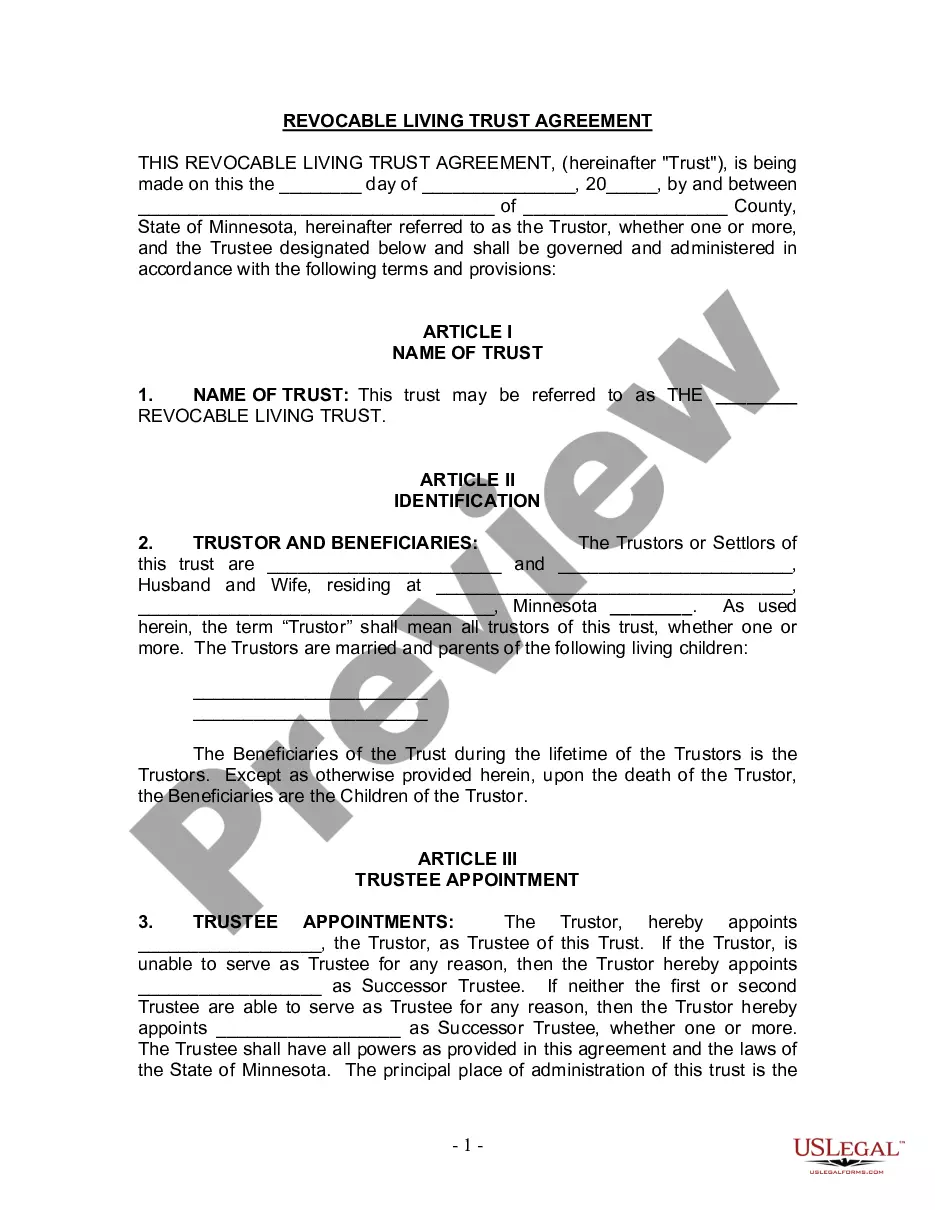

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Fort Wayne Indiana Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Indiana Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children?

Regardless of social or professional position, filling out legal documents is a regrettable requirement in the modern world.

Often, it’s nearly impossible for someone without legal expertise to create such documents from scratch, primarily due to the complex language and legal subtleties they involve.

This is where US Legal Forms can come to the rescue.

Ensure the form you’ve selected is tailored to your area, as the laws of one state or region do not apply to another.

Examine the form and look through a brief overview (if applicable) of the situations for which the document can be utilized.

- Our platform offers an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal matter.

- US Legal Forms is also a fantastic resource for partners or legal advisors seeking to enhance their efficiency with our DIY forms.

- Whether you need the Fort Wayne Indiana Living Trust for individuals who are Single, Divorced, or a Widow or Widower with Children or any other documentation that will be recognized in your state or locality, US Legal Forms puts everything at your disposal.

- Here’s a quick guide on how to obtain the Fort Wayne Indiana Living Trust for individuals who are Single, Divorced, or a Widow or Widower with Children rapidly using our trustworthy platform.

- If you are a current member, you can proceed to Log In to your account to access the necessary form.

- If you are new to our library, be sure to follow these steps before acquiring the Fort Wayne Indiana Living Trust for individuals who are Single, Divorced, or a Widow or Widower with Children.

Form popularity

FAQ

To establish a Fort Wayne Indiana Living Trust for individuals who are single, divorced, or widowed with children, start by determining the type of trust you need. Next, draft a trust document that outlines your wishes, beneficiary details, and asset allocation. You must then sign the document in front of a notary and fund the trust with your assets. Resources like uslegalforms provide comprehensive templates and expert assistance to simplify this process.

To establish a valid Fort Wayne Indiana Living Trust for individuals who are single, divorced, or widowed with children, certain requirements must be fulfilled. The trust must be created in writing, signed by the person creating the trust, and be funded with assets. The creator must also have the mental capacity to create the trust and must indicate their intent clearly. Using uslegalforms can help you navigate these requirements easily.

The minimum amount to set up a Fort Wayne Indiana Living Trust for individuals who are single, divorced, or widowed with children varies. There is generally no strict legal minimum; however, it is advisable to have enough assets to make the trust worth the setup costs. Typically, people consider establishing a trust when they have at least $50,000 in assets. Consider using uslegalforms to explore options and find guidance tailored to your financial situation.

When one spouse dies, a living trust facilitates the seamless transfer of assets to the surviving spouse or other designated beneficiaries. In the context of a Fort Wayne Indiana Living Trust for individuals who are single, divorced, or widowed with children, the trust ensures that your wishes regarding asset distribution are honored and can help avoid probate. This means that your loved ones can access their inheritance without lengthy legal processes. By utilizing a living trust, you provide clarity and security for your family during a challenging time.

Generally, a living trust becomes irrevocable when one spouse dies, meaning its terms cannot be modified. However, if the trust allows for certain conditions, adjustments may be possible, depending on the language used in the trust document itself. This aspect is particularly important for individuals who are single, divorced, or widowed with children when planning their estates. To ensure all changes are compliant and beneficial, explore resources available on platforms like uslegalforms for tailored support.

The 5 year rule for trusts refers to a time limit recognized by the IRS related to accumulated income or distributions of a trust. Essentially, if a distribution occurs within five years of the creation of the trust, it may be subject to certain tax implications. Being informed about this rule is vital when setting up a Fort Wayne Indiana Living Trust for individuals who are single, divorced, or widowed with children. For personalized guidance, consider using the uslegalforms platform to assist in navigating trust regulations.

When one spouse passes away, the living trust typically becomes irrevocable. This means that the trust's terms cannot be changed, and the assets within the trust are distributed according to the trust document. For individuals, especially those who are single, divorced, or widowed with children, understanding this process is crucial. Utilizing a Fort Wayne Indiana Living Trust for individuals, who are single, divorced, or widow or widower with children can help ensure that your wishes are honored even after you are gone.

In Indiana, a living trust must be created while the individual is alive and competent, and it requires a valid trust document that outlines its terms. The assets in the trust must be properly transferred to avoid probate issues later. Additionally, you can modify or revoke the trust at any time as long as you stay competent. For those considering Fort Wayne Indiana Living Trust for individual, who is single, divorced, or widowed with children, understanding these rules can help you make informed decisions.

Many parents overlook the importance of clearly defining the terms of the trust fund, which can lead to confusion and disputes later on. Sometimes, they fail to fully fund the trust, leaving assets outside of it, which could complicate distribution. It's crucial to review and update the trust regularly to reflect your current wishes and family dynamics. For individuals in Fort Wayne, Indiana, who are single, divorced, or widowed with children, using platforms like uslegalforms can help ensure your trust is set up effectively.

A living trust in Indiana allows you to place your assets into a trust during your lifetime, ensuring they are managed according to your wishes. You can maintain control over these assets, while also designating a trustee to handle them once you pass. This process helps your loved ones avoid probate, making the transition smoother and quicker. For those seeking Fort Wayne Indiana Living Trust for individual, who is single, divorced, or a widow or widower with children, this option provides significant peace of mind.