Boston Massachusetts Assignment to Living Trust

Description

How to fill out Massachusetts Assignment To Living Trust?

If you have previously utilized our service, Log In to your account and download the Boston Massachusetts Assignment to Living Trust to your device by clicking the Download button. Ensure your subscription remains active. If it has lapsed, renew it according to your payment plan.

If this is your initial engagement with our service, follow these straightforward instructions to obtain your document.

You have continuous access to every piece of documentation you have acquired: you can find it in your profile under the My documents section whenever you need to retrieve it again. Leverage the US Legal Forms service to quickly find and save any template for your personal or professional use!

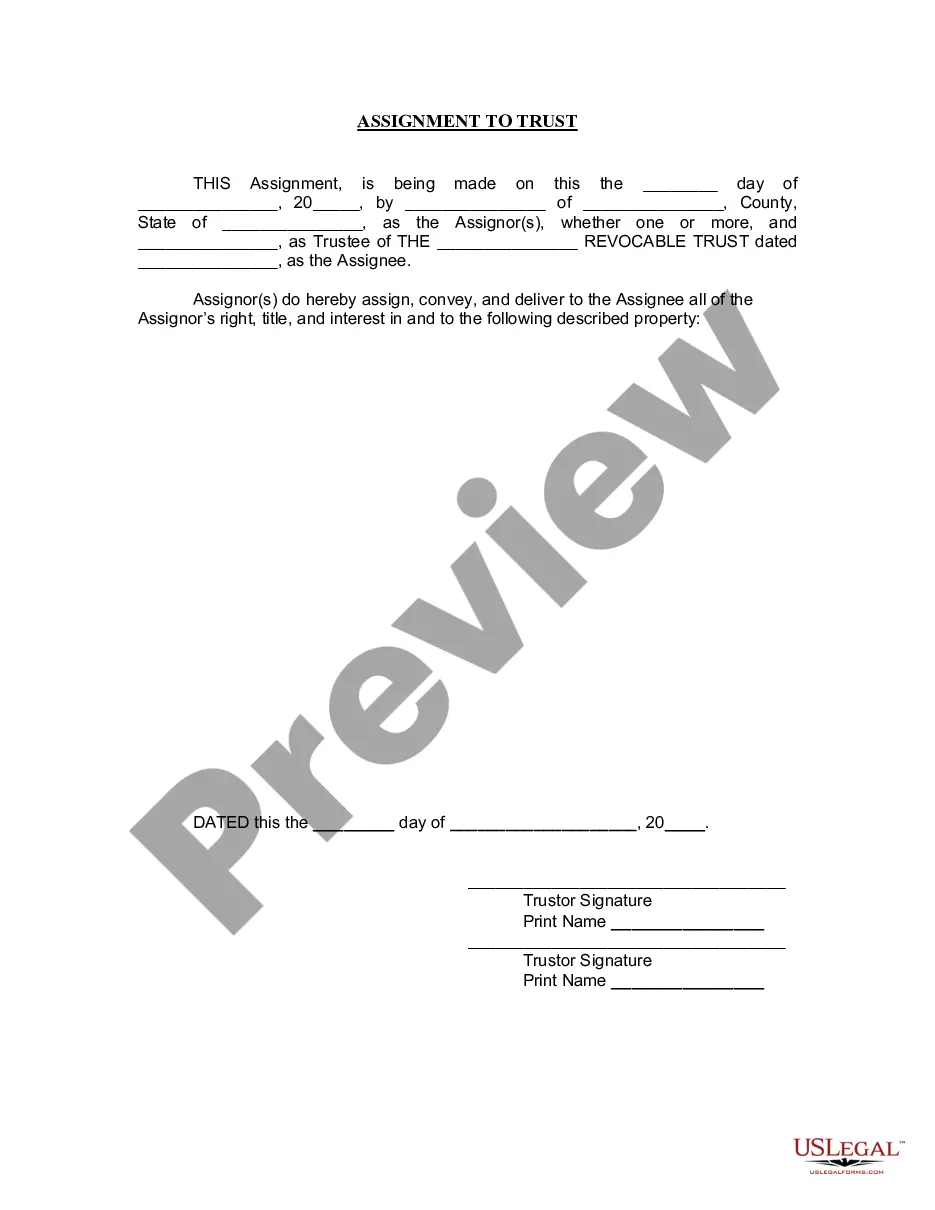

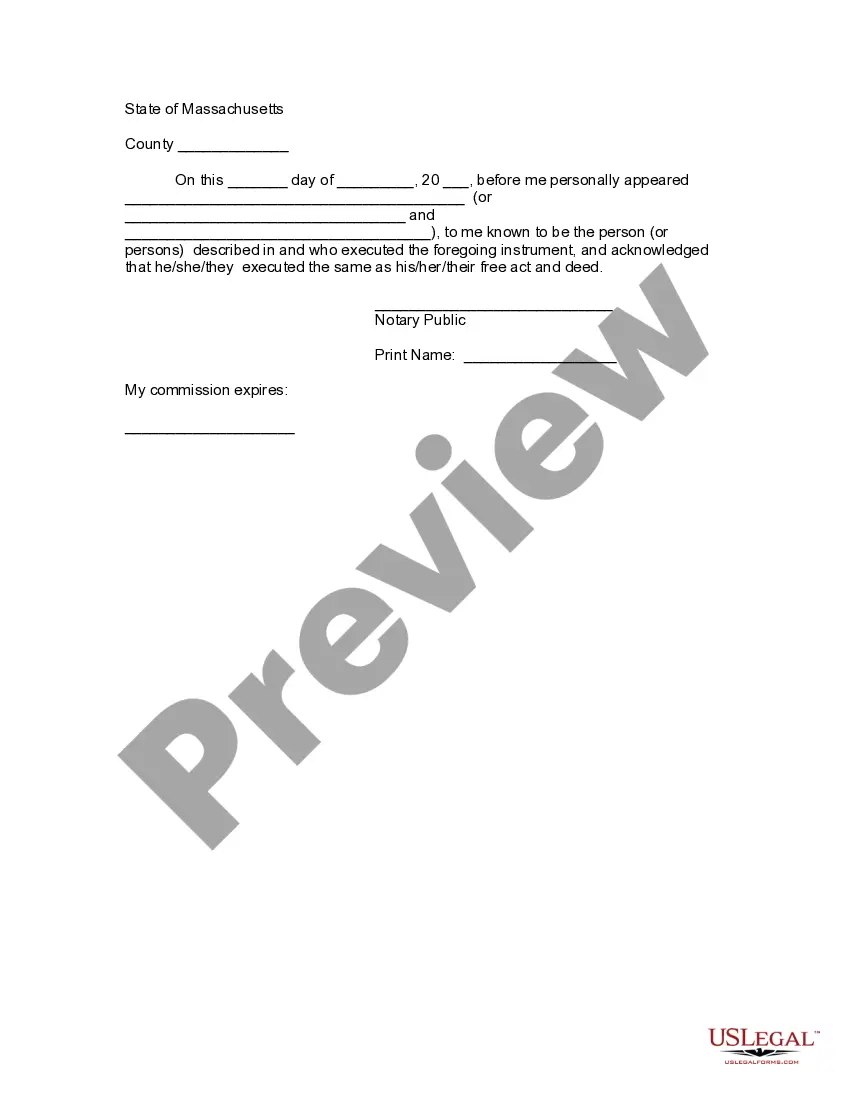

- Ensure you have located the correct document. Review the description and utilize the Preview option, if accessible, to determine if it satisfies your requirements. If it does not suit you, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and finalize your payment. Use your credit card information or the PayPal option to complete the purchase.

- Obtain your Boston Massachusetts Assignment to Living Trust. Choose your document's file format and save it to your device.

- Fill out your template. Print it or utilize online editing tools to complete and sign it digitally.

Form popularity

FAQ

How to Create a Living Trust in Massachusetts Decide between a single or joint trust. A single is obviously a good match for those that are unmarried.Review your property.Pick a trustee.Get your trust documents together.Sign your living trust.Fund your trust with your assets and property.

If you're a resident of Massachusetts and leave behind more than $1 million (for deaths occurring in 2022), your estate might have to pay Massachusetts estate tax. The Massachusetts tax is different from the federal estate tax, which is imposed only on estates worth more than $12.06 million (for deaths in 2022).

A Trust Provides More Privacy Than a Will or Intestacy If you prefer that the details of who inherits from you remain private, a trust is a better way to accomplish that end. A trust in Massachusetts is a private document that handles your estate without court intervention.

A trust can be a good way to cut the tax to be paid on your inheritance. But you need professional advice to get it right. Always talk to a solicitor/independent financial adviser. If you put things into a trust, provided certain conditions are met, they no longer belong to you.

Trusts. The best way to protect your assets is to create trusts. Depending on the total value of your estate and whether you are married, you and your spouse can create one or multiple types of trusts. Each may individually fall below the million dollar threshold, allowing you to avoid estate taxes in Massachusetts.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Living Trusts in Massachusetts A living trust in Massachusetts is created by the grantor, the person putting things into trust. As the grantor you must choose a trustee who is charged with managing the trust for your benefit while you are alive and distributing your assets to your beneficiaries after your death.

In order to create a general petition for the creation of a trust, the filing fee is $375 with a surcharge of $15. Once the trust has been created, there will be a great deal of paperwork involved, since every asset that is added to the trust will need to be signed for.

Here are some ways to reduce or avoid the Massachusetts estate tax: Credit Shelter Trusts. A surviving spouse receives an unlimited marital deduction, so there are no estate taxes on jointly-held assets when the first spouse passes away.Spend your money.Gifting during your lifetime.