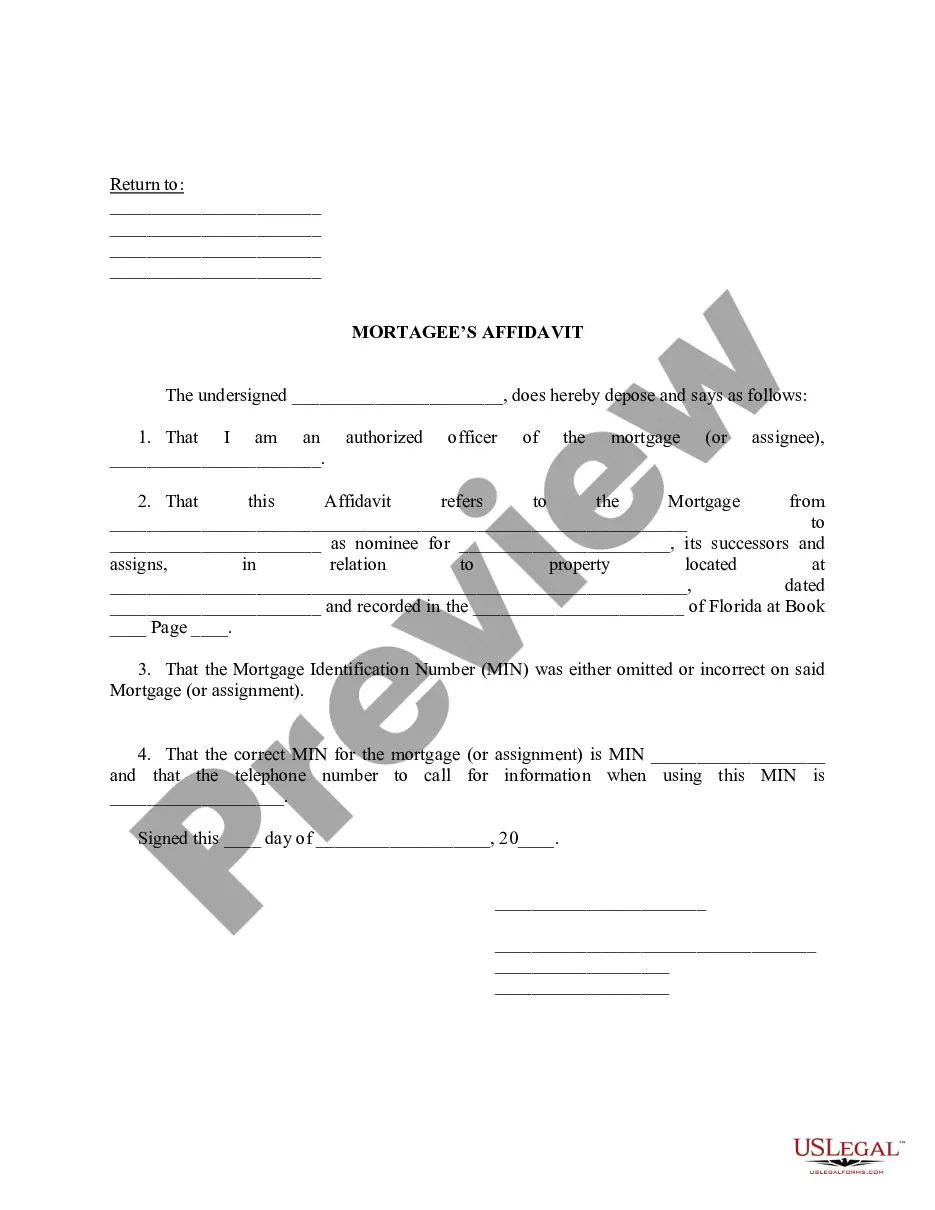

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDf format.

Hennepin Minnesota Mortgage By Individuals - UCBC Form 20.1.1

Description

How to fill out Minnesota Mortgage By Individuals - UCBC Form 20.1.1?

Are you searching for a reliable and economical legal document provider to purchase the Hennepin Minnesota Mortgage By Individuals - UCBC Form 20.1.1? US Legal Forms is your ideal choice.

Whether you require a straightforward agreement to establish guidelines for cohabitation with your spouse or a collection of forms to navigate through your separation or divorce in court, we've got you taken care of. Our platform features over 85,000 current legal document templates suitable for personal and business purposes. All templates that we provide are not generic and are customized according to the specific needs of various states and regions.

To obtain the form, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired form templates anytime from the My documents section.

Is this your first time visiting our site? No problem. You can create an account in moments, but before doing so, please ensure to.

Now you can register your account. Next, choose the subscription plan and move forward to payment. Once the transaction is completed, download the Hennepin Minnesota Mortgage By Individuals - UCBC Form 20.1.1 in any available format. You can return to the website whenever needed and redownload the form at no extra charge.

Acquiring current legal forms has never been simpler. Give US Legal Forms a try today and stop wasting your precious time learning about legal documents online permanently.

- Verify if the Hennepin Minnesota Mortgage By Individuals - UCBC Form 20.1.1 complies with the laws of your state and locality.

- Review the form's specifics (if accessible) to understand who the form is designed for and its intended purpose.

- Restart the search if the form is not suitable for your particular situation.

Form popularity

FAQ

Mortgage Registry Tax The tax is collected and paid to the Minnesota county where the mortgage document is being recorded. The state Mortgage Tax rate is 0.0023 of the debt that is being secured by a mortgage on Minnesota real property.

Minnesota Statute 287.035 provides for mortgage registry tax to be paid on mortgages to be recorded. The rate is 0.0023 of the debt secured (Example: $105,250 X 23 = $242.08 mortgage registry tax).

$495 must be paid when the deed is recorded. Who is responsible for paying the tax? The mortgagor (borrower) is liable for the MRT, while the seller is liable for the deed tax.

The buyer is required to pay a sales premium of 5 %. Deed Tax Basis: $ 525,000. Real property is sold for a purchase price of $ 150,000.

The MRT is based on the amount of debt secured by a mortgage of real property and is imposed when the mortgage is recorded. The MRT rate is 0.23 percent of the total debt.

The Mortgage Deed must be signed in person and then sent back to your conveyancing solicitor. The Mortgage Deed will be sent to your address from the mortgage lender.

Mortgage registry tax (MRT) MRT is paid when recording a mortgage. The rate is 0.0023 of the mortgage amount. Hennepin County adds an additional . 0001 for an environmental response fund (ERF) per Minnesota Statute 383A.

Deeds are usually recorded by the property owner, real estate agent, or closing attorney in the Mobile County Probate Court records department. If your deed was recorded, you may purchase a copy. For more information you can call the records department of the Mobile County Probate Court at 251-574-6000.

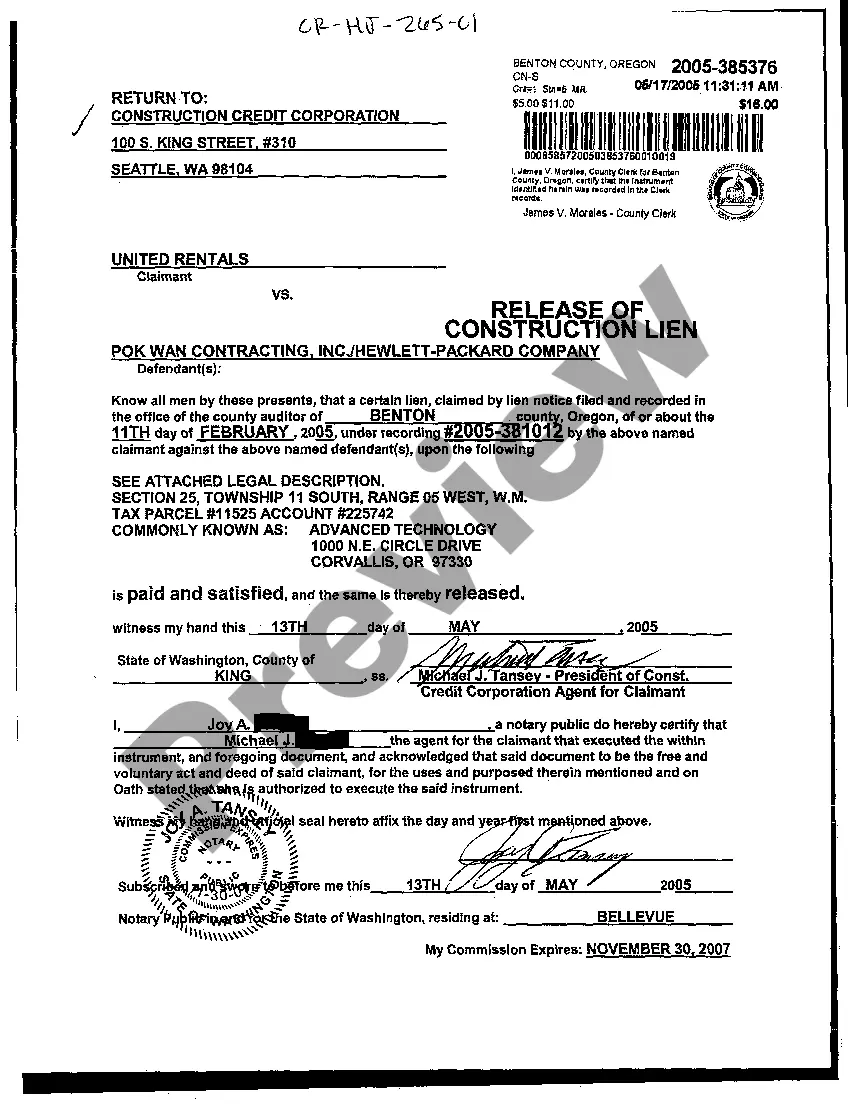

You can get a copy of your deed or mortgage release/satisfaction from the Recorder's office, and our staff can help you with your search. However, we cannot conduct searches for you. Companies may contact you and offer to send a copy of your deed for $60 or more.

The mortgage recording tax is used to document the loan transaction. This is separate from mortgage interest and other annual property taxes. It is paid when you take out a mortgage, but it is a state-imposed tax. Not everyone has to pay it. There are currently eight states that charge mortgage recording tax.