Massachusetts Assignment to Living Trust

About this form

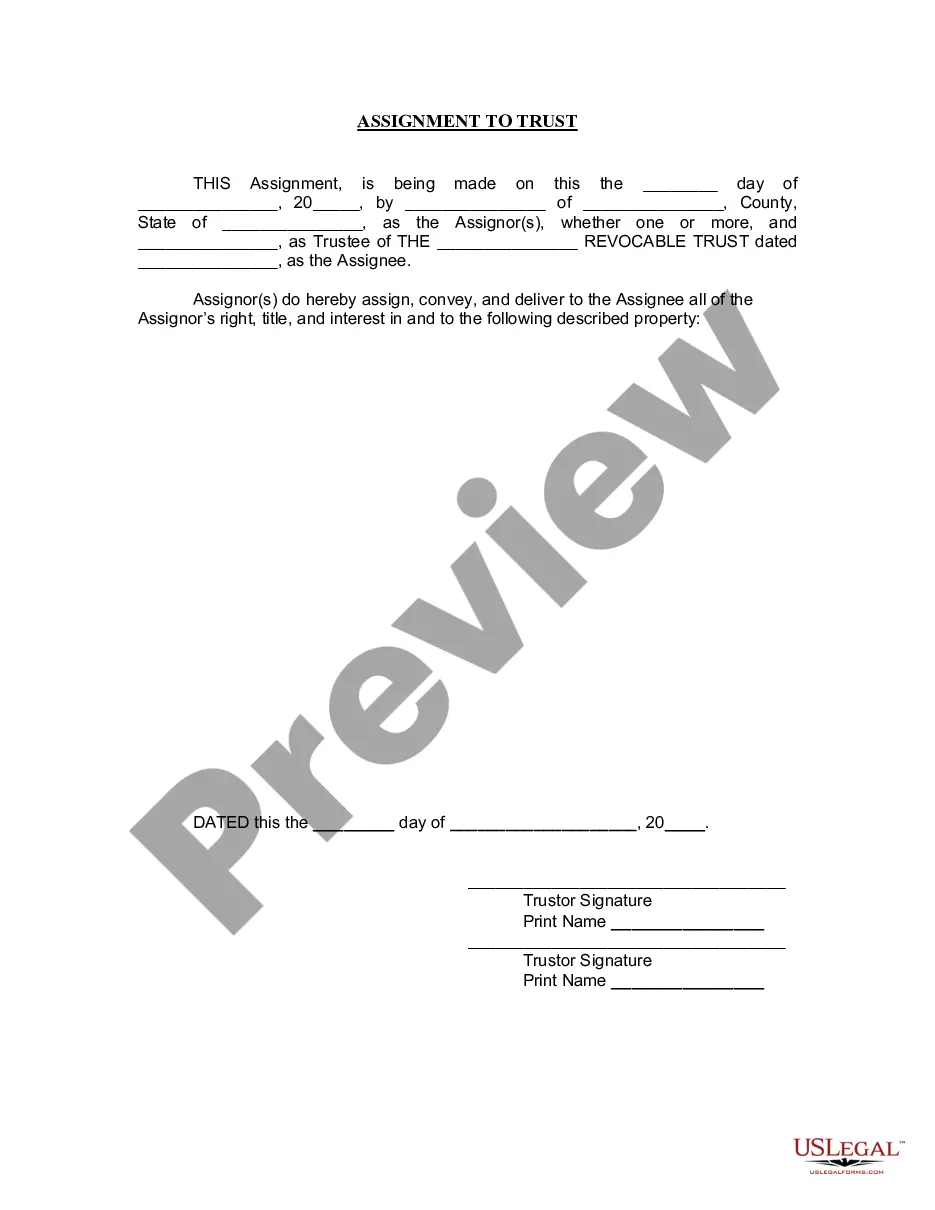

The Assignment to Living Trust form is used to transfer ownership of specific property into a Living Trust. A Living Trust is created during a person's lifetime to manage their assets and property primarily for estate planning purposes. This form legally documents the transfer of rights, titles, and interests in the property assigned to the trust, setting it apart from similar forms used for transferring real estate or personal property without the trust's involvement.

Key components of this form

- Date of assignment

- Names and addresses of the Assignor(s) and Trustee

- Specific property being assigned

- Signature lines for the Assignor and Trustee

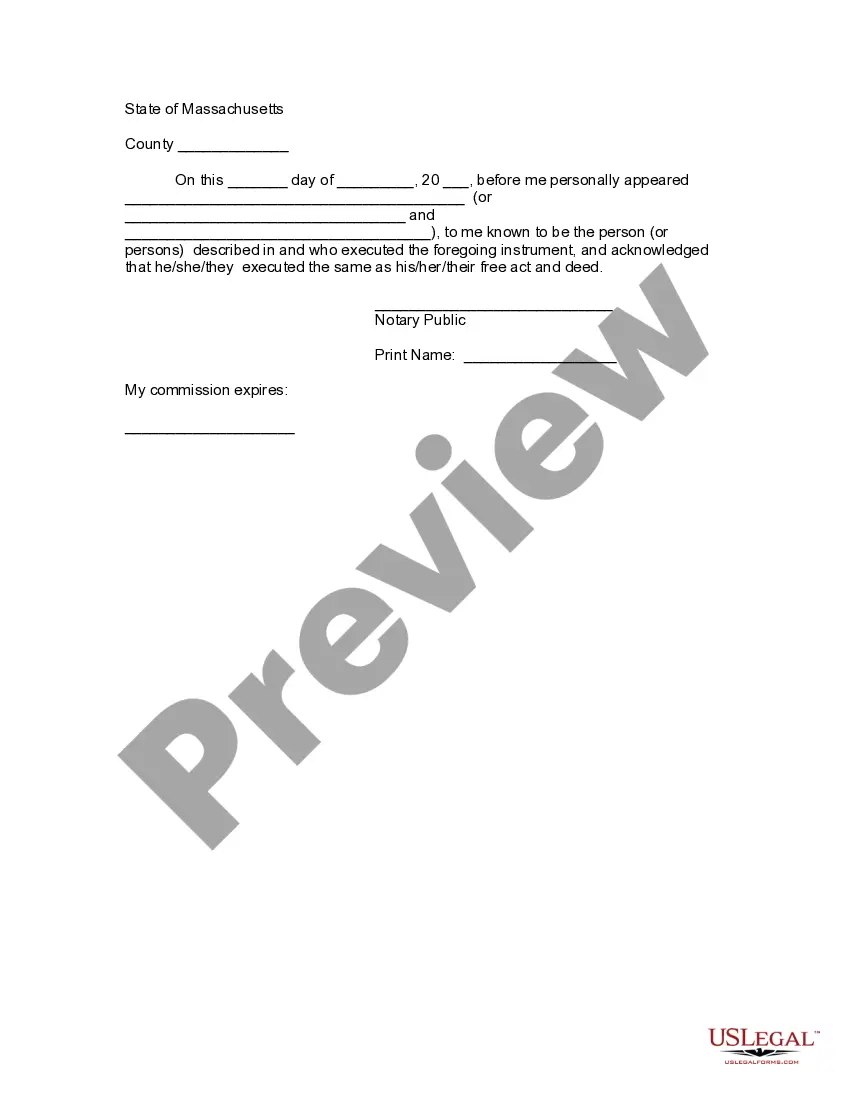

- Notary acknowledgement section

When this form is needed

This form is necessary when a property owner wishes to assign their property rights to a Living Trust. It is commonly used during estate planning to ensure that the property is managed and distributed according to the trust's terms upon the owner's death, thereby avoiding probate and ensuring privacy in asset distribution.

Who can use this document

This form is intended for:

- Individuals establishing a Living Trust to manage their assets

- Property owners looking to simplify the transfer of their property upon their death

- Trustees managing a Living Trust on behalf of the Trustor

How to prepare this document

- Identify the parties involved: the Assignor(s) and the Trustee.

- Specify the property being assigned, including full descriptions and addresses.

- Enter the date of the assignment.

- Obtain signatures from the Assignor(s) and the Trustee.

- Have the document notarized by a public notary.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide a complete description of the property being assigned.

- Omitting signatures from the Assignor(s) and Trustee.

- Not having the document notarized when required.

- Not using the correct date format when entering dates.

Benefits of using this form online

- Convenient access: Download the form at any time without needing to visit a legal office.

- Editability: Fill the form out digitally, saving time and reducing errors.

- Reliable source: The form is drafted by licensed attorneys, ensuring legal validity.

Looking for another form?

Form popularity

FAQ

In order to create a general petition for the creation of a trust, the filing fee is $375 with a surcharge of $15. Once the trust has been created, there will be a great deal of paperwork involved, since every asset that is added to the trust will need to be signed for.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

A living trust in Massachusetts is created by the grantor, the person putting things into trust. As the grantor you must choose a trustee who is charged with managing the trust for your benefit while you are alive and distributing your assets to your beneficiaries after your death.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Prior to enacting G.L.c. 184, §35, Massachusetts was among the few states requiring the full trust document for trusts containing real property to be recorded.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Decide between a single or joint trust. A single is obviously a good match for those that are unmarried. Review your property. Pick a trustee. Get your trust documents together. Sign your living trust. Fund your trust with your assets and property.