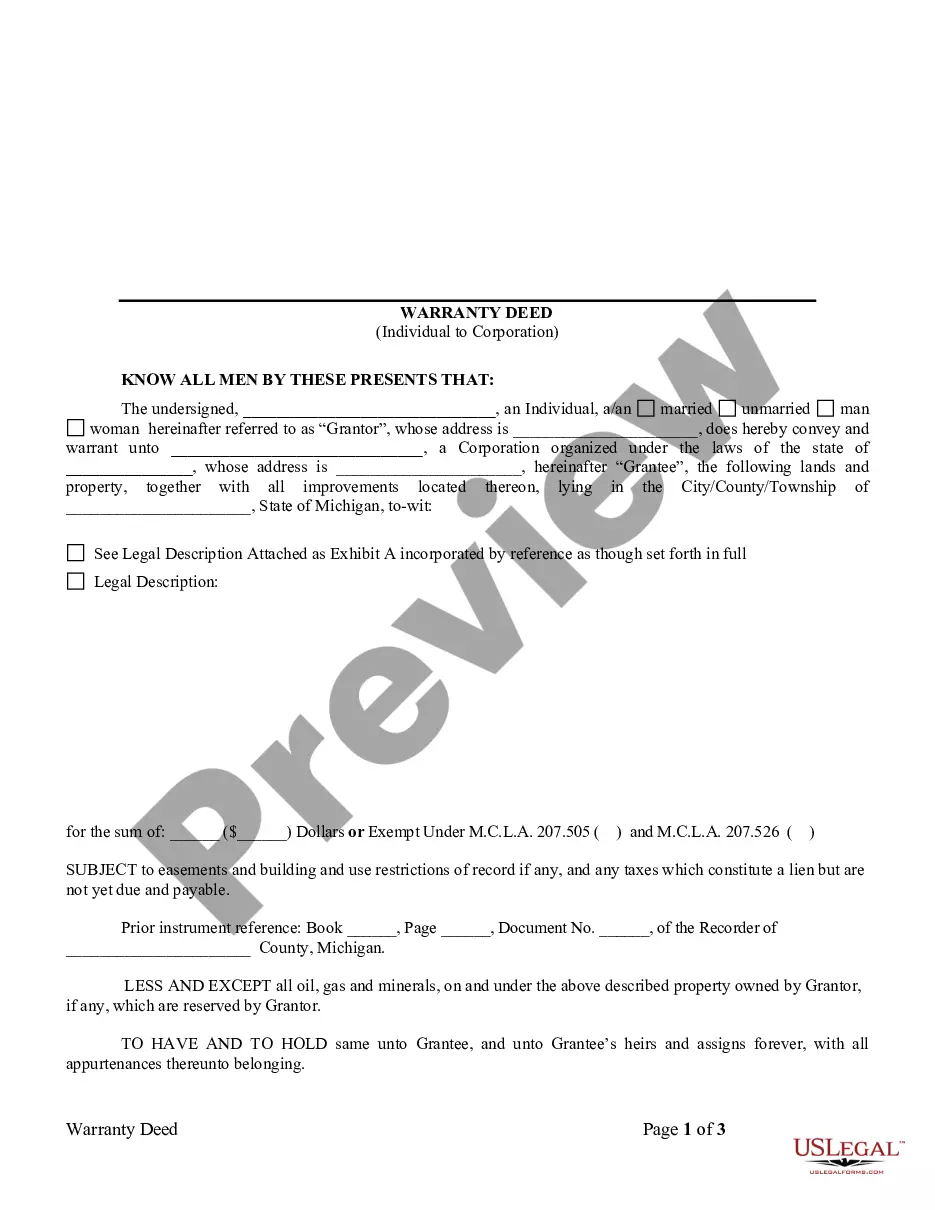

This Warranty Deed from Individual to Corporation form is a Warranty Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Lansing Michigan Warranty Deed from Individual to Corporation

Description

How to fill out Michigan Warranty Deed From Individual To Corporation?

If you are searching for a legitimate form, it's tough to locate a superior platform compared to the US Legal Forms website – likely the most comprehensive libraries available online.

Here you can obtain a vast number of templates for business and personal uses categorized by types and regions, or keywords.

With the excellent search functionality, locating the latest Lansing Michigan Warranty Deed from Individual to Corporation is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the file format and save it to your computer. Edit your document. Fill in, modify, print, and sign the obtained Lansing Michigan Warranty Deed from Individual to Corporation.

- Moreover, the accuracy of each document is confirmed by a team of expert lawyers who consistently evaluate the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to acquire the Lansing Michigan Warranty Deed from Individual to Corporation is to Log In to your user profile and click the Download button.

- If this is your first time using US Legal Forms, just adhere to the instructions outlined below.

- Ensure you have located the template you need. Review its description and utilize the Preview feature (if offered) to examine its content. If it doesn’t satisfy your requirements, employ the Search box at the top of the page to find the suitable document.

- Confirm your choice. Click the Buy now button. After that, choose the desired subscription plan and provide details to create an account.

Form popularity

FAQ

Yes, a warranty deed does prove ownership in Michigan. This type of deed provides a guarantee that the individual selling the property legally owns it and has the right to transfer it. Furthermore, it protects the new owner against claims to the property from any previous owners. If you are involved in a transfer, be sure to understand the implications of the Lansing Michigan Warranty Deed from Individual to Corporation, as it solidifies your ownership rights and offers peace of mind.

To transfer a warranty deed in Michigan, you must complete a few key steps. First, prepare the warranty deed using the appropriate form, ensuring it contains accurate information about the property and the parties involved. Next, have the deed signed by the individual transferring the property, then have it notarized. Finally, record the executed deed with the local county register of deeds to finalize the transfer, making it legally binding. For detailed guidance, consider using the US Legal Forms platform, which offers resources specific to the Lansing Michigan Warranty Deed from Individual to Corporation.

The best way to transfer property title between family members often involves utilizing a warranty deed, such as the Lansing Michigan Warranty Deed from Individual to Corporation. This type of deed provides a secure way to transfer ownership while protecting the interests of all parties involved. It's crucial to discuss the transfer with a real estate attorney or use a reliable service like uslegalforms to ensure proper documentation and compliance with state requirements. This approach helps avoid conflicts and reinforces the legal standing of the transfer.

Yes, filing a property transfer affidavit is mandatory in Michigan when transferring property, including a Lansing Michigan Warranty Deed from Individual to Corporation. This requirement helps local governments track property ownership and assess property taxes correctly. If you're unsure about the filing process, consider using platforms like uslegalforms to access the necessary forms and guidance. Ensuring compliance with this requirement can save you from potential legal issues in the future.

In Michigan, the property transfer affidavit must be filed by the individual or entity that is transferring the property. If you're involved in a Lansing Michigan Warranty Deed from Individual to Corporation, the corporation receiving the property typically handles this paperwork. It is essential to ensure this affidavit is submitted to the local tax assessor's office. This filing helps maintain accurate tax records and informs the local government of the change in property ownership.

To effectively avoid uncapping taxes in Michigan, you should explore options related to property ownership structures. Transferring ownership using a Lansing Michigan Warranty Deed from Individual to Corporation can have implications for tax assessment. To navigate these complexities, consider seeking advice from a tax consultant who specializes in property transfers.

To avoid uncapping of property taxes in Michigan, it's essential to understand when property transfers could trigger this event. Generally, transferring property through a Lansing Michigan Warranty Deed from Individual to Corporation may lead to uncapping if certain criteria are met. Working closely with a tax professional and observing local policies can mitigate the risk of uncapping.

In Michigan, property taxes can be capped under Proposal A, which limits annual taxable value increases to the rate of inflation or 5%, whichever is lower. This policy affects how property taxes are calculated, particularly after a property transfer like a Lansing Michigan Warranty Deed from Individual to Corporation. Understanding these caps can help you anticipate future tax liabilities.

The statute governing the transfer of ownership in Michigan primarily outlines the requirements for filing property transfers, including necessary documentation and timeframes. When executing a Lansing Michigan Warranty Deed from Individual to Corporation, understanding these statutes is essential for compliance. Familiarizing yourself with local regulations can streamline the process and avoid complications.

To become tax exempt in Michigan, you must meet specific criteria and apply for tax-exempt status with the appropriate authority. This often requires proving that your organization serves a charitable purpose. If you're using a Lansing Michigan Warranty Deed from Individual to Corporation to transfer property, securing tax exemption may further benefit your corporation's financial standing.