Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

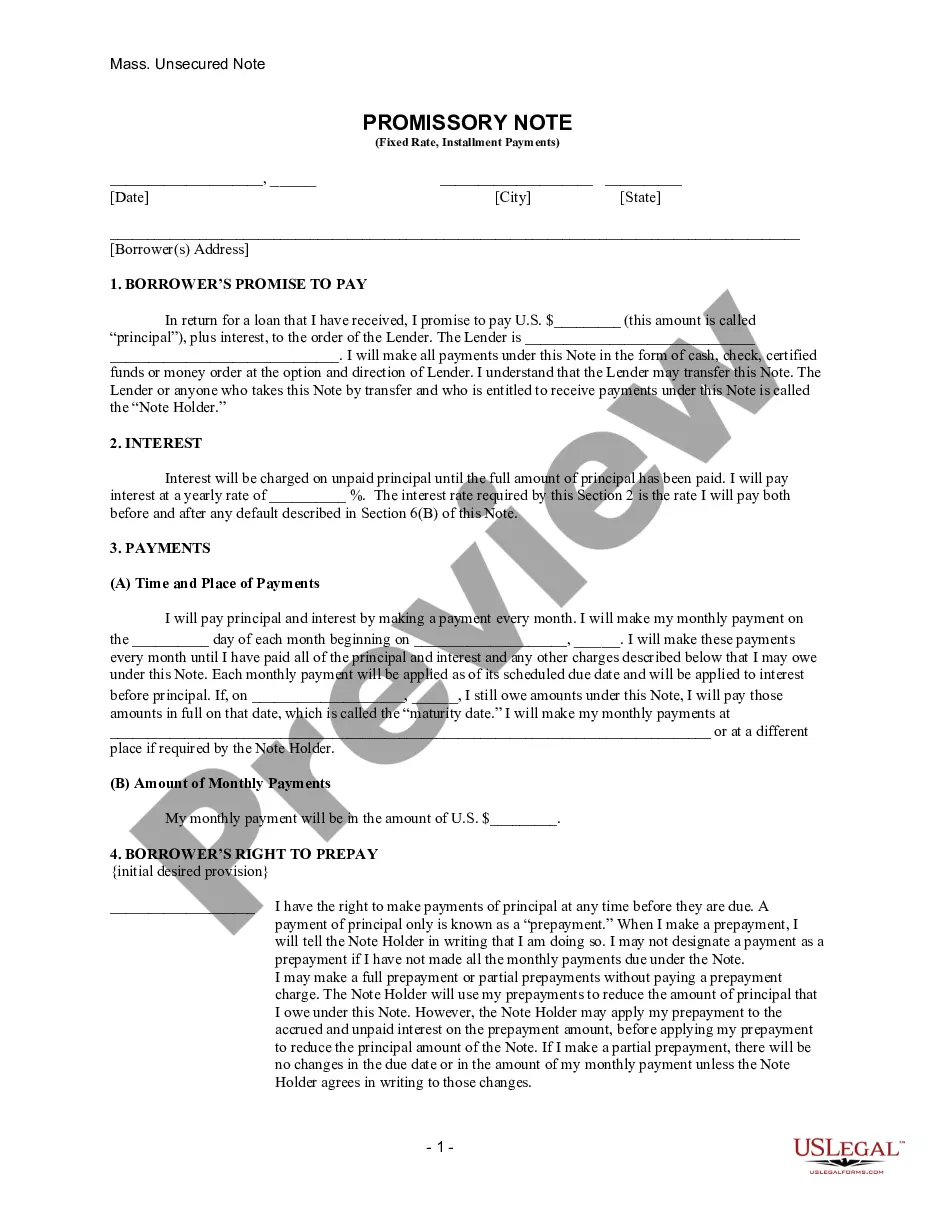

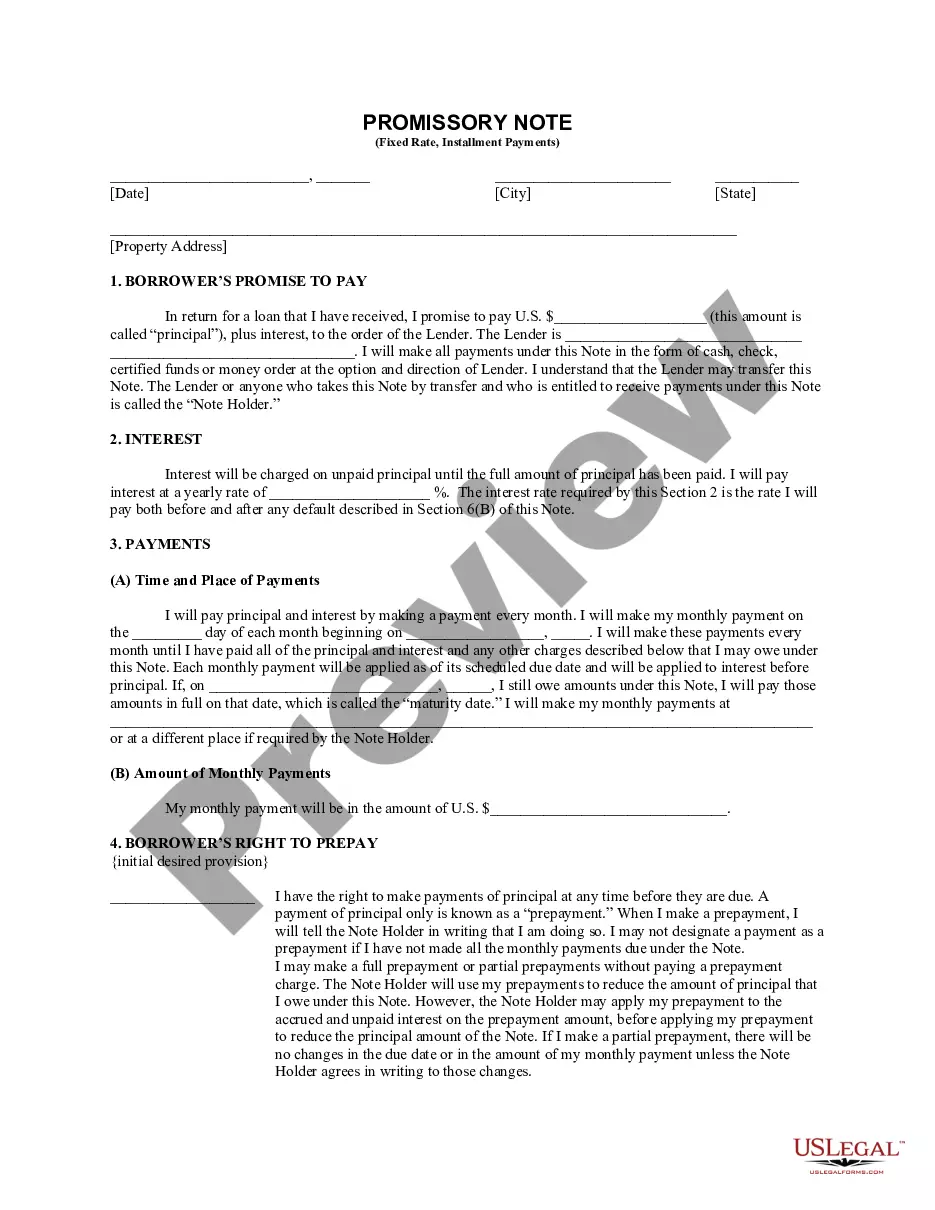

How to fill out Massachusetts Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

If you have previously utilized our service, Log In to your account and retrieve the Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate onto your device by clicking the Download button. Verify that your subscription is active. If it has expired, renew it based on your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your document.

You have indefinite access to every document you have acquired: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to quickly find and download any template for your personal or professional requirements!

- Confirm you’ve found a suitable document. Browse the description and utilize the Preview option, if available, to verify if it fulfills your necessities. If it does not meet your expectation, use the Search tab above to locate the right one.

- Purchase the template. Click the Buy Now button and choose either a monthly or annual subscription option.

- Create an account and proceed with payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Select the file format for your document and store it on your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Typically, the lender holds the promissory note while you are repaying it. This arrangement ensures that the lender has the legal right to claim the debt if needed. In the case of a Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, securing this document with the proper parties is crucial for protecting both lender and borrower interests.

To fill up a promissory note, begin by entering the date, names of the parties involved, and the principal amount. Then, detail the repayment terms, including the interest rate and schedule, and if applicable, the collateral involved in a Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Ensuring that you fill in each section accurately is crucial for creating a valid agreement.

Yes, a promissory note can be secured by real property, which provides added security for the lender. This means that if the borrower defaults, the lender has the right to claim the property. In the case of a Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the property serves as collateral, enhancing the transaction's stability for both parties.

Yes, a promissory note can indeed be secured. When you secure a promissory note, you back it with collateral, like real estate or personal property, which gives the lender recourse in case of default. Specifically, a Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate provides additional security for the lender, making it a safer investment.

To write a secured promissory note, you should begin with the basic terms, including the amount, interest rate, and repayment schedule. Then, specify the collateral securing the note, such as commercial real estate. The Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate details must be clear and legally binding, ensuring both parties understand their rights and obligations.

The interest rate on a promissory note varies based on factors such as the borrower's creditworthiness and the prevailing economic environment. For a Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, lenders typically assess different criteria to set an appropriate rate. It's important to compare rates to ensure you receive a competitive deal.

A reasonable interest rate for a promissory note typically depends on current market conditions and the specific terms of the note. For a Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, interest rates often reflect the risk associated with the investment. It’s advisable to consult recent market trends and possibly a financial advisor to determine a fair rate.

You can obtain a promissory note through various sources, such as legal service platforms like US Legal Forms. This platform offers templates specifically for a Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. By using these templates, you can customize the document to fit your needs, ensuring clarity and compliance with local laws.