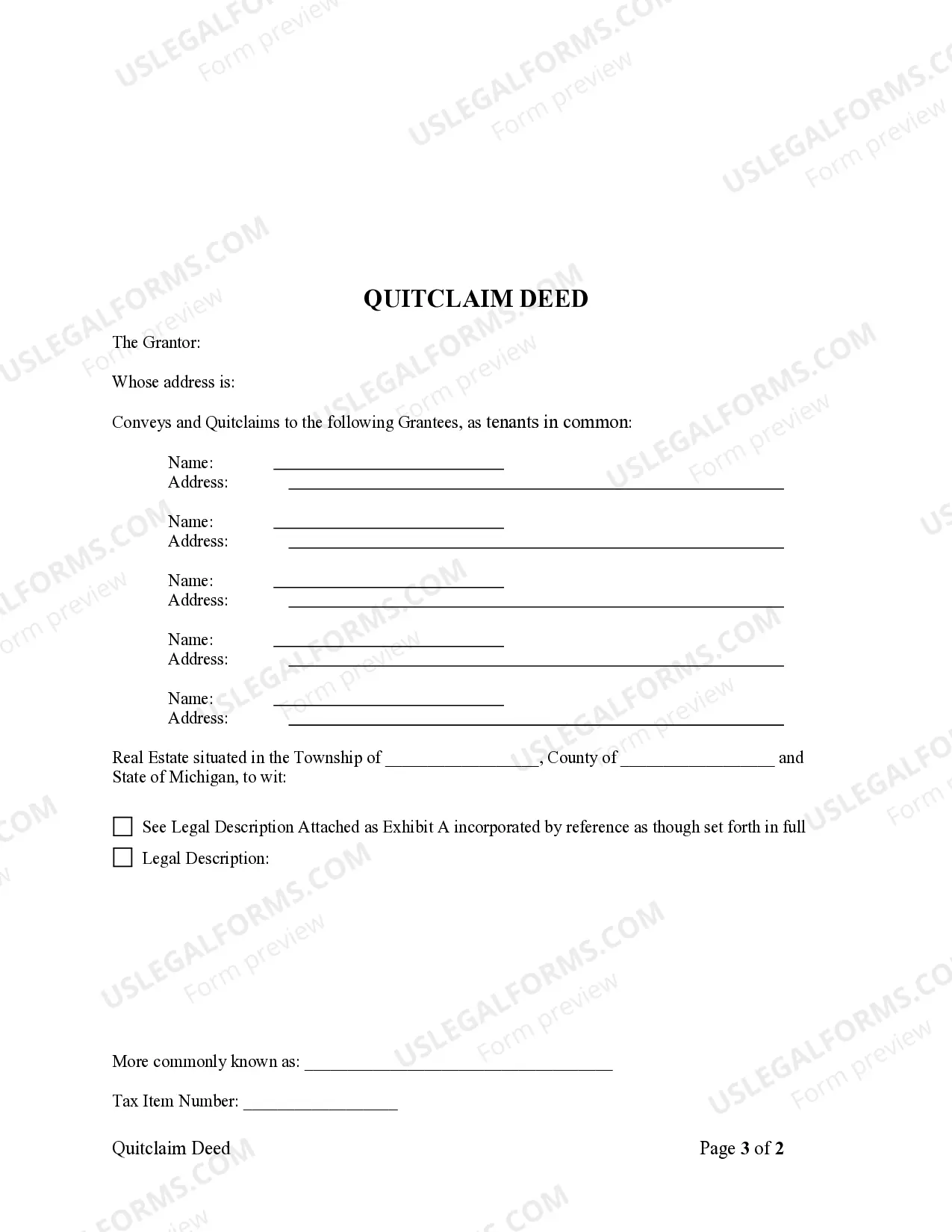

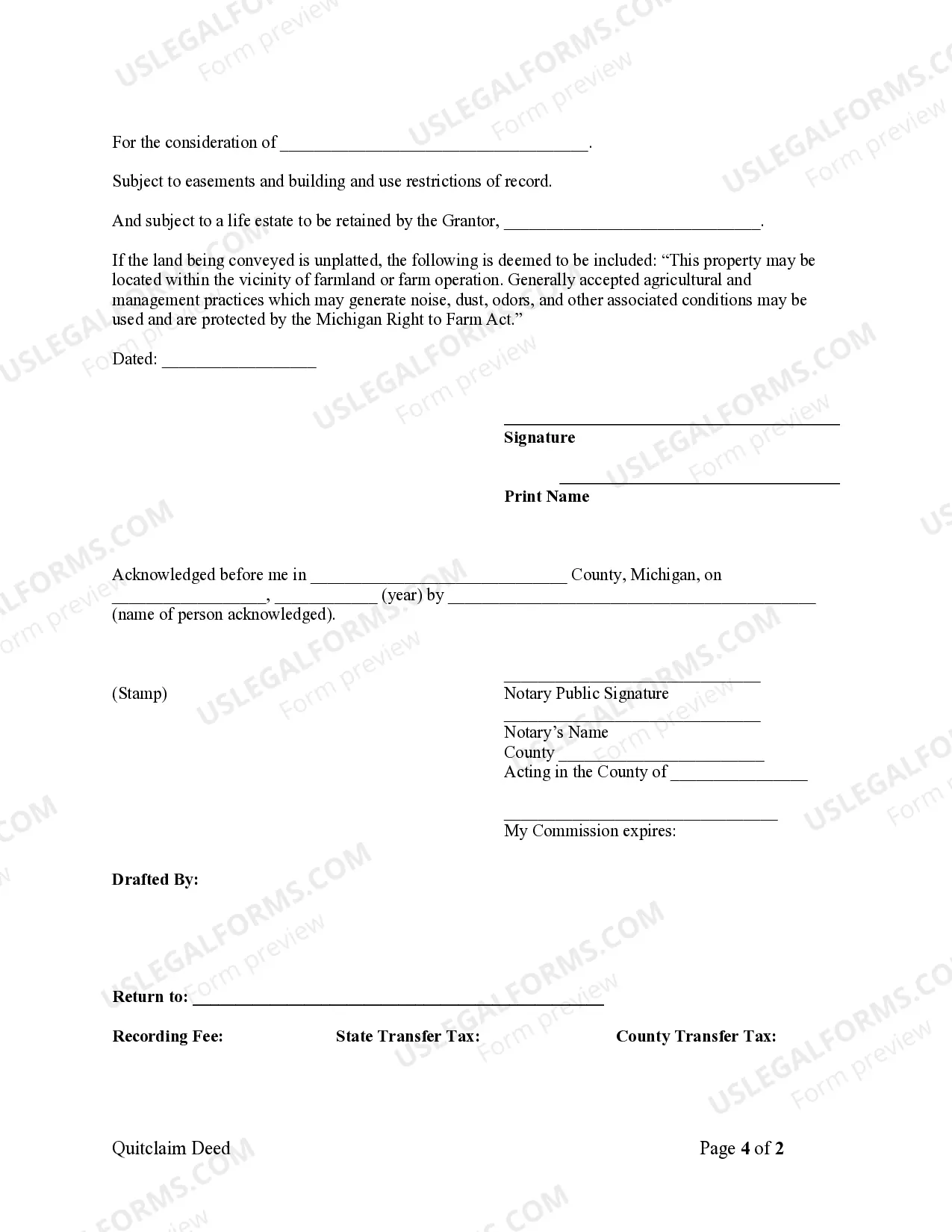

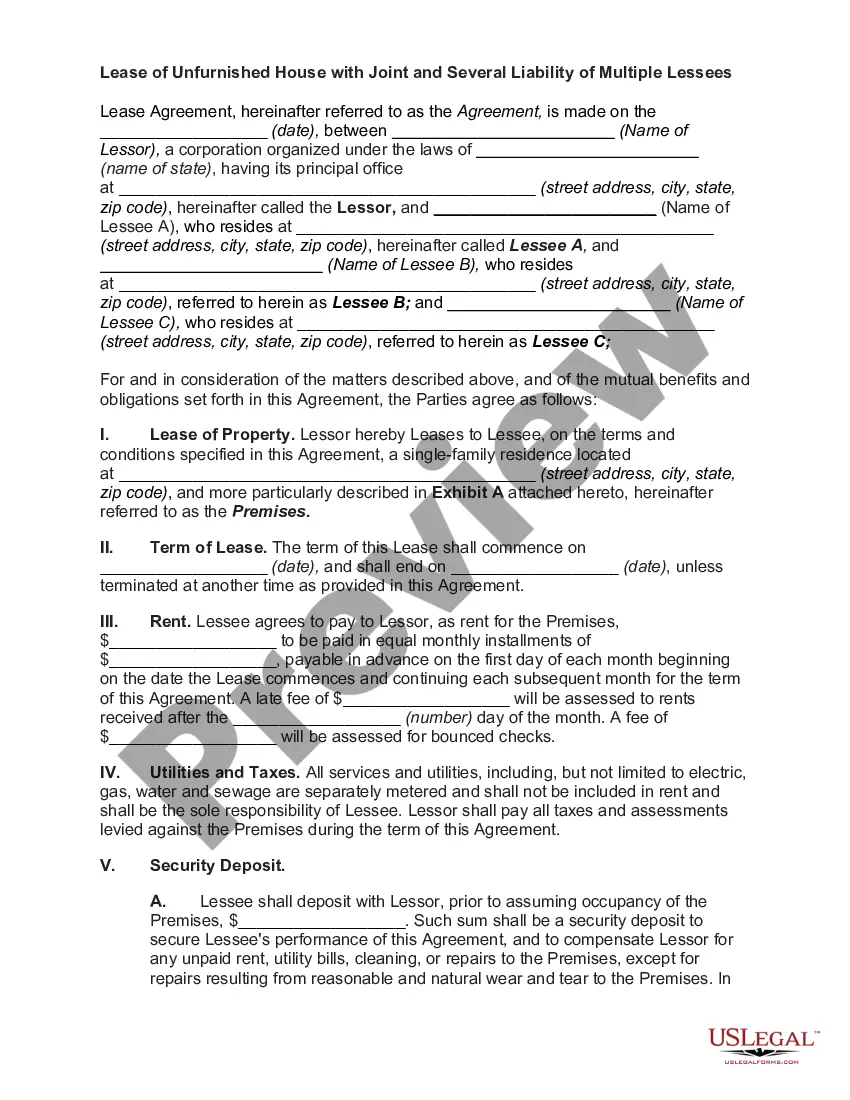

This form is a Warranty Deed where the grantor is an individual and the five grantees are individuals. Grantor conveys and quitclaims the described property tothe grantees as tenants in common or as joint tenants with the right of survivorship. This transfer is subject to a retained life estate in Grantor. This deed complies with all state statutory laws.

Detroit Michigan Quitclaim Deed - One Individual to Five Individuals Subject to Retained Life Estate

Description

How to fill out Michigan Quitclaim Deed - One Individual To Five Individuals Subject To Retained Life Estate?

Do you require a reliable and affordable supplier of legal forms to obtain the Detroit Michigan Quitclaim Deed - One Individual to Five Individuals Subject to Retained Life Estate? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of documents to facilitate your separation or divorce in court, we've got you covered. Our website offers over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and are tailored to meet the requirements of specific states and regions.

To access the document, you must Log In to your account, locate the required form, and click the Download button next to it. Please note that you can retrieve your previously purchased form templates at any time from the My documents tab.

Are you a newcomer to our website? No need to worry. You can create an account with great ease, but before doing so, ensure that you.

Now you can set up your account. Then choose your subscription option and continue to payment. Once the payment is completed, download the Detroit Michigan Quitclaim Deed - One Individual to Five Individuals Subject to Retained Life Estate in any offered file format. You can revisit the website anytime and redownload the document at no additional cost.

Locating current legal forms has never been simpler. Try US Legal Forms today, and stop wasting hours on understanding legal documentation online.

- Verify if the Detroit Michigan Quitclaim Deed - One Individual to Five Individuals Subject to Retained Life Estate aligns with your state and local regulations.

- Review the form's specifics (if available) to understand who and what the document is intended for.

- Restart your search if the form does not meet your unique situation.

Form popularity

FAQ

To remove a deceased party from a Michigan real estate deed, submit a certified copy of the death certificate along with the new instrument of conveyance stating ?survivor of? in the grantor section, or show by liber and page or instrument number reference that the death certificate has been recorded in the Register of

Here are 5 ways to avoid probate in Michigan: Make sure your assets have named beneficiaries.Create a Trust (revocable trust or irrevocable trust).Create a Lady Bird Deed for your real estate. Add joint ownership to your assets.Gift assets away (speak to an accountant or lawyer first).

In Michigan, a Lady Bird Deed (also known as a Ladybird Deed or Enhanced Life Estate Deed) is a type of Quitclaim Deed that allows you, the creator, to transfer your property upon your death to a named beneficiary without having to go through the expensive and time consuming Probate process.

Disadvantages of a Lady Bird Deed If you plan to apply for a mortgage on the property, some title insurance companies may be reluctant to provide title insurance on property subject to a Lady Bird deed. You want to leave the property to more than one grantee. There is a fairly large mortgage balance on the property.

Michigan Probate Laws require a decedent's assets go through Probate if the assets were held solely in their name. Assets usually don't need to go through Probate if the assets that are jointly owned, the assets have a beneficiary designation, or the assets are held in a Living Trust.

Property that is jointly owned with a survivorship right will avoid probate. If one owner dies, title passes automatically to the remaining owner. There are three types of joint ownership with survivorship rights: Joint tenancy with rights of survivorship.

Statute of Limitations on a Quitclaim Deed in Michigan For example, challenging a quitclaim deed given by a close family member or a court-ordered sale has a five-year statute of limitations.

A Lady Bird deed is a special kind of deed that is commonly recognized by Texas law. Also called an enhanced life estate deed, it can be used to transfer property to beneficiaries outside of probate. It gives the current owner continued control over the property until his or her death.

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death, when it passes to the other owner. Life estates can be used to avoid probate and to give a house to children without giving up the ability to live in it.

Disadvantages of a Lady Bird Deed If you plan to apply for a mortgage on the property, some title insurance companies may be reluctant to provide title insurance on property subject to a Lady Bird deed. You want to leave the property to more than one grantee. There is a fairly large mortgage balance on the property.