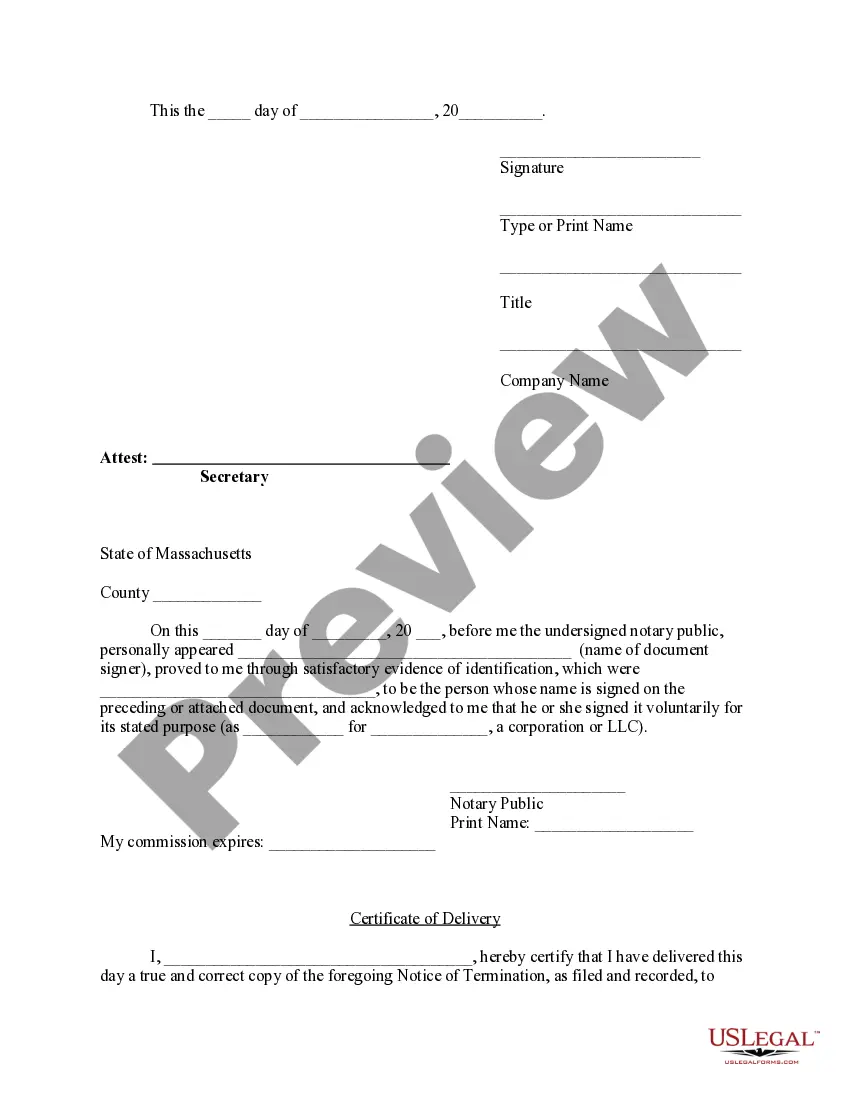

If in the event that a contract has been terminated prior to substantial completion, the owner shall provide a notice of termination by certified mail to every person who has filed or recorded a notice of contract and to the contractor. The contractor must then deliver a copy of said notice to every person who entered into a written contract directly with the contractor or who has given to the contractor written notice of identification.

Middlesex Massachusetts Notice of Termination by Corporation or LLC

Description

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

Utilize the US Legal Forms to gain immediate access to any template you require.

Our user-friendly website featuring a vast array of documents simplifies the process of locating and acquiring nearly any document sample you will need.

You can download, complete, and sign the Middlesex Massachusetts Notice of Termination by Corporation or LLC in a matter of minutes, instead of spending hours searching the internet for the correct template.

Leveraging our assortment is an excellent method to enhance the security of your document submissions. Our skilled legal experts consistently review all documents to ensure that the forms are suitable for a specific state and compliant with current laws and regulations.

Locate the form you need. Ensure that it is the template you were seeking: verify its title and description, and use the Preview feature when available. Alternatively, use the Search bar to find the correct one.

Begin the saving process. Click Buy Now and choose the pricing option you prefer. Then, register for an account and complete your order using a credit card or PayPal. Download the document. Select the format to obtain the Middlesex Massachusetts Notice of Termination by Corporation or LLC and modify, complete, or sign it as necessary.

- How do you obtain the Middlesex Massachusetts Notice of Termination by Corporation or LLC.

- If you have an account, simply Log In. The Download button will be visible on all the documents you review. Additionally, you can access all previously saved documents in the My documents section.

- If you haven't created an account yet, follow the steps below.

Form popularity

FAQ

When an LLC is terminated, it ceases to exist as a legal entity, meaning it can no longer conduct business or enter into contracts. Assets of the LLC must be distributed according to the operating agreement or state laws. Understanding this process can crucially influence how you handle any ongoing responsibilities. For any help with the Middlesex Massachusetts Notice of Termination by Corporation or LLC process, consider leveraging the resources offered by uslegalforms.

The primary difference lies in the management structure and formalities. An LLC allows for a flexible management system, enabling members to define their management roles, whereas corporations have a more rigid structure with shareholders, a board of directors, and officers. This flexibility often makes LLCs more appealing to small business owners. As you consider a Middlesex Massachusetts Notice of Termination by Corporation or LLC, keep these differences in mind.

One main difference is how they are taxed. An LLC usually offers pass-through taxation, where profits are taxed only at the individual member level, avoiding double taxation. In contrast, corporations may face taxation at both the company and shareholder levels. When navigating a Middlesex Massachusetts Notice of Termination by Corporation or LLC, understanding these tax implications can impact your decision-making.

An LLC is not considered a corporation, though both are separate legal entities. LLCs provide liability protection similar to a corporation but have different tax treatments and regulatory requirements. While both forms shield personal assets, corporations typically have more formalities, such as board meetings and extensive record-keeping. If you're dealing with a Middlesex Massachusetts Notice of Termination by Corporation or LLC, knowing this distinction can guide your actions.

In the context of business structures, an LLC, or Limited Liability Company, falls under the category of hybrid entities. LLCs combine features of both corporations and partnerships, providing flexibility in management and structure. Businesses seeking personal liability protection while enjoying operational ease often choose the LLC structure. If you're filing a Middlesex Massachusetts Notice of Termination by Corporation or LLC, understanding your entity type is essential.

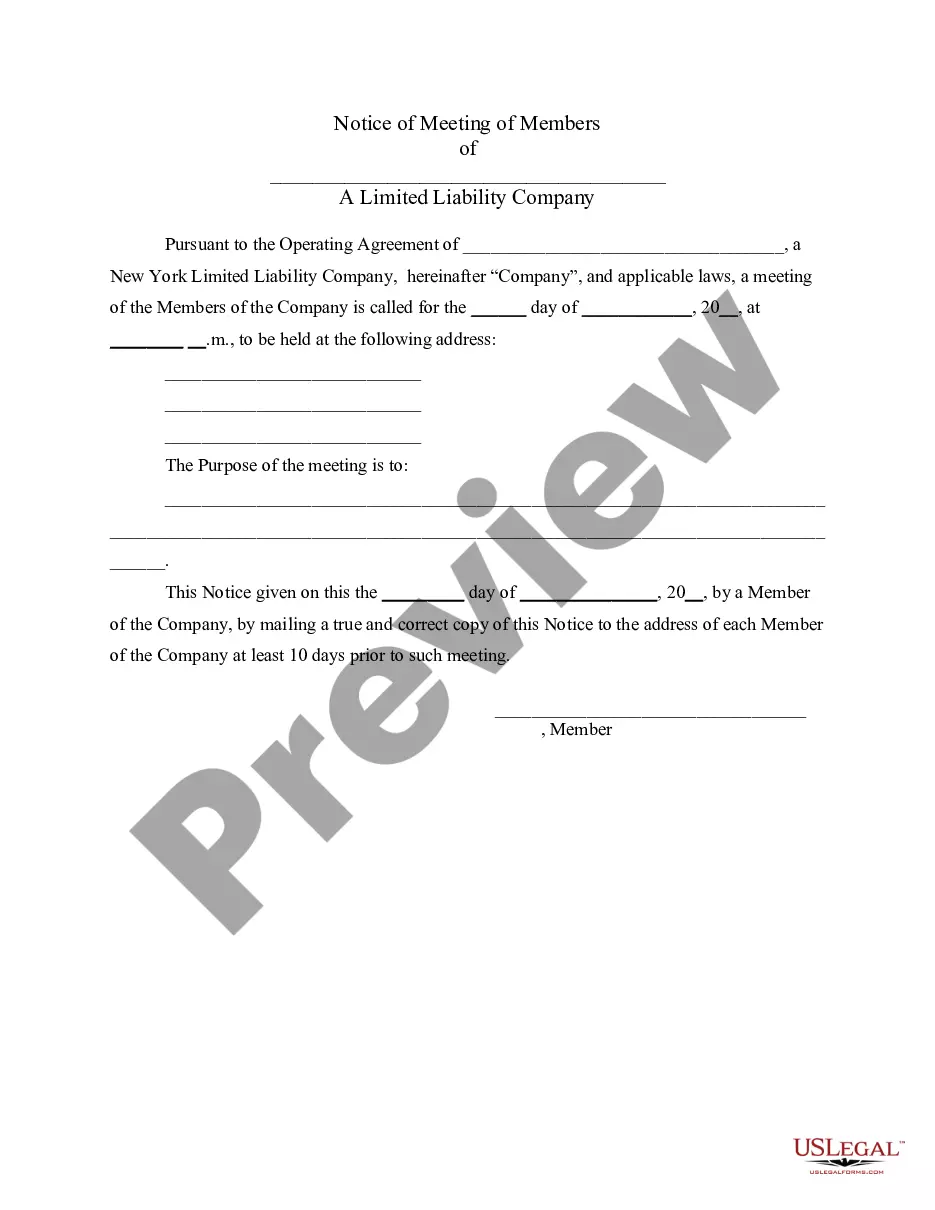

To remove someone from your LLC in Massachusetts, follow the procedures outlined in your operating agreement. Typically, this process involves a vote by the remaining members and may require filing a Middlesex Massachusetts Notice of Termination by Corporation or LLC if it leads to dissolution. Documentation supporting the decision must be maintained for legal purposes. For detailed templates and guidance, consider using uslegalforms to navigate this important process effectively.

In Massachusetts, an LLC is not classified as a corporation. Instead, it is a distinct business entity that combines elements of both partnerships and corporations. Unlike corporations, LLCs offer flexible management structures while still providing limited liability benefits. Understanding the nuances of each entity can help ensure you choose the right form for your business needs; refer to resources like uslegalforms for more insights.

To shut down an LLC in Massachusetts, you need to file a Middlesex Massachusetts Notice of Termination by Corporation or LLC with the Secretary of State. This document formally notifies authorities and members of your intent to dissolve the business. Be sure to settle any outstanding debts, distribute assets among members, and file final tax returns. Using services like uslegalforms can simplify this process and ensure you meet all legal requirements.

To file a Certificate of Cancellation in Massachusetts, you need to complete the required form and submit it to the Secretary of the Commonwealth's office. This document will officially inform the state of your LLC's termination. Utilizing resources from USLegalForms can simplify this process and clarify the relationship to the Middlesex Massachusetts Notice of Termination by Corporation or LLC.

The corporate dissolution form for Massachusetts is an official document used by corporations to file for dissolution with the state. This form requires essential details about the business and the reason for dissolution. By understanding the Middlesex Massachusetts Notice of Termination by Corporation or LLC, you can accurately complete this form and fulfill your obligations.