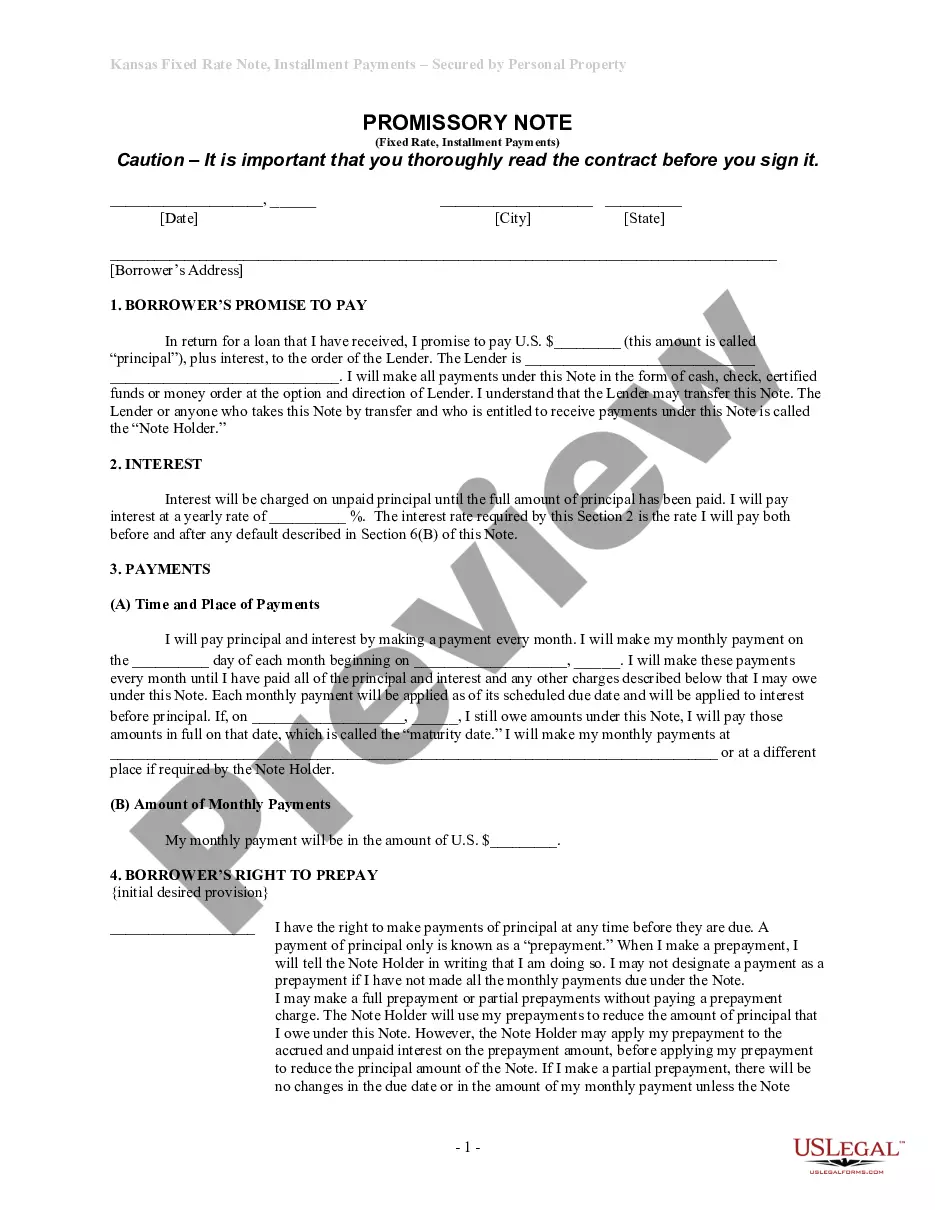

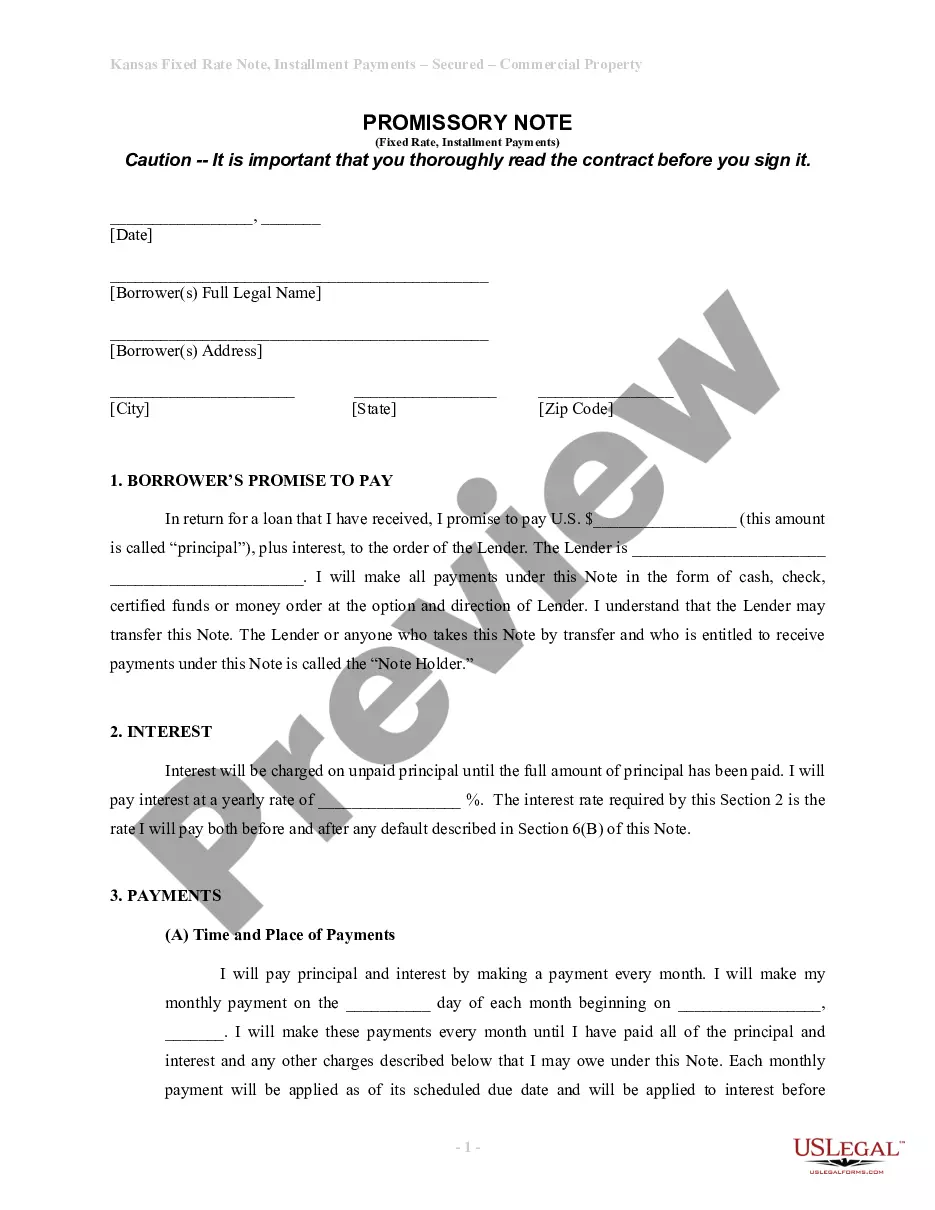

Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

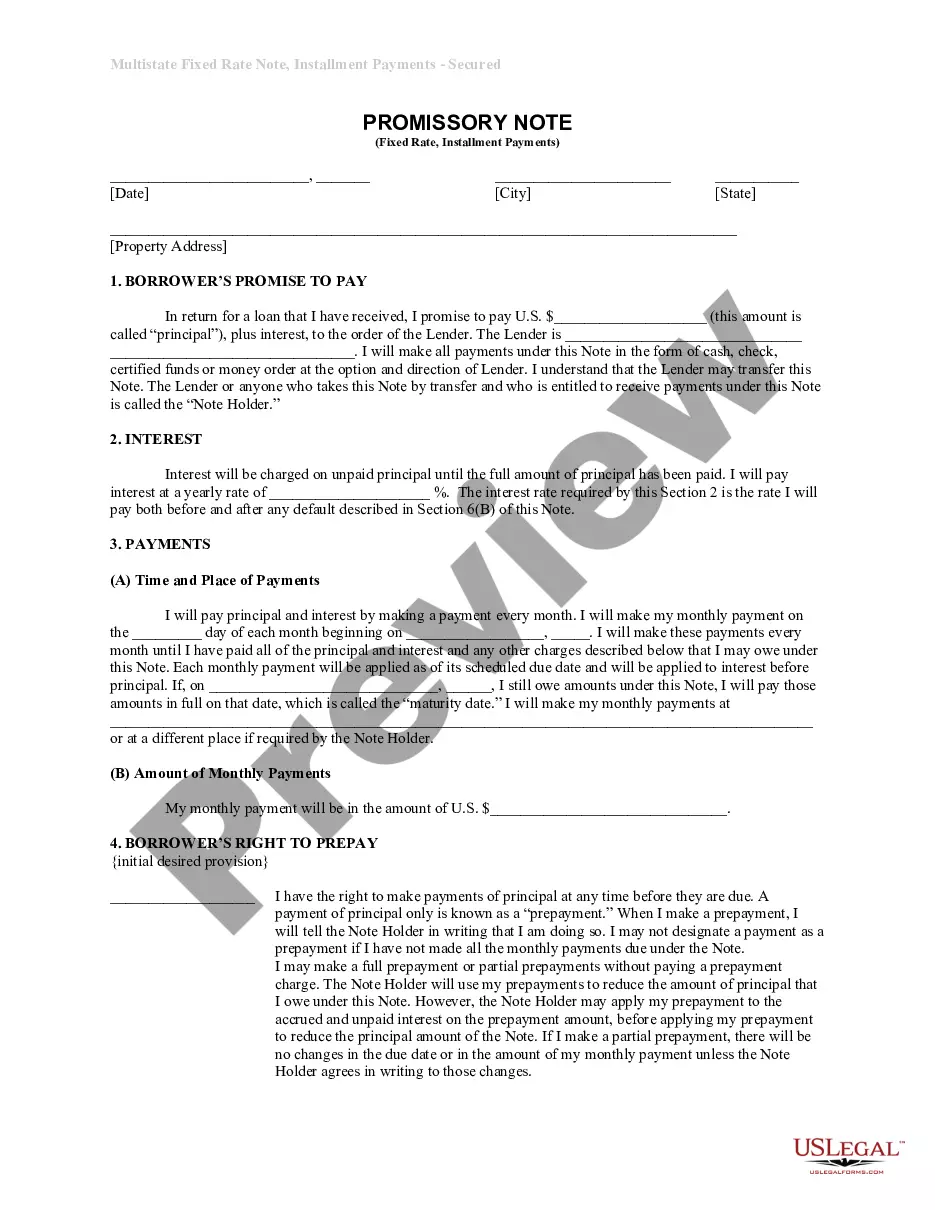

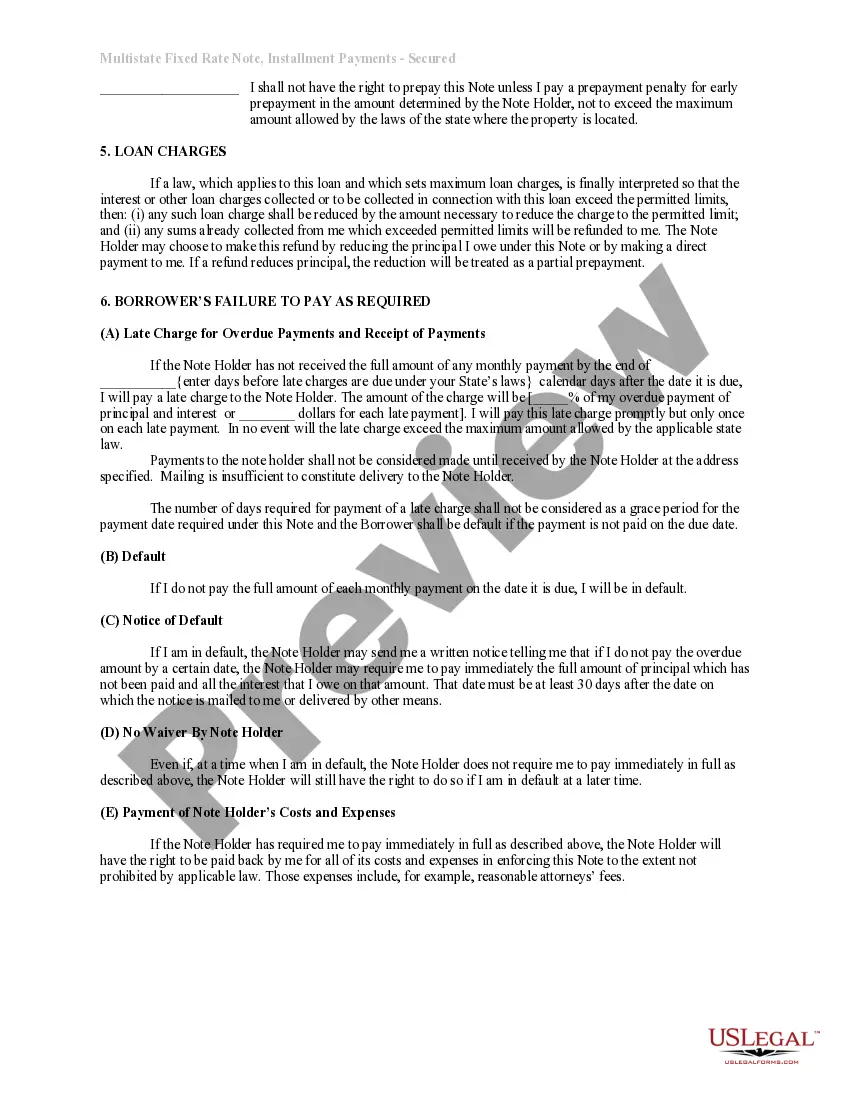

How to fill out Kansas Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you are looking for an authentic form, it’s tough to find a more suitable site than the US Legal Forms platform – one of the most extensive collections available online. With this collection, you can obtain countless sample forms for business and personal reasons sorted by categories and areas, or keywords.

Utilizing our superior search capability, locating the newest Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate is as simple as 1-2-3. Moreover, the relevance of each document is validated by a team of professional attorneys who routinely evaluate the templates on our platform and update them according to the latest state and county regulations.

If you are already familiar with our system and possess an account, all you need to acquire the Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate is to Log In to your account and click the Download button.

Every template you save in your account does not expire and belongs to you indefinitely. You can easily access them via the My documents section, so if you wish to obtain another version for editing or producing a hard copy, feel free to come back and download it again anytime.

Leverage the extensive US Legal Forms catalog to access the Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate you were seeking along with thousands of other professional and state-specific samples all on one platform!

- Verify you have located the sample you need. Review its description and take advantage of the Preview feature to examine its contents. If it isn’t suitable for your requirements, utilize the Search functionality at the top of the page to find the right document.

- Confirm your choice. Click the Buy now button. After that, select your desired subscription option and provide the information needed to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finish the signup process.

- Obtain the template. Choose the format and download it to your device.

- Make adjustments. Fill in, modify, print, and sign the acquired Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Form popularity

FAQ

You can obtain a promissory note for your mortgage through various sources, including financial institutions and online platforms like US Legal Forms. These resources offer customizable templates, such as the Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate, that meet your specific needs. Ensuring you have an appropriate note is crucial for clear agreements and liability.

Yes, you can foreclose on a promissory note when it is secured by property, such as in the case of a Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate. If the borrower fails to meet repayment terms, the lender has the right to initiate foreclosure proceedings to recover the owed amount by selling the property. This legal process reinforces the importance of understanding the terms detailed in the promissory note.

Notarization is not always required for a promissory note to be valid, including a Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate. However, having the document notarized adds a layer of authenticity and protection, especially for larger loans. It's advisable to consult local regulations or a legal professional to determine the best course of action for your specific situation.

Yes, a handwritten promissory note can be legal as long as it meets certain requirements. In Topeka, Kansas, a note must clearly state the amount owed, the repayment terms, and the signatures of both parties involved. However, for added protection and to ensure compliance with local laws, using a professionally drafted Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate is recommended.

The document that secures the promissory note to the real property is called a mortgage or deed of trust. In the context of the Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this legal instrument provides the lender with the right to take ownership of the property if the borrower defaults. It is important to ensure this document is properly recorded to protect both parties involved.

To secure a promissory note with real property, you typically need to create a security agreement that specifies the property as collateral. In the case of the Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the title of the property is often recorded in the public records. This ensures protection for the lender and establishes a legal claim to the property against any default.

You generally do not need to file a promissory note with the government. However, it is advisable to keep it in a safe place, along with relevant documents related to the Topeka Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate. If the note is secured by real estate, you must file the associated security document with the county clerk to protect your rights in the property.