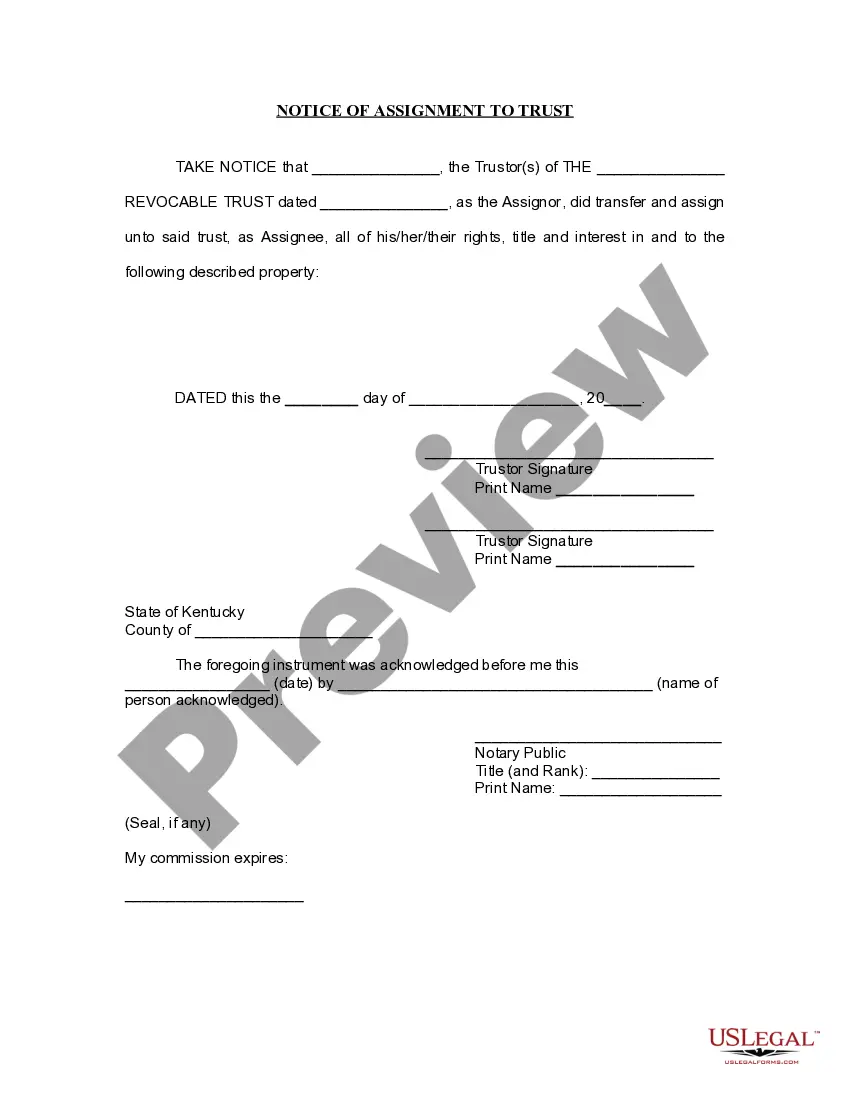

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Louisville Kentucky Notice of Assignment to Living Trust

Description

How to fill out Kentucky Notice Of Assignment To Living Trust?

If you are searching for an authentic document, it’s incredibly challenging to locate a more suitable place than the US Legal Forms website – one of the most comprehensive collections on the internet.

Here you can obtain numerous form templates for professional and personal use by categories and states, or keywords.

With the top-notch search feature, acquiring the latest Louisville Kentucky Notice of Assignment to Living Trust is as straightforward as 1-2-3.

Obtain the document. Choose the format and download it to your device.

Edit as needed. Fill out, modify, print, and sign the downloaded Louisville Kentucky Notice of Assignment to Living Trust.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Louisville Kentucky Notice of Assignment to Living Trust is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have located the document you require. Review its details and use the Preview option (if available) to examine its content. If it doesn’t suit your requirements, utilize the Search field at the top of the page to find the appropriate file.

- Verify your choice. Click the Buy now button. After that, select your desired subscription plan and provide the necessary information to register for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

To make a living trust in Kentucky, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Lawyers often use hourly fee schedules, and the price associated with creating a living trust is generally at least $1,000. Again, more complex estates may pay even more than that. In particular, make sure you're using an estate planning lawyer that has a specialty in trusts.

In short, a revocable trust, also called a living trust or a revocable living trust, is an entity that holds a person's property. A trust represents a fiduciary relationship between a trustee and a beneficiary. The trustee manages the assets inside the trust and the beneficiary enjoys the benefit of the assets.

The trust is not public record, as a will and probate proceeding are. The terms of the trust, assets in it, and beneficiaries of it are never revealed and remain completely private.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

To make a living trust in Maryland, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Common Types of Trusts Inter vivos trusts or living trusts: created and active during the lifetime of the grantor. Testamentary trusts: trusts formed after the death of the grantor. Revocable trusts: can be changed or revoked entirely by the grantor.