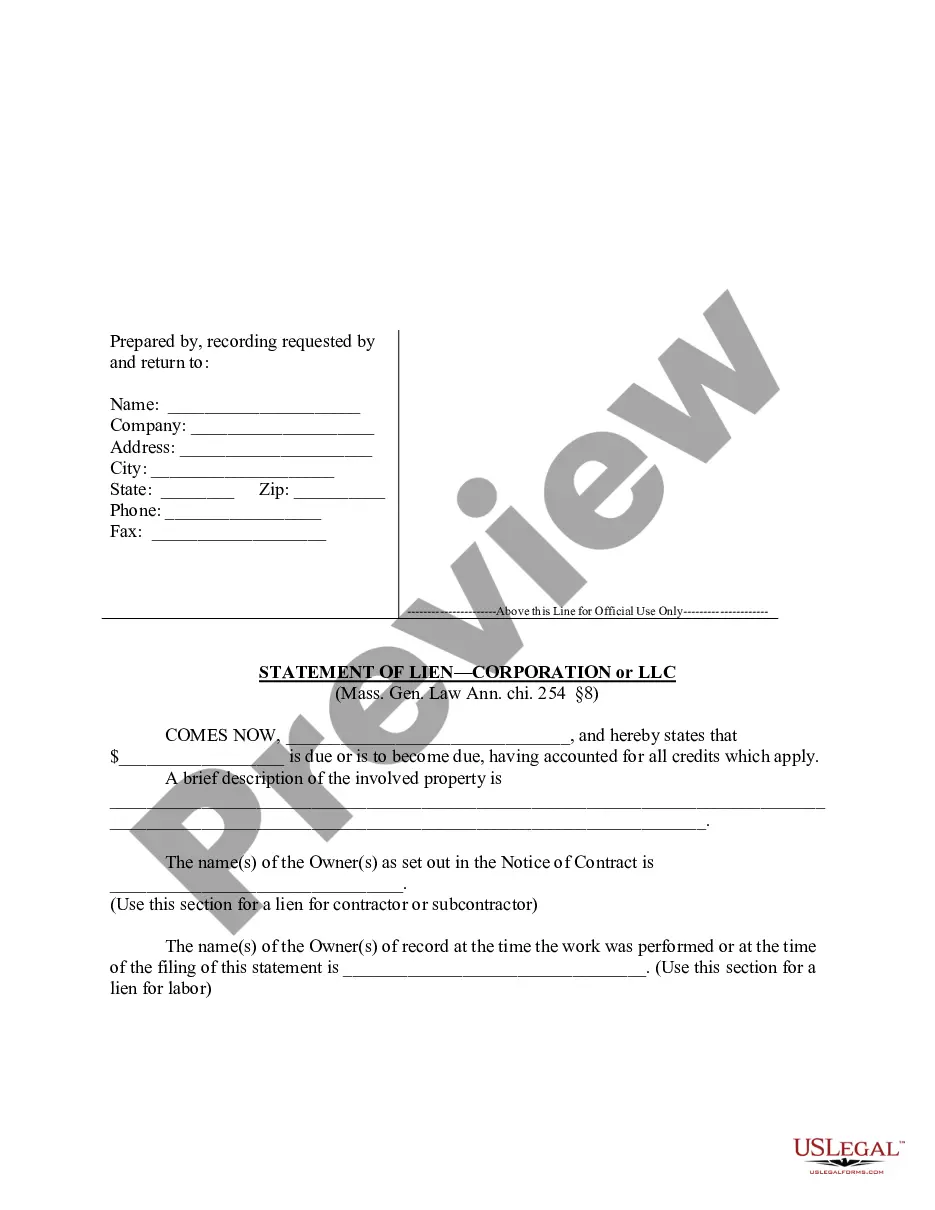

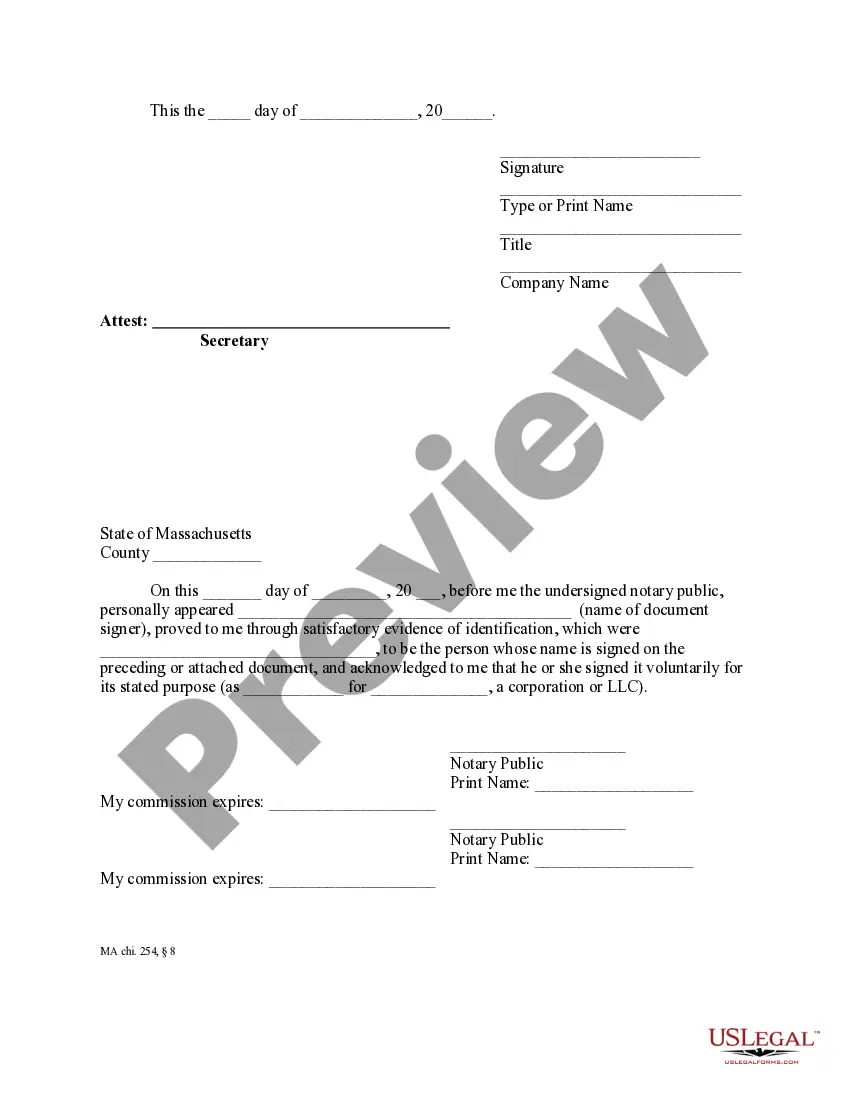

"Liens shall be dissolved unless the contractor, subcontractor, or some person claiming by, through or under them, shall, not later than the earliest of: (i) ninety days after the filing or recording of the notice of substantial completion under section two A; (ii) one hundred and twenty days after the filing or recording of the notice of termination under section two B; or (iii) one hundred and twenty days after the last day a person, entitled to enforce a lien under section two or anyone claiming by, through or under him, performed or furnished labor or material or both labor and materials or furnished rental equipment, appliances or tools, file or record in the registry of deeds in the county or district where the land lies a statement, giving a just and true account of the amount due or to become due him, with all just credits..." Mass. Gen. Laws Ann. ch. 254 §8.

Boston Massachusetts Statement of Lien by Corporation or LLC

Description

How to fill out Massachusetts Statement Of Lien By Corporation Or LLC?

We consistently aim to minimize or circumvent legal repercussions when managing intricate legal or financial matters.

To achieve this, we seek out legal services that, generally, tend to be quite expensive. Nonetheless, not all legal issues are similarly complicated. The majority can be handled independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and power of attorney to articles of incorporation and petitions for dissolution. Our site enables you to take control of your matters without the necessity of consulting an attorney. We offer access to legal document templates that are not frequently accessible. Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Leverage US Legal Forms whenever you need to obtain and download the Boston Massachusetts Statement of Lien by Corporation or LLC or any other document conveniently and securely. Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always retrieve it again from the My documents tab.

Once you confirm that the Boston Massachusetts Statement of Lien by Corporation or LLC meets your needs, you can select a subscription plan and make a payment. After that, you can download the form in any preferred file format. For more than 24 years, we’ve assisted millions of individuals by providing ready-to-customize and current legal documents. Utilize US Legal Forms now to conserve time and resources!

- The procedure is equally simple if you’re not acquainted with the platform!

- You can set up your account in a few minutes.

- Ensure that the Boston Massachusetts Statement of Lien by Corporation or LLC complies with the laws and regulations of your state and locality.

- Furthermore, it’s essential to review the form’s description (if provided), and if you identify any inconsistencies with your initial requirements, look for an alternative template.

Form popularity

FAQ

Massachusetts is among the states that does not impose a corporate or franchise tax on LLCs. The LLC members are still required to pay state and federal income taxes on their earnings. The state income tax for Massachusetts is a flat rate of 5.05%.

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

These continuous requirements include those related to the following: Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping.Board meetings.Meeting minutes.State registration.Licensing.

A corporate seal is no longer required by LLCs or Corporations and any state in the United States.

County Clerk's Office: Your local county clerk, recorder or assessor has access to the public records as well. One of these offices is typically where liens are filed. You can speak with a clerk and more often than not they will assist you and let you know if there are any liens attached to your property.

Corporate bylaws are a detailed set of rules adopted by a corporation's board of directors after the company has been incorporated. They are an important legal document for a corporation to have in place as they specify its internal management structure and how it will be run.

Benefits of starting a Massachusetts LLC: Limits and separates your personal liability from your business liability and debts. Simple tax filing and potential advantages for tax treatment. Strong support for small local businesses. Numerous business tax credits.

(a) A corporation shall have a president, a treasurer and a secretary and such other officers described in its bylaws or appointed by the board of directors in accordance with the bylaws.

Corporate bylaws are legally required in Massachusetts. Massachusetts Gen L ch 156d § 2.06 (2019) requires either the incorporators or the board of directors to adopt bylaws. The board of directors typically adopt initial bylaws at the first organizational meeting.

Go to the Secretary of State's Website in order to lookup a business entity (Corporation, LLC, Limited Partnership) in Massachusetts (Click Here to see if an entity name is available).