Montgomery Maryland Dissolution Package to Dissolve Corporation

Description

How to fill out Maryland Dissolution Package To Dissolve Corporation?

If you are looking for a suitable form template, it’s very challenging to select a more efficient service than the US Legal Forms website – likely the most extensive online collections.

With this collection, you can discover a vast array of document samples for business and personal use by categories and regions, or keywords.

Utilizing our sophisticated search feature, obtaining the latest Montgomery Maryland Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and download it to your device. Edit your form. Complete, modify, print, and sign the acquired Montgomery Maryland Dissolution Package to Dissolve Corporation.

- Furthermore, the relevance of every document is validated by a team of experienced attorneys who routinely review the templates on our site and refresh them in line with the latest state and county regulations.

- If you are already acquainted with our system and possess an account, all you need to do to acquire the Montgomery Maryland Dissolution Package to Dissolve Corporation is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the guidelines outlined below.

- Ensure that you have accessed the form you require. Review its description and utilize the Preview function to examine its content. If it doesn’t fulfill your requirements, use the Search option at the top of the page to find the suitable document.

- Verify your selection. Click the Buy now button. Subsequently, choose the preferred pricing plan and provide the necessary details to create an account.

Form popularity

FAQ

If you are planning to permanently close your corporation, you must file articles of dissolution. This step is required to ensure that your business is officially recognized as dissolved by state authorities. Utilizing the Montgomery Maryland Dissolution Package to Dissolve Corporation can simplify this process and provide you with all the necessary forms and information to help you fulfill your obligations.

Yes, articles of dissolution are indeed filed with the Secretary of State when dissolving a corporation. This official filing is a crucial step in the process and is included in the Montgomery Maryland Dissolution Package to Dissolve Corporation. By submitting these articles, you are formally notifying the state of your intention to dissolve the business, setting in motion the legal procedures necessary to finalize the closure.

Filing articles of dissolution in Maryland requires a few clear steps. You will first need to gather the proper documentation, which is available in the Montgomery Maryland Dissolution Package to Dissolve Corporation. After completing the necessary forms, you can submit them online or by mail to the Maryland Secretary of State. Make sure to follow any specific guidelines provided by the state to ensure a smooth process.

Articles of dissolution and articles of termination serve distinct purposes in the process of ending a corporation. Articles of dissolution are specifically used to officially dissolve a corporation, while articles of termination typically refer to terminating a business entity's existence without the formal dissolution process. Understanding this difference is crucial when using a Montgomery Maryland Dissolution Package to Dissolve Corporation, as it can save time and clarify your intentions.

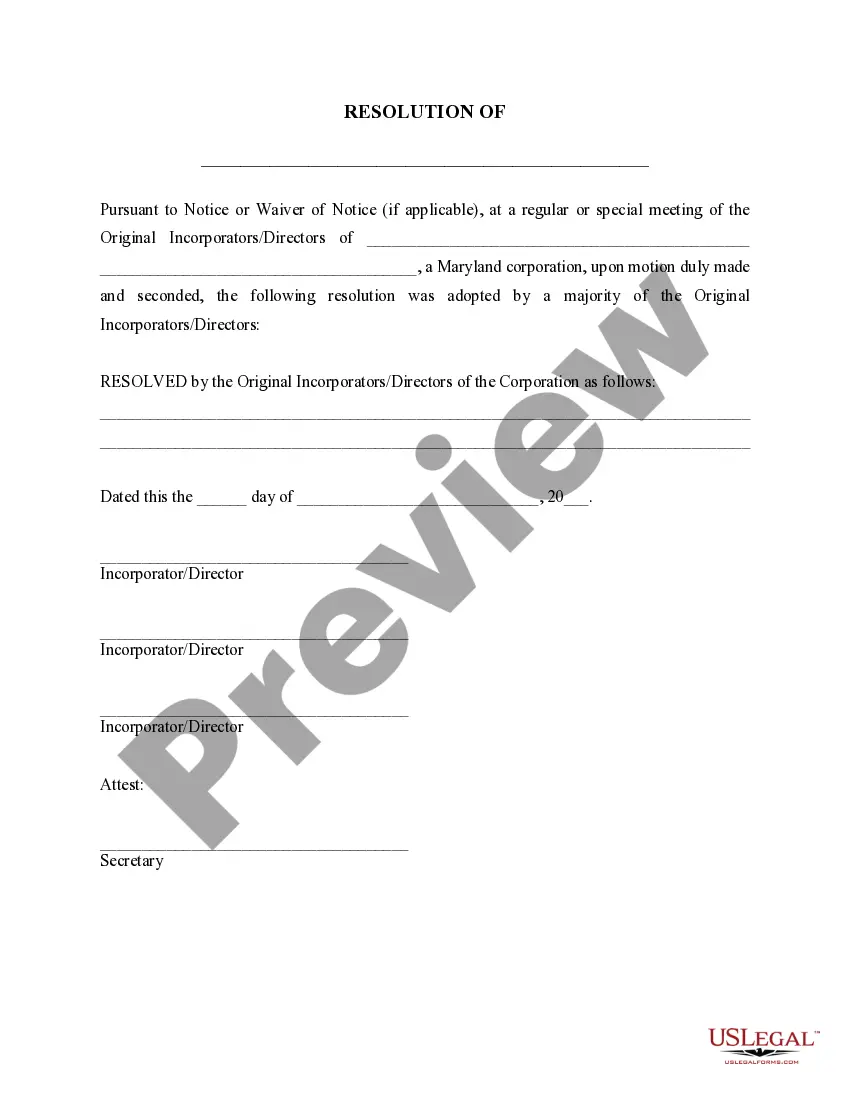

The process of dissolving a company involves several important steps. First, you need to obtain a Montgomery Maryland Dissolution Package to Dissolve Corporation, which will guide you through the necessary paperwork. Next, you must hold a meeting with your board of directors to approve the dissolution, then file the required articles of dissolution with the state. Finally, ensure that all debts and obligations are settled before formally closing the business.

A corporation completes its dissolution by following several key steps that include notifying stakeholders, settling debts, and filing the necessary dissolution documents with the state. After submitting the Certificate of Dissolution, the corporation must also deal with any licenses and permits. The Montgomery Maryland Dissolution Package to Dissolve Corporation offers a comprehensive approach, giving you all the tools needed to finalize your corporation's dissolution efficiently.

Failing to dissolve a corporation can lead to ongoing tax obligations and potential legal issues. The corporation remains liable for debts and could face penalties for noncompliance. To avoid these complications, consider utilizing the Montgomery Maryland Dissolution Package to Dissolve Corporation, which guides you through the process to ensure your corporation is properly and completely dissolved.

When you dissolve a corporation, the company must settle any outstanding debts before completing the process. Creditors can claim payment from the corporation's assets. However, within the framework of the Montgomery Maryland Dissolution Package to Dissolve Corporation, you'll find resources to help manage debts and obligations efficiently, protecting your interests throughout the dissolution.

To dissolve a corporation in Maryland, start by filing a Certificate of Dissolution with the Maryland State Department of Assessments and Taxation. This document formally ends the corporation's existence. Additionally, using the Montgomery Maryland Dissolution Package to Dissolve Corporation simplifies this process by providing all necessary forms and guidance, ensuring a smooth dissolution experience.

The primary federal form used for dissolving corporations is Form 966, which notifies the IRS about the dissolution. Utilizing the Montgomery Maryland Dissolution Package to Dissolve Corporation provides a streamlined solution for managing this requirement. Additionally, ensure you submit a final tax return to address any pending financial obligations. These steps help protect you from future tax issues.