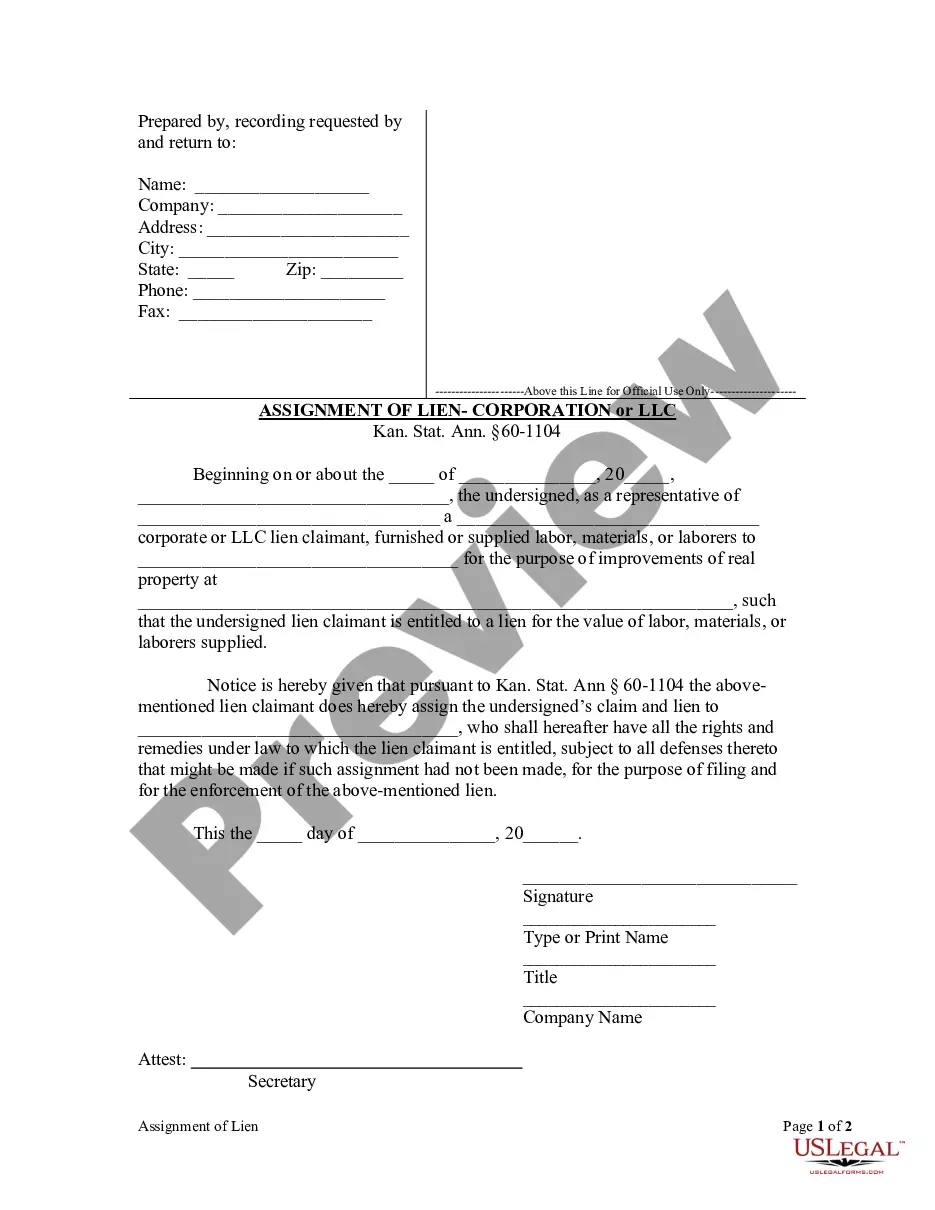

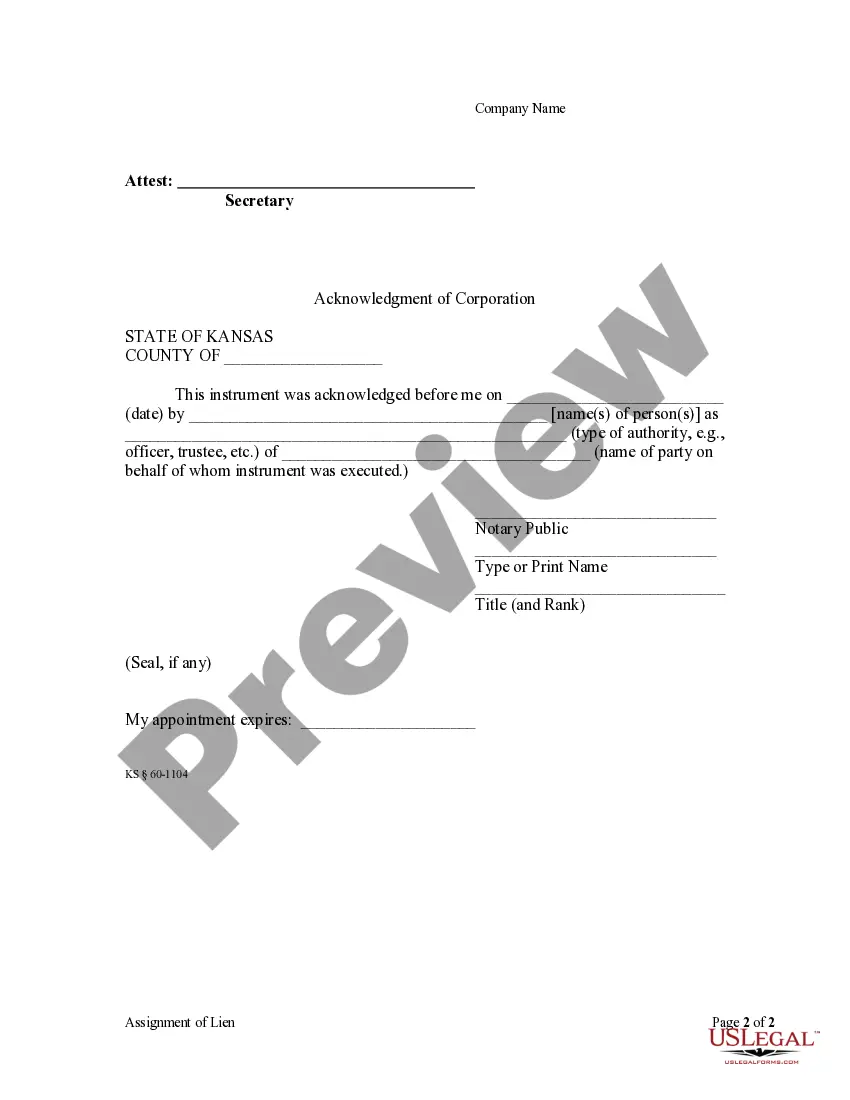

This Assignment of Lien form is for use by a corporate or LLC lien claimant that furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lien claimant is entitled to a lien for the value of labor, materials, or laborers supplied, to assign its claim and lien, including all the rights and remedies under law to which the lien claimant is entitled, subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

Topeka, Kansas Assignment of Lien — Corporation or LLC: A Comprehensive Overview An Assignment of Lien refers to the legal process through which a party holding a lien on a property transfers their rights and interests to another individual or entity. In the context of Topeka, Kansas, this article focuses specifically on the Assignment of Lien for corporations or limited liability companies (LCS). It is important to note that there are several types of Assignments of Lien within this specific category. 1. Individual Assignment of Lien — Corporation or LLC: This type of Assignment of Lien involves an individual corporation or LLC transferring its lien rights to another designated party. In Topeka, Kansas, corporations and LCS have the legal authority to assign their liens to a third party of their choice, subject to certain legal requirements. 2. Assignment of Lien by Consent — Corporation or LLC: In some cases, multiple parties may hold a lien on a property, such as subcontractors or suppliers involved in a construction project. To streamline the lien process and facilitate debt collection, all parties holding a lien may collectively assign their rights to a designated entity, typically a corporation or LLC. This Assignment of Lien by Consent ensures that the designated entity assumes all lien rights and responsibilities. 3. Partial Assignment of Lien — Corporation or LLC: A Partial Assignment of Lien involves the transfer of only a portion of the lien rights held by a corporation or LLC. This may occur when the creditor wants to assign a specific amount or percentage of their lien claim to another party or when multiple parties are involved in the debt collection process. The remaining lien rights would still be retained by the assigning entity. 4. Assignment of Lien for Debt Settlement — Corporation or LLC: Sometimes, a debtor may negotiate a debt settlement agreement with a corporation or LLC holding a lien. In such cases, an Assignment of Lien can transfer the lien rights from the creditor to the debtor as part of the settlement terms. This type of assignment is typically executed upon the successful completion of the settlement agreement and ensures the release of the lien from the assigned party. 5. Assignment of Lien for Collection Purposes — Corporation or LLC: When a corporation or LLC faces challenges in collecting a debt, they may opt to assign their lien rights to a professional collection agency or an attorney who specializes in debt collection. This Assignment of Lien for Collection Purposes empowers the designated party to proceed with legal actions, such as filing a lawsuit, on behalf of the assigning entity to recover the outstanding debt. Complying with the legal procedures and requirements inherent in Assignment of Lien — Corporation or LLC in Topeka, Kansas is crucial to ensure the enforceability and legitimacy of the transferred lien rights. Seeking legal counsel or consulting the relevant statutes and regulations within the state is advisable before engaging in any Assignment of Lien process.