Cambridge Massachusetts Assignment to Living Trust

Description

How to fill out Massachusetts Assignment To Living Trust?

If you are looking for a legitimate form template, it’s challenging to find a more suitable service than the US Legal Forms website – likely one of the most extensive repositories on the web.

Here you can locate numerous templates for business and personal uses sorted by types and states, or keywords.

With our sophisticated search option, finding the latest Cambridge Massachusetts Assignment to Living Trust is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Specify the file format and download it to your device.

- Moreover, the pertinence of each document is confirmed by a group of skilled attorneys who routinely review the templates on our site and update them according to the latest state and county laws.

- If you are already familiar with our platform and possess a registered account, all you need to do to get the Cambridge Massachusetts Assignment to Living Trust is to Log In to your account and click the Download button.

- If this is your first time using US Legal Forms, just adhere to the guidelines provided below.

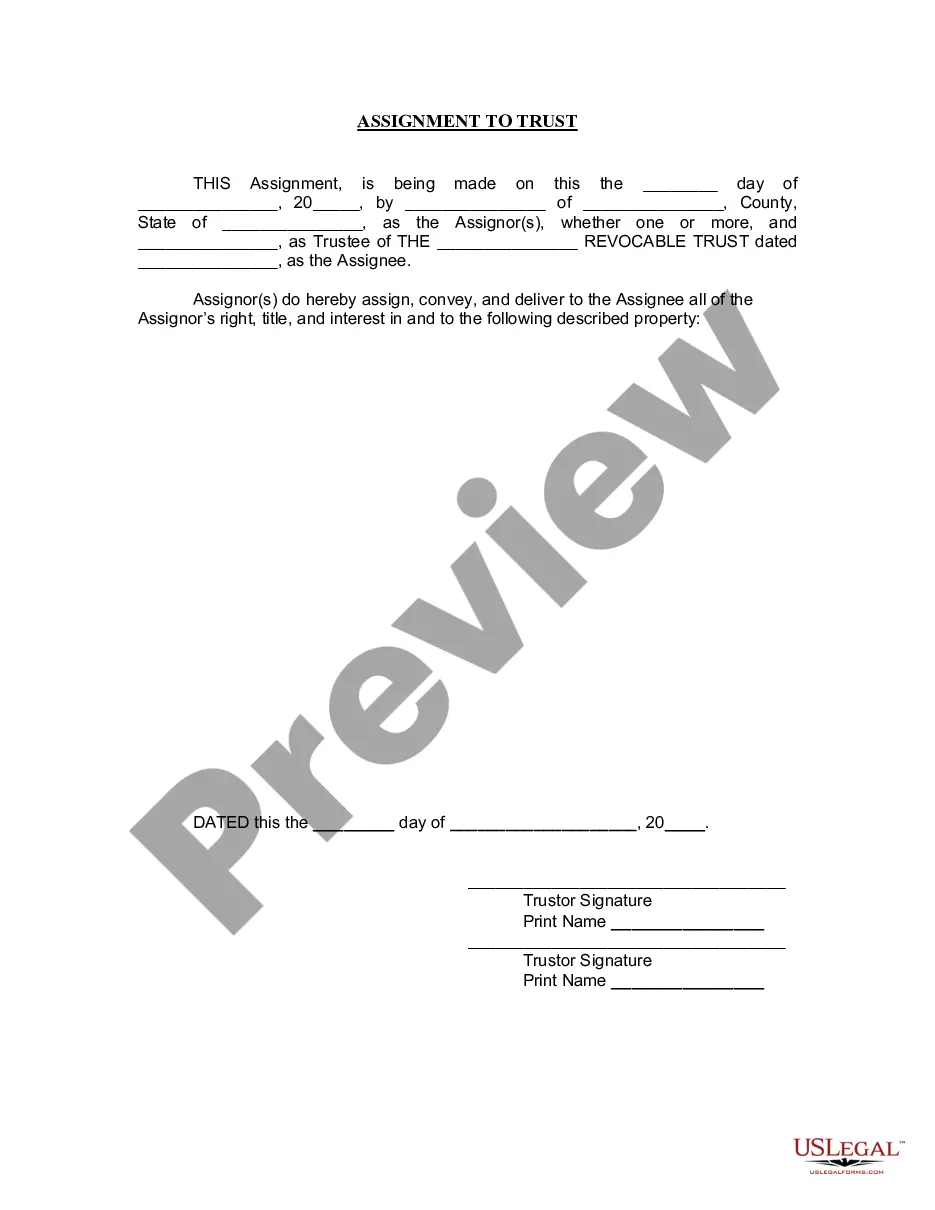

- Ensure you have selected the form you require. Review its details and utilize the Preview feature to verify its contents. If it doesn’t satisfy your requirements, make use of the Search option at the top of the page to find the necessary document.

- Confirm your choice. Click the Buy now button. Subsequently, select the desired pricing plan and provide the information to create an account.

Form popularity

FAQ

While there are advantages to putting your house in a trust, there are also notable disadvantages. For instance, you may incur initial setup costs, and there might be ongoing maintenance or administrative tasks associated with managing the trust. Additionally, transferring your house into a Cambridge Massachusetts Assignment to Living Trust can subject it to certain legal intricacies that may not be present in traditional ownership.

Establishing a trust in Massachusetts can potentially help minimize your estate tax liability. However, it is crucial to understand that while a trust may provide benefits, it does not automatically exempt your estate from taxation. A well-structured Cambridge Massachusetts Assignment to Living Trust can help in tax planning, but consulting with a tax professional is advisable for detailed guidance.

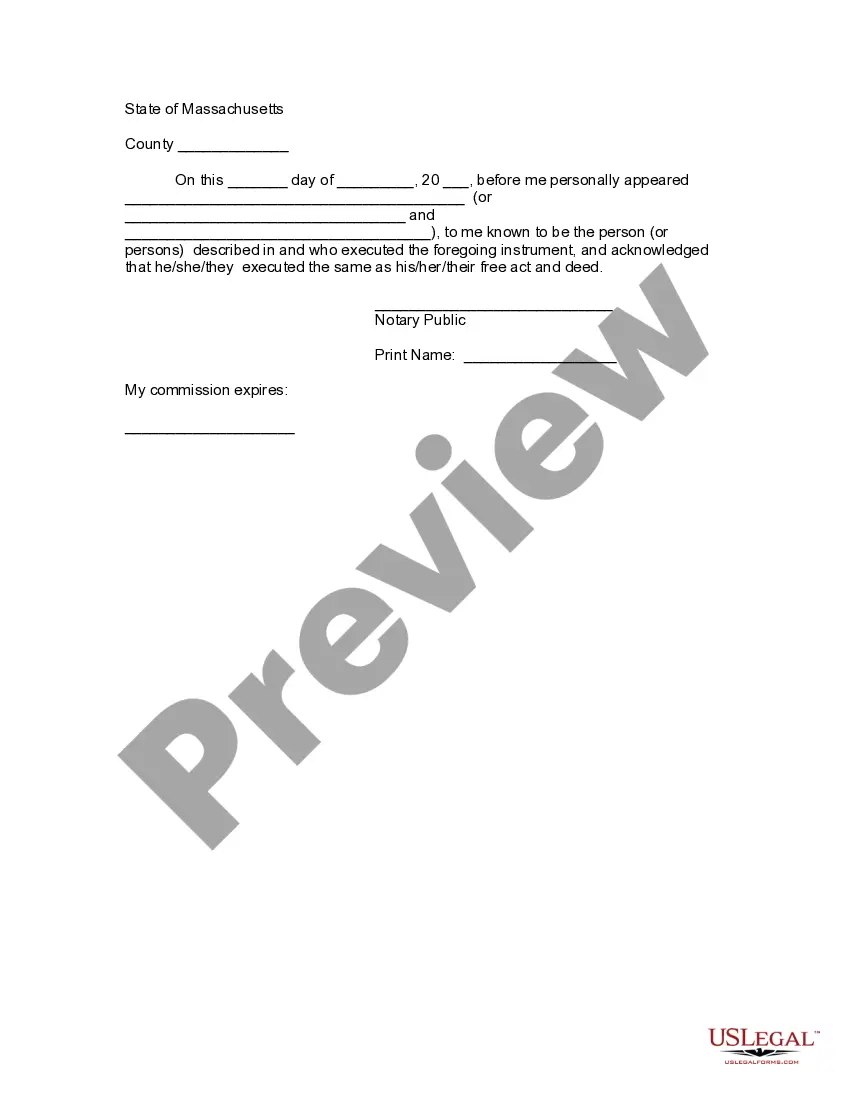

Putting your property in a trust in Massachusetts involves a few key steps. You start with creating a trust document, which specifies how you want your property managed. Then, you need to transfer the title of the property into the trust by executing a new deed, ensuring that the change is recorded with the local government. This process is central to the Cambridge Massachusetts Assignment to Living Trust approach.

To place your house in a trust in Massachusetts, you first need to create a living trust document. This document outlines the terms of the trust and names a trustee to manage it. Next, you'll draft and record a deed transferring the property title from your name to the trust. This process is often referred to as a Cambridge Massachusetts Assignment to Living Trust.

One potential downfall of having a trust, such as a Cambridge Massachusetts Assignment to Living Trust, is that it may not cover everything in your estate plan. Some individuals mistakenly believe a trust eliminates the need for a will, but this is not the case. Also, without proper management, there can be confusion over the trust terms or asset distribution. Regular communication and documentation are key to avoiding these issues.

Filling a living trust, like a Cambridge Massachusetts Assignment to Living Trust, involves transferring your assets into the trust. First, you need to identify which assets to include, such as real estate, bank accounts, or investments. Then, you will need to change the titles or deeds to reflect the trust as the new owner. A service like UsLegalForms can guide you through this process, ensuring you complete the necessary steps accurately.

One common mistake when establishing a trust fund, such as a Cambridge Massachusetts Assignment to Living Trust, is failing to fund the trust properly. Parents often overlook adding assets to the trust, which can render it ineffective. Furthermore, not updating the trust when circumstances change can lead to complications in the future. It's crucial to keep the trust current and fully funded.

A family trust, including a Cambridge Massachusetts Assignment to Living Trust, can have its own challenges. One key disadvantage is the potential for misunderstandings among family members, especially if the trust terms are unclear. Additionally, maintaining the trust may require ongoing management and fees, which can add to the complexity. It's essential to weigh these factors against the benefits.

Deciding whether to use a Cambridge Massachusetts Assignment to Living Trust requires careful thought. If your parents wish to control how their assets are managed and distributed after their passing, a trust can be a beneficial option. Moreover, trusts can help avoid probate, which makes the process smoother for the family. Consulting with an estate planning attorney can offer clarity tailored to their needs.

When you choose a Cambridge Massachusetts Assignment to Living Trust, there are potential downsides to consider. First, the process of setting up a trust can take time and require fees, which might not be suitable for every situation. Second, you could lose some control over your assets, as they are managed according to the trust's terms. Lastly, trusts may not offer the same tax benefits as other estate planning options.