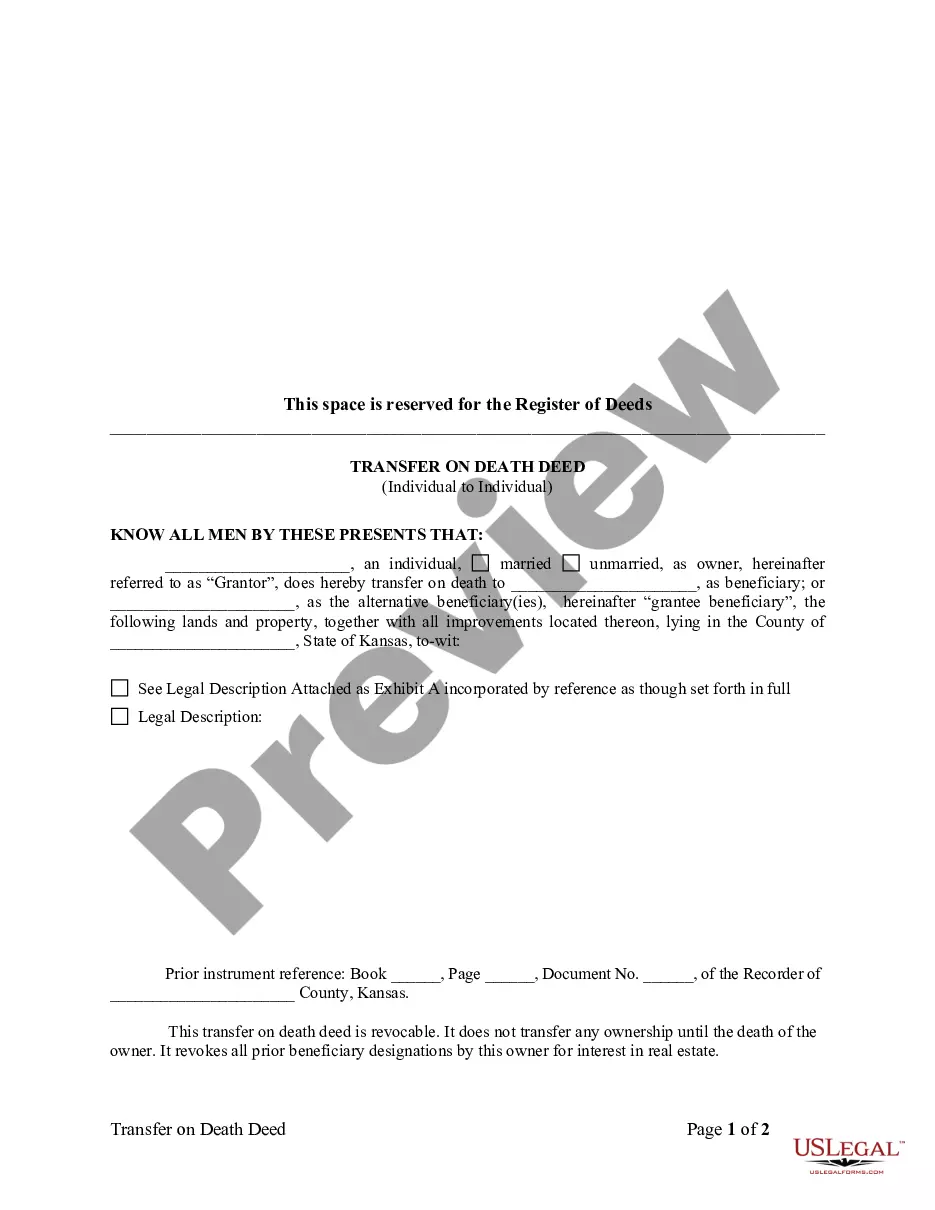

Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description

How to fill out Kansas Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

No matter one’s social or professional rank, completing legal documents is a regrettable requirement in the modern world.

Frequently, it’s nearly unfeasible for an individual lacking legal training to create this type of paperwork from inception, mainly due to the intricate terminology and legal nuances involved.

This is where US Legal Forms can come to the rescue.

However, if you are not acquainted with our library, make sure to follow these guidelines prior to downloading the Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual.

Make sure the document you've located is appropriate for your location as the regulations of one state or county do not apply to another.

- Our platform features a vast repository of over 85,000 state-specific documents ready for use that are applicable for nearly any legal circumstance.

- US Legal Forms is also a valuable resource for professionals or legal advisors looking to enhance their time efficiency with our DIY papers.

- Whether you need the Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, or any other document valid in your state or county, US Legal Forms has everything within reach.

- Here’s how to swiftly obtain the Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual using our reliable platform.

- If you are already a member, feel free to Log In to access the necessary form.

Form popularity

FAQ

Several states in the U.S. allow transfer on death deeds, including Kansas. Each state has its specific regulations governing their usage, so it’s essential to understand the rules that apply to your location. If you're considering a Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, you will have the advantage of a streamlined estate transfer process. Be sure to check with legal experts or platforms like USLegalForms for comprehensive guidance.

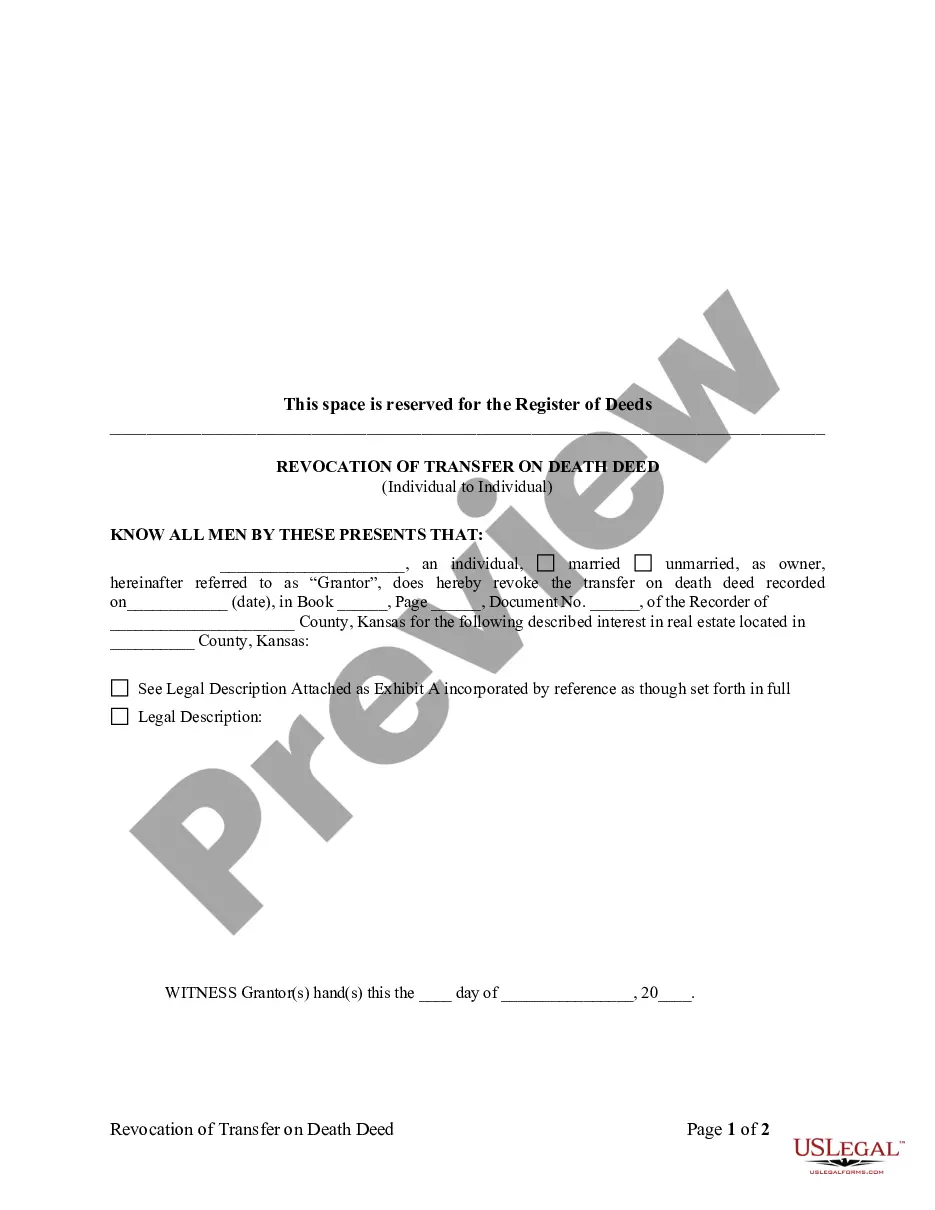

While a transfer on death deed offers many benefits, there are some disadvantages to consider. For instance, the property is not protected from creditors during the owner's lifetime, and if not executed properly, the deed may become invalid. Furthermore, a Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual may require additional estate planning documents for complete effectiveness. Be sure to evaluate your unique circumstances and consult with professionals if needed.

Yes, Kansas has specific provisions for transfer on death deeds, making them a popular option among property owners. These deeds enable individuals to pass their real estate directly to heirs without the complexities of probate court proceedings. By opting for a Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, you can simplify the inheritance process for your loved ones. This is a smart choice for effective estate management.

Yes, a transfer on death deed is indeed also known as a beneficiary deed. This terminology is commonly used in Kansas to describe the same concept, where property ownership is automatically transferred to designated beneficiaries upon the owner's passing. By implementing a Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, you can ensure a seamless transfer of ownership without the delays of probate. It's a beneficial approach for estate planning.

A transfer on death deed (TOD) and a beneficiary deed essentially serve the same purpose, but they can differ slightly in terminology and structure. The Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual allows property owners to designate beneficiaries to receive their property after death. Both documents help to avoid probate, but it's important to consult an expert or use a platform like US Legal Forms to ensure you choose the right option for your needs.

Yes, Kansas does allow a transfer on death deed, commonly referred to as a TOD. This legal document allows individuals to transfer property to their beneficiaries upon their passing, avoiding the probate process. The Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual can simplify the transfer procedure and ensure that your property goes directly to your chosen beneficiary. By using this deed, you can retain full control over the property until your death.

Yes, Kansas allows the creation of transfer on death deeds. The Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual enables property owners to designate a beneficiary for their real estate. This legal tool allows for a seamless transfer after death, minimizing probate complications. To ensure that all requirements are met, consider using a trusted platform like uslegalforms for guidance.

Many states across the U.S. recognize transfers on death deeds, including Kansas. The Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual provides residents with a straightforward way to transfer property. Each state has its own set of rules and requirements, so it's essential to consult local laws or resources. Understanding these regulations can help you make informed decisions.

While the Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual offers simplicity, it also has disadvantages. It does not prevent creditors from claiming your property after your death. Additionally, if the beneficiary predeceases you, the deed may become ineffective unless amended. Conflicts can arise if multiple heirs have different expectations regarding the property.

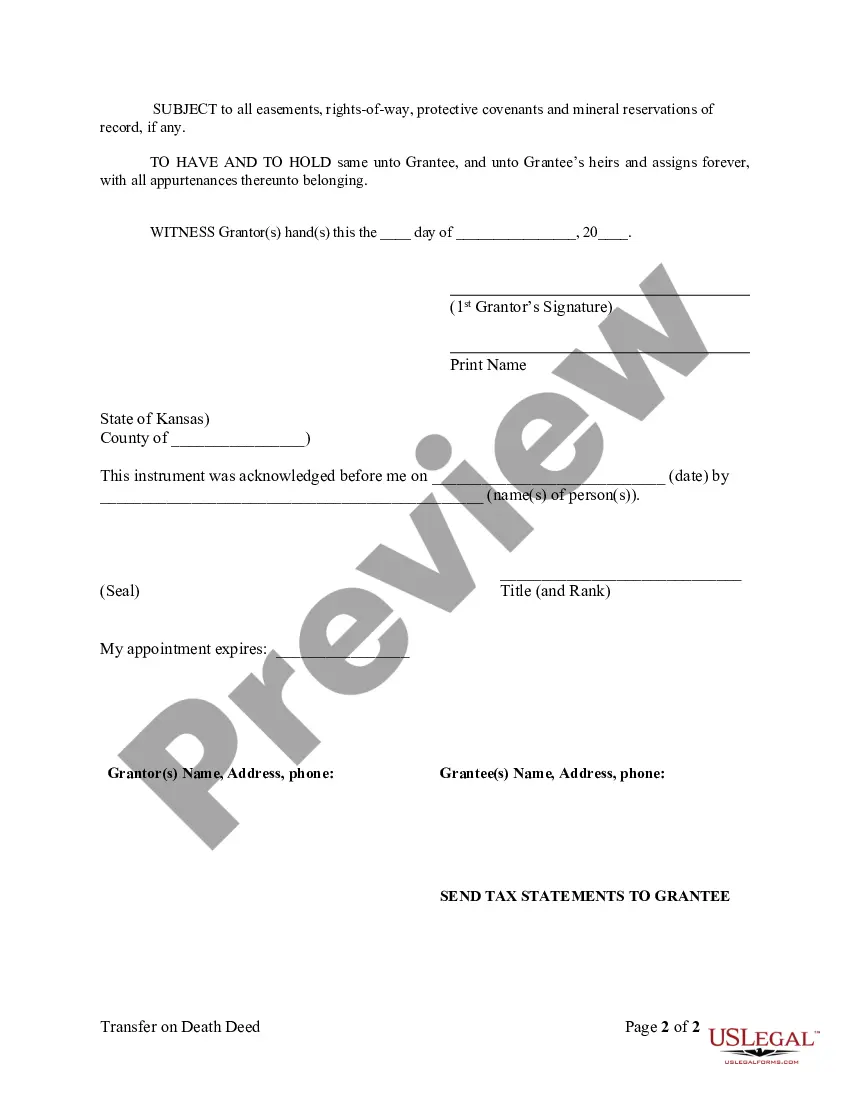

To write a beneficiary deed in accordance with the Topeka Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, start by obtaining the appropriate form from a reliable source. Fill in essential details such as the property description, the name of the beneficiary, and your signature. It's important to have the deed notarized to ensure its validity. Finally, file the deed with the county registrar to secure your intent.