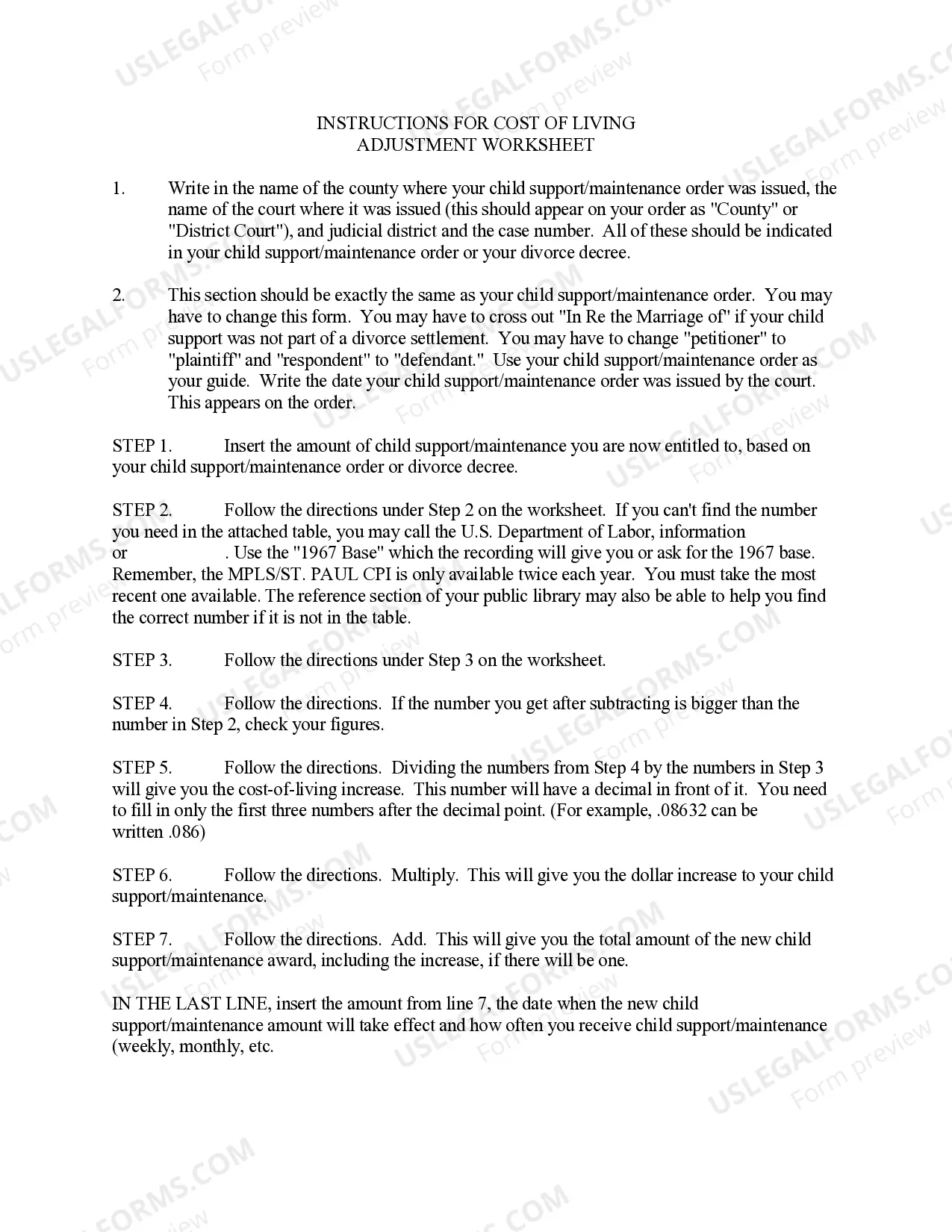

How is a COLA calculated? The Social Security Act specifies a formula for determining each COLA. According to the formula, COLAs are based on increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). CPI-Ws are calculated on a monthly basis by the Bureau of Labor Statistics.

Anyone who draws Social Security benefits will get a cost of living adjustment to their credits. The purpose of the increase is to offset the rising cost of consumer goods and services, so don't expect to have leftover money at the end of each month.

Last Updated: October 13, 2022 The CPI-W rises when inflation increases, leading to a higher cost-of-living. This change means prices for goods and services, on average, are higher. The cost-of-living adjustment (COLA) helps to offset these costs.

Since 1975, Social Security's general benefit increases have been based on increases in the cost of living, as measured by the Consumer Price Index. We call such increases Cost-Of-Living Adjustments, or COLAs.

It is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the last year a COLA was determined to the third quarter of the current year. If there is no increase, there can be no COLA.

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. The 5.9 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2022.

Unlike child support, there is no standard formula for calculating spousal support in Minnesota. In general, however, the longer you've been married, and the greater the disparity in earning capacity between the spouses, the more likely it is that a substantial maintenance award will be made.

Since 1975, Social Security's general benefit increases have been based on increases in the cost of living, as measured by the Consumer Price Index. We call such increases Cost-Of-Living Adjustments, or COLAs. We determined an 8.7-percent COLA on October 13, 2022. We will announce the next COLA in October 2023.

Cost-of-living adjustments.