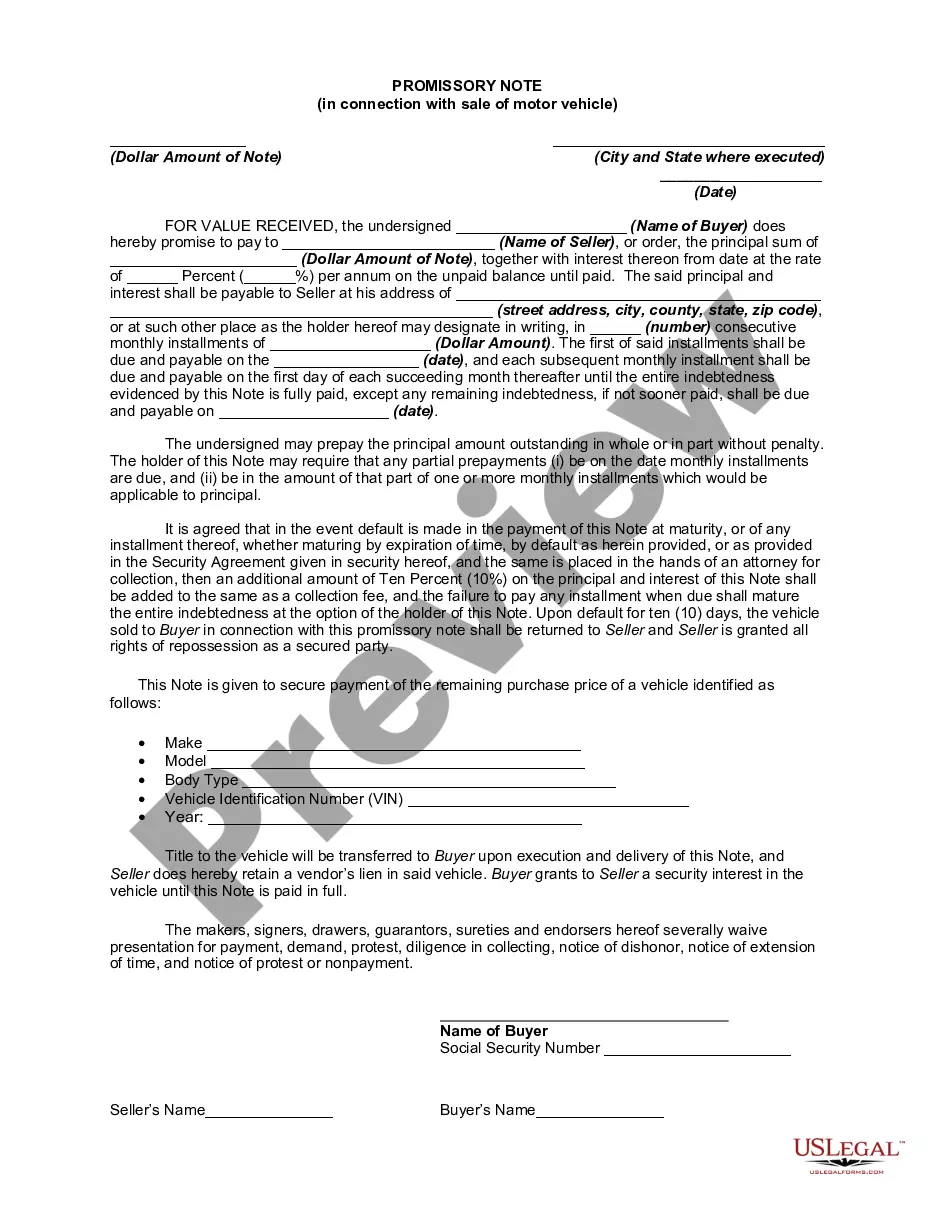

This note may be used in connection with a purchase of a motor vehicle in Massachusetts and reserves a vendor's lien in favor of the Seller.

Middlesex Massachusetts Promissory Note - Loan in connection with sale of motor vehicle, car, or auto

Description

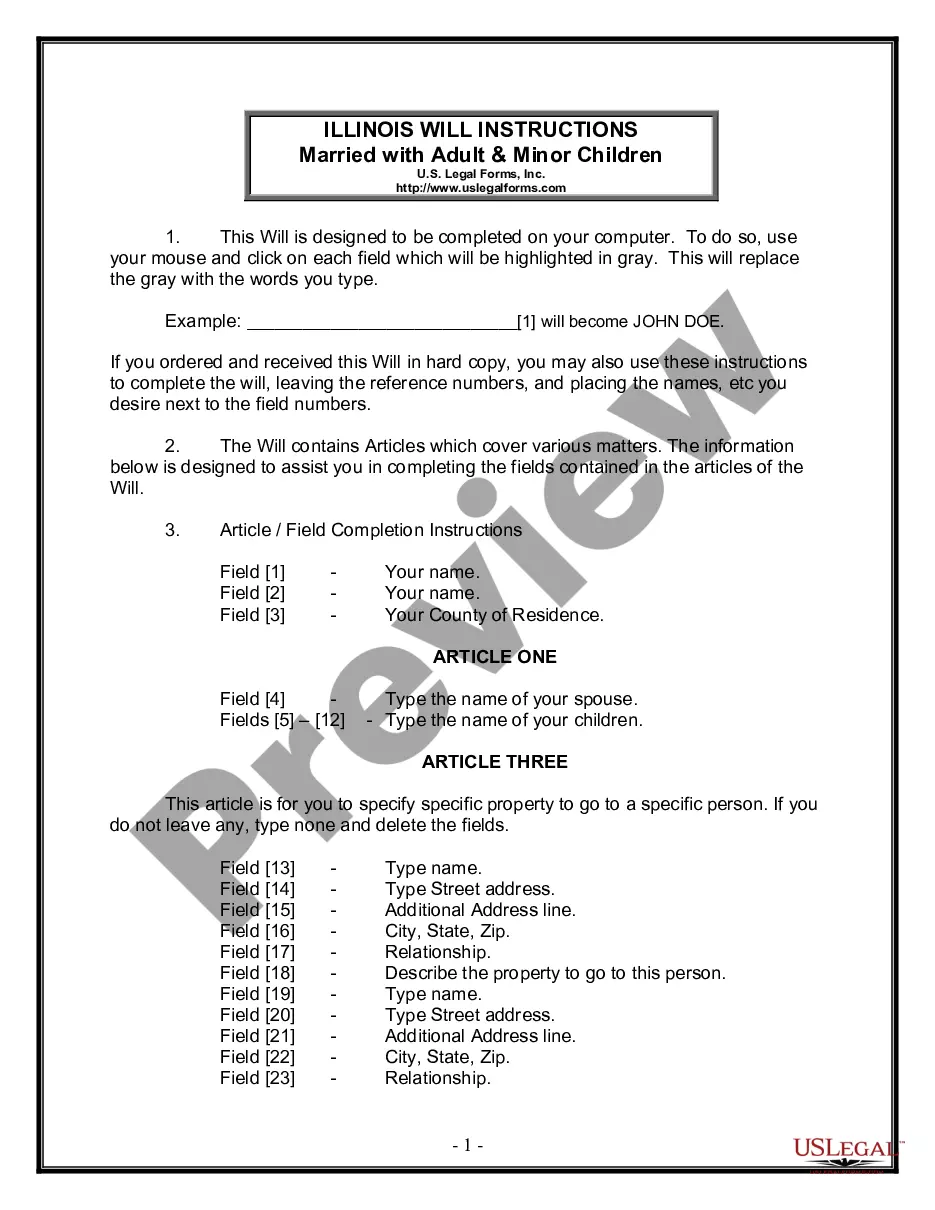

How to fill out Massachusetts Promissory Note - Loan In Connection With Sale Of Motor Vehicle, Car, Or Auto?

If you’ve previously utilized our service, Log In to your account and retrieve the Middlesex Massachusetts Promissory Note - Loan related to the sale of a motor vehicle, car, or auto onto your device by selecting the Download button. Verify that your subscription is active. If not, renew it according to your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to obtain your document.

You have uninterrupted access to all documents you have purchased: you can find them in your profile under the My documents section whenever you wish to access them again. Utilize the US Legal Forms service to swiftly locate and download any template for your personal or business requirements!

- Confirm you've located an appropriate document. Browse the description and utilize the Preview feature, if available, to verify if it fulfills your needs. If it’s not a match, use the Search tab above to discover the correct one.

- Purchase the template. Select the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process the payment. Employ your credit card information or the PayPal option to finalize the purchase.

- Obtain your Middlesex Massachusetts Promissory Note - Loan related to the sale of a motor vehicle, car, or auto. Select the file format for your document and store it on your device.

- Fill out your template. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

To fill out a promissory demand note, start by clearly writing the names of the involved parties, usually the lender and the borrower. Next, specify the principal amount being borrowed in connection with the sale of a vehicle. Include the payment terms, due dates, and any interest rates if applicable. Finally, ensure both parties sign and date the document to make it legally binding.

Whether you need a lawyer for a promissory note in Middlesex Massachusetts often depends on your comfort level with legal documents. If you feel confident drafting the note yourself, you can certainly proceed without legal counsel. Nevertheless, having a lawyer review your note can ensure that all provisions are clear and legally binding. Uslegalforms offers resources that can simplify the process if you decide to go it alone.

Promissory notes are invaluable legal tools to bind other individuals to an agreement for goods or money; they carry the full weight of the law and are legally binding on both parties. Use promissory notes in routine and straight-forward contractual relationships between parties to avoid costly legal expertise.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark ?paid in full? on the promissory note.Place a signature beside the ?paid in full? notation.Mail the original promissory note to the borrower.

Financial institutions such as banks and lenders often use promissory notes when issuing real estate mortgage loans or student loans. Companies or individuals also use promissory notes when issuing or taking on personal loans or corporate loans.

A car promissory note is an agreement where a borrower promises to make payments in exchange for a vehicle. It typically has even terms throughout the loan, but often also includes a lump sum down payment at the beginning of the loan term. It also should include information about the make and model of the vehicle.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

While car loans are a type of promissory note, not all promissory notes are car loans. So the short answer is: No, car loans and promissory notes are not the same. Car loans are a type of agreement where one party borrows money from another to purchase a car.

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.