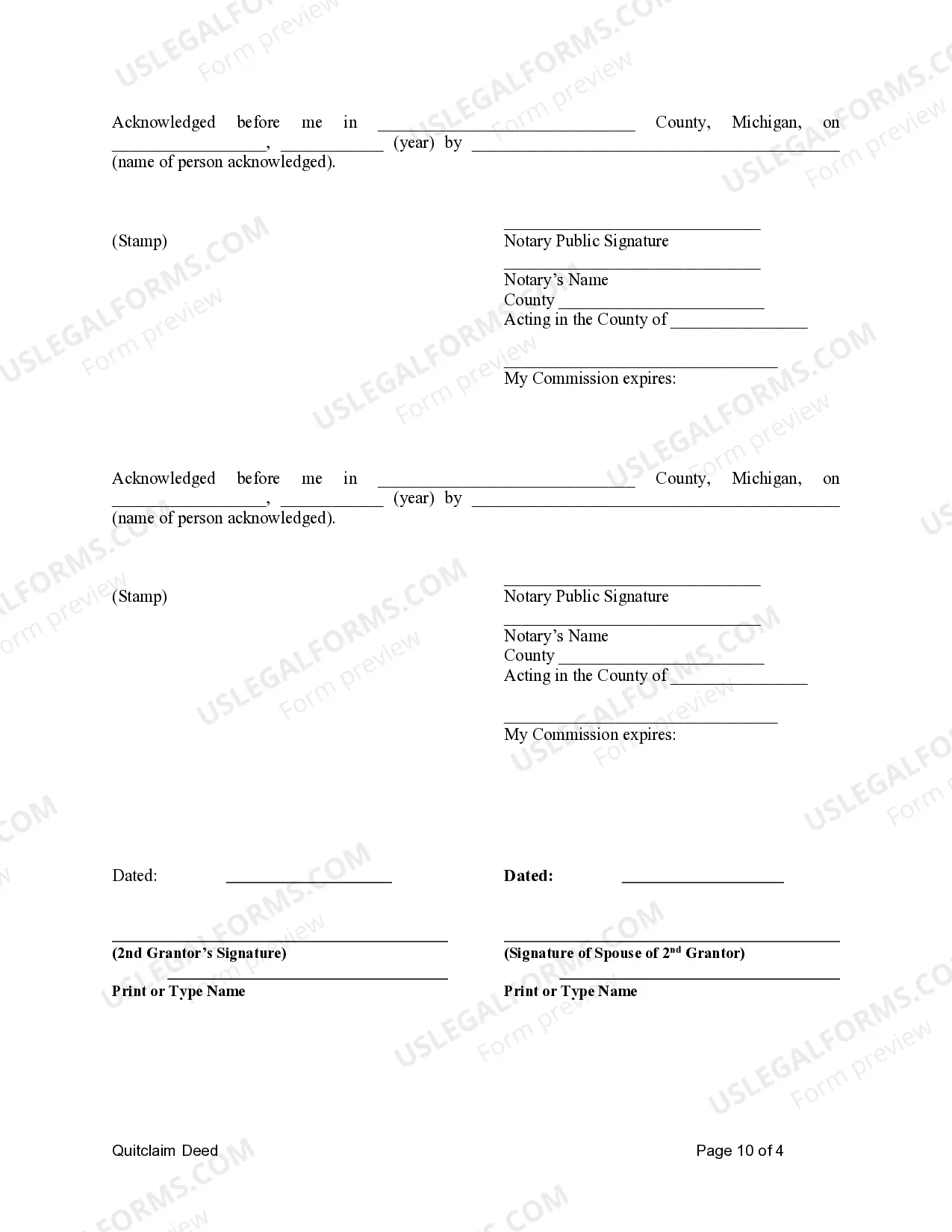

This form is a Quitclaim Deed where the Grantors are three (3) individuals and the Grantees are four (4) individuals. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Detroit Michigan Quitclaim Deed from Three (3) Individuals to Four (4) Individuals

Description

How to fill out Michigan Quitclaim Deed From Three (3) Individuals To Four (4) Individuals?

If you’ve previously used our service, Log In to your account and download the Detroit Michigan Quitclaim Deed from Three (3) Persons to Four (4) Persons onto your device by selecting the Download button. Ensure your subscription is active. If it’s not, renew it based on your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have perpetual access to every document you have acquired: it can be found in your profile within the My documents section whenever you wish to use it again. Leverage the US Legal Forms service to quickly find and save any template for your personal or business needs!

- Ensure you’ve located an appropriate document. Review the description and utilize the Preview feature, if available, to determine if it satisfies your needs. If it’s not suitable, use the Search tab above to find the correct one.

- Purchase the template. Select the Buy Now button and choose a monthly or yearly subscription plan.

- Set up an account and complete the payment. Enter your credit card information or opt for PayPal to finalize the purchase.

- Obtain your Detroit Michigan Quitclaim Deed from Three (3) Persons to Four (4) Persons. Choose the file format for your document and download it to your device.

- Finish your document. Print it out or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

?Adding someone to a deed? means transferring ownership to that person. The transfer of ownership can occur during life (with a regular quitclaim deed, for example) or at death (using a lady bird deed, transfer-on-death-deed, or life estate deed).

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

As a homeowner, you have the ability to execute a quitclaim deed to change ownership, and you don't need to refinance the mortgage loan to file a quitclaim deed. Filing a quitclaim deed will change only the property's ownership and title, not anything regarding the loan.

Statute of Limitations on a Quitclaim Deed in Michigan For example, challenging a quitclaim deed given by a close family member or a court-ordered sale has a five-year statute of limitations.

You cannot simply add someone to the deed in most cases, and it will require a change in the form of the deed on the property. You will have to file a quitclaim deed and then file a new deed with joint ownership.

If you are the person keeping the property, take the deed to the Register of Deeds and record it after your ex-spouse has signed it and delivered it to you. There will be a $30 recording fee.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Yes you can. This is called a transfer of equity but you will need the permission of your lender.

Current Transfer Tax rate is $8.60 per $1,000, rounded up to the nearest $500. $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.

If you are the person transferring your property to your ex-spouse, you must sign the quitclaim deed in front of a notary. Then give the deed to your ex-spouse. Your ex-spouse will need to sign the deed and take it to be recorded at the Register of Deeds.