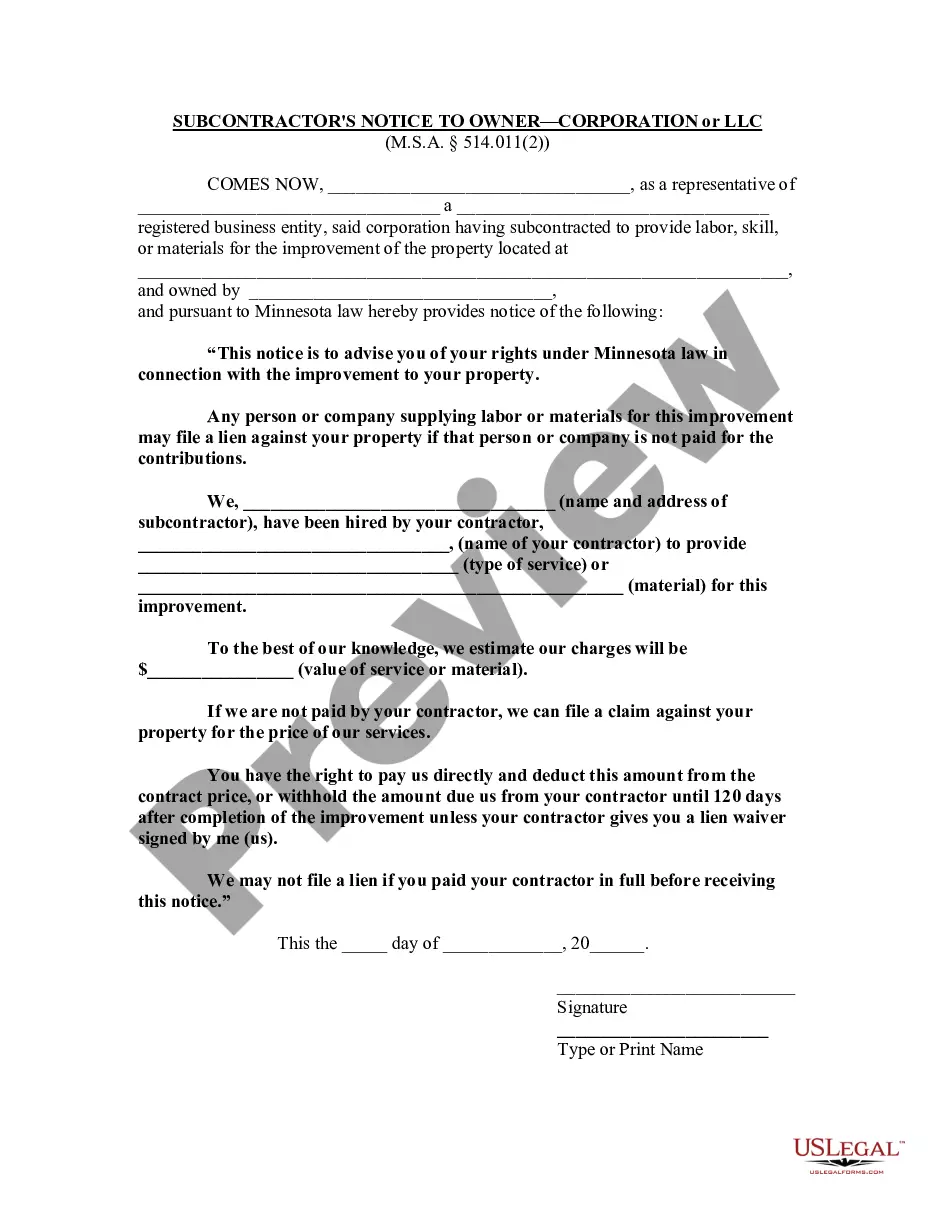

Minnesota statutes require parties who contribute to the improvement of real property without the benefit of a direct oral or written contract with the property owner to provide the owner with this notice. It includes form language required by Minnesota law and serves to let the property owner know exactly what work is being provided and the cost thereof. The corporate or LLC subcontractor must provide this notice to the owner within forty-five (45) days after the lien claimant has first furnished labor, skill, or materials in order to claim a lien against the improved property.

Saint Paul Minnesota Subcontractor's Notice to Owner - Corporation or LLC

Description

How to fill out Minnesota Subcontractor's Notice To Owner - Corporation Or LLC?

Utilize the US Legal Forms and gain immediate access to any form you require.

Our user-friendly website featuring thousands of templates simplifies the process of locating and acquiring nearly any document sample you desire.

You can export, complete, and sign the Saint Paul Minnesota Subcontractor's Notice to Owner - Corporation or LLC within just a few minutes rather than spending countless hours online seeking the appropriate template.

Using our library is an excellent approach to enhance the security of your document filing.

- Our skilled attorneys frequently review all documents to ensure that the forms are suitable for specific states and adhere to updated laws and regulations.

- How can you obtain the Saint Paul Minnesota Subcontractor's Notice to Owner - Corporation or LLC.

- If you already possess an account, simply Log In to your profile. The Download option will be made available for all samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

- If you lack an account, follow the instructions outlined below.

Form popularity

FAQ

LLC self-employment taxes You'll pay these taxes directly to the IRS in the form of self-employment taxes. The total self-employment tax is 15.3%, and it's broken down into several parts: 12.4% social security tax on earnings up to $137,700. 2.9% Medicare tax on all earnings.

Just follow these six steps, and you'll be on your way. Name Your Minnesota LLC.Your LLC must establish a registered office.Prepare and File Articles of Organization.Receive a Certificate From the State.Create an Operating Agreement.Get an Employer Identification Number.

Business profits are taxed at the owners' personal tax rates. However, if an LLC elects to be taxed as a C corporation, it must pay federal corporate income tax and a flat 9.8% Minnesota corporate franchise tax.

In Minnesota, this corporate tax generally is a flat 9.8% of taxable income. However, additional or alternative taxes may also apply. In general, if your Minnesota LLC is taxed as a corporation, it will need to pay some kind of income taxes or fees to the state.

Generally, members of LLCs filing Partnership Returns pay self-employment tax on their share of partnership earnings. If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return.

In Minnesota, you must first file a Statement of Dissolution stating that you are in the process of winding up your business. Then, once you wind up your LLC, you must file the Statement of Termination. Minnesota requires business owners to submit their Statement of Termination by mail, online, or in-person.

A limited liability company (LLC) is a business structure that blends some of the characteristics of corporations and partnerships. LLCs that are based in Minnesota or do business in Minnesota but based in another state must file its Articles of Organization with the Minnesota Secretary of State.

You can file an LLC name reservation for $50 if filed by mail and $55 if filed online or in-person. Minnesota LLCs are also required to file an Annual Renewal each year. It costs $25 to file this renewal by mail and $45 if filed online or in-person.

S corporations must pay Minnesota's corporate tax rate of 9.8% on the following: The Minnesota portion of any passive income that is subject to federal tax.

How much does it cost to form an LLC in Minnesota? The Minnesota Secretary of State charges $135 to file the Articles of Organization by mail and $155 to file online or in-person. You can file an LLC name reservation for $50 if filed by mail and $55 if filed online or in-person.