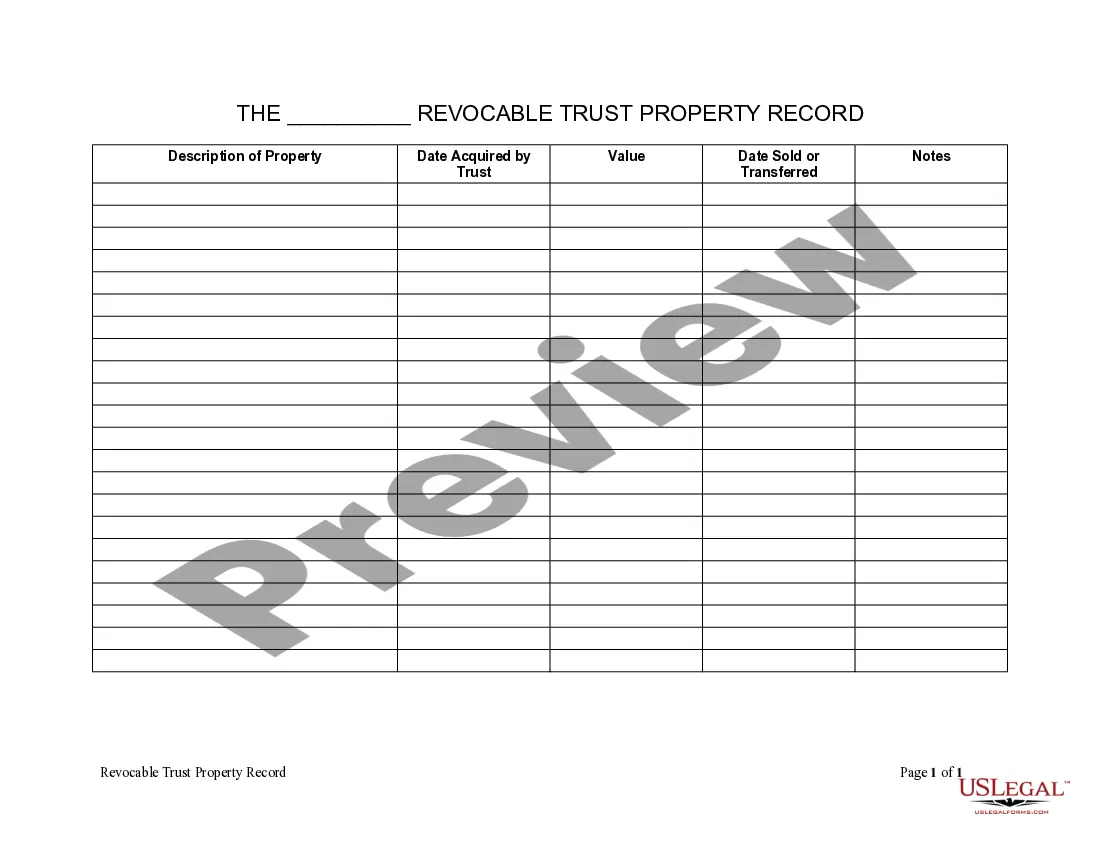

Grand Rapids Michigan Living Trust Property Record

Description

How to fill out Michigan Living Trust Property Record?

Are you searching for a trustworthy and economical provider of legal forms to obtain the Grand Rapids Michigan Living Trust Property Record? US Legal Forms is your preferred option.

Whether you need a straightforward agreement to establish rules for living with your partner or a set of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our website offers over 85,000 current legal document templates for both personal and business needs. All templates available are not generic and tailored according to the regulations of individual states and areas.

To download the document, you must Log In to your account, locate the desired template, and press the Download button adjacent to it. Please note that you can retrieve your previously acquired form templates anytime from the My documents section.

Is this your first visit to our site? No problem. You can create an account in a matter of minutes, but before doing that, ensure to complete the following.

Now you can set up your account. Then select the subscription plan and proceed to payment. After the payment is processed, download the Grand Rapids Michigan Living Trust Property Record in any of the provided file formats. You can revisit the website at any moment and redownload the document without any additional charges.

Finding current legal documents has never been simpler. Try US Legal Forms today, and eliminate the hassle of wasting your precious time searching for legal paperwork online once and for all.

- Verify that the Grand Rapids Michigan Living Trust Property Record complies with the laws of your state and local jurisdiction.

- Review the form’s specifics (if available) to determine who and what the document is applicable for.

- Restart the search if the template is not appropriate for your particular situation.

Form popularity

FAQ

Yes, a trust can hold title to real property in Michigan. This arrangement allows the property to be managed according to the terms of the trust, providing benefits like avoiding probate and ensuring privacy. For individuals interested in creating a trust for property ownership, understanding the implications within the Grand Rapids Michigan Living Trust Property Record is crucial for effective estate planning.

Generally, a trust does not need to be recorded in Michigan unless it specifically involves real estate transactions. For real property held in a trust, the trust must be referenced in property records to clarify ownership. It's important to note that maintaining proper records with respect to the Grand Rapids Michigan Living Trust Property Record can simplify future transactions and disputes.

In Michigan, beneficiaries do have a right to access information regarding the trust, but this right can depend on the terms outlined in the trust document itself. Typically, beneficiaries can request documents that prove their interests. Understanding how this process affects the Grand Rapids Michigan Living Trust Property Record is vital for beneficiaries to ensure they receive their intended benefits.

Trusts are not required to be registered in Michigan, which differentiates them from wills and other legal documents. This lack of registration offers privacy, allowing beneficiaries to manage assets without public scrutiny. However, trusts that involve real estate must still comply with local property record requirements, which can give you insights into the Grand Rapids Michigan Living Trust Property Record.

Trusts in Michigan do not have a specific filing requirement like wills, meaning they are generally not filed with a state or county office. However, any property held in trust must be recorded in the local property records, which can be reviewed to understand the Grand Rapids Michigan Living Trust Property Record. For precise procedures, reviewing local laws or consulting with a legal professional can be helpful.

To obtain a copy of a trust in Michigan, you typically need to contact the trustee or the attorney who created the trust. Trust documents are private and not filed with the state unless they include real property. If you're interested in how Grand Rapids Michigan Living Trust Property Record applies, it’s best to check directly with involved parties for access to such documents.

A trust in Michigan functions as a legal arrangement where one party holds property for the benefit of another. The person who creates the trust, known as the grantor, appoints a trustee to manage the assets. Trusts can facilitate smoother asset distribution, help avoid probate, and provide privacy for estate matters. For details specific to Grand Rapids Michigan Living Trust Property Record, consult local resources to fully understand the benefits.

A living trust in Michigan does not need to be recorded; however, the assets within it may require titling in the trust's name. While recording is not necessary, having a comprehensive Grand Rapids Michigan Living Trust Property Record aids in asset management and ensures seamless transitions.

In Michigan, trusts generally do not need to be filed with the court unless they are subject to court supervision. Living trusts typically operate outside of the court system. However, maintaining your Grand Rapids Michigan Living Trust Property Record is essential for clarity and organization.

To file a trust in Michigan, you first need to prepare the trust document and then register for an Employer Identification Number (EIN). After that, follow the state’s filing procedures for trusts. You can simplify this process by using uslegalforms, especially when managing your Grand Rapids Michigan Living Trust Property Record.