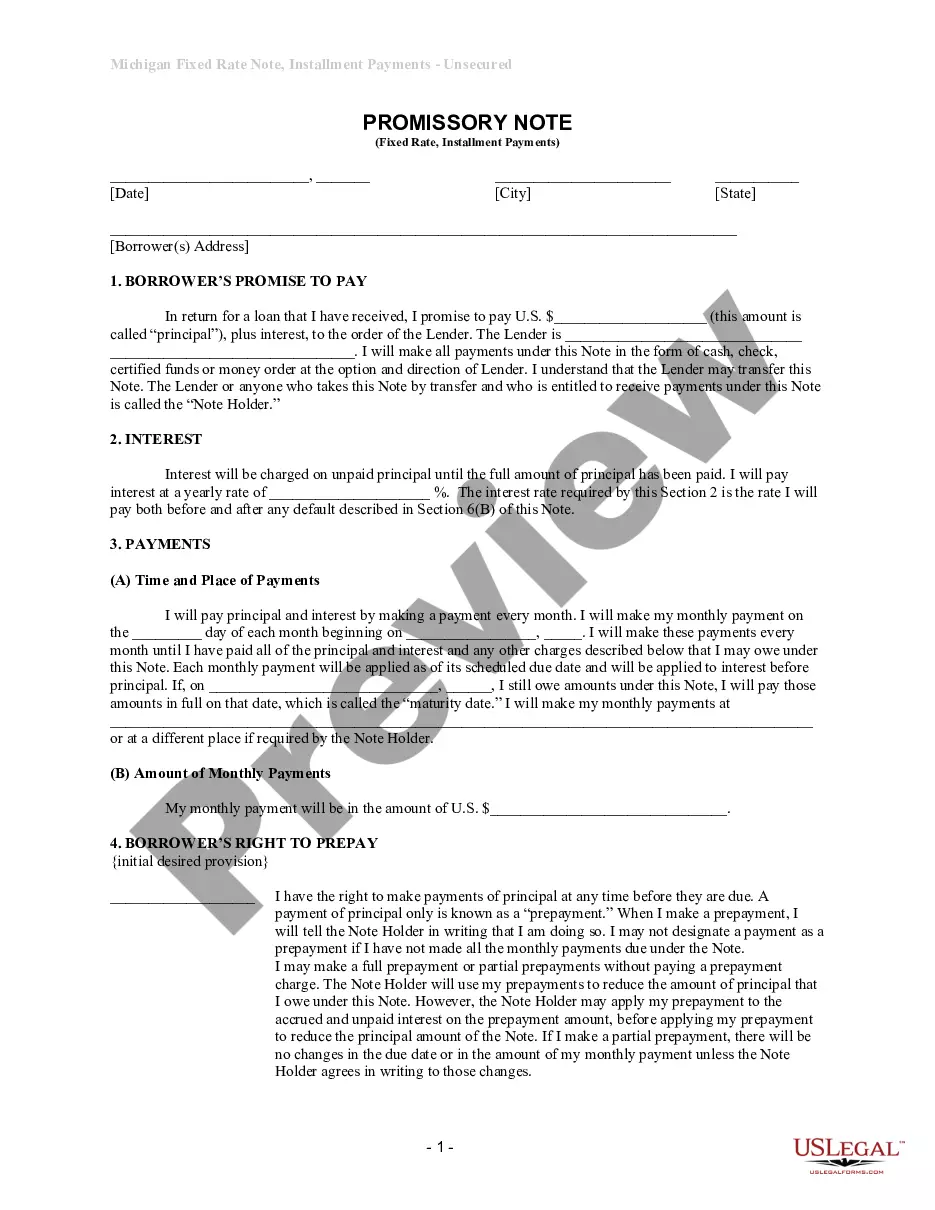

Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Michigan Unsecured Installment Payment Promissory Note For Fixed Rate?

Are you seeking a trustworthy and budget-friendly provider of legal forms to purchase the Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate? US Legal Forms is your ideal solution.

Whether you require a straightforward agreement to outline guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the court, we have you covered. Our platform presents over 85,000 current legal document templates for both personal and business purposes. All templates we supply are not generic and are tailored according to the needs of specific states and counties.

To acquire the form, you must Log In to your account, find the required form, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased form templates at any time from the My documents section.

Are you a newcomer to our website? No problem. You can easily create an account, but prior to that, ensure to do the following.

Now you can establish your account. Then select the subscription option and continue to payment. Once the payment is finalized, download the Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate in any accessible file format. You can return to the website at any time and redownload the form free of charge.

Locating up-to-date legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal paperwork online once and for all.

- Verify if the Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate adheres to the regulations of your state and locality.

- Review the details of the form (if available) to understand who and what the form is designed for.

- Restart the search if the form does not suit your particular situation.

Form popularity

FAQ

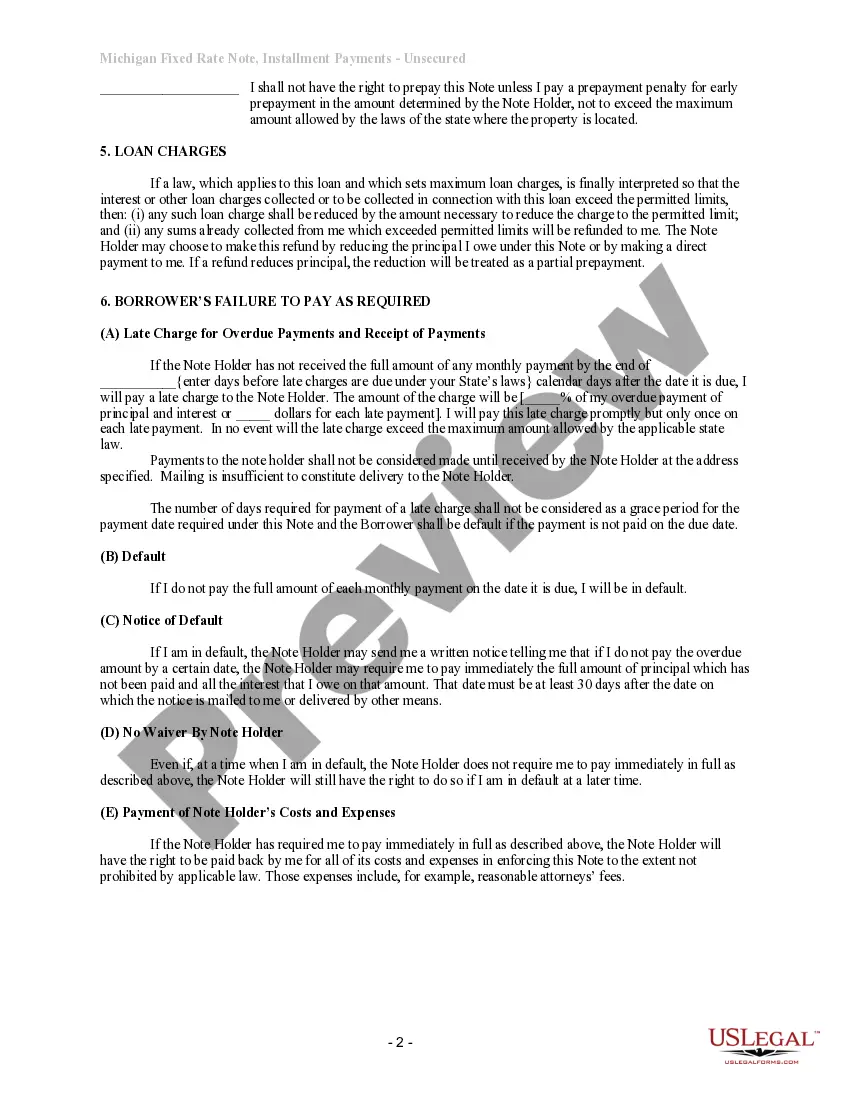

To make a promissory note enforceable, it must include specific elements such as the principal amount, interest rate, repayment terms, and signatures from both parties. The document should be clear and unambiguous, leaving no room for misunderstandings. This is crucial for your Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate to stand up in legal proceedings.

A promissory note may become unenforceable due to several factors, including lack of clarity in terms, missing signatures, or violation of state laws. If the note lacks essential information such as the repayment schedule or interest rate, it may be contested. Therefore, ensure that your Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate is complete and compliant with legal standards.

Setting up a payment plan with the state of Michigan involves contacting the appropriate state agency responsible for your debts. You may need to provide your financial information and propose a reasonable payment schedule. Using a Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate can aid in formalizing your repayment commitment.

The reasonable interest rate for a Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate typically varies based on several factors, including the creditworthiness of the borrower and prevailing market rates. Generally, you can expect rates to range from 5% to 15%. It is essential to ensure that the rate aligns with state regulations and remains fair for both parties involved. To find the best option, consider utilizing the uslegalforms platform to create or review your promissory note.

A valid example of a promissory note includes a straightforward document that outlines the amount borrowed, interest rate, and terms of repayment. It should include the parties' signatures and date. For instance, a Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate makes a great example as it meets all legal requirements for enforceability.

Yes, a Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate remains valid even if it is not notarized. The essential element is that both parties agree to the terms and sign the document. Therefore, while notarization is useful, it is not a requirement for the note's validity.

In Michigan, a promissory note does not require notarization to be legally binding. However, having it notarized can provide additional evidence of authenticity and help in case of disputes. It’s often advantageous to have a witness or notary involved for added security and peace of mind.

To obtain a Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate, you need to engage with a lender or use a reputable online service like USLegalForms. This process typically involves filling out an application and providing necessary documentation. Once approved, you will receive your promissory note detailing the payment terms.

You can obtain a copy of your Lansing Michigan Unsecured Installment Payment Promissory Note for Fixed Rate from the lender or financial institution that issued it. Many lenders maintain digital copies, so check your email or online account. If you cannot find it, contact the lender directly for assistance in retrieving your document.