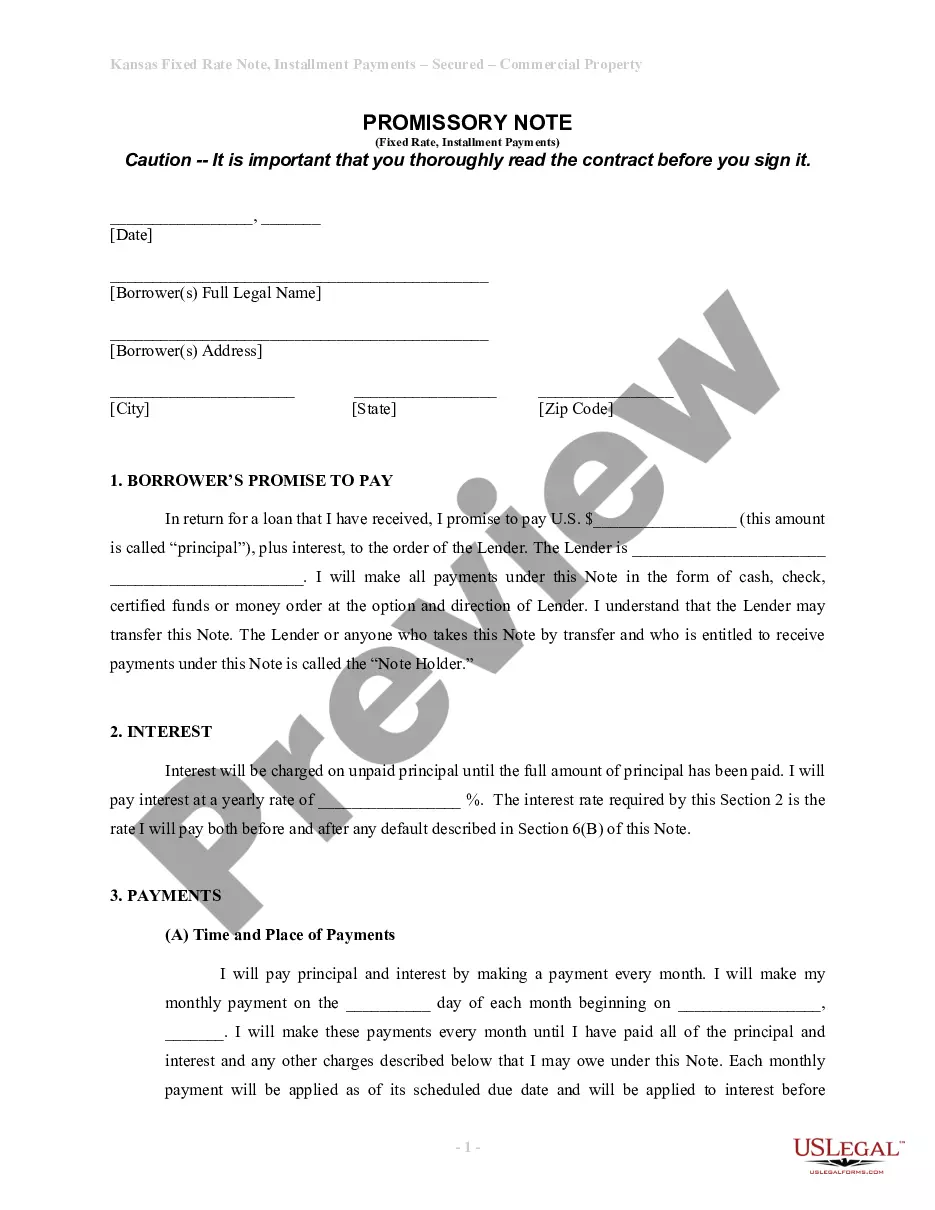

Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Kansas Installments Fixed Rate Promissory Note Secured By Personal Property?

We consistently aim to minimize or prevent legal complications when engaging with intricate legal or financial matters.

To achieve this, we subscribe to legal solutions that are typically quite expensive.

However, not all legal challenges are inherently complicated.

The majority can be resolved by ourselves.

Take advantage of US Legal Forms whenever you need to acquire and download the Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property or any other form quickly and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform enables you to manage your affairs independently without relying on a lawyer.

- We offer access to legal form templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, which significantly streamlines the search process.

Form popularity

FAQ

In most cases, you do not file a promissory note with a government office. The ideal practice is to retain the original document in a secure location, ensuring both parties have copies. If your situation involves a Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property and leads to legal proceedings, seeking guidance on necessary documentation can clarify your next steps.

Generally, promissory notes do not need official filing unless judicial action arises. Instead, you should keep the original signed note in a safe place for your records. If your Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property requires legal enforcement, consult a legal expert to understand any applicable recording or filing procedures.

Yes, promissory notes can be enforceable in court if they meet specific legal requirements and conditions set by state laws. A properly executed Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property usually provides substantial evidence of the agreement and the borrower’s obligations. To safeguard your interests, it’s vital to maintain accurate records and consider using platforms like uslegalforms to create legally sound documents.

A secured promissory note includes specific collateral that protects the lender if the borrower defaults on payments. In contrast, a standard promissory note does not have this backing, relying solely on the borrower's promise to repay. When dealing with a Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property, the security provided by personal property can enhance trust and reduce risk for the lender.

A promissory note typically does not appear on your personal credit record, as it is a private agreement between parties. However, if the note goes into default and a legal action arises, it could potentially affect your credit score. In the context of a Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property, it is essential to ensure timely payments to avoid any negative consequences.

A promissory note can indeed function as a mortgage note when it is secured by real estate. It conveys the borrower's promise to repay, while the mortgage connects that obligation to the property. In Topeka, Kansas, understanding this relationship is essential for borrowers involved with the Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property.

Indeed, a note secured by land qualifies as a mortgage note. When the note is secured by real estate, it becomes a formal agreement that binds the borrower to repay their debt using the land itself as collateral. This is a common practice in Topeka, Kansas, enhancing the security of loans provided to borrowers.

A promissory note itself is not a physical property but rather a financial instrument indicating a debt. It represents a borrower's commitment to repay the lender under specific conditions, often secured by physical collateral, like personal property. In Topeka, Kansas, many individuals utilize the Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property to finance personal assets.

No, a promissory note alone does not create a lien on a property. However, when combined with a security agreement, such as a Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property, a lien can be established on the collateral. This means the lender has a legal right to the property if payment terms are not met. It’s advisable to explore such agreements for effective financial planning.

A mortgage or a promissory note secured by real estate creates a lien on the property. In this case, a Topeka Kansas Installments Fixed Rate Promissory Note Secured by Personal Property serves a similar purpose. It gives the lender legal rights to the property until the debt is fully repaid. Knowing this can help you navigate the complexities of secured transactions.