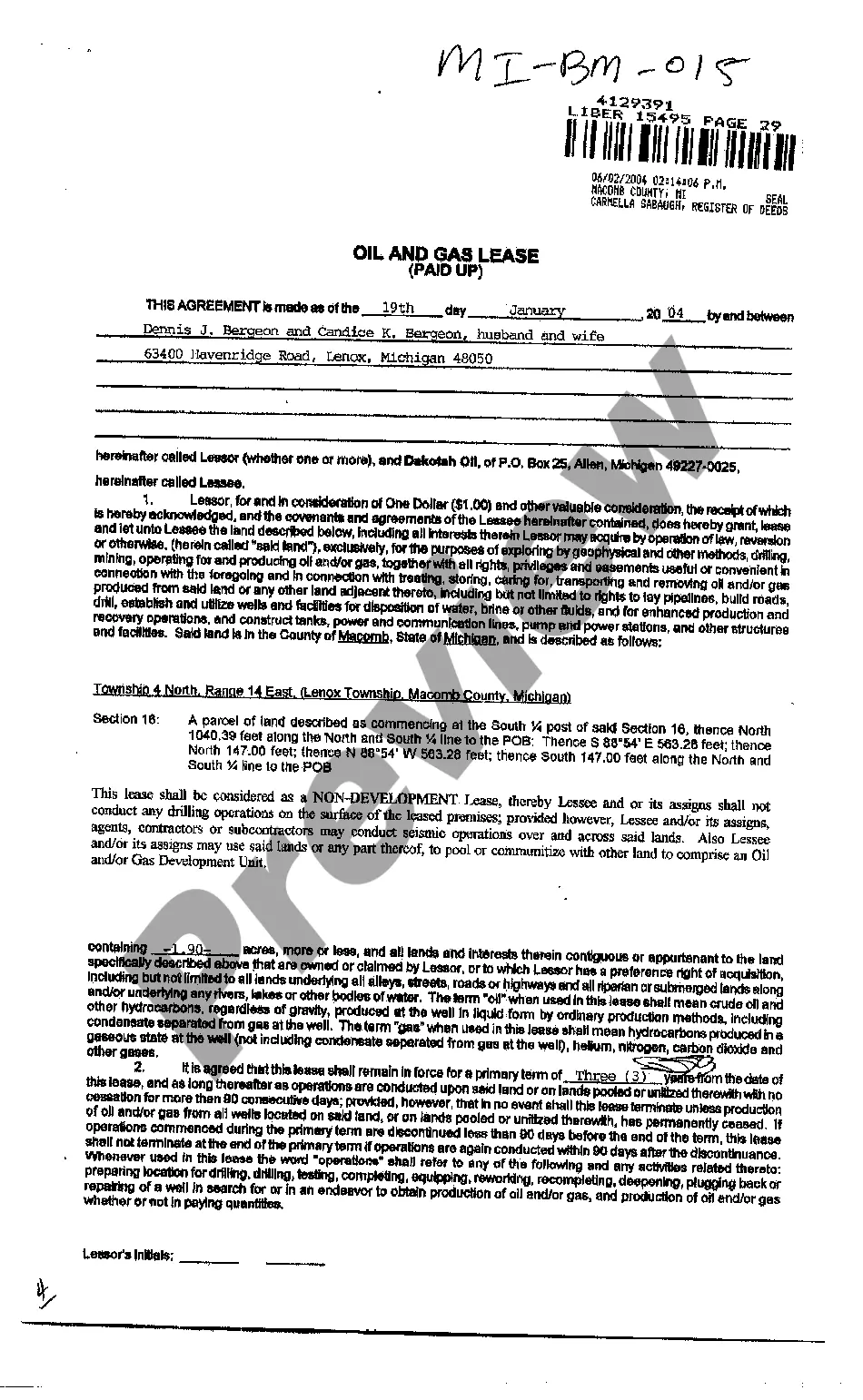

Lansing Michigan Oil And Gas Lease

Description

How to fill out Michigan Oil And Gas Lease?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our user-friendly website with a vast selection of documents enables you to locate and acquire nearly any document example you require.

You can download, complete, and authenticate the Lansing Michigan Oil And Gas Lease in just minutes rather than spending hours online searching for a suitable template.

Utilizing our directory is an excellent method to enhance the security of your form submissions.

The Download feature will be activated for all the documents you view. Additionally, you can locate all your previously saved files in the My documents section.

If you don't have an account yet, follow the steps outlined below.

- Our qualified attorneys routinely review all documents to ensure the forms are suitable for a specific area and adhere to current laws and regulations.

- How can you access the Lansing Michigan Oil And Gas Lease.

- If you have an account, simply Log In to your account.

Form popularity

FAQ

Reporting oil and gas lease income in Lansing, Michigan, involves including the income on your tax return as miscellaneous income. It's crucial to keep detailed records of all payments received, including bonuses and royalties. Additionally, consider consulting a tax professional knowledgeable in oil and gas income reporting to ensure compliance with local regulations and maximize your financial benefits.

To obtain an oil and gas lease in Lansing, Michigan, you start by identifying companies interested in leasing your property. Next, you negotiate lease terms, ensuring fair compensation and obligations are outlined. Utilizing platforms like US Legal Forms can simplify the legal documentation process, making it easier to secure an effective lease agreement.

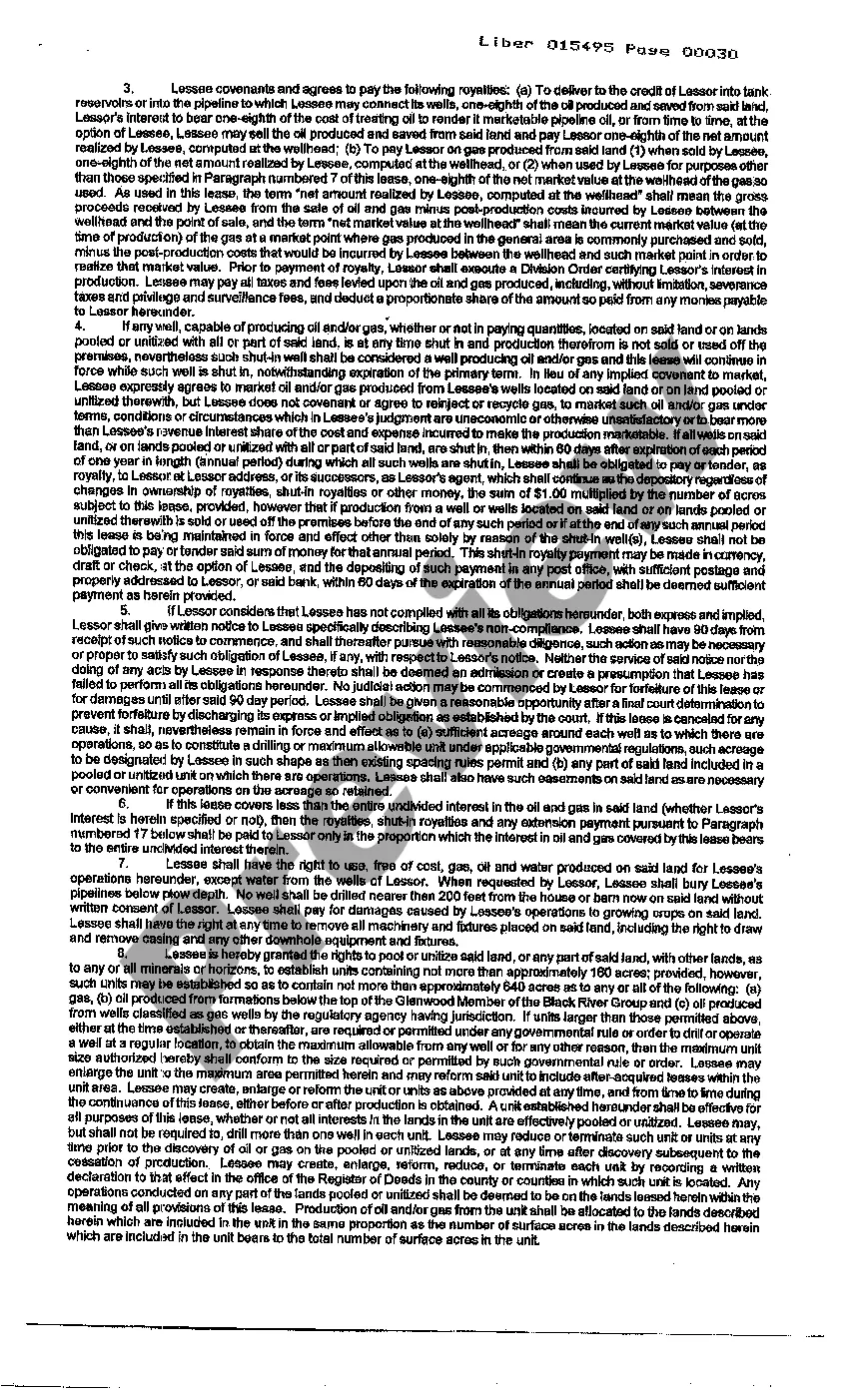

A typical oil and gas lease in Lansing, Michigan, usually lasts for three to five years, but this can vary based on specific agreements. If production begins, the lease may continue for as long as resources are being extracted. Therefore, understanding the potential duration helps landowners manage their expectations. It’s important to consult legal advice to clarify these terms in your Lansing Michigan oil and gas lease.

Yes, you can negotiate the terms of your oil and gas lease. Many landowners in Lansing, Michigan, successfully modify the initial offer to better fit their needs. Key aspects to negotiate include bonuses, royalty rates, and the duration of the lease. Engaging with legal experts, such as those at US Legal Forms, can provide valuable guidance during this process.

An oil and gas lease allows a company to explore and extract resources from your property in Lansing, Michigan. When you sign a lease, you grant rights to the lessee, typically an oil and gas company, in exchange for bonuses and royalties. This agreement outlines the terms of extraction, duration, and compensation. Understanding these terms helps you make informed decisions regarding your Lansing Michigan oil and gas lease.

The maximum term for a Lansing Michigan oil and gas lease typically ranges from three to five years. However, lease terms can extend beyond this initial period if drilling or production occurs. It's essential to review the specific conditions of any lease you consider, as they may include options for extensions or renewals. Consulting with legal experts can help you navigate these details effectively.

Average royalty payments for oil and gas leases in Lansing, Michigan typically range from 12.5% to 25% of the gross revenue generated from the sale of oil or gas. The exact percentage can vary depending on negotiations and industry standards. If you want to understand more about how these payments work, consider exploring resources available on the US Legal Forms platform, which can provide you with helpful information regarding your Lansing Michigan Oil And Gas Lease.

The going rate for oil and gas leases in Lansing, Michigan fluctuates with market demand and local geological conditions. Factors such as the oil market, competition among bidders, and the specific attributes of the land can greatly affect lease rates. By utilizing US Legal Forms, you can access valuable insights and documents that can guide you in obtaining the best rates for your Lansing Michigan Oil And Gas Lease.

If you have income from an oil and gas lease in Lansing, Michigan, you will report it on your federal tax return, typically on Schedule E. It's important to keep accurate records of your income and any expenses related to your lease. In addition, consulting the resources on US Legal Forms can help clarify your responsibilities and ensure you meet all legal requirements regarding your Lansing Michigan Oil And Gas Lease.

The rate of an oil and gas lease in Lansing, Michigan can vary significantly based on various factors including location, land quality, and current market conditions. Generally, property owners can expect to see leasing rates that fall within the range of several hundred to several thousand dollars per acre. To better navigate the leasing process, consider using the US Legal Forms platform, which provides resources tailored to the Lansing Michigan Oil And Gas Lease market.